|

市場調查報告書

商品編碼

1885860

汽車電源管理IC市場機會、成長促進因素、產業趨勢分析及2025-2034年預測Automotive Power Management IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

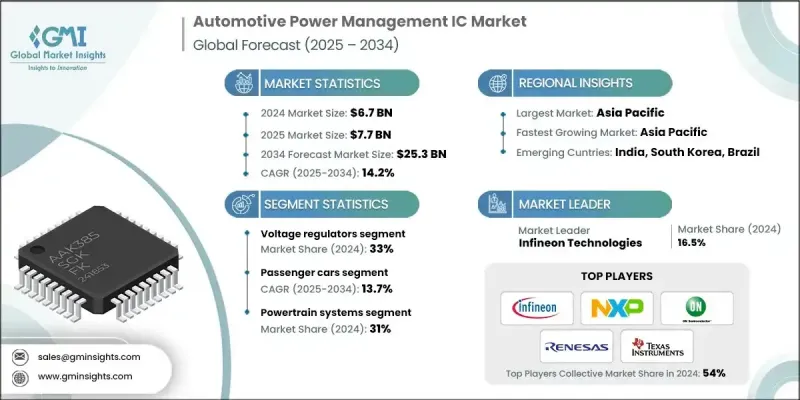

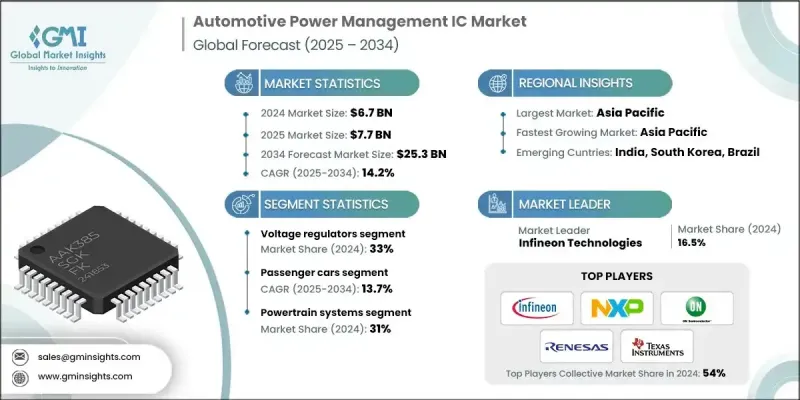

2024 年全球汽車電源管理 IC 市場價值為 67 億美元,預計到 2034 年將以 14.2% 的複合年成長率成長至 253 億美元。

電動車的快速普及正在重塑車輛架構,因為混合動力和純電動車需要高效的電池監控、能量分配和高壓電源控制。政府支持電動車推廣、研究和電池技術進步的政策正在加速電源管理積體電路在車輛中的整合。現代汽車配備了複雜的電子系統,每個系統都需要精確的電壓調節和能量管理。調查顯示,典型的電動車整合了超過100個電源管理積體電路,用於控制資訊娛樂系統、熱調節系統、儀表板和電池運作等。對包括碳化矽(SiC)和氮化鎵(GaN)在內的半導體材料的研究正在帶來高效高性能的解決方案。美國和歐洲的合作研究計畫正在進一步推動寬禁帶半導體的發展,從而提高汽車電子產品的可靠性、熱管理和效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 67億美元 |

| 預測值 | 253億美元 |

| 複合年成長率 | 14.2% |

到2024年,電壓調節器市佔率將達到33%。電壓調節器對於穩定向微控制器、感測器和資訊娛樂單元供電至關重要。隨著汽車電子設備的日益複雜,對具有低壓差和多相功能的高效調節器的需求持續成長。

預計2025年至2034年,乘用車市場將以13.7%的複合年成長率成長。由於電氣化、資訊娛樂系統和高級駕駛輔助系統(ADAS)的日益普及,乘用車成為汽車電源管理積體電路(IC)的主要需求驅動力。汽車中先進的電子架構需要高效的電源轉換、穩定的電壓等級和最佳的負載管理,以確保安全性、性能和舒適性。

德國汽車電源管理IC市場預計將在2025年至2034年間維持13.8%的強勁複合年成長率。電動車產量的成長、日益嚴格的排放法規以及高階汽車對節能半導體技術的廣泛應用,是推動市場成長的主要因素。德國汽車產業擁有強大的本土OEM廠商和一級供應商之間的緊密合作,不斷創新汽車電氣化和數位化技術。消費者對傳統汽車和電動車的強勁需求,也促進了高效能電壓調節和先進診斷功能的應用。

汽車電源管理IC市場的主要參與者包括Analog Devices、英飛凌科技、Maxim Integrated、Microchip Technology、恩智浦半導體、安森美半導體、瑞薩電子、羅姆半導體、義法半導體和德州儀器。各公司致力於電源管理解決方案的創新,包括開發電動車的高效穩壓器和多相IC。與汽車OEM廠商和一級供應商建立策略合作夥伴關係,有助於加速IC與先進車輛平台的整合。對碳化矽(SiC)和氮化鎵(GaN)等寬禁帶半導體的研發投入,有助於提升性能、改善散熱和提高能源效率。各公司正在擴大生產能力和區域佈局,以滿足全球日益成長的電動車需求。與軟體和電子開發人員的合作,則有助於開發更智慧、支援人工智慧的電源管理系統。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 車輛電氣化程度不斷提高(電動車/混合動力車)

