|

市場調查報告書

商品編碼

1885913

新生兒護理市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Neonatal Infant Care Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

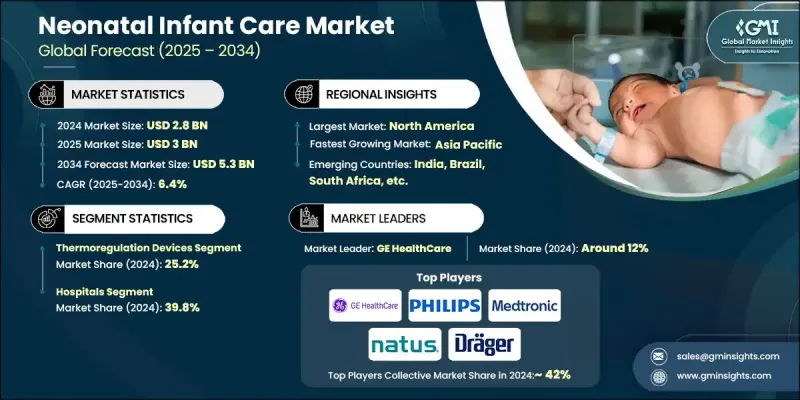

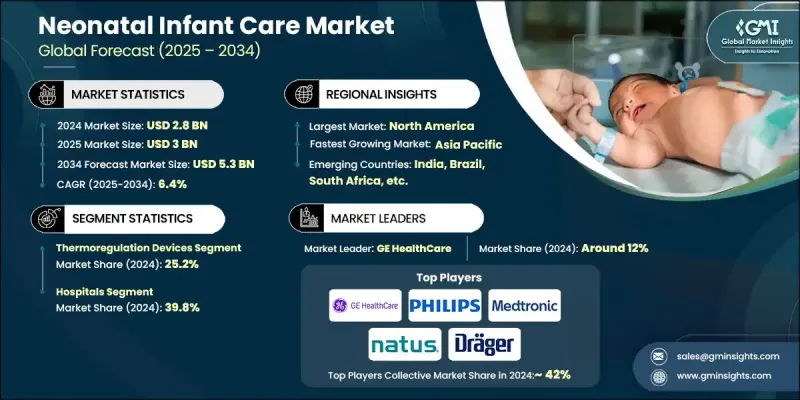

2024 年全球新生兒護理市場價值為 28 億美元,預計到 2034 年將以 6.4% 的複合年成長率成長至 53 億美元。

新生兒加護病房(NICU)的日益普及、政府對婦幼保健投入的增加以及早產兒數量的上升,共同推動了市場擴張。新生兒護理技術的進步,以及人們對嬰兒死亡率和醫療品質標準的日益關注,都促進了新生兒護理設備的普及。攜帶式和非侵入性新生兒護理解決方案的開發,以及新興經濟體醫療支出的增加,也是重要的成長動力。公共衛生措施和國際資助支持新生兒設備的普及,而醫院補貼和報銷政策則使醫療機構能夠投資先進技術。總而言之,這些因素共同為全球新生兒護理設備的普及創造了良好的環境。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 53億美元 |

| 複合年成長率 | 6.4% |

2024年,體溫調節設備市佔率達25.2%。諸如保溫箱和輻射保暖器等設備能夠維持早產兒和低出生體重兒的最佳體溫,預防低體溫及其相關併發症。政府對婦幼保健計畫的支持進一步推動了對這些技術的需求。

預計到2024年,醫院市佔率將達到39.8%。作為新生兒護理設備的主要用戶,醫院受益於專業的NICU(新生兒加護病房)和先進的基礎設施。不斷成長的患者群體和持續的政府資助推動了包括呼吸器、監護系統和保溫箱在內的設備的不斷升級。由於醫院具備整合全面新生兒解決方案的能力,因此仍是市場成長的核心力量。

預計到2024年,北美新生兒護理市場將佔據34.1%的市場。美國和加拿大強大的醫療基礎設施、日益增強的嬰兒健康意識以及先進的新生兒重症監護室(NICU)的普及,都為市場擴張提供了支持。人工智慧和物聯網設備的快速普及,以及有利的報銷政策,進一步推動了相關技術的採用。

新生兒護理市場的主要參與者包括GE醫療、德爾格、費雪派克醫療、美敦力、ATOM醫療、Masimo、飛利浦、Phoenix、Inspiration Healthcare Group、Cobams、Natus Medical、David、Novos Medical Systems、Fanem Medical Devices、Pluss和AVI Healthcare。這些公司透過投資創新設備技術,例如人工智慧驅動的監護系統和攜帶式護理解決方案,不斷鞏固其市場地位。他們專注於與醫院和醫療保健機構進行策略合作,以拓展分銷網路並提高市場滲透率。持續的研發投入提升了產品的可靠性、能源效率和易用性,並確保符合法規標準。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 早產發生率上升

- 新生兒加護病房的安裝數量不斷增加

- 政府加大對婦幼保健計畫的投入

- 新生兒護理設備的技術進步

- 產業陷阱與挑戰

- 先進的新生兒護理設備價格昂貴

- 低收入地區新生兒重症監護設施的可近性有限

- 機會

- 擴大居家新生兒護理解決方案

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 政策環境

- 流行病學情景

- 新生兒加護病房的病人安全與感染控制措施

- 2024年各區新生兒加護病房數量

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 波特的分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 體溫調節裝置

