|

市場調查報告書

商品編碼

1885832

重型設備市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Heavy Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

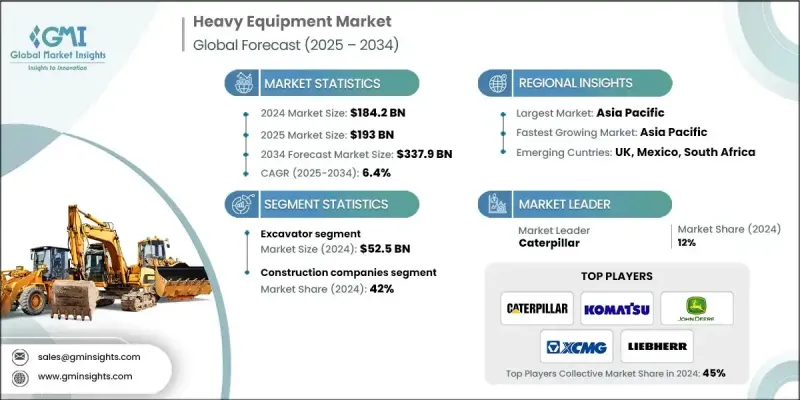

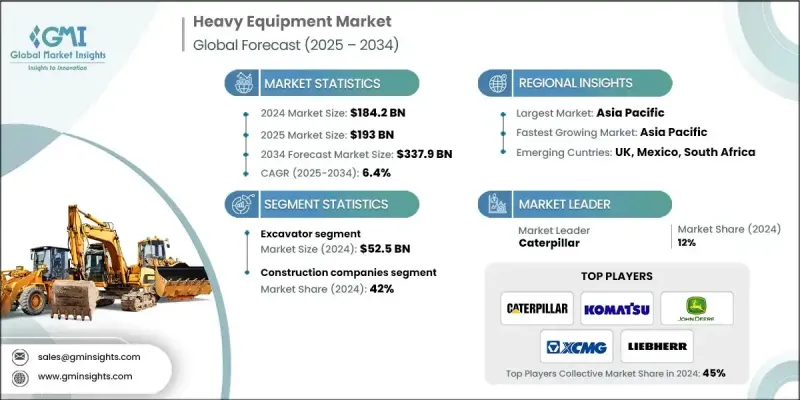

2024年全球重型設備市場價值為1,842億美元,預計到2034年將以6.4%的複合年成長率成長至3,379億美元。

市場在支撐全球基礎設施和工業發展方面發揮著至關重要的作用,是城市化、資源流動和經濟擴張的支柱。其主要應用領域涵蓋建築、採礦、農業和物料搬運,這些產業對全球經濟成長至關重要。新興經濟體大力投資道路、能源項目和住房,引領市場需求;而成熟市場則透過採用節能、數位互聯和技術先進的機械設備來更新車隊。自動化、遠端資訊處理和電氣化正在變革營運模式,幫助企業在降低營運成本的同時實現永續發展目標。對效率和生產力的日益重視,以及技術融合,正在重塑重型設備市場格局,並推動各行業實現更智慧、更環保的營運。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1842億美元 |

| 預測值 | 3379億美元 |

| 複合年成長率 | 6.4% |

隨著企業尋求靈活、經濟高效的解決方案,避免前期大筆投資,租賃市場正經歷強勁成長。然而,該行業也面臨諸多挑戰,包括原料價格波動、勞動力短缺以及日益嚴格的排放法規,這些都迫使製造商在保持合規性和競爭力的同時,加快創新步伐。儘管有這些挑戰,市場前景依然強勁。

預計到2024年,建築公司板塊將佔據42%的市場。挖土機、裝載機、推土機和起重機等機械設備廣泛應用於土方工程、物料搬運、場地準備和結構組裝。城市化進程的加速和政府基礎設施項目的推進,正穩步推動對這些機械設備的需求。

2024年,柴油動力設備市場佔據了相當大的佔有率,這得益於其高扭矩、高可靠性以及在建築、採礦和農業作業中久經考驗的性能。柴油引擎受益於完善的燃料供應基礎設施、更長的作業里程以及操作人員的熟悉程度,使其成為電動車充電網路有限的偏遠或難以到達地區不可或缺的設備。柴油動力對於持續的重型作業仍然至關重要。

2024年,美國重型設備市場規模達392億美元,佔全球82%的市佔率。該地區注重先進機械、自動化和遠端資訊處理技術,大型基礎設施和採礦專案推動了強勁的需求。強勁的更新換代需求和成熟的設備租賃市場確保了穩定的收入來源,而持續的研發投入則鞏固了北美在全球市場的地位。

全球重型設備市場的主要參與者包括日立建機、多田野株式會社、沃爾沃建築設備、利勃海爾集團、小松株式會社、三一重工、Caterpillar公司、中聯重科、JCB、約翰迪爾、德維隆(原斗山工程機械)、特雷克斯公司、HD現代工程機械、馬尼瓦克以及其他領先商。重型設備市場的企業正致力於技術創新,包括自動化、遠端資訊處理和電氣化,以實現產品差異化並吸引具有環保意識的客戶。與承包商、租賃服務提供者和車隊營運商建立策略合作夥伴關係和開展合作,有助於擴大市場覆蓋範圍並加強分銷網路。製造商正在加大研發投入,以提高燃油效率、耐用性和運作性能,同時遵守更嚴格的排放法規。進軍高成長的新興市場,確保企業能夠參與大型基礎設施和工業專案。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 基礎設施建設和城市化

- 技術進步和自動化

- 永續性和排放法規

- 產業陷阱與挑戰

- 較高的初始投資和維護成本

- 供應鏈中斷與原物料價格波動

- 機會

- 電氣化和綠色設備解決方案

- 數位化和預測性維護

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按機器類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依機器類型分類,2021-2034年

- 主要趨勢

- 挖土機

- 起重機

- 反鏟裝載機

- 推土機/推土機

- 輪式裝載機

- 平地機

- 自卸卡車

- 壓路機/壓路機

- 其他

第6章:市場估算與預測:以出行方式分類,2021-2034年

- 主要趨勢

- 行動裝置

- 固定設備

- 半行動裝置

第7章:市場估算與預測:依電源類型分類,2021-2034年

- 主要趨勢

- 柴油動力

- 電動的

- 油電混合

第8章:市場估算與預測:按應用領域分類 2021-2034 年

- 主要趨勢

- 建造

- 礦業

- 基礎設施建設

- 工業製造

- 物料搬運

- 拆除

- 其他(農業、林業、公用事業等)

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 建築公司

- 租賃服務提供者

- 礦業公司

- 基礎設施開發商

- 製造工廠

- 其他(公用事業、政府等)

第10章:市場估價與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直銷

- 間接銷售

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Caterpillar Inc.

- Doosan Infracore (now Develon)

- Hitachi Construction Machinery

- Hyundai Construction Equipment (now HD Hyundai Construction Equipment)

- JCB

- John Deere

- Komatsu Ltd.

- Liebherr Group

- Manitowoc Company

- Sany Heavy Industry

- Tadano Ltd.

- Terex Corporation

- Volvo Construction Equipment

- XCMG Group

- Zoomlion Heavy Industry

The Global Heavy Equipment Market was valued at USD 184.2 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 337.9 billion by 2034.

The market plays a critical role in supporting global infrastructure and industrial development, acting as a backbone for urbanization, resource movement, and economic expansion. Its primary applications span construction, mining, agriculture, and material handling, sectors that are pivotal for growth worldwide. