|

市場調查報告書

商品編碼

1885927

家用電器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Electric Household Appliances Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

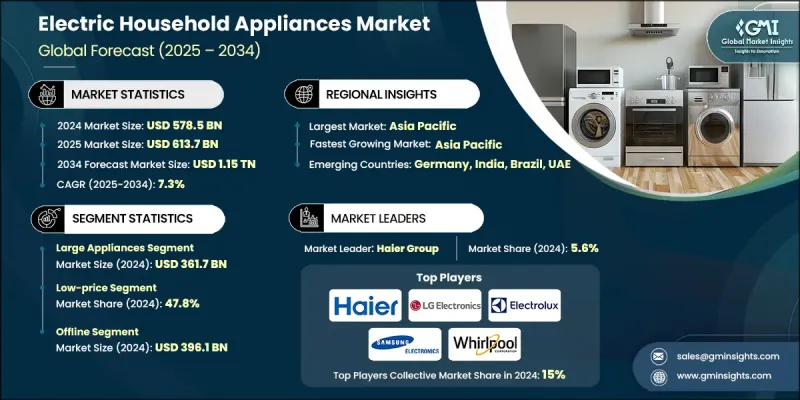

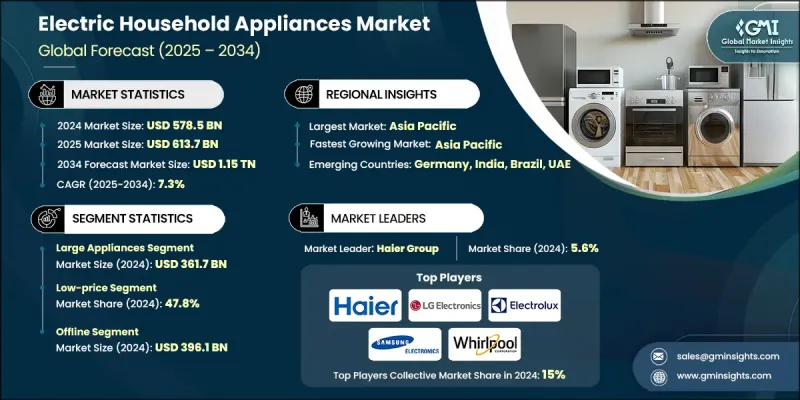

2024 年全球家用電器市場價值為 5,785 億美元,預計到 2034 年將以 7.3% 的複合年成長率成長至 1.15 兆美元。

在科技進步的驅動下,家電產業正經歷快速轉型,科技進步正在重塑日常生活的便利性和效率。具備物聯網連接、人工智慧驅動的自動化和語音控制功能的智慧家電正無縫融入智慧家庭生態系統,實現遠端監控、預測性維護和個人化設定。製造商日益重視節能技術,以實現永續發展目標並遵守環境法規,同時吸引具有環保意識的消費者。城市化進程正在影響家電設計,小型住宅催生了對緊湊型多功能設備的需求,例如洗衣乾衣一體機和節省空間的廚房電器。雙薪家庭和快節奏的生活方式進一步推動了自動化和智慧設備的普及,這些設備能夠節省時間並減少體力勞動。此外,消費者對現代設計、美觀和高階功能的需求也在推動創新,因為城市消費者尋求兼具時尚外觀和卓越性能的家電。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5785億美元 |

| 預測值 | 1.15兆美元 |

| 複合年成長率 | 7.3% |

2024年,大型家電市場規模達3,617億美元。該市場涵蓋冰箱、洗衣機、烤箱和空調等產品,由於其必需品的特性,即使在經濟低迷時期,大型家電仍然是消費者的優先購買選擇,因此佔據市場主導地位。產品更新換代以及消費者向節能智慧型機型升級的需求,持續推動該市場的營收成長。

2024年,低價產品市佔率達47.8%。這個細分市場主要由新興市場和農村地區對價格高度敏感的消費者所驅動,在這些地區,價格實惠比高級功能更為重要。風扇、熨斗和簡易廚房電器等具備基本功能和耐用性的產品被視為家庭必需品,銷售可觀。

美國家用電器市場佔66.8%的市場佔有率,預計2024年市場規模將達860億美元。美國市場需求成長的促進因素包括:智慧環保電器的日益普及、物聯網和人工智慧控制技術的進步,以及消費者對永續性和能源效率日益成長的關注。此外,生活方式的改變,例如房屋裝修增加和居家時間延長,也促進了高階電器的消費。

全球家用電器市場的主要參與者包括日立、伊萊克斯、LG電子、美的集團、沃爾頓集團、三星電子、博世、松下、夏普、格力電器、惠而浦、博世家電、海爾集團、西門子和美諾。這些公司正採取多種策略來鞏固市場地位並擴大市場佔有率。他們大力投資研發,以提高能源效率、增強智慧功能並整合人工智慧。策略合作、併購有助於拓展分銷網路並滲透新興市場。產品組合多元化,尤其注重多功能和節省空間的電器,以滿足城市消費者的需求。為了吸引具有環保意識的消費者,各公司強調永續生產實踐、環保認證以及遵守全球能源標準。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 技術進步

