|

市場調查報告書

商品編碼

1892664

鋰金屬電池材料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Lithium Metal Battery Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

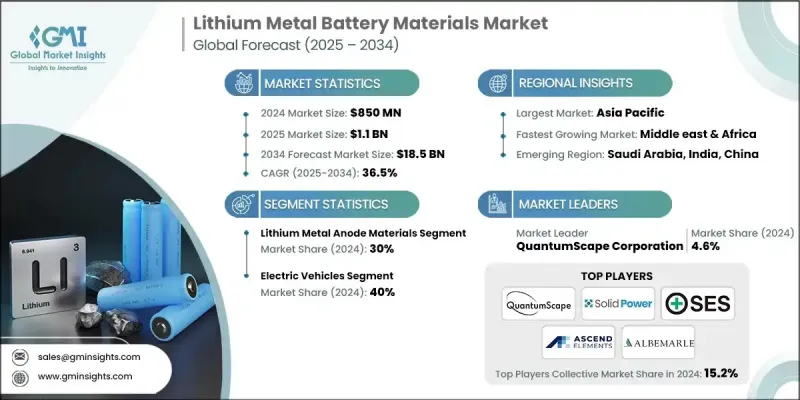

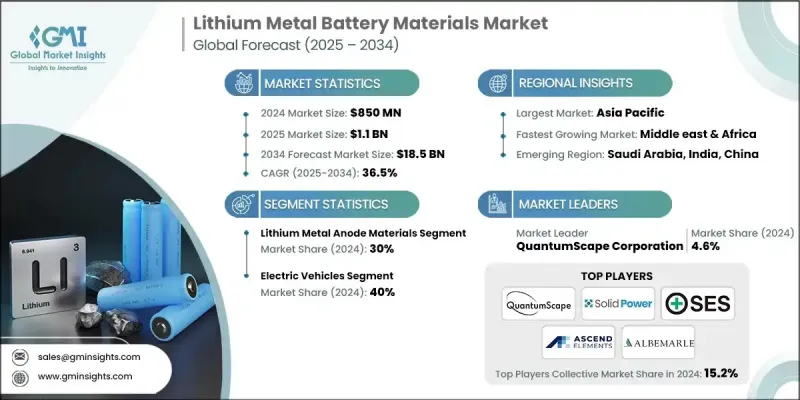

2024 年全球鋰金屬電池材料市場價值為 8.5 億美元,預計到 2034 年將以 36.5% 的複合年成長率成長至 185 億美元。

全球電動車的快速成長推動了對先進電池材料的需求,這些材料需要更高的能量密度、更長的續航里程和更快的充電速度。再生能源和儲能解決方案的普及進一步增加了對高效能、高性能電池材料的需求。環保意識的增強,以及各產業對更快充電速度和更高容量電池日益成長的期望,正在加速向鋰基解決方案的轉型。對固態鋰金屬電池(SS-LMB)技術的巨額投資正在改變市場格局,汽車製造商和電池製造商正投入數十億美元進行研發。 SS-LMB解決了傳統鋰離子電池的安全性和耐久性問題,其理論能量密度超過500 Wh/kg,而液態電解質電池的能量密度約為350 Wh/kg。鋰金屬負極生產技術的進步,特別是熱蒸發技術的進步,正在降低成本,並推動大規模商業化應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.5億美元 |

| 預測值 | 185億美元 |

| 複合年成長率 | 36.5% |

到2024年,固態電解質市佔率將達到25%。這些材料是下一代鋰金屬電池的核心,與傳統的液態電解質相比,它們具有更高的穩定性、能量密度和安全性。其優異的性能使其成為儲能和電動車等先進應用的理想選擇。

預計到2024年,電動車市佔率將達到40%。消費者對更長續航里程、快速充電、更高安全性和更長循環壽命的需求不斷成長,推動了鋰金屬電池材料的應用。電動車製造商越來越傾向於採用鋰基解決方案來滿足這些性能標準和監管要求。

2024年,北美鋰金屬電池材料市佔率達25%。包括《通膨抑制法案》在內的政策舉措為國內電池製造和電動車普及提供了強力的激勵,同時私部門對鋰電池生產的投資也大幅成長。美國電池產能到2023年已接近70吉瓦時,與幾年前幾乎為零的產能相比,成長迅速。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場規模及預測:依材料分類,2021-2034年

- 鋰金屬負極材料

- 純鋰金屬箔

- 鋰合金陽極

- 複合鋰負極

- 固態電解質材料

- 硫化物基電解質

- 氧化物/石榴石電解質

- 聚合物電解質

- 鹵化物基電解質

- 液態電解質材料

- 先進液態電解質

- 電解質添加劑

- 保護塗層及人工SEI材料

- 分離材料

- 其他

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 電動車

- 電池電動車(BEV)

- 插電式混合動力車(PHEV)

- 航太航太

- 商用飛機系統

- 無人機和無人飛行器

- 空間應用

- 消費性電子產品

- 電網和固定式儲能

- 醫療器材

- 海洋與海事

- 其他

第7章:市場規模及預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第8章:公司簡介

- QuantumScape Corporation

- Solid Power, Inc.

