|

市場調查報告書

商品編碼

1885925

醫療產品市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Medical Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

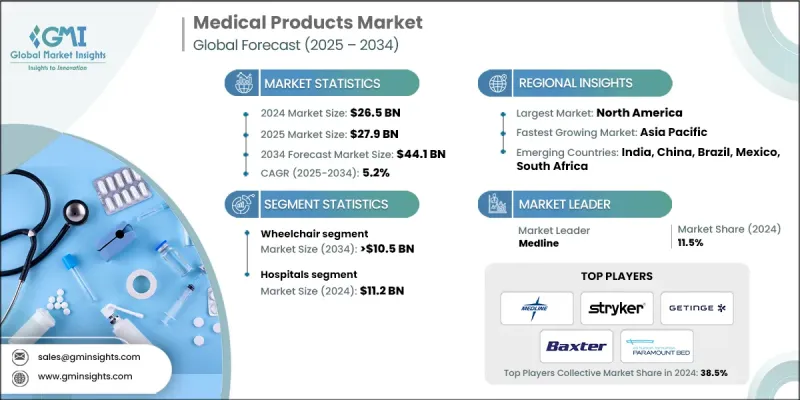

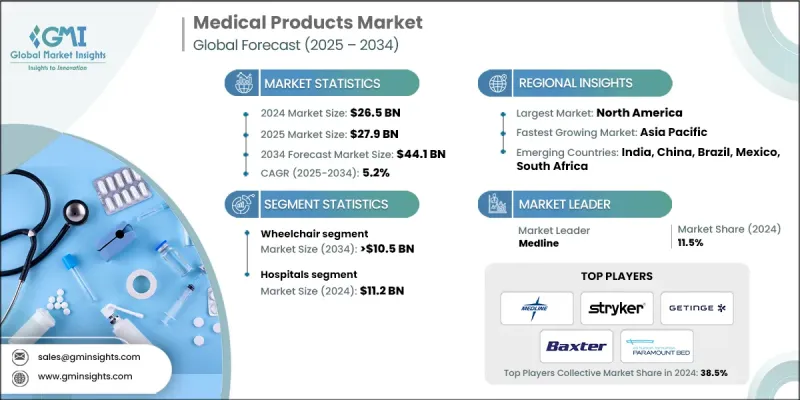

2024 年全球醫療產品市場價值為 265 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長至 441 億美元。

市場擴張的促進因素包括人口老化、殘疾人數增加以及對先進的行動輔助、骨科和家庭醫療保健解決方案日益成長的需求。醫療產品為醫院、診所和家庭護理服務機構提供創新工具和設備,旨在提高病患安全、舒適度和營運效率。主要產品包括醫用床、移動輔助設備、患者搬運設備和骨科支撐,所有這些產品都旨在增強康復效果、提高舒適度和整體生活品質。技術創新在該市場中發揮關鍵作用,智慧病床、符合人體工學的骨科支撐、電動移動設備和數位監測系統在改善患者療效和安全性的同時,也簡化了臨床工作流程。物聯網和智慧感測器的整合實現了遠端患者監測和遠端康復,從而拓展了家庭護理的機會。此外,已開發地區和新興地區對醫療保健基礎設施的持續投入也促進了醫療產品的廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 265億美元 |

| 預測值 | 441億美元 |

| 複合年成長率 | 5.2% |

預計到2034年,醫用床市場將以4.5%的複合年成長率成長,而輪椅市場仍將保持領先。輪椅分為手動和電動兩種類型,其需求不斷成長的促進因素包括老年人、慢性病患者和受傷者行動不便的情況。人們對無障礙標準和復健方案的認知不斷提高,推動了醫院、長期照護機構和家庭護理環境中手動和電動輪椅的普及。

2025年至2034年間,醫院業務部門佔27.9%,營收達112億美元。醫院是先進病患照護解決方案、復健設備和手術輔助設備的主要需求方。為滿足日益嚴格的醫療標準,醫院不斷升級設備,因此需要醫用床、病患搬運工具、助行器和矯形支架等。

2024年,北美醫療產品市佔率達33.3%。該地區受益於人口結構、技術和經濟等多方面因素的共同作用。人口老化、慢性病和行動不便的增加,催生了對醫用床、助行器、矯形支架和居家護理解決方案的強勁需求。先進的醫療基礎設施,以及對醫院、診所和長期護理機構的大量投資,也促進了技術先進的醫療產品的廣泛應用。

