|

市場調查報告書

商品編碼

1885859

醫療設備維護市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Medical Equipment Maintenance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

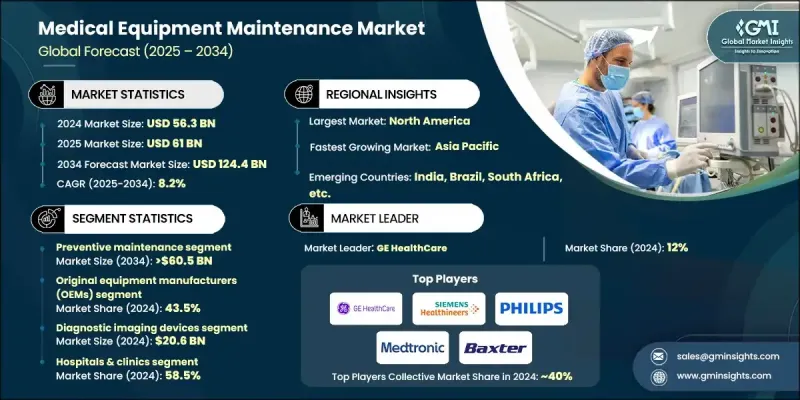

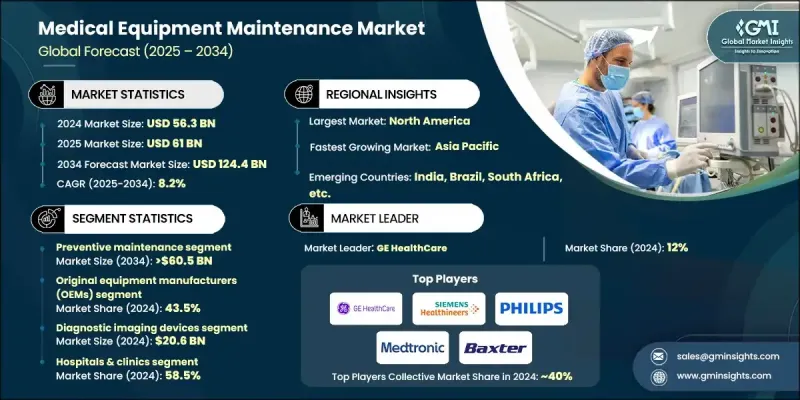

2024 年全球醫療設備維護市場價值為 563 億美元,預計到 2034 年將以 8.2% 的複合年成長率成長至 1244 億美元。

市場成長的促進因素包括:對病人安全的日益重視、翻新和先進醫療設備的普及、慢性病盛行率的上升以及醫療設備維護方面日益嚴格的監管要求。醫院和診所致力於最大限度地降低設備故障的風險,因為設備故障會危及患者的護理和安全。預防性維護計畫正被廣泛採用,以確保設備在安全參數範圍內運作、減少錯誤並符合相關法規。對可靠性、運作效率和監管的需求促使醫療機構選擇計劃性維護策略,從而推動市場擴張。該領域的維護包括對醫療設備進行定期檢查、保養、維修和校準,以確保醫療機構設備的最佳性能、安全性和更長的使用壽命。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 563億美元 |

| 預測值 | 1244億美元 |

| 複合年成長率 | 8.2% |

2024年,預防性維護業務市佔率達47.2%。該業務的成長得益於專為小型醫療機構設計的經濟高效的維護解決方案。預防性維護包括例行檢查、校準和保養,旨在減少設備意外故障並保持最佳效能。透過及早發現並解決潛在問題,預防性維護可以最大限度地減少停機時間,延長設備使用壽命,並提高病患安全。越來越多的醫院採用這些方案,以符合相關法規並降低緊急維修成本。

到2024年,原始設備製造商(OEM)市佔率將達到43.5%。 OEM透過提供客製化服務、基於規格的零件和專業技術來維持市場主導地位。他們的策略包括長期服務協議、預測性維護和遠端監控,這些通常由數位化平台提供支援。 OEMOEM能夠確保符合法規要求並提供高品質的服務,因此成為關鍵和高價值醫療設備的首選供應商。

