|

市場調查報告書

商品編碼

1885917

耐用醫療設備市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Durable Medical Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

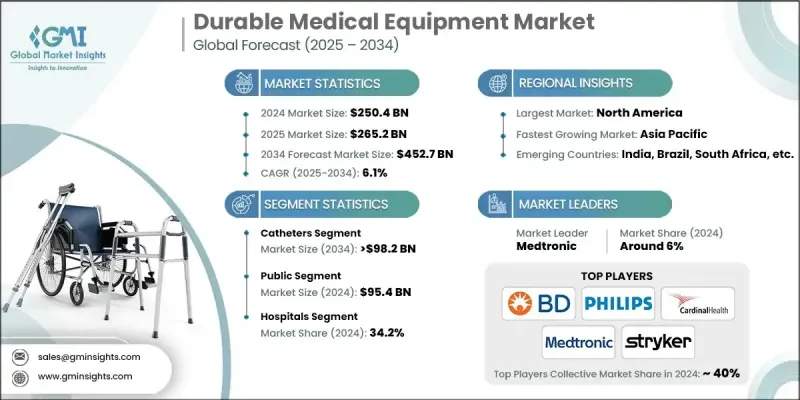

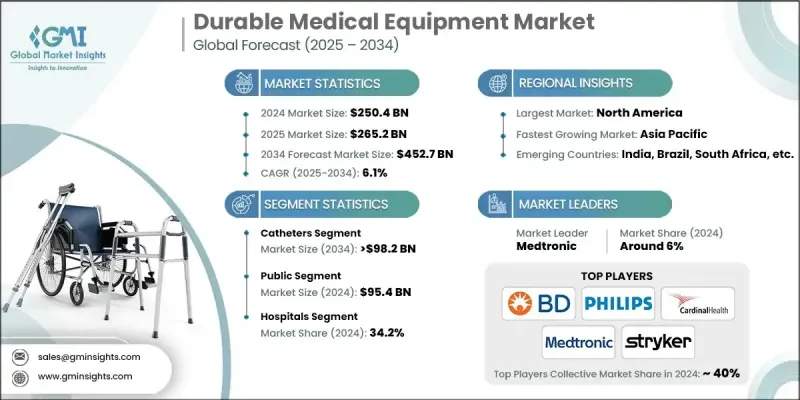

2024 年全球耐用醫療設備市場價值為 2,504 億美元,預計到 2034 年將以 6.1% 的複合年成長率成長至 4,527 億美元。

全球慢性病盛行率上升、醫療技術進步、居家醫療保健需求成長以及有利的報銷政策是推動市場成長的主要因素。對復健、以患者為中心的照護以及符合人體工學且易於使用的設備日益重視,進一步刺激了市場需求。人口老化也增加了對專用設備的需求。各公司正積極進行產品創新,整合新型材料,並建立區域合作夥伴關係以拓展地理市場。技術整合正成為市場的核心驅動力,如今的設備提供無線監測、人工智慧診斷和行動應用程式連接功能,從而實現即時資料共享和個人化護理。隨著醫療保健向數位化和價值導向模式轉型,科技增強型耐用醫療設備對於高效、以患者為中心的治療至關重要,這為差異化和市場成長開闢了新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2504億美元 |

| 預測值 | 4527億美元 |

| 複合年成長率 | 6.1% |

2024年,導尿管市場佔有率預計將達到22.3%,主要得益於外科手術和泌尿科相關治療數量的成長。導尿管在引流液體、給藥和建立循環系統路徑方面發揮著至關重要的作用。它們廣泛應用於醫院、長期照護機構和家庭照護場所,尤其適用於尿液滯留、心血管疾病或接受透析治療的患者。

2024年,公共醫療支付方市場規模預估為954億美元。公共醫療支付者包括政府支持的醫療項目和保險計劃,為受保人員提供醫療保障。他們通常透過大量採購的方式進行價格談判,並強調提供經濟實惠的基本耐用醫療設備(DME)。公共醫療支付方在擴大醫療服務覆蓋範圍方面發揮著至關重要的作用,尤其是在低收入和農村地區,其報銷政策直接影響產品的供應和市場需求。