- 新生兒保溫箱

- 保暖器

- 新生兒降溫系統

- 光療設備

- LED光療系統

- CFL光療系統

- 監控系統

- 新生兒通氣

- 血氣監測系統

- 腦監測

- 其他監控系統

- 新生兒復甦裝置

- 新生兒聽力篩檢

- 視力篩檢

- 其他產品類型

第6章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 兒科和新生兒診所

- 養老院

第7章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

第8章:公司簡介

- ATOM MEDICAL

- AVI Healthcare

- COBAMS

- DAVID

- Drager

- Fanem Medical Devices

- Fisher & Paykel HEALTHCARE

- GE Healthcare

- INSPIRATION HEALTHCARE GROUP

- MASIMO

- Medtronic

- Natus Medical

- Novos Medical Systems

- PHILIPS

- PHOENIX

- PLUSS

The Global Neonatal Infant Care Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 5.3 billion by 2034.

The market expansion is driven by the increasing establishment of NICU units, rising government investments in maternal and child healthcare, and the growing incidence of premature births. Advances in neonatal care technology, coupled with heightened awareness of infant mortality and healthcare quality standards, are fueling adoption. The development of portable and non-invasive neonatal care solutions and increased healthcare spending in emerging economies are also key growth contributors. Public health initiatives and international grants support access to neonatal devices, while hospital subsidies and reimbursement policies enable institutions to invest in advanced technology. Collectively, these factors are creating a robust environment for the adoption of neonatal infant care devices globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6.4% |

In 2024, the thermoregulation devices segment accounted for a 25.2% share. Devices such as incubators and radiant warmers maintain optimal body temperature for premature and low-birth-weight infants, preventing hypothermia and related complications. Government support for maternal and child health programs further drives demand for these technologies.

The hospitals segment held a 39.8% share in 2024. As primary users of neonatal care devices, hospitals benefit from specialized NICUs and advanced infrastructure. The rising patient population and consistent government funding encourage continuous upgrades, including ventilators, monitoring systems, and incubators. Hospitals remain central to market growth due to their capacity to integrate comprehensive neonatal solutions.

North America Neonatal Infant Care Market held 34.1% share in 2024. Strong healthcare infrastructure, increased awareness of infant health, and the presence of advanced NICUs in the U.S. and Canada support market expansion. The rapid integration of AI- and IoT-enabled devices, along with favorable reimbursement policies, further propels adoption.

Key players in the Neonatal Infant Care Market include GE Healthcare, Drager, Fisher & Paykel Healthcare, Medtronic, ATOM Medical, Masimo, Philips, Phoenix, Inspiration Healthcare Group, Cobams, Natus Medical, David, Novos Medical Systems, Fanem Medical Devices, Pluss, and AVI Healthcare. Companies operating in the Neonatal Infant Care Market are strengthening their position by investing in innovative device technologies, such as AI-driven monitoring systems and portable care solutions. They focus on strategic collaborations with hospitals and healthcare providers to expand distribution networks and increase market penetration. Continuous R&D initiatives enhance product reliability, energy efficiency, and usability, ensuring compliance with regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of premature birth rate

- 3.2.1.2 Increasing number of installations for NICU units

- 3.2.1.3 Growing government investments in maternal and child health programs

- 3.2.1.4 Technological advancements in neonatal infant care devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced neonatal care equipment

- 3.2.2.2 Limited accessibility to NICU facilities in low-income regions

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of home-based neonatal care solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Policy landscape

- 3.7 Epidemiology scenario

- 3.8 Patient safety and infection control measures in NICUs

- 3.9 Number of neonatal intensive care units, by region, 2024

- 3.9.1 Global

- 3.9.2 North America

- 3.9.3 Europe

- 3.9.4 Asia Pacific

- 3.9.5 Latin America

- 3.9.6 MEA

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

- 3.13 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Thermoregulation devices

- 5.2.1 Neonatal incubators

- 5.2.2 Warmers

- 5.2.3 Neonatal cooling systems

- 5.3 Phototherapy devices

- 5.3.1 LED phototherapy system

- 5.3.2 CFL phototherapy system

- 5.4 Monitoring systems

- 5.4.1 Neonatal ventilation

- 5.4.2 Blood gas monitoring system

- 5.4.3 Brain monitoring

- 5.4.4 Other monitoring systems

- 5.5 Neonatal infant resuscitator devices

- 5.6 Neonatal hearing screening

- 5.7 Vision screening

- 5.8 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Pediatric & neonatal clinics

- 6.4 Nursing homes

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Nigeria

- 7.6.5 Egypt

Chapter 8 Company Profiles

- 8.1 ATOM MEDICAL

- 8.2 AVI Healthcare

- 8.3 COBAMS

- 8.4 DAVID

- 8.5 Drager

- 8.6 Fanem Medical Devices

- 8.7 Fisher & Paykel HEALTHCARE

- 8.8 GE Healthcare

- 8.9 INSPIRATION HEALTHCARE GROUP

- 8.10 MASIMO

- 8.11 Medtronic

- 8.12 Natus Medical

- 8.13 Novos Medical Systems

- 8.14 PHILIPS

- 8.15 PHOENIX

- 8.16 PLUSS