- 車輛中電子內容的日益成長(ADAS、資訊娛樂、互聯)

- 積體電路的小型化和整合化

- 產業陷阱與挑戰

- 汽車級積體電路的研發和認證成本很高

- 供應鏈集中度和替代寬頻隙元件(GaN/SiC)

- 市場機遇

- 車輛向域/區域架構過渡(集中式電源域)

- 新興市場(中國、印度、東南亞)快速成長

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 定價分析

- 各產品平均售價 (ASP) 趨勢

- 成本與效能之間的權衡

- 製程節點縮小(40nm → 28nm → 7nm)對價格的影響

- ASIL認證的PMIC產品價格較高

- 成本細分分析

- 專利分析

- 用例和應用

- 風險評估

- 地緣政治與貿易風險(美中關係、出口管制)

- 半導體產能風險

- 汽車生產週期波動

- 技術過時風險

- 投資與融資環境

- 對晶圓廠、封裝和自動化的資本投資

- 對功率半導體新創企業的風險投資

- 政府激勵措施和產業政策

- 企業研發支出趨勢

- 創新資金與研發情報

- 主要IDM公司研發支出比較

- 重點領域:熱效率、ASIL 安全等級、整合

- 電力電子研究實驗室的發展

- 各區域的知識產權發展強度

- 永續性和環境方面

- 碳足跡評估

- 循環經濟一體化

- 電子垃圾管理要求

- 綠色製造計劃

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 電池管理積體電路(BMIC)

- 電壓調節器

- 電源開關和負載開關

- 整合式 PMIC

第6章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 緊湊型/經濟型

- 中型/家庭

- 豪華/高級

- SUV/跨界車

- 商用車輛

- 輕型商用

- 重型卡車

- 公車/大眾運輸

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- ADAS(進階駕駛輔助系統)

- 資訊娛樂系統

- 人體電子系統

- 動力總成系統

- 安全系統

- 其他

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 馬來西亞

- 泰國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 全球參與者

- Analog Devices

- Broadcom

- Infineon Technologies

- Intel Corporation

- Maxim Integrated

- Microchip Technology

- NXP Semiconductors

- ON Semiconductor

- Qualcomm Technologies

- Renesas Electronics

- ROHM Semiconductor

- Samsung Electronics

- STMicroelectronics

- Texas Instruments

- Toshiba Electronic Devices & Storage

- 區域玩家

- Dialog Semiconductor

- Fuji Electric

- Hitachi Astemo

- Melexis

- Mitsubishi Electric

- Murata Manufacturing

- Panasonic Industry

- Semikron Danfoss

- TT Electronics

- Vishay Intertechnology

- 新興參與者/顛覆者

- EPC (Efficient Power Conversion)

- Monolithic Power Systems

- Navitas Semiconductor

- Qorvo

- Silergy

The Global Automotive Power Management IC Market was valued at USD 6.7 billion in 2024 and is estimated to grow at a CAGR of 14.2% to reach USD 25.3 billion by 2034.

The rapid adoption of electrified vehicles is reshaping vehicle architecture, as hybrid and electric models require efficient battery monitoring, energy distribution, and high-voltage power control. Government policies supporting electric vehicle adoption, research, and advancements in battery technologies are accelerating the integration of power management ICs in vehicles. Modern automobiles feature complex electronic systems, each demanding precise voltage regulation and energy management. Surveys suggest that typical electric vehicles incorporate over 100 power management ICs to control systems such as infotainment, thermal regulation, instrument clusters, and battery operations. Research into semiconductor materials, including silicon carbide (SiC) and gallium nitride (GaN), is delivering highly efficient and high-performance solutions. Collaborative research initiatives in the US and Europe are further promoting wide-bandgap semiconductors, enhancing reliability, thermal management, and efficiency across automotive electronics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $25.3 Billion |

| CAGR | 14.2% |

The voltage regulators segment accounted for a 33% share in 2024. Voltage regulators are essential for stabilizing power delivery to microcontrollers, sensors, and infotainment units. As vehicle electronics become more sophisticated, demand for efficient regulators with low dropout and multi-phase capabilities continues to grow.

The passenger cars segment is expected to grow at a CAGR of 13.7% from 2025 to 2034. Passenger vehicles drive most of the demand for automotive power management ICs due to rising electrification, infotainment systems, and ADAS adoption. Advanced electronic architectures in cars require efficient power conversion, stable voltage levels, and optimal load management to ensure safety, performance, and comfort.