2024年,北美醫療設備維護市場佔40.7%的佔有率。該地區先進的醫療保健體系、對新型醫療技術的廣泛應用以及嚴格的監管標準,推動了對預防性和預測性維護的需求。該地區的主要原始設備製造商(OEM)提供整合服務合約和數位化解決方案,而獨立服務機構(ISO)也擴大提供經濟高效的外包維護方案。

全球醫療設備維護市場的主要參與者包括富士膠片、Alliance Medical CORPORATION、Drive DeVilbiss HEALTHCARE、百特、日立高新技術、ALTHEA、STERIS HEALTHCARE、飛利浦、Aramark、美敦力、GE醫療、Probo MEDICAL、瑞思邁、GETINGE和西門子醫療。各公司正透過投資先進的數位化維護平台、預測性維護技術和遠端監控解決方案來鞏固其市場地位。策略合作、併購有助於企業拓展至新的地區和醫療保健領域。提供客製化的服務契約,包括預防性和緊急維護方案,有助於提升客戶忠誠度。各公司注重合規性、認證和培訓項目,以建立信譽和信任。此外,透過獨立銷售機構(ISO)提供的外包解決方案為醫院提供了更具成本效益的替代方案,而維護解決方案的創新則確保了停機時間的減少、效率的提高和患者安全性的提升,從而鞏固了企業的長期市場地位。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 先進醫療器材的日益普及

- 慢性病盛行率激增

- 越來越重視病人安全和設備正常運作時間

- 醫療器械維護的監管合規要求

- 翻新醫療器材的高採用率

- 產業陷阱與挑戰

- 維護服務和合約成本高昂

- 複雜設備熟練技術人員短缺

- 機會

- 利用人工智慧和物聯網進行預測性維護

- 遠端監控解決方案,提高成本效益

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 服務合約模式展望

- 永續發展和綠色維護舉措

- 波特的分析

- PESTEL 分析

- 差距分析

- 遠端監控與遠端維護的整合

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新服務上線

- 擴張計劃

第5章:市場估算與預測:依服務類型分類,2021-2034年

- 主要趨勢

- 預防性維護

- 修正性維護

- 運作維護

第6章:市場估算與預測:依服務提供者分類,2021-2034年

- 主要趨勢

- 原始設備製造商(OEM)

- 內部維護

- 獨立服務機構(ISO)

第7章:市場估算與預測:依設備類型分類,2021-2034年

- 主要趨勢

- 診斷影像設備

- 電療設備

- 手術器械

- 病人監護和維生設備

- 牙科設備

- 內視鏡設備

- 實驗室設備

- 其他設備

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院和診所

- 診斷影像中心

- 門診手術中心(ASC)

- 牙醫診所

- 透析中心

- 其他最終用途

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Alliance Medical CORPORATION

- ALTHEA

- Aramark

- Baxter

- Drive DeVilbiss HEALTHCARE

- FUJIFILM

- GE HealthCare

- GETINGE

- Hitachi High-Tech

- Medtronic

- PHILIPS

- Probo MEDICAL

- Resmed

- SIEMENS Healthineers

- STERIS HEALTHCARE

The Global Medical Equipment Maintenance Market was valued at USD 56.3 billion in 2024 and is estimated to grow at a CAGR of 8.2 % to reach USD 124.4 billion by 2034.

Market growth is driven by increasing emphasis on patient safety, rising adoption of refurbished and advanced medical devices, growing prevalence of chronic diseases, and stringent regulatory requirements for medical device upkeep. Hospitals and clinics are focusing on minimizing the risks posed by equipment failure, which can compromise patient care and safety. Preventive maintenance programs are being widely adopted to ensure devices operate within safe parameters, reduce errors, and maintain compliance with regulations. The need for reliability, operational efficiency, and oversight is pushing healthcare providers to opt for planned maintenance strategies, thereby fueling market expansion. Maintenance in this sector includes regular inspection, servicing, repair, and calibration of medical devices, ensuring optimal performance, safety, and longer equipment lifespan across healthcare facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $56.3 Billion |

| Forecast Value | $124.4 Billion |

| CAGR | 8.2% |

The preventive maintenance segment held a 47.2% share in 2024. Growth in this segment is supported by cost-effective maintenance solutions designed for smaller healthcare facilities. Preventive maintenance involves routine inspections, calibration, and servicing to reduce unplanned device failures and maintain peak performance. By identifying and resolving potential issues early, it minimizes downtime, extends equipment life, and enhances patient safety. Hospitals increasingly adopt these programs to comply with regulations and reduce the costs associated with emergency repairs.

