|

市場調查報告書

商品編碼

1885863

風扇馬達市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Fan Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

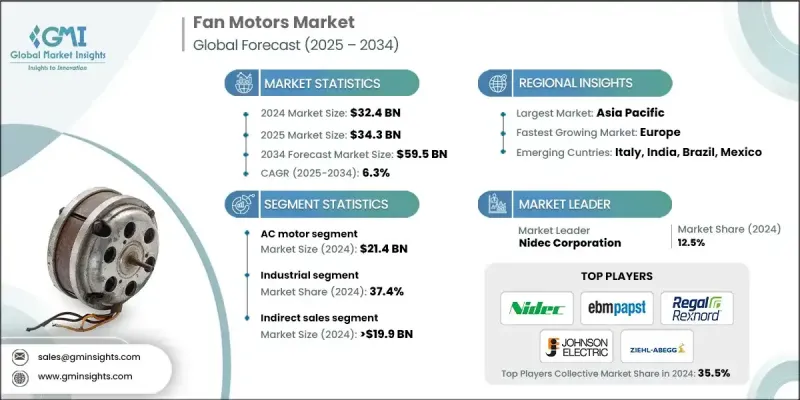

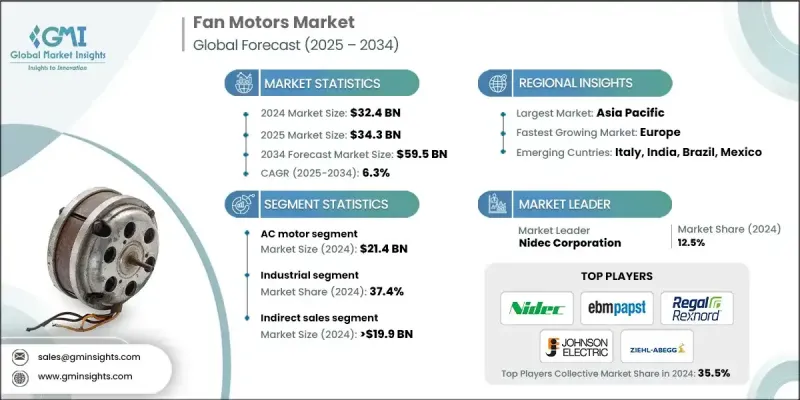

2024 年全球風扇馬達市場價值為 324 億美元,預計到 2034 年將以 6.3% 的複合年成長率成長至 595 億美元。

儘管產業持續成長,但仍面臨著與價格敏感型消費者相關的挑戰,尤其是在新興地區,小型製造商面臨著在不犧牲性能的前提下保持低價的壓力。隨著政府政策日益嚴格和消費者期望不斷提高,永續技術的應用加速,風扇馬達的需求也穩定轉向節能型產品。歐盟的能源指令也加大了對馬達設計能源效率標準的要求。同時,降噪已成為產品的重要考量因素,因為消費者越來越傾向於選擇噪音較低的電器。製造商正致力於採用先進的工程技術來滿足這些期望,同時保持產品的性能和耐用性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 324億美元 |

| 預測值 | 595億美元 |

| 複合年成長率 | 6.3% |

2024年,交流電機市場規模預計將達214億美元。由於價格實惠、經久耐用且應用廣泛,交流電機仍然是最常用的馬達類型。此外,由於其初始成本較低且維護需求較少,交流馬達在大型應用中也繼續佔據主導地位。

2024年,產業領域佔37.4%的市場佔有率,成為最具影響力的終端用戶類別。工業生產過程中,通風、冷卻、空氣處理和生產流程高度依賴風扇和電機,導致電力消耗巨大。高效能馬達技術已成為工業環境中不可或缺的一部分,最佳化能源利用能夠直接降低營運成本。

2024年,美國風扇馬達市佔率達74.3%。該地區各公司正加大對先進電機技術的投資,旨在提高效率並降低資源消耗。產業組織也持續強調,隨著製造商響應全球能源效率標準以及客戶對環保解決方案日益成長的需求,永續馬達設計的重要性日益凸顯。

全球風扇馬達市場的主要參與者包括Ametek、Emerson Electric、ebm papst、Fantech、Johnson Electric、Mitsumi Electric、Nidec、New York Blower、Orion Fans、Revcor、Sanyo Denki、Sunon、TECO Westinghouse、Toshiba和ZIEHL-ABEGG。風扇馬達產業的企業正透過加速開發符合全球市場日益嚴格的能源法規的高效能馬達來增強其競爭地位。許多企業正在擴展其產品組合,提供低噪音、緊湊型和數位化控制的馬達解決方案,以滿足工業和住宅應用的需求。對自動化、智慧製造和最佳化供應鏈系統的投資使企業能夠在降低生產成本的同時提高產品品質。一些製造商也致力於長期永續發展,例如採用可回收材料、減少碳足跡以及設計具有更高生命週期效率的馬達。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 節能家電的需求不斷成長

