|

市場調查報告書

商品編碼

1885871

雙向電動車充電(V2G/V2H)系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Bidirectional EV Charging (V2G/V2H) System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

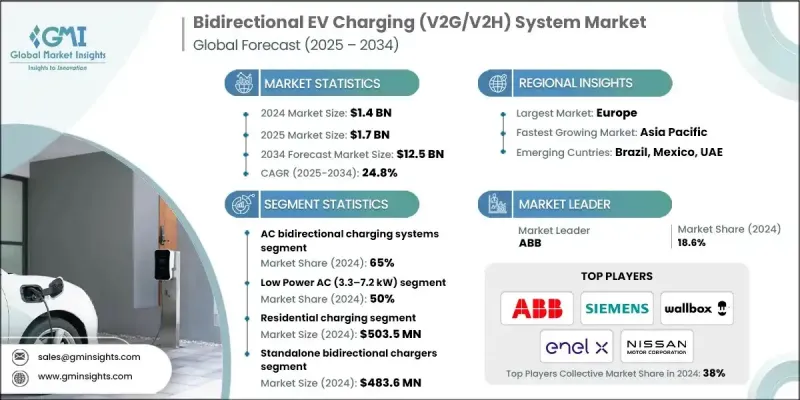

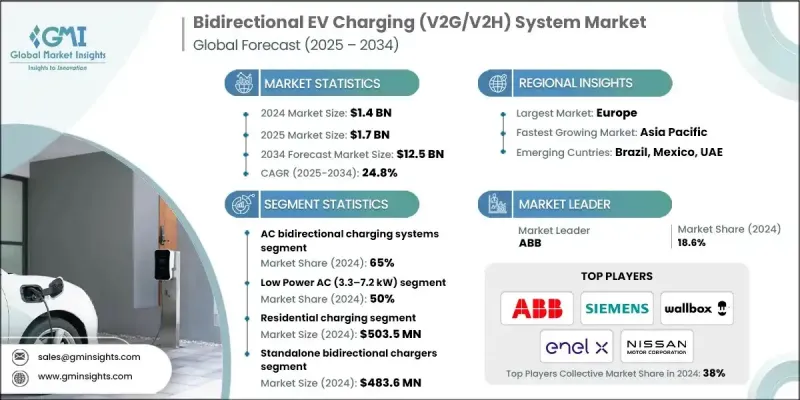

2024 年全球雙向電動車充電(V2G/V2H)系統市值為 14 億美元,預計到 2034 年將以 24.8% 的複合年成長率成長至 125 億美元。

市場成長的驅動力來自電動車的快速普及、商用和私家電動車車隊的擴張以及對智慧能源管理解決方案日益成長的需求。隨著車網互動(V2G)和車家互動(V2H)技術的進步,各利害關係人正致力於提升營運效率、電網穩定性以及最佳化負載分配。市場正朝著數據驅動、自動化和互聯互通的V2G/V2H網路轉型,從而改變傳統的能源管理方式。物聯網雙向充電器、人工智慧驅動的負載平衡演算法以及基於雲端的能源平台的日益普及正在革新營運模式,實現預測性能源消耗、公用事業公司與車隊營運商之間的無縫協調以及即時監控,從而提高效率、降低峰值負載並減少營運成本。這些創新為住宅、商業和車隊應用領域提供了可擴展、經濟高效且具彈性的雙向充電生態系統。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 125億美元 |

| 複合年成長率 | 24.8% |

2024 年,交流雙向充電系統市佔率達到 65%,預計 2025 年至 2034 年間將以 25.2% 的複合年成長率成長。交流雙向系統是實現高效 V2G/V2H 能量流動的關鍵,它利用車載交流充電器、智慧負載控制器和通訊介面,促進電動車向家庭或電網釋放能量。

低功率交流電(3.3-7.2 kW)市場在 2024 年佔據了 50% 的市場佔有率,預計到 2034 年將以 24.5% 的複合年成長率成長。該市場主要由住宅和小型商業應用驅動,提供經濟高效、易於安裝的解決方案,相容於大多數電動車,並透過物聯網監控和人工智慧驅動的能源調度得到增強。