全球醫療產品市場的主要參與者包括Pride Mobility Products、Medline、Gendron、Baxter、Sunrise Medical、Cardinal Health、Stryker Corporation、INTCO MEDICAL TECHNOLOGY、Paramount Bed、Getinge AB、GF Health Products、Compass Health Brands、Antano Group、Invacare Corporation Bed、Getinge AB、GF Health Products、Compass Health Brands、Antano Group、Invacare Corporation和Malvestio。醫療產品市場的企業正透過創新、拓展產品組合和加大研發投入來提升病患療效,鞏固自身市場地位。策略合作和收購有助於擴大地域覆蓋範圍和分銷網路。各企業致力於開發技術先進且符合人體工學的解決方案,以在競爭激烈的市場環境中脫穎而出。永續發展措施、提升客戶服務、遵守全球醫療保健標準,都有助於增強品牌信譽。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 老年人口基數不斷增加

- 殘疾人數和道路交通事故數量不斷增加

- 技術進步

- 增加對醫療基礎建設和醫療設施的投資

- 產業陷阱與挑戰

- 嚴格的監管

- 該設備成本高昂

- 市場機遇

- 家庭醫療保健和遠距復健的拓展

- 新興經濟體需求不斷成長

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 技術格局

- 當前技術趨勢

- 智慧病床,可調節位置並具備病人監護功能

- 電動且符合人體工學的輪椅,增強行動能力

- 物聯網賦能的病患搬運與復健設備

- 新興技術

- 人工智慧驅動的患者監測和預測分析

- 用於遠距復健的物聯網連接矯形支架。

- 語音控制與自動化醫院病床系統

- 當前技術趨勢

- 差距分析

- 2024年產品定價分析

- 報銷方案

- 品牌分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 家庭醫療保健和遠距復健解決方案的擴展

- 智慧、互聯、以病人為中心的醫療產品

- 採用節能、低維護的設備

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 輪椅

- 手動輪椅

- 折疊式手動輪椅

- 硬架手動輪椅

- 電動輪椅

- 醫用床

- 病床

- 檢查床

- 按摩床

- 擔架床

- 其他醫療床

- 沃克

- 雙手持助行器

- 單手助行器

- 浴室輔助產品

- 便盆

- 浴缸座椅

- 淋浴座椅

- 其他浴室輔助產品

- 骨科

- 頸托支撐

- 肩部支撐

- 手臂吊帶

- 腕部夾板

- 腹部束帶

- 孕婦腰帶

- 彈性繃帶

- 空中護盾步行者

- 護膝

- 其他產品

第6章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 門診手術中心

- 家庭醫療保健

- 其他最終用途

第7章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Antano Group

- Baxter

- Cardinal Health

- Compass Health Brands

- Gendron

- Getinge AB

- GF Health Products

- INTCO MEDICAL TECHNOLOGY

- Invacare Corporation

- Malvestio Spa

- Medline

- Paramount Bed

- Pride Mobility Products

- Stryker Corporation

- Sunrise Medical

The Global Medical Products Market was valued at USD 26.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 44.1 billion by 2034.

Market expansion is driven by an aging population, increasing prevalence of disabilities, and rising demand for advanced mobility, orthopedic, and home healthcare solutions. Medical products provide innovative tools and equipment for hospitals, clinics, and home care services, aimed at improving patient safety, comfort, and operational efficiency. Key offerings include medical beds, mobility aids, patient handling equipment, and orthopedic supports, all designed to enhance rehabilitation, comfort, and overall quality of life. Technological innovation plays a pivotal role in this market, with smart hospital beds, ergonomic orthopedic supports, powered mobility devices, and digital monitoring systems improving patient outcomes and safety while streamlining clinical workflows. The integration of IoT and smart sensors allows remote patient monitoring and tele-rehabilitation, expanding opportunities in home care. Additionally, increasing investments in healthcare infrastructure across developed and emerging regions are supporting widespread adoption of medical products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.5 Billion |

| Forecast Value | $44.1 Billion |

| CAGR | 5.2% |

The medical beds segment is projected to grow at a CAGR of 4.5% through 2034, while the wheelchairs segment remains the market leader. Wheelchairs are divided into manual and powered types, with rising demand fueled by mobility impairments from aging, chronic conditions, and injuries. Awareness of accessibility standards and rehabilitation protocols is driving adoption of both manual and powered wheelchairs across hospitals, long-term care facilities, and home care environments.

