|

市場調查報告書

商品編碼

1885879

地毯市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Carpet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

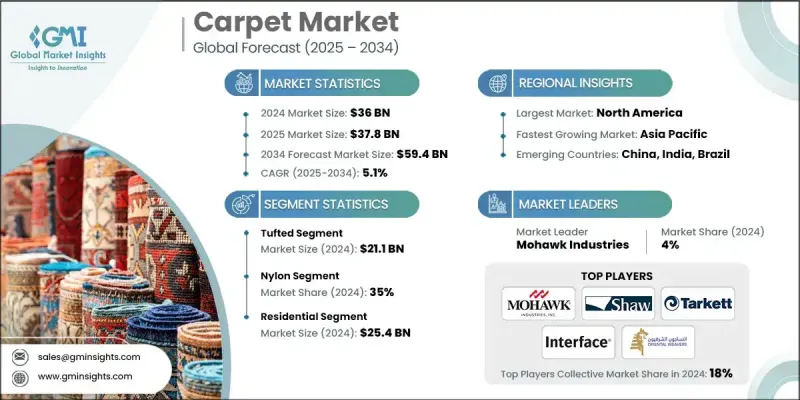

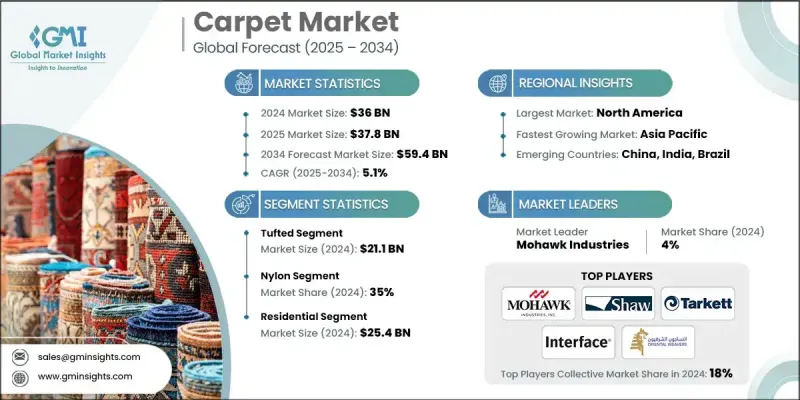

2024 年全球地毯市場價值為 360 億美元,預計到 2034 年將以 5.1% 的複合年成長率成長至 594 億美元。

推動這一成長的主要動力是消費者對環保地毯日益成長的偏好。為了滿足消費者對綠色產品日益成長的需求,生產商正在更多地使用再生纖維、羊毛、黃麻和劍麻等天然材料以及低揮發性有機化合物(VOC)黏合劑。 「從搖籃到搖籃」(Cradle to Cradle)和「綠色標籤+」(Green Label Plus)等認證已成為產品品質和環保承諾的有力標誌。循環經濟原則催生了可回收背襯、回收計劃和模組化地毯系統等創新,這些創新有助於減少浪費並提高材料利用率。這些以永續發展為導向的變革不僅影響產品設計,也影響行銷,因為具有環保意識的消費者,尤其是年輕一代,更傾向於選擇能夠體現自身價值觀的品牌。同時,數位轉型和電子商務的快速發展正在重塑地毯的推廣和銷售方式,使消費者能夠更廣泛地接觸到各種款式,並享受更便利的購買體驗。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 360億美元 |

| 預測值 | 594億美元 |

| 複合年成長率 | 5.1% |

2024年,簇絨地毯市場規模達211億美元。其市場主導地位源自於快速的生產週期、較低的製造成本和廣泛的設計彈性。簇絨工藝使用特製針頭將紗線插入底布層,與傳統編織工藝相比,能夠以更少的人工實現快速生產。這種高效的技術使企業能夠以具有競爭力的價格供應大量產品,同時提供豐富的紋理、絨毛變化和圖案選擇,適用於住宅、商業和酒店等各種環境。