德國雙向電動車充電(V2G/V2H)系統市場佔40%的佔有率,預計2024年市場規模將達到1.948億美元。德國的領先地位得益於其強大的汽車製造業、優惠的監管政策以及互聯互通的V2G基礎設施的廣泛應用。德國正日益廣泛地應用基於人工智慧的負載最佳化、物聯網雙向充電器、預測性能源調度以及雲端整合能源管理平台,以確保電網的可靠性和運作效率,同時遵守不斷變化的能源法規。

推動雙向電動車充電(V2G/V2H)系統市場成長的關鍵企業包括 Nuvve、Wallbox Chargers、Eaton、ABB、西門子、Enel X、ChargePoint、The Mobility House、施耐德電機和日產汽車。各公司正透過策略性措施鞏固其市場地位,例如擴展區域充電網路、與公用事業公司和車隊營運商建立合作關係,以及投資基於人工智慧和物聯網的雙向技術。產品創新包括經濟高效的低功耗交流解決方案和可擴展的商用 V2G 系統。各公司也致力於整合雲端平台、預測性能源調度和智慧負載平衡,以提高效能和合規性。行銷活動的目標客戶涵蓋住宅、商業和車隊用戶,旨在提高產品普及率;同時,併購和長期服務協議有助於增強分銷管道、品牌知名度和全球市場佔有率。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電動車快速普及和車隊擴張

- 智慧電網與能源管理需求

- 技術進步

- 政府政策與激勵措施

- 產業陷阱與挑戰

- 高昂的基礎設施和實施成本

- 監管和標準化方面的差距

- 市場機遇

- 與再生能源和家庭能源系統的整合

- 車隊及商業應用

- 監管激勵措施和支持性政策

- 智慧城市和車隊電氣化項目

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美監管環境

- 歐盟指令和授權

- 亞太政策框架

- 互聯標準和公用事業要求

- 車輛安全與認證要求

- 建築規範和電氣規範更新

- 保險與責任監理框架

- 資料隱私與消費者保護法規

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 交流雙向充電技術演進

- 直流雙向充電技術進展

- 車載架構與車載架構的權衡

- 電力電子和逆變技術趨勢

- 電池管理系統整合

- 智慧逆變器功能和併網支援能力

- 無線/感應式雙向充電研究

- 依組件進行技術準備度評估

- 下一代技術研發管線

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 最佳情況

- 試點專案和部署案例研究

3.14.1. Utility v2 g 試點計畫概述

- Pg&e BMW 儲值計劃

- 康愛迪生智慧充電

3.14.4. Opg v2 g 飛行員

3.14.5. 英國 v2 g 試驗

3.14.6. 日本V2H部署計劃

- 消費者行為與採納分析

- 各地區消費者意識水平

- 購買決策因素和優先事項

- 支付意願分析

- 公用事業計劃的參與率

- 流失率和留存率分析

- 客戶滿意度指標

- 宏觀經濟因素及市場影響

- 能源價格波動的影響

- 電力價格結構與分時電價

- 批發能源市場價格趨勢

- 利率環境與融資成本

- 通貨膨脹對設備成本的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:以收費方式分類,2021-2034年

- 主要趨勢

- 交流雙向充電系統

- 直流雙向充電系統

第6章:市場估算與預測:依電力容量分類,2021-2034年

- 主要趨勢

- 低功率交流電(3.3-7.2千瓦)

- 中等功率交流電(11-22千瓦)

- 直流快速充電(50-150千瓦)

- 高功率直流電(150度以上)