The hospitals segment held a 27.9% share and generated USD 11.2 billion during 2025-2034. Hospitals drive demand for advanced patient care solutions, rehabilitation devices, and surgical support equipment. Continuous upgrades to meet stringent healthcare standards necessitate medical beds, patient handling tools, mobility aids, and orthopedic supports.

North America Medical Products Market held a 33.3% share in 2024. The region benefits from a combination of demographic, technological, and economic factors. An aging population with increasing chronic illnesses and mobility limitations creates strong demand for medical beds, mobility devices, orthopedic supports, and home care solutions. Advanced healthcare infrastructure, along with substantial investments in hospitals, clinics, and long-term care facilities, supports widespread adoption of technologically advanced medical products.

Key players in the Global Medical Products Market include Pride Mobility Products, Medline, Gendron, Baxter, Sunrise Medical, Cardinal Health, Stryker Corporation, INTCO MEDICAL TECHNOLOGY, Paramount Bed, Getinge AB, GF Health Products, Compass Health Brands, Antano Group, Invacare Corporation, and Malvestio Spa. Companies in the Medical Products Market are strengthening their presence through innovation, expanding product portfolios, and investing in R&D to improve patient outcomes. Strategic partnerships and acquisitions help broaden geographic reach and distribution networks. Businesses are focusing on developing technologically advanced and ergonomic solutions to differentiate themselves in the competitive landscape. Sustainability initiatives, enhanced customer service, and compliance with global healthcare standards reinforce brand credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population base

- 3.2.1.2 Rising number of disabilities and road accidents

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing investments in healthcare infrastructural development and healthcare facilities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulations

- 3.2.2.2 High cost of the device

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in home healthcare and tele-rehabilitation

- 3.2.3.2 Increasing demand in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Smart hospital beds with adjustable positions and patient monitoring

- 3.5.1.2 Powered and ergonomic wheelchairs for enhanced mobility

- 3.5.1.3 IoT-enabled patient handling and rehabilitation devices

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-driven patient monitoring and predictive analytics

- 3.5.2.2 IoT-connected orthopedic supports for remote rehabilitation.

- 3.5.2.3 Voice-controlled and automated hospital bed systems

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Pricing analysis, by product, 2024

- 3.8 Reimbursement scenario

- 3.9 Brand analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Future market trends

- 3.12.1 Expansion of home healthcare and tele-rehabilitation solutions

- 3.12.2 Smart, connected, and patient-centric medical products

- 3.12.3 Adoption of energy-efficient, low-maintenance devices

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launch

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wheelchairs

- 5.2.1 Manual wheelchair

- 5.2.2 Folding frame manual wheelchairs

- 5.2.3 Rigid frame manual wheelchairs

- 5.2.4 Powered wheelchair

- 5.3 Medical beds

- 5.3.1 Patient beds

- 5.3.2 Examination beds

- 5.3.3 Massage beds

- 5.3.4 Gurney beds

- 5.3.5 Other medical beds

- 5.4 Walkers

- 5.4.1 Double handed walkers

- 5.4.2 Single handed walkers

- 5.5 Bathroom assistive products

- 5.5.1 Commodes

- 5.5.2 Bathtub seats

- 5.5.3 Shower seats

- 5.5.4 Other bathroom assistive products

- 5.6 Orthopedics

- 5.6.1 Cervical collar support

- 5.6.2 Shoulder support

- 5.6.3 Arm sling

- 5.6.4 Wrist splint

- 5.6.5 Abdominal binder

- 5.6.6 Maternity belt

- 5.6.7 Elastic bandage

- 5.6.8 Air shield walker

- 5.6.9 Knee support

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Home healthcare

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Antano Group

- 8.2 Baxter

- 8.3 Cardinal Health

- 8.4 Compass Health Brands

- 8.5 Gendron

- 8.6 Getinge AB

- 8.7 GF Health Products

- 8.8 INTCO MEDICAL TECHNOLOGY

- 8.9 Invacare Corporation

- 8.10 Malvestio Spa

- 8.11 Medline

- 8.12 Paramount Bed

- 8.13 Pride Mobility Products

- 8.14 Stryker Corporation

- 8.15 Sunrise Medical