|

市場調查報告書

商品編碼

1885858

昆蟲蛋白水解物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Insect Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

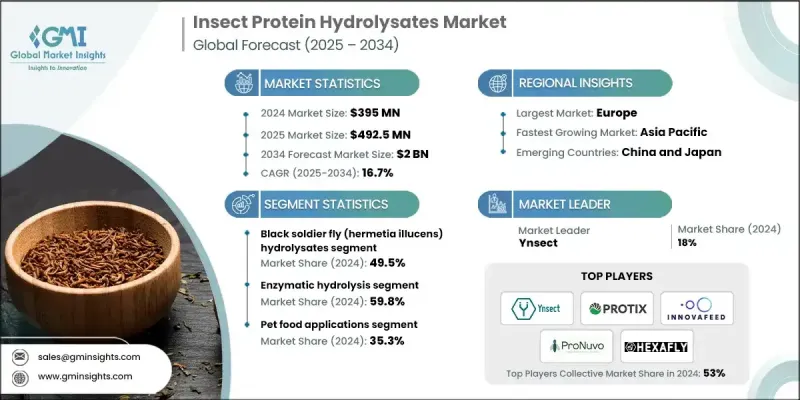

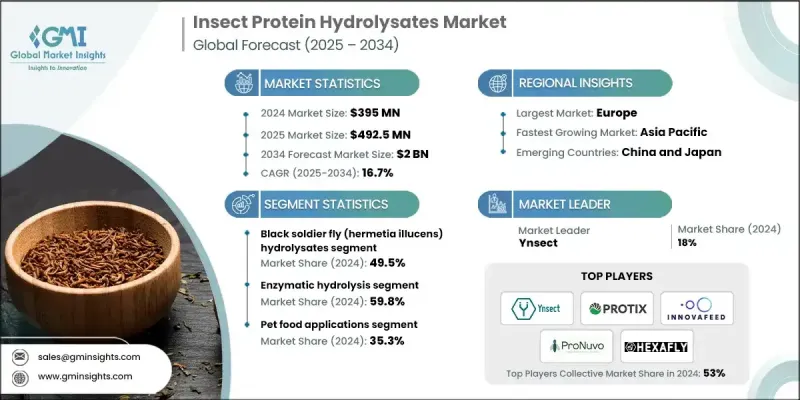

2024 年全球昆蟲蛋白水解物市場價值為 3.95 億美元,預計到 2034 年將以 16.7% 的複合年成長率成長至 20 億美元。

隨著昆蟲源水解物在替代蛋白領域佔據越來越重要的地位,市場需求也不斷成長。對黃粉蟲和黑水虻幼蟲等昆蟲原料進行酵素加工,可以生產出吸收率更高、生物活性更強、營養特性更豐富的成分。這些特性使其在運動營養、臨床營養、寵物保健和功能性食品開發等高價值應用領域極具吸引力,吸引了許多創新者和投資者的目光。昆蟲養殖資源利用效率高,符合永續發展目標,進一步提升了這些產品作為環保蛋白解決方案的吸引力。其獨特的成分優勢,例如抗氧化和免疫支持能力,使其在醫療和營養保健品領域也擁有廣闊的應用前景。隨著越來越多的國家完善昆蟲源成分的監管體系,商業機會日益增多,消費者也越來越傾向選擇高蛋白、成分純淨、功能多樣的配方。不同地區對昆蟲蛋白的接受程度有差異,加上政府支持的永續發展舉措,這些因素共同推動了市場對昆蟲源蛋白的接受度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.95億美元 |

| 預測值 | 20億美元 |

| 複合年成長率 | 16.7% |

2024年,黑水虻水解物市佔率達到49.5%,預計到2034年將以16.4%的複合年成長率成長。其成長主要得益於其豐富的胺基酸組成和相對較低的生產成本,使其適用於多種營養和飼料應用。蟋蟀水解物因其清潔標示和良好的消化特性,正日益被納入人類營養品領域。同時,黃粉蟲水解物因其均衡的營養成分,在高級臨床配方和其他特殊膳食產品中也越來越受歡迎。