第7章:市場估算與預測:依充電地點分類,2021-2034年

- 主要趨勢

- 住宅收費

- 工作場所充電

- 車隊倉庫充電

- 公共收費

第8章:市場估算與預測:以一體化程度分類,2021-2034年

- 主要趨勢

- 獨立式雙向充電器

- 與太陽能光電發電系統整合

- 與固定式電池儲能系統整合

- 全整合家庭能源系統

- 微電網整合系統

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 住宅用戶

- 商業和車隊營運商

- 電力公司和電網營運商

- 工業設施

- 公共部門及緊急服務

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第11章:公司簡介

- Global Player

- ABB

- ChargePoint

- Eaton

- Enel X

- Nissan Motor

- Nuvve

- Schneider Electric

- Shell Recharge Solutions

- Siemens

- Wallbox Chargers

- Regional Player

- Blink charging

- Engie EV solutions

- Evbox

- Pod point

- Star charge

- Tesla energy

- TGOOD

- The mobility house

- Tritium

- Virta

- 新興參與者

- Freewire technologies

- Greenlots

- Incharge energy

- Ohme

11.3.5. Ovo 能源 V2 G 解決方案

The Global Bidirectional EV Charging (V2G/V2H) System Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 24.8% to reach USD 12.5 billion by 2034.

Market growth is fueled by the rapid adoption of electric vehicles, the expansion of commercial and private EV fleets, and rising demand for smart energy management solutions. As vehicle-to-grid and vehicle-to-home technologies advance, stakeholders are focusing on enhancing operational efficiency, grid stability, and optimized load distribution. The market is shifting toward data-driven, automated, and connected V2G/V2H networks, transforming conventional energy management approaches. Increasing use of IoT-enabled bidirectional chargers, AI-powered load balancing algorithms, and cloud-based energy platforms is revolutionizing operations, enabling predictive energy discharge, seamless coordination between utilities and fleet operators, and real-time monitoring to improve efficiency, reduce peak load, and lower operational costs. These innovations support scalable, cost-effective, and resilient bidirectional charging ecosystems across residential, commercial, and fleet applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 24.8% |

The AC bidirectional charging systems segment accounted for a 65% share in 2024 and is projected to grow at a CAGR of 25.2% between 2025 and 2034. AC bidirectional systems are integral for efficient V2G/V2H energy flow, leveraging onboard AC chargers, smart load controllers, and communication interfaces to facilitate energy discharge from EVs to homes or grids.

The low-power AC segment (3.3-7.2 kW) held a 50% share in 2024 and is expected to grow at a CAGR of 24.5% through 2034. This segment is primarily driven by residential and small commercial applications, offering cost-effective, easily installable solutions compatible with most EVs, enhanced by IoT monitoring and AI-enabled energy scheduling.

Germany Bidirectional EV Charging (V2G/V2H) System Market held a 40% share, generating USD 194.8 million in 2024. The country's leadership is supported by strong automotive manufacturing, regulatory incentives, and widespread adoption of connected, V2G-enabled infrastructure. Germany is increasingly implementing AI-based load optimization, IoT-enabled bidirectional chargers, predictive energy scheduling, and cloud-integrated energy management platforms to ensure grid reliability and operational efficiency while adhering to evolving energy regulations.

Key players driving growth in the Bidirectional EV Charging (V2G/V2H) System Market include Nuvve, Wallbox Chargers, Eaton, ABB, Siemens, Enel X, ChargePoint, The Mobility House, Schneider Electric, and Nissan Motor. Companies are strengthening their presence through strategic initiatives such as expanding regional charging networks, forming partnerships with utilities and fleet operators, and investing in AI and IoT-based bidirectional technologies. Product innovations include cost-efficient, low-power AC solutions and scalable commercial V2G systems. Firms also focus on integrating cloud platforms, predictive energy scheduling, and smart load balancing to improve performance and compliance. Marketing efforts target residential, commercial, and fleet customers to increase adoption, while mergers, acquisitions, and long-term service agreements enhance distribution, brand recognition, and market foothold globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Charging

- 2.2.3 Power capacity

- 2.2.4 Charging location

- 2.2.5 Integration level

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid EV adoption & fleet expansion

- 3.2.1.2 Smart grid & energy management needs

- 3.2.1.3 Technological advancements

- 3.2.1.4 Government policies & incentives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High infrastructure & implementation costs

- 3.2.2.2 Regulatory & standardization gaps

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with renewable energy & home energy systems

- 3.2.3.2 Fleet & commercial applications

- 3.2.3.3 Regulatory incentives and supportive policies

- 3.2.3.4 Smart city and fleet electrification projects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America regulatory environment