2024年,尼龍材料佔了35%的市場。其受歡迎的原因在於其耐用性、結構韌性和均衡的性價比。尼龍纖維能夠承受高人流量,不易磨損,並能長期維持外觀。經過保護性塗層處理後,尼龍纖維具有很強的抗污性,因此非常適合需要持久性能的場所。

美國地毯市場佔76.9%的市場佔有率,預計2024年市場規模將達89億美元。住宅和商業空間的持續成長鞏固了其領先地位。環保地毯的日益普及與該地區對永續發展的日益重視相契合。強勁的建築活動、不斷成長的翻新需求以及纖維技術的進步,包括更強的抗污性和更高的耐用性,都進一步鞏固了美國在區域市場中的地位。

全球地毯市場的主要企業包括 Brintons、EGE Carpets、Lano、Balta、Beaulieu、Bentley Mills、Engineered Floors、Interface、Merinos Hali、Milliken & Company、Mohawk Industries、Oriental Weavers、Shaw Industries Group、Tarkett 和 The Dixie Group。參與地毯市場競爭的企業透過創新、永續發展和策略擴張相結合的方式鞏固自身地位。許多企業正在投資先進的製造技術,以提高效率並加快產品開發。永續發展已成為核心,促使企業採用再生原料、環保背襯和低排放材料,以滿足不斷變化的環境期望。數位化平台和電子商務的提升有助於品牌觸及更廣泛的受眾並增強客戶互動。眾多企業也正在拓展分銷網路並建立策略合作夥伴關係,以改善市場准入。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 室內美學和房屋翻新需求不斷成長

- 商業和機構建築業的成長

- 技術進步與產品創新

- 產業陷阱與挑戰

- 原物料價格波動和價格不穩定

- 勞動力短缺和技能差距

- 機會

- 對永續和環保地毯的需求不斷成長

- 客製化和設計個人化

- 成長促進因素

- 成長潛力分析

- 主要市場趨勢和顛覆性因素

- 未來市場趨勢

- 差距分析

- 風險及緩解分析

- 貿易統計

- 主要進口國

- 主要出口國

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 北美洲

- 歐洲

- 亞太

- 中東和非洲

- 拉丁美洲

- 波特的分析

- PESTEL 分析

- 市場評估

- 全球的

- 歐洲

- 土耳其

- 整體評估和成長前景

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 簇絨

- 編織

- 針刺

- 打結

- 平織

- 其他

第6章:市場估算與預測:依材料分類,2021-2034年

- 主要趨勢

- 尼龍

- 聚酯纖維

- 聚丙烯

- 羊毛

- 丙烯酸纖維

- 其他

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 住宅

- 商業的

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 折扣零售通路

- 居家裝修中心

- 大型零售商

- 折扣零售商

- 家具折扣店/奧特萊斯店

- 傳統專業管道

- 折扣零售通路

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 土耳其

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Balta

- Beaulieu

- Bentley Mills

- Brintons

- EGE Carpets

- Engineered Floors

- Interface

- Lano

- Merinos Hali

- Milliken & Company

- Mohawk Industries

- Oriental Weavers

- Shaw Industries Group

- Tarkett

- The Dixie Group

The Global Carpet Market was valued at USD 36 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 59.4 billion by 2034.

A major force behind this growth is the rising preference for environmentally responsible carpets. Producers are incorporating more recycled fibers, natural materials such as wool, jute, and sisal, and low-VOC adhesives to satisfy the growing demand for green products. Certifications like Cradle to Cradle and Green Label Plus have become stronger signals of product quality and environmental commitment. Circular-economy principles are inspiring innovations such as recyclable backings, take-back initiatives, and modular carpet systems that help reduce waste and enhance material efficiency. These sustainability-driven changes influence not just product design but also marketing, as environmentally conscious buyers, especially younger generations, favor brands that reflect their values. At the same time, digital transformation and the rapid rise of e-commerce are reshaping how carpets are promoted and sold, giving consumers broader access to diverse styles and a more convenient buying experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36 Billion |

| Forecast Value | $59.4 Billion |

| CAGR | 5.1% |

In 2024, the tufted carpets segment generated USD 21.1 billion. Their dominance comes from fast production cycles, lower manufacturing costs, and wide design flexibility. The tufting process uses specialized needles to insert yarn into a backing layer, enabling rapid output with far less labor than traditional weaving. This efficient technique allows companies to supply large quantities at competitive prices while offering a wide range of textures, pile variations, and patterns suitable for residential, commercial, and hospitality environments.