- 技術進步

- 智慧家庭設備的成長

- 產業陷阱與挑戰

- 成本考量

- 消費者偏好的轉變

- 機會

- 對永續性的需求日益成長

- 人工智慧的技術進步

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 風險評估與緩解

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2021-2034年

- 直流馬達

- 交流馬達

- EC Motors

第6章:市場估算與預測:依功率等級分類,2021-2034年

- 小型馬達(小於0.5馬力)

- 中型馬達(0.5 至 5 馬力)

- 大型馬達(大於 5 馬力)

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 暖通空調

- 汽車

- 工業的

- 電子冷卻

- 家用電器

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 直接的

- 間接

第9章:市場估計與預測:依地區分類,2021-2034年

- 鑰匙

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Ametek

- Emerson Electric

- ebm-papst

- Fantech

- Johnson Electric

- Mitsumi Electric

- Nidec

- New York Blower

- Orion Fans

- Revcor

- Sanyo Denki

- Sunon

- TECO Westinghouse

- Toshiba

- ZIEHL-ABEGG

The Global Fan Motors Market was valued at USD 32.4 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 59.5 billion by 2034.

While the industry continues to grow, it still faces challenges tied to cost-sensitive buyers, particularly in emerging regions where smaller manufacturers operate under pressure to keep prices low without compromising on performance. Demand for fan motors has steadily shifted toward energy-efficient models as tighter government policies and growing consumer expectations accelerate the adoption of sustainable technologies. The European Union's energy directives have also intensified the push toward higher efficiency standards across electric motor designs. At the same time, noise reduction has become a defining product priority, as consumers increasingly favor quieter appliances. Manufacturers are focusing on advanced engineering techniques to meet these expectations while maintaining performance and durability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.4 Billion |

| Forecast Value | $59.5 Billion |

| CAGR | 6.3% |

The AC motor segment generated USD 21.4 billion in 2024. These motors remain the most used type due to their affordability, durability, and broad operational versatility. They continue to dominate large-scale applications because of their lower initial cost and reduced maintenance requirements.

The industrial sector held a 37.4% share in 2024, making it the most influential end-use category. Industrial operations rely heavily on fans and motors for ventilation, cooling, air handling, and production processes, leading to substantial electricity consumption. High-efficiency motor technologies have become essential across industrial environments, where optimized energy use directly supports lower operating costs.

U.S. Fan Motors Market held 74.3% share in 2024. Companies across the region are increasingly directing investments toward advanced motor technologies designed to enhance efficiency and reduce resource consumption. Industry organizations also continue to highlight the rising prioritization of sustainable motor designs as manufacturers respond to global efficiency standards and customers' growing preference for environmentally conscious solutions.

Major players active in the Global Fan Motors Market include Ametek, Emerson Electric, ebm papst, Fantech, Johnson Electric, Mitsumi Electric, Nidec, New York Blower, Orion Fans, Revcor, Sanyo Denki, Sunon, TECO Westinghouse, Toshiba, and ZIEHL-ABEGG. Companies in the fan motors industry are strengthening their competitive positions by accelerating the development of high-efficiency motors that comply with tightening energy regulations across global markets. Many are expanding their portfolios with low-noise, compact, and digitally controlled motor solutions tailored to both industrial and residential applications. Investments in automation, smart manufacturing, and optimized supply chain systems are enabling firms to reduce production costs while improving product quality. Several manufacturers are also focusing on long-term sustainability by incorporating recyclable materials, reducing carbon footprints, and designing motors with enhanced lifecycle efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Power Rating

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for energy efficient appliances

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growth of smart home devices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Cost concerns

- 3.2.2.2 Shift in consumer preferences

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for sustainability

- 3.2.3.2 Technological advancements in AI

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Risk assessment and mitigation

- 3.10 Gap Analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 DC Motors

- 5.2 AC Motors

- 5.3 EC Motors

Chapter 6 Market Estimates & Forecast, By Power Ratings, 2021-2034 (USD Million) (Million Units)

- 6.1 Small Motors (Less than 0.5 HP)

- 6.2 Medium Motors (Between 0.5 and 5 HP)

- 6.3 Large Motors (Greater than 5 HP)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Million Units)

- 7.1 HVAC

- 7.2 Automotive

- 7.3 Industrial

- 7.4 Electronics cooling

- 7.5 Appliances

Chapter 8 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Million) (Million Units)

- 8.1 Direct

- 8.2 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Million Units)

- 9.1 Key

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ametek

- 10.2 Emerson Electric

- 10.3 ebm-papst

- 10.4 Fantech

- 10.5 Johnson Electric

- 10.6 Mitsumi Electric

- 10.7 Nidec

- 10.8 New York Blower

- 10.9 Orion Fans

- 10.10 Revcor

- 10.11 Sanyo Denki

- 10.12 Sunon

- 10.13 TECO Westinghouse

- 10.14 Toshiba

- 10.15 ZIEHL-ABEGG