2024年,北美耐用醫療設備市場佔了相當大的佔有率,這主要得益於其先進的醫療基礎設施、高昂的醫療支出以及龐大的老齡人口。糖尿病、心血管疾病和呼吸系統疾病等慢性病的高發生率推動了醫療設備的長期使用。家庭醫療保健和數位健康技術的日益普及加速了對攜帶式連網設備的需求。包括聯邦醫療保險(Medicare)和聯邦醫療補助(Medicaid)在內的政府舉措進一步支持了人們獲得必要的耐用醫療設備,尤其是老年人和殘疾人群體。

全球耐久性醫療設備市場的主要參與者包括B Braun、Baxter、BD、Cardinal Health、CAREX、Coloplast、COMPASS HEALTH、ConvaTec、Drive DeVilbiss Healthcare、Getinge、Graham-Field、INTCO MEDICAL、INVACARE、Koninklijke Philips、WISEMED 或ReLINE、Rexax、Et.市場領導者專注於產品創新,開發符合人體工學、患者客製化和互聯互通的設備,以增強易用性並改善臨床療效。各公司大力投資研發,將人工智慧、無線監測和行動連接功能整合到設備中,在市場中脫穎而出。與區域分銷商、醫療服務提供者和技術公司建立策略合作夥伴關係和合作,有助於擴大地域覆蓋範圍並加快市場滲透速度。各公司也利用併購來擴展產品組合併加強供應鏈。此外,各公司也注重監管合規、品質認證和政府報銷計劃,以確保市場信譽和准入。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 患者越來越傾向於選擇居家護理

- 全球慢性病盛行率不斷上升

- 老年人口不斷增加

- 產品技術進步

- 產業陷阱與挑戰

- 高昂的設備成本和價格負擔能力方面的挑戰

- 對兒科產品的需求不斷成長

- 機會

- 人工智慧/機器學習整合和預測分析

- 新興市場擴張與基礎建設發展

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 投資環境

- 報銷方案

- 醫療服務模式轉型

- 個人化醫療和精準醫療保健應用

- 軟體即醫療器材 (SaMD) 整合分析

- 波特的分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 個人行動裝置

- 輪椅和電動代步車

- 拐杖和手杖

- 沃克

- 其他個人行動裝置

- 監測和治療設備

- 氧氣設備

- 血糖分析儀

- 生命徵象監測儀

- 點滴幫浦

- 持續性呼吸道正壓通氣(CPAP)裝置

- 霧化器

- 其他監測和治療設備

- 浴室安全裝置

- 醫療家具

- 成人尿墊

- 吸乳器

- 導管

- 耗材和配件

- 其他產品

第6章:市場估計與預測:依支付方分類,2021-2034年

- 主要趨勢

- 民眾

- 私人的

- 自費

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 家庭醫療保健

- 門診手術中心

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- B Braun

- Baxter

- BD

- Cardinal Health

- CAREX

- Coloplast

- COMPASS HEALTH

- convaTec

- drive DeVilbiss Healthcare

- Getinge

- graham-field

- INTCO MEDICAL

- INVACARE

- Koninklijke Philips

- MEDLINE

- Medtronic

- ResMed

- Stryker

- SUNRISE MEDICAL

The Global Durable Medical Equipment Market was valued at USD 250.4 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 452.7 billion by 2034.

Market growth is driven by the rising prevalence of chronic illnesses worldwide, advancements in medical technology, the growing preference for home healthcare, and supportive reimbursement policies. Increasing emphasis on rehabilitation, patient-centered care, and ergonomic, user-friendly equipment is further fueling demand. The aging population also contributes to the need for specialized devices. Companies are actively innovating products, integrating novel materials, and forming regional partnerships to expand geographically. Technological integration is becoming a core market driver, with devices now offering wireless monitoring, AI-powered diagnostics, and mobile app connectivity to enable real-time data sharing and personalized care. As healthcare shifts toward digital and value-based models, technology-enhanced DME is increasingly critical for efficient, patient-focused treatment, opening new opportunities for differentiation and market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $250.4 Billion |

| Forecast Value | $452.7 Billion |

| CAGR | 6.1% |

The catheters segment held a 22.3% share in 2024, driven by the growing number of surgical procedures and urology-related treatments. Catheters serve essential roles in draining fluids, administering medication, and providing circulatory system access. They are widely used across hospitals, long-term care facilities, and home care settings, particularly among patients with urinary retention, cardiovascular conditions, or those undergoing dialysis.

