|

市場調查報告書

商品編碼

1885839

油基生物燃料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Oil Based Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

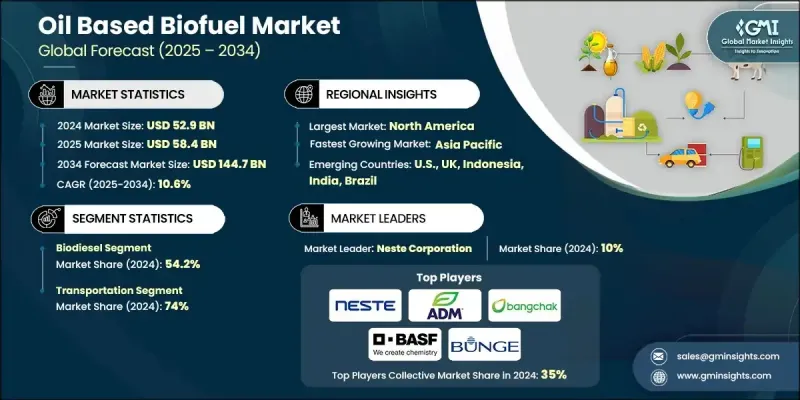

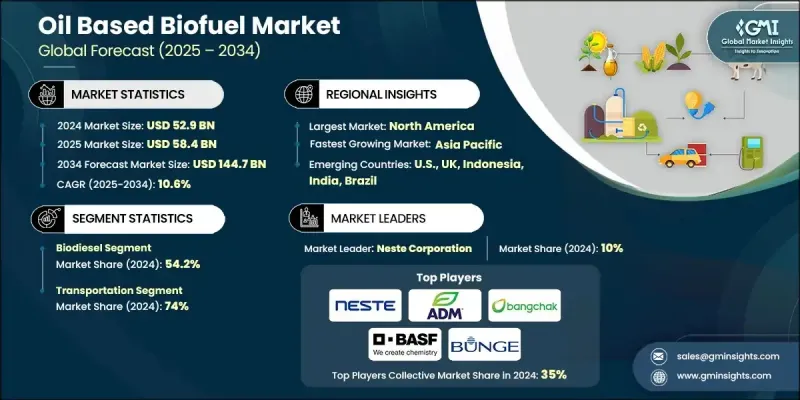

2024 年全球石油基生質燃料市場價值為 529 億美元,預計到 2034 年將以 10.6% 的複合年成長率成長至 1,447 億美元。

具有約束力的交通運輸脫碳承諾正在加速重型公路系統、航空和海運作業對再生燃料的需求。各國政府正在實施低碳燃料標準和再生能源目標,這些標準和目標正式納入了生物燃料,從而增強了生產商和承購商的商業確定性。這項政策有助於降低長期風險,鼓勵煉油廠轉型生產再生燃料,並幫助營運商在新興技術規模化應用的同時,確保立即減排。在美國,更新後的可再生燃料標準在塑造需求、制定年度燃料產量標準以及支持對諸如酒糟玉米油、廢食用油和大豆油等原料的投資方面繼續發揮著核心作用。明確的路徑核准和生命週期門檻為產業發展提供了進一步的指導,而結構化的合規和信用體系則使專案能夠在原料市場波動的情況下保持財務可行性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 529億美元 |

| 預測值 | 1447億美元 |

| 複合年成長率 | 10.6% |

2024年,生質柴油市佔率達到54.2%,預計2034年將以9.9%的複合年成長率成長。核心市場不斷加強的摻混要求持續建立可預測的基準消費水平,使生物柴油成為國家燃料戰略中可靠的組成部分。摻混規則的持續調整將政策轉化為區域運輸供應鏈的穩定需求。

2024年,交通運輸領域佔74%的市場佔有率,預計到2034年將以10%的複合年成長率成長。各國鼓勵以再生燃料取代柴油的指令持續刺激對加氫處理植物油和脂肪酸甲酯混合物的需求。這一趨勢有助於貨運、公共交通系統和市政車隊遵守相關規定,同時減少對傳統石油的依賴。

預計到2024年,美國石油基生物燃料市場將佔93%的佔有率,產值將達到175億美元。聯邦和州政府的監管體系共同提升了再生柴油和廢油基燃料的信用價值,有力地激勵了生產規模的擴大。各州政府的計畫也持續獎勵低排放燃料,從而加強了專案開發和長期合規性。

推動石油基生質燃料市場發展的關鍵企業包括:Verbio Vereinigte BioEnergie AG、馬拉松石油公司、嘉吉公司、道達爾能源、埃克森美孚公司、殼牌公司、ADM、Targray、Zilor、邦吉巴斯有限公司、Greenergy International Ltd.、雪佛龍可再生能源集團、埃尼塔、路易山環境公司Limited、瓦萊羅能源公司和豐益國際有限公司。石油基生物燃料市場的領導者正透過投資靈活的煉油技術、擴大原料來源和簽訂長期承購協議來增強其競爭力。各公司正透過確保取得廢棄物衍生油和農業投入品來多元化供應鏈,從而降低價格波動風險。許多公司正在升級加氫處理能力,以提高再生柴油產量,並改善生命週期排放性能,以獲得監管誘因。與物流營運商和燃料分銷商建立策略夥伴關係有助於擴大市場滲透率,而區域擴張和先進的合規策略則確保在不斷變化的政策環境中保持韌性。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭性標竿分析

- 戰略儀錶板

- 創新與技術格局

第5章:市場規模及預測:依燃料類型分類,2021-2034年

- 主要趨勢

- 生質柴油

- 氫釩

- 新加坡武裝部隊

- 其他

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 運輸

- 航空

- 其他

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 印尼

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ADM

- Bangchak Corporation Public Company Limited

- BASF

- Bunge Limited

- Chevron Renewable Energy Group

- Cargill Incorporated

- Eni SpA

- ExxonMobil Corporation

- Greenergy International Ltd.

