|

市場調查報告書

商品編碼

1892661

連續油管鑽井服務市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Coiled Tubing Drilling Service Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

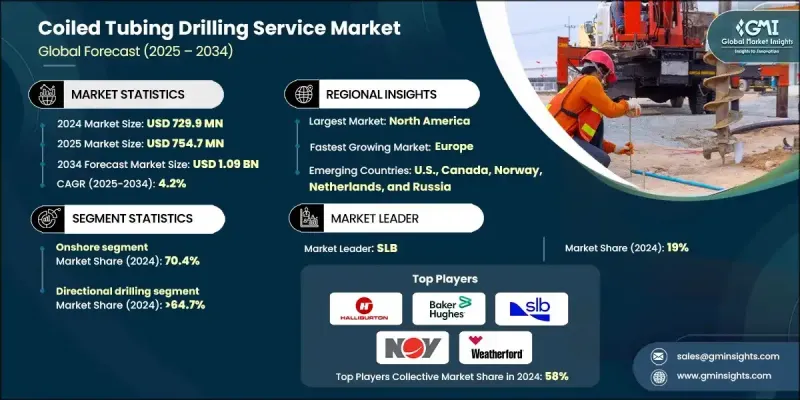

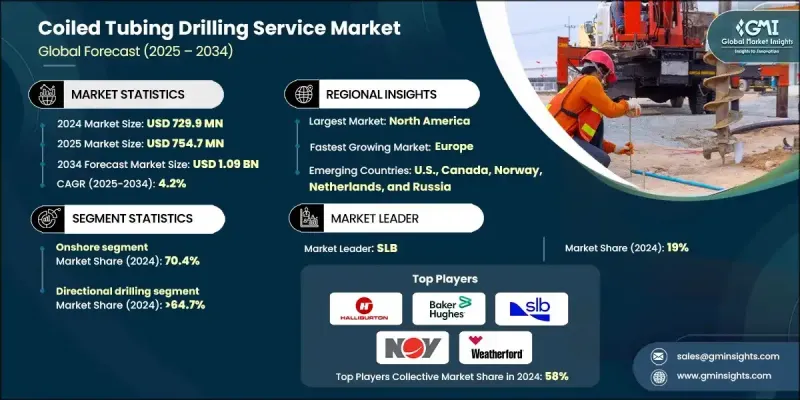

2024 年全球連續油管鑽井服務市場價值為 7.299 億美元,預計到 2034 年將以 4.2% 的複合年成長率成長至 10.9 億美元。

全球能源需求不斷成長,以及維護老舊油氣資產的需求日益迫切,正在加速對先進油井干預和鑽井技術的投資。隨著營運商尋求更安全、更有效率的方法來處理複雜的油井干預作業,尤其是在需要重入作業的油藏中,現代化的連續油管解決方案正變得至關重要。水平鑽井和頁岩氣開採活動的推動,使得非常規資源的開發不斷擴大,進一步提升了對連續油管系統的需求。致力於在複雜油藏中實現產量最大化的營運商,對支援高性能開採策略的整合式連續油管技術表現出越來越濃厚的興趣。數位轉型也在重塑產業格局,自動化和即時監控提高了作業的精準性和安全性,尤其是在海上環境中。隨著企業尋求簡化工作流程並提高現場可靠性,能夠提供最佳化、高效鑽井解決方案的服務供應商越來越受到青睞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.299億美元 |

| 預測值 | 10.9億美元 |

| 複合年成長率 | 4.2% |

2024年,陸上油氣市場佔比達到70.4%,預計到2034年將以4%的複合年成長率成長。頁岩油氣開發的擴張以及完善的基礎設施持續推動陸上油氣市場的發展,該市場採用包括垂直鑽井、水平鑽井和定向鑽井在內的多種鑽井方式來開採非常規油氣儲量。與海上油氣活動相比,陸上油氣營運成本較低,這也是推動該市場成長的重要因素。

定向鑽井業務在2024年佔據了64.7%的市場佔有率,預計到2034年將以3.5%的年成長率成長。對更深層地層和非常規油氣資源的需求推動了對精準井眼控制技術的需求。自動化導向技術和數據驅動系統的進步提高了井眼精度並降低了作業風險,從而支持了該業務領域的進一步擴張。

2024年,美國連續油管鑽井服務市場佔62%的佔有率,市場規模達1.824億美元。緻密油和頁岩油田的強勁產量持續推動市場發展。即時資料系統、自動化工具和先進材料技術的改進提升了鑽井性能。旨在降低排放和提高井完整性的監管舉措,也促使人們更廣泛地採用連續油管作為傳統鑽井方式的高效替代方案。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 利用物聯網技術實現數位轉型

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 重要夥伴關係與合作

- 主要併購活動

- 主要創新與產品發布

- 市場擴張策略

- 競爭性標竿分析

- 戰略儀錶板

- 創新與永續發展格局

第5章:市場規模及預測:依鑽井類型分類,2021-2034年

- 控壓鑽井

- 定向鑽井

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 陸上

- 離岸

- 淺的

- 深的

- 超深

第7章:市場規模及預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 俄羅斯

- 英國

- 挪威

- 荷蘭

- 亞太地區

- 中國

- 印度

- 澳洲

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第8章:公司簡介

- AFG Holdings, Inc.