The public payer segment was valued at USD 95.4 billion in 2024. Public payers include government-backed health programs and insurance plans that provide coverage for insured individuals. They often negotiate bulk pricing and emphasize cost-effective essential DME. Public payers are crucial in expanding access, especially in low-income and rural areas, with reimbursement policies directly influencing product availability and market demand.

North America Durable Medical Equipment Market held a substantial share in 2024, owing to advanced healthcare infrastructure, high medical expenditure, and a significant elderly population. The prevalence of chronic illnesses such as diabetes, cardiovascular disorders, and respiratory diseases drives long-term equipment use. The growing adoption of home healthcare and digital health technologies has accelerated demand for portable, connected devices. Government initiatives, including Medicare and Medicaid, further support access to essential DME products, particularly for geriatric and disabled populations.

Prominent players in the Global Durable Medical Equipment Market include B Braun, Baxter, BD, Cardinal Health, CAREX, Coloplast, COMPASS HEALTH, ConvaTec, Drive DeVilbiss Healthcare, Getinge, Graham-Field, INTCO MEDICAL, INVACARE, Koninklijke Philips, MEDLINE, Medtronic, ResMed, Stryker, and SUNRISE MEDICAL. Market leaders focus on product innovation, developing ergonomic, patient-specific, and connected devices to enhance usability and improve clinical outcomes. Companies invest heavily in R&D to integrate AI, wireless monitoring, and mobile connectivity into their equipment, differentiating themselves in the market. Strategic partnerships and collaborations with regional distributors, healthcare providers, and technology firms allow broader geographic reach and faster market penetration. Firms also leverage mergers and acquisitions to expand portfolios and strengthen supply chains. Focus on regulatory compliance, quality certifications, and government reimbursement programs to ensure market credibility and access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Payer trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising patient preference for home-based care

- 3.2.1.2 Increasing prevalence of chronic diseases across the globe

- 3.2.1.3 Growing geriatric population

- 3.2.1.4 Technological advancements in products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High device costs and affordability challenges

- 3.2.2.2 Growing demand for pediatric-focused products

- 3.2.3 Opportunities

- 3.2.3.1 AI/ML integration and predictive analytics

- 3.2.3.2 Emerging markets expansion and infrastructure development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Investment landscape

- 3.7 Reimbursement scenario

- 3.8 Healthcare delivery model transformation

- 3.9 Personalized medicine and precision healthcare applications

- 3.10 Software as medical device (SaMD) integrated analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

- 3.14 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Personal mobility devices

- 5.2.1 Wheelchair and scooter

- 5.2.2 Crutches and canes

- 5.2.3 Walkers

- 5.2.4 Other personal mobility devices

- 5.3 Monitoring and therapeutic devices

- 5.3.1 Oxygen equipment

- 5.3.2 Blood glucose analyzers

- 5.3.3 Vital sign monitors

- 5.3.4 Infusion pumps

- 5.3.5 Continuous positive airway pressure (CPAP) devices

- 5.3.6 Nebulizers

- 5.3.7 Other monitoring and therapeutic devices

- 5.4 Bathroom safety devices

- 5.5 Medical furniture

- 5.6 Incontinent pads

- 5.7 Breast pumps

- 5.8 Catheters

- 5.9 Consumables and accessories

- 5.10 Other products

Chapter 6 Market Estimates and Forecast, By Payer, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Public

- 6.3 Private

- 6.4 Out-of-pocket

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Home healthcare

- 7.4 Ambulatory surgical centers

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Baxter

- 9.3 BD

- 9.4 Cardinal Health

- 9.5 CAREX

- 9.6 Coloplast

- 9.7 COMPASS HEALTH

- 9.8 convaTec

- 9.9 drive DeVilbiss Healthcare

- 9.10 Getinge

- 9.11 graham-field

- 9.12 INTCO MEDICAL

- 9.13 INVACARE

- 9.14 Koninklijke Philips

- 9.15 MEDLINE

- 9.16 Medtronic

- 9.17 ResMed

- 9.18 Stryker

- 9.19 SUNRISE MEDICAL