The original equipment manufacturers (OEMs) segment held a 43.5% share in 2024. OEMs maintain control by offering tailored service, specification-based parts, and technical expertise. Their strategies include long-term service agreements, predictive maintenance, and remote monitoring, often supported by digital platforms. OEM maintenance guarantees compliance with regulations and high-quality service, making them preferred providers for critical and high-value medical equipment.

North America Medical Equipment Maintenance Market captured 40.7% share in 2024. The region's advanced healthcare systems, high adoption of new medical technologies, and stringent regulatory standards drive demand for preventive and predictive maintenance. Major OEMs in the region provide integrated service contracts and digital solutions, while independent service organizations (ISOs) are increasingly offering cost-effective outsourced maintenance options.

Key players in the Global Medical Equipment Maintenance Market include FUJIFILM, Alliance Medical CORPORATION, Drive DeVilbiss HEALTHCARE, Baxter, Hitachi High-Tech, ALTHEA, STERIS HEALTHCARE, Philips, Aramark, Medtronic, GE Healthcare, Probo MEDICAL, ResMed, and GETINGE, SIEMENS Healthineers. Companies are strengthening their presence by investing in advanced digital maintenance platforms, predictive maintenance technologies, and remote monitoring solutions. Strategic partnerships, mergers, and acquisitions allow expansion into new regions and healthcare segments. Offering customized service contracts, including preventive and emergency maintenance packages, enhances customer loyalty. Firms focus on regulatory compliance, certifications, and training programs to build credibility and trust. Additionally, outsourcing solutions via ISOs provides cost-effective alternatives to hospitals, while innovation in maintenance solutions ensures reduced downtime, improved efficiency, and higher patient safety, reinforcing long-term market positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Service type trends

- 2.2.3 Service provider trends

- 2.2.4 Equipment trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of advanced medical devices

- 3.2.1.2 Surging prevalence of chronic diseases

- 3.2.1.3 Growing focus on patient safety and equipment uptime

- 3.2.1.4 Regulatory compliance requirements for medical device maintenance

- 3.2.1.5 High adoption of refurbished medical equipment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of maintenance services and contracts

- 3.2.2.2 Shortage of skilled technicians for complex devices

- 3.2.3 Opportunities

- 3.2.3.1 Predictive maintenance using AI and IoT

- 3.2.3.2 Remote monitoring solutions for cost efficiency

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Service contract models outlook

- 3.7 Sustainability and green maintenance initiatives

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Integration of remote monitoring and tele-maintenance

- 3.12 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Preventive maintenance

- 5.3 Corrective maintenance

- 5.4 Operational maintenance

Chapter 6 Market Estimates and Forecast, By Service Provider, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Original equipment manufacturers (OEMs)

- 6.3 In-house maintenance

- 6.4 Independent service organizations (ISOs)

Chapter 7 Market Estimates and Forecast, By Equipment, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostic imaging devices

- 7.3 Electromedical devices

- 7.4 Surgical instruments

- 7.5 Patient monitoring and life support devices

- 7.6 Dental equipment

- 7.7 Endoscopic devices

- 7.8 Laboratory equipment

- 7.9 Other equipment

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals & clinics

- 8.3 Diagnostic imaging centers

- 8.4 Ambulatory surgical centers (ASCs)

- 8.5 Dental clinics

- 8.6 Dialysis centers

- 8.7 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alliance Medical CORPORATION

- 10.2 ALTHEA

- 10.3 Aramark

- 10.4 Baxter

- 10.5 Drive DeVilbiss HEALTHCARE

- 10.6 FUJIFILM

- 10.7 GE HealthCare

- 10.8 GETINGE

- 10.9 Hitachi High-Tech

- 10.10 Medtronic

- 10.11 PHILIPS

- 10.12 Probo MEDICAL

- 10.13 Resmed

- 10.14 SIEMENS Healthineers

- 10.15 STERIS HEALTHCARE