- SES AI Corporation

- Ascend Elements

- Saft

- Albemarle

- Pure Lithium Corporation

- Cuberg

- Group14 Technologies

The Global Lithium Metal Battery Materials Market was valued at USD 850 million in 2024 and is estimated to grow at a CAGR of 36.5% to reach USD 18.5 billion by 2034.

The rapid growth of electric vehicles worldwide is fueling demand for advanced battery materials that offer higher energy densities, longer driving ranges, and faster charging capabilities. Adoption of renewable energy and energy storage solutions is further increasing the need for efficient, high-performance battery materials. Environmental awareness, coupled with rising expectations for faster charging and higher-capacity batteries across industries, is accelerating the shift toward lithium-based solutions. Massive investments in solid-state lithium metal battery (SS-LMB) technologies are transforming the market, as automakers and battery manufacturers are dedicating billions to R&D. SS-LMBs address safety and durability issues associated with conventional lithium-ion batteries, offering theoretical energy densities above 500 Wh/kg compared to ~350 Wh/kg for liquid-electrolyte cells. Advances in lithium-metal anode production, particularly through thermal evaporation, are driving down costs and enabling large-scale commercial adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $850 Million |

| Forecast Value | $18.5 Billion |

| CAGR | 36.5% |

The solid-state electrolytes segment held a 25% share in 2024. These materials are central to next-generation lithium metal batteries, providing enhanced stability, higher energy density, and improved safety over traditional liquid electrolytes. Their superior properties make them ideal for advanced applications in energy storage and electric mobility.

The electric vehicle segment held a 40% share in 2024. Growing consumer demand for extended driving range, rapid charging, enhanced safety, and long cycle life is driving the adoption of lithium metal battery materials. EV manufacturers increasingly prefer lithium-based solutions to meet these performance standards and regulatory requirements.

North America Lithium Metal Battery Materials Market held a 25% share in 2024. Policy initiatives, including the Inflation Reduction Act, provide substantial incentives for domestic battery manufacturing and EV adoption, while private sector investments in lithium battery production have surged. Battery manufacturing capacity in the U.S. reached nearly 70 GWh in 2023, growing rapidly from negligible production a few years earlier.

Key players in the Global Lithium Metal Battery Materials Market include Albemarle, Cuberg, QuantumScape Corporation, SES AI Corporation, Ascend Elements, Group14 Technologies, Saft, Solid Power, and Pure Lithium Corporation. Companies in the Lithium Metal Battery Materials Market are strengthening their positions through aggressive investment in research and development to enhance energy density, safety, and production efficiency. Strategic partnerships with automakers, technology developers, and supply chain partners are helping to accelerate the commercialization of solid-state batteries. Firms are also expanding production facilities in regions with strong policy support, ensuring proximity to key customers and reducing logistics costs. Intellectual property acquisition, joint ventures, and licensing agreements are employed to secure access to critical materials and technologies. In addition, many companies are emphasizing sustainable practices and recycling initiatives to appeal to environmentally conscious stakeholders while highlighting the superior performance and rapid charging capabilities of their lithium metal battery solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Material

- 2.2.2 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Lithium metal anode materials

- 5.2.1 Pure lithium metal foils

- 5.2.2 Lithium alloy anodes

- 5.2.3 Composite lithium anodes

- 5.3 Solid-state electrolyte materials

- 5.3.1 Sulfide-based electrolytes

- 5.3.2 Oxide/garnet electrolytes

- 5.3.3 Polymer electrolytes

- 5.3.4 Halide-based electrolytes

- 5.4 Liquid electrolyte materials

- 5.4.1 Advanced liquid electrolytes

- 5.4.2 Electrolyte additives

- 5.5 Protective coatings & artificial SEI materials

- 5.6 Separator materials

- 5.7 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Electric vehicles

- 6.2.1 Battery electric vehicles (BEV)

- 6.2.2 Plug-in hybrid electric vehicles (PHEV)

- 6.3 Aerospace & aviation

- 6.3.1 Commercial aircraft systems

- 6.3.2 Drones & UAVs

- 6.3.3 Space applications

- 6.4 Consumer electronics

- 6.5 Grid & stationary energy storage

- 6.6 Medical devices

- 6.7 Marine & maritime

- 6.8 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East & Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Rest of Middle East & Africa

Chapter 8 Company Profiles

- 8.1 QuantumScape Corporation

- 8.2 Solid Power, Inc.

- 8.3 SES AI Corporation

- 8.4 Ascend Elements

- 8.5 Saft

- 8.6 Albemarle

- 8.7 Pure Lithium Corporation

- 8.8 Cuberg

- 8.9 Group14 Technologies