The nylon segment accounted for a 35% share in 2024. Its popularity stems from its durability, structural resilience, and balanced price-to-performance profile. Nylon fibers withstand heavy foot traffic without significant wear and maintain their appearance over time. When enhanced with protective finishes, they offer strong resistance to stains, making them highly appealing for settings that require long-lasting performance.

United States Carpet Market held a 76.9% share and generated USD 8.9 billion in 2024. Continued growth in both residential and commercial spaces supports this leadership. Increasing adoption of eco-friendly carpets aligns with the region's heightened focus on sustainability. Strong construction activity, rising renovation efforts, and improvements in fiber technology, including better stain resistance and enhanced durability, reinforce the country's position in the regional market.

Key companies operating in the Global Carpet Market include Brintons, EGE Carpets, Lano, Balta, Beaulieu, Bentley Mills, Engineered Floors, Interface, Merinos Hali, Milliken & Company, Mohawk Industries, Oriental Weavers, Shaw Industries Group, Tarkett, and The Dixie Group. Companies competing in the Carpet Market strengthen their position through a mix of innovation, sustainability, and strategic expansion. Many are investing in advanced manufacturing technologies to improve efficiency and accelerate product development. Sustainability has become central, prompting firms to adopt recycled inputs, eco-friendly backings, and low-emission materials to meet evolving environmental expectations. Digital platforms and e-commerce enhancements help brands reach wider audiences and improve customer engagement. Numerous players are also expanding their distribution networks and forming strategic partnerships to improve market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Material

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for interior aesthetics and home renovation

- 3.2.1.2 Growth in commercial and institutional construction

- 3.2.1.3 Technological advancements and product innovation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Volatility in raw material prices and price instability

- 3.2.2.2 Labor shortages and skill gaps

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for sustainable and eco-friendly carpets

- 3.2.3.2 Customization and design personalization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and Disruptions

- 3.5 Future market trends

- 3.6 Gap Analysis

- 3.7 Risk and mitigation Analysis

- 3.8 Trade statistics

- 3.8.1 Major importing country

- 3.8.2 Major exporting country

- 3.9 Consumer behaviour analysis

- 3.9.1 Purchasing patterns

- 3.9.2 Preference analysis

- 3.9.3 Regional variations in consumer behavior

- 3.9.4 Impact of e-commerce on buying decisions

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Price trends

- 3.11.1 By region

- 3.11.2 By product type

- 3.12 Regulatory landscape

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia-Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Market Evaluation

- 3.15.1 Global

- 3.15.2 Europe

- 3.15.3 Turkey

- 3.16 Overall assessment and growth prospects

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Square Feet)

- 5.1 Key trends

- 5.2 Tufted

- 5.3 Woven

- 5.4 Needle-punched

- 5.5 Knotted

- 5.6 Flat-weave

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Million Square Feet)

- 6.1 Key trends

- 6.2 Nylon

- 6.3 Polyester

- 6.4 Polypropylene

- 6.5 Wool

- 6.6 Acrylic

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Million Square Feet)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Square Feet)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Discount retail channels

- 8.3.1.1 Home Improvement Centers

- 8.3.1.2 Mass Merchandisers

- 8.3.1.3 Off-price Retailers

- 8.3.1.4 Furniture Discount/Outlet Stores

- 8.3.2 Traditional speciality channels

- 8.3.1 Discount retail channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million Square Feet)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Turkey

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Balta

- 10.2 Beaulieu

- 10.3 Bentley Mills

- 10.4 Brintons

- 10.5 EGE Carpets

- 10.6 Engineered Floors

- 10.7 Interface

- 10.8 Lano

- 10.9 Merinos Hali

- 10.10 Milliken & Company

- 10.11 Mohawk Industries

- 10.12 Oriental Weavers

- 10.13 Shaw Industries Group

- 10.14 Tarkett

- 10.15 The Dixie Group