- 3.4.2 European union directives & mandates

- 3.4.3 Asia pacific policy frameworks

- 3.4.4 Interconnection standards & utility requirements

- 3.4.5 Vehicle safety & certification requirements

- 3.4.6 Building code & electrical code updates

- 3.4.7 Insurance & liability regulatory framework

- 3.4.8 Data privacy & consumer protection regulations

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 AC bidirectional charging technology evolution

- 3.7.2 DC bidirectional charging advancements

- 3.7.3 Onboard vs offboard architecture trade-offs

- 3.7.4 Power electronics & inverted technology trends

- 3.7.5 Battery management system integration

- 3.7.6 Smart inverter functions & grid support capabilities

- 3.7.7 Wireless/inductive bidirectional charging research

- 3.7.8 Technology readiness assessment by component

- 3.7.9 Next-generation technology pipeline

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Best case scenarios

- 3.14 Pilot programs & deployment case studies

- 3.14.1. Utility v2 g pilot programs overview

- 3.14.2 Pg&e BMW chargeforward program

- 3.14.3 Con Edison smart charge

- 3.14.4. Opg v2 g pilot

- 3.14.5. Uk v2 g trials

- 3.14.6. Japanese v2 h deployment programs

- 3.15 Consumer Behavior & Adoption Analysis

- 3.15.1 Consumer awareness levels by region

- 3.15.2 Purchase decision factors & priorities

- 3.15.3 Willingness to pay analysis

- 3.15.4 Participation rates in utility programs

- 3.15.5 Churn rates & retention analysis

- 3.15.6 Customer satisfaction metrics

- 3.16 Macroeconomic Factors & Market Impact

- 3.16.1 Energy price volatility impact

- 3.16.2 Electricity rate structures & time-of-use pricing

- 3.16.3 Wholesale energy market price trends

- 3.16.4 Interest rate environment & financing costs

- 3.16.5 Inflation impact on equipment costs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Charging, 2021 - 2034 ($ Bn, Units)

- 5.1 Key trends

- 5.2 AC bidirectional charging systems

- 5.3 DC bidirectional charging systems

Chapter 6 Market Estimates & Forecast, By Power Capacity, 2021 - 2034 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Low power AC (3.3-7.2 kW)

- 6.3 Medium power AC (11-22 kW)

- 6.4 DC fast charging (50-150 kW)

- 6.5 High power DC (150+ kW)

Chapter 7 Market Estimates & Forecast, By Charging Location, 2021 - 2034 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Residential charging

- 7.3 Workplace charging

- 7.4 Fleet depot charging

- 7.5 Public charging

Chapter 8 Market Estimates & Forecast, By Integration Level, 2021 - 2034 ($ Bn, Units)

- 8.1 Key trends

- 8.2 Standalone bidirectional chargers

- 8.3 Integrated with solar PV

- 8.4 Integrated with stationary battery storage

- 8.5 Fully integrated home energy systems

- 8.6 Microgrid-integrated systems

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($ Bn, Units)

- 9.1 Key trends

- 9.2 Residential users

- 9.3 Commercial & fleet operators

- 9.4 Electric utilities & grid operators

- 9.5 Industrial facilities

- 9.6 Public sector & emergency services

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 ABB

- 11.1.2 ChargePoint

- 11.1.3 Eaton

- 11.1.4 Enel X

- 11.1.5 Nissan Motor

- 11.1.6 Nuvve

- 11.1.7 Schneider Electric

- 11.1.8 Shell Recharge Solutions

- 11.1.9 Siemens

- 11.1.10 Wallbox Chargers

- 11.2 Regional Player

- 11.2.1 Blink charging

- 11.2.2 Engie EV solutions

- 11.2.3 Evbox

- 11.2.4 Pod point

- 11.2.5 Star charge

- 11.2.6 Tesla energy

- 11.2.7 TGOOD

- 11.2.8 The mobility house

- 11.2.9 Tritium

- 11.2.10 Virta

- 11.3 Emerging Players

- 11.3.1 Freewire technologies

- 11.3.2 Greenlots

- 11.3.3 Incharge energy

- 11.3.4 Ohme

- 11.3.5. Ovo energy V2 G solutions