- 都市化與生活方式的改變

- 可支配所得增加

- 產業陷阱與挑戰

- 前期成本高

- 監理複雜性

- 機會

- 智慧互聯家電

- 節能環保的解決方案

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 大型家電

- 冰箱

- 烹飪用具

- 洗衣設備

- 清潔設備

- 氣候控制設備

- 小家電

- 烤麵包機

- 咖啡機

- 攪拌機和攪拌器

- 鐵

- 吹風機

- 水過濾器

- 其他(電水壺、蒸籠等)

第6章:市場估計與預測:依價格分類,2021-2034年

- 主要趨勢

- 低的

- 中等的

- 高的

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 住宅

- 商業的

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 大型零售商店

- 超市/大型超市

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- BSH Hausgerate

- Electrolux

- Gree Electric Appliances

- Haier Group

- Hitachi

- LG Electronics

- Midea Group

- Miele

- Panasonic

- Robert Bosch

- Samsung Electronics

- Sharp

- Siemens

- Walton Group

- Whirlpool

The Global Electric Household Appliances Market was valued at USD 578.5 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 1.15 trillion by 2034.

The industry is undergoing rapid transformation, driven by technological advancements that are reshaping convenience and efficiency in everyday living. Smart appliances featuring IoT connectivity, AI-driven automation, and voice control are integrating seamlessly into smart home ecosystems, enabling remote monitoring, predictive maintenance, and personalized settings. Manufacturers are increasingly prioritizing energy-efficient technologies to meet sustainability goals and comply with environmental regulations, while appealing to eco-conscious consumers. Urbanization is influencing appliance design, with smaller dwellings creating demand for compact, multi-functional devices such as washer-dryer combinations and space-saving kitchen appliances. Dual-income households and busy lifestyles are further boosting the adoption of automated and smart devices that save time and reduce manual effort. Additionally, consumer demand for modern designs, aesthetics, and premium features is shaping innovation, as urban buyers seek appliances that combine style with advanced performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $578.5 Billion |

| Forecast Value | $1.15 Trillion |

| CAGR | 7.3% |

In 2024, the large appliances segment generated USD 361.7 billion. This segment, which includes refrigerators, washing machines, ovens, and air conditioners, dominates due to its essential nature, making them a priority purchase even during economic downturns. Replacement cycles and consumer upgrades toward energy-efficient and smart models continue to drive revenue growth in this segment.

The low-price segment held a 47.8% share in 2024. This segment is primarily driven by highly price-sensitive consumers in emerging markets and rural areas, where affordability takes precedence over advanced features. Products with basic functionality and durability, such as fans, irons, and simple kitchen appliances, are considered household essentials, generating significant sales volumes.

United States Electric Household Appliances Market held a 66.8% share, generating USD 86 billion in 2024. Demand in the U.S. is fueled by the growing popularity of smart and eco-friendly appliances, advancements in IoT and AI-enabled controls, and increasing consumer focus on sustainability and energy efficiency. Lifestyle changes, such as increased home renovations and more time spent at home, are also boosting the consumption of premium appliances.

Key players in the Global Electric Household Appliances Market include Hitachi, Electrolux, LG Electronics, Midea Group, Walton Group, Samsung Electronics, Bosch, Panasonic, Sharp, Gree Electric Appliances, Whirlpool, BSH Hausgerate, Haier Group, Siemens, and Miele. Companies in the Electric Household Appliances Market are employing several strategies to strengthen their presence and expand market share. They are investing heavily in research and development to enhance energy efficiency, smart features, and AI integration. Strategic partnerships, mergers, and acquisitions help broaden distribution networks and penetrate emerging markets. Product portfolio diversification, focusing on multi-functional and space-saving appliances, caters to urban consumers. Firms emphasize sustainable manufacturing practices, eco-friendly certifications, and compliance with global energy standards to appeal to environmentally conscious buyers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Price

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements

- 3.2.1.2 Urbanization & changing lifestyles

- 3.2.1.3 Rising disposable income

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs

- 3.2.2.2 Regulatory complexity

- 3.2.3 Opportunities

- 3.2.3.1 Smart & connected appliances

- 3.2.3.2 Energy-efficient & sustainable solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million units)

- 5.1 Key trends

- 5.2 Large appliances

- 5.2.1 Refrigerators

- 5.2.2 Cooking appliances

- 5.2.3 Laundry appliances

- 5.2.4 Cleaning appliances

- 5.2.5 Climate control appliances

- 5.3 Small appliances

- 5.3.1 Toasters

- 5.3.2 Coffee makers

- 5.3.3 Blenders & mixers

- 5.3.4 Irons

- 5.3.5 Hair dryers

- 5.3.6 Water filters

- 5.3.7 Others (electric kettles, steamers, etc.)

Chapter 6 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Mega retail stores

- 8.3.2 Supermarket/hypermarket stores

- 8.3.3 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 BSH Hausgerate

- 10.2 Electrolux

- 10.3 Gree Electric Appliances

- 10.4 Haier Group

- 10.5 Hitachi

- 10.6 LG Electronics

- 10.7 Midea Group

- 10.8 Miele

- 10.9 Panasonic

- 10.10 Robert Bosch

- 10.11 Samsung Electronics

- 10.12 Sharp

- 10.13 Siemens

- 10.14 Walton Group

- 10.15 Whirlpool