- Gushan Environmental Energy

- Louis Dreyfus Company (LDC)

- Marathon Petroleum Corporation

- Neste Corporation

- POET LLC

- Shell plc

- Targray

- TotalEnergies

- Valero Energy Corporation

- Verbio Vereinigte BioEnergie AG

- Wilmar International Limited

- Zilor

The Global Oil Based Biofuel Market was valued at USD 52.9 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 144.7 billion by 2034.

Binding transportation decarbonization commitments are accelerating demand for renewable fuels across heavy road systems, aviation, and marine operations. Governments are implementing low-carbon fuel standards and renewable energy targets that formally incorporate biofuels, reinforcing commercial certainty for producers and offtakers. This policy supports reducing long-term risk, encourages refinery conversions toward renewable fuel production, and helps operators secure immediate emissions reductions while emerging technologies scale. In the United States, updated renewable fuel standards continue to play a central role in shaping demand, establishing annual fuel volume criteria, and supporting investment in feedstocks such as distillers' corn oil, used cooking oil, and soybean oil. Defined pathway approvals and lifecycle thresholds provide further guidance for industry development, while structured compliance and credit systems enable projects to remain financially viable despite fluctuations in feedstock markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.9 billion |

| Forecast Value | $144.7 billion |

| CAGR | 10.6% |

The biodiesel segment accounted for a 54.2% share in 2024 and is expected to grow at a CAGR of 9.9% through 2034. Strengthening blend requirements in core markets continues to build predictable baseline consumption, making biodiesel a dependable component of national fuel strategies. Ongoing adjustments to blending rules translate policy into guaranteed demand across regional transportation supply chains.

The transportation segment held a 74% share in 2024 and is forecast to grow at a 10% CAGR by 2034. National directives encouraging diesel substitution with renewable alternatives continue to stimulate demand for hydrotreated vegetable oil and Fatty Acid Methyl Ester blends. This trend supports compliance across freight operations, transit systems, and municipal fleets while reducing reliance on conventional petroleum.

United States Oil Based Biofuel Market held a 93% share in 2024, generating USD 17.5 billion. Combined federal and state regulatory systems are enhancing credit value for renewable diesel and waste-oil-based fuels, creating strong incentives for production scale-up. State-level programs continue to reward low-emission fuels, reinforcing project development and long-term compliance.

Key companies shaping the Oil Based Biofuel Market include Verbio Vereinigte BioEnergie AG, Marathon Petroleum Corporation, Cargill Incorporated, TotalEnergies, ExxonMobil Corporation, Shell plc, ADM, Targray, Zilor, Bunge Limited, Greenergy International Ltd., Chevron Renewable Energy Group, Eni S.p.A., Gushan Environmental Energy, BASF, Louis Dreyfus Company (LDC), POET LLC, Bangchak Corporation Public Company Limited, Valero Energy Corporation, and Wilmar International Limited. Leading players in the Oil Based Biofuel Market are strengthening their competitive presence through investments in flexible refining technologies, expanded feedstock sourcing, and long-term offtake agreements. Companies are diversifying supply chains by securing access to waste-derived oils and agricultural inputs to reduce exposure to price volatility. Many are upgrading hydrotreating capacity to boost renewable diesel output and improving lifecycle emissions performance to capture regulatory incentives. Strategic partnerships with logistics operators and fuel distributors help scale market penetration, while regional expansions and advanced compliance strategies ensure resilience in fluctuating policy environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Fuel trends

- 2.1.3 Application trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 Environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, Mtoe)

- 5.1 Key trends

- 5.2 Biodiesel

- 5.3 HVO

- 5.4 SAF

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, Mtoe)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Aviation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Mtoe)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Indonesia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ADM

- 8.2 Bangchak Corporation Public Company Limited

- 8.3 BASF

- 8.4 Bunge Limited

- 8.5 Chevron Renewable Energy Group

- 8.6 Cargill Incorporated

- 8.7 Eni S.p.A.

- 8.8 ExxonMobil Corporation

- 8.9 Greenergy International Ltd.

- 8.10 Gushan Environmental Energy

- 8.11 Louis Dreyfus Company (LDC)

- 8.12 Marathon Petroleum Corporation

- 8.13 Neste Corporation

- 8.14 POET LLC

- 8.15 Shell plc

- 8.16 Targray

- 8.17 TotalEnergies

- 8.18 Valero Energy Corporation

- 8.19 Verbio Vereinigte BioEnergie AG

- 8.20 Wilmar International Limited

- 8.21 Zilor