2024年,酵素水解領域佔據59.8%的市場佔有率,預計2025年至2034年將以16.6%的複合年成長率成長。此方法應用廣泛,因為它能夠製備結構穩定、功能活性高的胜肽,滿足運動營養和臨床營養的需求。製程工程的進步,包括最佳化水解控制、改進過濾和高效乾燥技術,正在幫助生產商擴大生產規模,同時保持最終產品的生物活性完整性。

2024年,北美昆蟲蛋白水解物市佔率達27.6%。人們對永續營養的日益關注,以及對有益於消化健康的成分的需求,持續推動市場擴張。此外,該地區在寵物食品和水產養殖領域對昆蟲蛋白水解物的使用也日益增多,使其應用範圍除了人類營養之外,更加廣泛。

昆蟲蛋白水解物市場的主要企業包括Ynsect、Protix BV、InnovaFeed、ProNuvo、Hexafly、Nutrition Technologies、AgriProtein(已被Insect Technology Group收購)、Entocycle、P&O Biotechnology和Agronutris。參與昆蟲蛋白水解物市場的企業採取多種策略來增強其競爭優勢。許多企業正在投資擴大產能,以滿足日益成長的永續蛋白質需求。各公司優先考慮酵素法加工、廢棄物資源化利用系統以及垂直整合的昆蟲養殖等方面的技術改進,以最佳化產量和成本效益。與營養品牌、寵物食品製造商和飼料生產商建立策略合作夥伴關係有助於加速市場滲透。此外,各公司也致力於開發針對特定營養領域的高純度胜肽組分,進而增強產品差異化。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 對永續蛋白質替代品的需求日益成長

- 監理核准和政策支持

- 水解產物的優異功能特性

- 產業陷阱與挑戰

- 與傳統蛋白質相比,高生產成本蛋白質

- 複雜的法規核准流程

- 市場機遇

- 擴大新型食品授權範圍

- 生物活性胜肽的應用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按來源昆蟲

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)

(註:貿易統計僅針對重點國家提供)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依來源昆蟲分類,2021-2034年

- 主要趨勢

- 黑水虻(Hermetia illucens)水解物

- 蟋蟀(acheta Domesticus)水解物

- 黃粉蟲(Tenebrio molitor)水解物

- 其他昆蟲物種水解物

- 飛蝗水解物

- Alphitobius diaperinus 水解物

- 褐斑石首魚水解物

- 新興物種發展

第6章:市場估算與預測:依加工方式分類,2021-2034年

- 主要趨勢

- 酵素水解

- 單酶水解

- 多酶水解

- 序貫酶處理

- 高壓輔助酶水解

- 加工技術整合

- 濕式水解

- 乾法水解

- 薄膜過濾與濃縮

- 噴霧乾燥與穩定化

- 專門的處理方法

- 美拉德反應增強水解物

- 超音波輔助水解

- 微波輔助處理

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 寵物食品應用

- 水產養殖飼料應用

- 人類食品應用

- 化妝品及個人護理

- 牲畜飼料應用

- 其他應用

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Ynsect

- Protix BV

- InnovaFeed

- ProNuvo

- Hexafly

- Nutrition Technologies

- AgriProtein (acquired by Insect Technology Group)

- Entocycle

- P&O Biotechnology

- Agronutris

The Global Insect Protein Hydrolysates Market was valued at USD 395 million in 2024 and is estimated to grow at a CAGR of 16.7% to reach USD 2 billion by 2034.

Demand is increasing as insect-derived hydrolysates become an important part of the alternative-protein segment. Enzymatic processing applied to insect sources such as mealworms and black soldier fly larvae has produced ingredients with improved absorption, high bioactivity, and versatile nutritional properties. This profile makes them appealing for high-value uses spanning sports and clinical nutrition, pet health, and functional food development, attracting both innovators and investors. Insect farming's resource-efficient footprint aligns with sustainability goals and reinforces the appeal of these products as eco-friendly protein solutions. Their unique compositional strengths, including antioxidant and immune-support capacities, further position them well in medical and nutraceutical applications. As more countries advance regulatory pathways for insect-based ingredients, commercial opportunities are broadening, while consumer preferences continue shifting toward protein-dense, clean-label, and multifunctional formulations. Regional trends reflect differing cultural acceptance of insect-based proteins, along with government-backed sustainability initiatives, adding further momentum to market adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $395 Million |

| Forecast Value | $2 Billion |

| CAGR | 16.7% |

The black soldier fly hydrolysates segment held 49.5% share in 2024 and is projected to grow at a CAGR of 16.4% through 2034. Their rise is linked to strong amino acid profiles and comparatively lower production costs, which make them suitable for a wide range of nutrition and feed applications. Hydrolysates sourced from crickets are increasingly incorporated into human nutrition categories due to their clean-label positioning and favorable digestibility traits. Meanwhile, mealworm-derived hydrolysates are gaining traction in advanced clinical formulations and other specialized dietary products because of their well-rounded nutrient composition.