Germany Automotive Power Management IC Market is anticipated to witness a robust CAGR of 13.8% from 2025 to 2034 in the automotive power management IC market. Growth is fueled by increasing electric vehicle production, strict emission regulations, and widespread adoption of energy-efficient semiconductor technologies in premium vehicles. Germany's automotive sector features strong collaboration between domestic OEMs and Tier 1 suppliers, continually innovating vehicle electrification and digitalization. High customer demand for both conventional and electrified vehicles supports the adoption of efficient voltage regulation and advanced diagnostics functionalities.

Key players operating in the Automotive Power Management IC Market include Analog Devices, Infineon Technologies, Maxim Integrated, Microchip Technology, NXP Semiconductors, ON Semiconductor, Renesas Electronics, ROHM Semiconductor, STMicroelectronics, and Texas Instruments. Companies are focusing on innovation in power management solutions, including the development of high-efficiency voltage regulators and multi-phase ICs for electrified vehicles. Strategic partnerships with automotive OEMs and Tier 1 suppliers allow faster integration of ICs into advanced vehicle platforms. Investment in R&D for wide-bandgap semiconductors such as SiC and GaN improves performance, thermal management, and energy efficiency. Firms are expanding manufacturing capabilities and regional presence to meet growing EV demand globally. Collaborations with software and electronics developers support the development of smarter, AI-enabled power management systems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising electrification of vehicles (EV/HEV)

- 3.2.1.2 Growing electronic content in vehicles (ADAS, infotainment, connectivity)

- 3.2.1.3 Miniaturization & integration of ICs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development & qualification cost for automotive-grade ICs

- 3.2.2.2 Supply chain concentration and alternative wide-bandgap devices (GaN/SiC)

- 3.2.3 Market opportunities

- 3.2.3.1 Transition to domain/zone architectures in vehicles (centralised power domains)

- 3.2.3.2 Rapid growth in emerging markets (China, India, Southeast Asia)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1 Average selling price (ASP) trends by product

- 3.8.2 Cost vs performance trade-offs

- 3.8.3 Impact of node shrink (40nm → 28nm → 7nm) on pricing

- 3.8.4 Premium pricing for ASIL-certified PMICs

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Use cases and applications

- 3.12 Risk assessment

- 3.12.1 Geopolitical and trade risks (US-China, export controls)

- 3.12.2 Semiconductor capacity risks

- 3.12.3 Automotive production cycle fluctuations

- 3.12.4 Technological obsolescence risk

- 3.13 Investment & funding landscape

- 3.13.1 Capital investments in fabs, packaging, and automation

- 3.13.2 Venture funding in power semiconductor start-ups

- 3.13.3 Government incentives & industrial policies

- 3.13.4 Corporate R&D spending trends

- 3.14 Innovation Funding & R&D Intelligence

- 3.14.1 R&D spending comparison across major IDMs

- 3.14.2 Focus areas: thermal efficiency, ASIL safety, integration

- 3.14.3 Growth of power electronics research labs

- 3.14.4 IP development intensity across regions

- 3.15 Sustainability & environmental aspects

- 3.15.1 Carbon Footprint Assessment

- 3.15.2 Circular Economy Integration

- 3.15.3 E-Waste Management Requirements

- 3.15.4 Green Manufacturing Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Battery Management ICs (BMICs)

- 5.3 Voltage regulators

- 5.4 Power switches & load switches

- 5.5 Integrated PMICs

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Compact/Economy

- 6.2.2 Mid-size/Family

- 6.2.3 Luxury/Premium

- 6.2.4 SUVs/Crossovers

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial

- 6.3.2 Heavy Trucks

- 6.3.3 Buses/Transit

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 ADAS (Advanced Driver Assistance Systems)

- 7.3 Infotainment system

- 7.4 Body electronics

- 7.5 Powertrain system

- 7.6 Safety & security system

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Singapore

- 8.4.7 Malaysia

- 8.4.8 Thailand

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 Analog Devices

- 9.1.2 Broadcom

- 9.1.3 Infineon Technologies

- 9.1.4 Intel Corporation

- 9.1.5 Maxim Integrated

- 9.1.6 Microchip Technology

- 9.1.7 NXP Semiconductors

- 9.1.8 ON Semiconductor

- 9.1.9 Qualcomm Technologies

- 9.1.10 Renesas Electronics

- 9.1.11 ROHM Semiconductor

- 9.1.12 Samsung Electronics

- 9.1.13 STMicroelectronics

- 9.1.14 Texas Instruments

- 9.1.15 Toshiba Electronic Devices & Storage

- 9.2 Regional Players

- 9.2.1 Dialog Semiconductor

- 9.2.2 Fuji Electric

- 9.2.3 Hitachi Astemo

- 9.2.4 Melexis

- 9.2.5 Mitsubishi Electric

- 9.2.6 Murata Manufacturing

- 9.2.7 Panasonic Industry

- 9.2.8 Semikron Danfoss

- 9.2.9 TT Electronics

- 9.2.10 Vishay Intertechnology

- 9.3 Emerging Players / Disruptors

- 9.3.1 EPC (Efficient Power Conversion)

- 9.3.2 Monolithic Power Systems

- 9.3.3 Navitas Semiconductor

- 9.3.4 Qorvo

- 9.3.5 Silergy