- AnTech Ltd

- Baker Hughes

- Blade Energy Partners

- EXCEED (XCD) Holdings Ltd.

- FracJet-Volga LLC

- GOES GmbH

- Granite Construction Inc.

- Halliburton

- HI LONG OIL SERVICE & ENGINEERING CO., LTD.

- Hunting PLC

- KLX

- Nabors Industries Ltd.

- National Petroleum Services Company (NAPESCO)

- Oilserv

- Pruitt

- SLB

- Stena Drilling US Inc.

- TAQA KSA

- Tenaris

- Weatherford

The Global Coiled Tubing Drilling Service Market was valued at USD 729.9 million in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 1.09 billion by 2034.

Rising global energy requirements and the growing need to maintain aging oil and gas assets are accelerating investment in advanced well intervention and drilling technologies. Modern coiled tubing solutions are becoming essential as operators seek safer and more efficient methods for handling complex well interventions, particularly in reservoirs that require re-entry operations. Expanding development of unconventional resources, supported by horizontal drilling and shale extraction activity, is further elevating demand for coiled tubing systems. Operators working to maximize output in challenging reservoirs are showing greater interest in integrated coiled tubing technologies that support high-performance extraction strategies. Digital transformation is also reshaping the landscape, with automation and real-time monitoring improving operational precision and safety, especially in offshore environments. Service providers offering optimized, high-efficiency drilling solutions are increasingly preferred as companies look to streamline workflows and strengthen field reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $729.9 Million |

| Forecast Value | $1.09 Billion |

| CAGR | 4.2% |

The onshore segment held a 70.4% share in 2024 and is forecasted to grow at a CAGR of 4% through 2034. Expansion in shale development and the presence of extensive mature infrastructure continue to support onshore adoption, where a wide range of drilling approaches, including vertical, horizontal, and directional techniques, are used to access unconventional reserves. Lower operational expenses compared with offshore activity also contribute to segment growth.

The directional drilling segment held a 64.7% share in 2024 and is anticipated to grow at a 3.5% through 2034. The need to reach deeper formations and unconventional hydrocarbon sources is driving demand for precise wellbore control. Advancements in automated steering technologies and data-driven systems are improving well accuracy and reducing operational hazards, supporting further expansion of this segment.

U.S. Coiled Tubing Drilling Service Market held a 62% share in 2024 and generated USD 182.4 million. Strong production from tight oil and shale fields continues to shape market progress. Improvements in real-time data systems, automation tools, and enhanced material technologies are strengthening drilling performance. Regulatory initiatives aimed at lowering emissions and improving well integrity are encouraging broader adoption of coiled tubing as an efficient alternative to conventional drilling practices.

Prominent companies in the industry include Hunting PLC, TAQA KSA, SLB, Tenaris, Nabors Industries Ltd., AnTech Ltd, GOES GmbH, Halliburton, Oilserv, Weatherford, National Petroleum Services Company (NAPESCO), Baker Hughes, Stena Drilling US Inc., Kleen, HI LONG OIL SERVICE & ENGINEERING CO., LTD., AFG Holdings, Inc., EXCEED (XCD) Holdings Ltd., Blade Energy Partners, Pruitt, FracJet-Volga LLC, and Granite Construction Inc. Companies operating in the Global Coiled Tubing Drilling Service Market are adopting targeted strategies to strengthen their competitive position. Many are upgrading their service portfolios with automation-based drilling systems, high-strength tubing materials, and enhanced downhole tools to improve performance in complex reservoir conditions. Partnerships with operators and technology developers are helping service providers expand capabilities and deliver integrated solutions tailored to unconventional and offshore environments. Firms are also investing in digital monitoring platforms, predictive maintenance technologies, and real-time analytics to boost operational safety and increase efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Drilling type trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digital transformation with IoT technologies

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Key innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Drilling Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Managed pressure drilling

- 5.3 Directional drilling

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

- 6.3.1 Shallow

- 6.3.2 Deep

- 6.3.3 Ultra-deep

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Norway

- 7.3.4 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Australia

- 7.4.4 Indonesia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 AFG Holdings, Inc.

- 8.2 AnTech Ltd

- 8.3 Baker Hughes

- 8.4 Blade Energy Partners

- 8.5 EXCEED (XCD) Holdings Ltd.

- 8.6 FracJet-Volga LLC

- 8.7 GOES GmbH

- 8.8 Granite Construction Inc.

- 8.9 Halliburton

- 8.10 HI LONG OIL SERVICE & ENGINEERING CO., LTD.

- 8.11 Hunting PLC

- 8.12 KLX

- 8.13 Nabors Industries Ltd.

- 8.14 National Petroleum Services Company (NAPESCO)

- 8.15 Oilserv

- 8.16 Pruitt

- 8.17 SLB

- 8.18 Stena Drilling US Inc.

- 8.19 TAQA KSA

- 8.20 Tenaris

- 8.21 Weatherford