The enzymatic hydrolysis segment held a 59.8% share in 2024 and is projected to grow at a CAGR of 16.6% from 2025 to 2034. This method is widely used because it enables consistent peptide structures with high functional activity tailored to sports and clinical nutrition needs. Advances in process engineering, including optimized hydrolysis control, improved filtration, and efficient drying techniques, are helping manufacturers scale production while preserving the bioactive integrity of the final product.

North America Insect Protein Hydrolysates Market held a 27.6% share in 2024. Rising awareness of sustainable nutrition, combined with interest in ingredients that support digestive health, continues to shape market expansion. The region is also seeing increasing use of insect-based hydrolysates in pet food and aquaculture, creating a broader set of applications alongside human nutrition.

Leading companies in the Insect Protein Hydrolysates Market include Ynsect, Protix B.V., InnovaFeed, ProNuvo, Hexafly, Nutrition Technologies, AgriProtein (acquired by Insect Technology Group), Entocycle, P&O Biotechnology, and Agronutris. Companies participating in the Insect Protein Hydrolysates Market pursue several strategies to strengthen their competitive edge. Many are investing in expanding production capacity to meet growing demand for sustainable proteins. Firms are prioritizing technological improvements in enzymatic processing, waste-to-value systems, and vertically integrated insect farming to optimize yield and cost-efficiency. Strategic partnerships with nutrition brands, pet food manufacturers, and feed producers help accelerate market penetration. Companies are also focusing on developing high-purity peptide fractions tailored for specialized nutrition segments, enhancing product differentiation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source Insect

- 2.2.3 Processing Method

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for sustainable protein alternatives

- 3.2.1.2 Regulatory approvals & policy support

- 3.2.1.3 Superior functional properties of hydrolysates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs vs conventional proteins

- 3.2.2.2 Complex regulatory approval processes

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding novel food authorizations

- 3.2.3.2 Bioactive peptide applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By source insect

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source Insect, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Black soldier fly (hermetia illucens) hydrolysates

- 5.3 Cricket (acheta domesticus) hydrolysates

- 5.4 Mealworm (tenebrio molitor) hydrolysates

- 5.5 Other insect species hydrolysates

- 5.5.1 Locusta migratoria hydrolysates

- 5.5.2 Alphitobius diaperinus hydrolysates

- 5.5.3 Gryllodes sigillatus hydrolysates

- 5.5.4 Emerging species development

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.2.1 Single enzyme hydrolysis

- 6.2.2 Multi-enzyme hydrolysis

- 6.2.3 Sequential enzyme treatment

- 6.2.4 High-pressure assisted enzymatic hydrolysis

- 6.3 Processing technology integration

- 6.3.1 Wet processing with hydrolysis

- 6.3.2 Dry processing with hydrolysis

- 6.3.3 Membrane filtration & concentration

- 6.3.4 Spray drying & stabilization

- 6.4 Specialized processing methods

- 6.4.1 Maillard reaction enhanced hydrolysates

- 6.4.2 Ultrasound-assisted hydrolysis

- 6.4.3 Microwave-assisted processing

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Pet food applications

- 7.3 Aquaculture feed applications

- 7.4 Human food applications

- 7.5 Cosmetics & personal care

- 7.6 Livestock feed applications

- 7.7 Other applications

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Ynsect

- 9.2 Protix B.V.

- 9.3 InnovaFeed

- 9.4 ProNuvo

- 9.5 Hexafly

- 9.6 Nutrition Technologies

- 9.7 AgriProtein (acquired by Insect Technology Group)

- 9.8 Entocycle

- 9.9 P&O Biotechnology

- 9.10 Agronutris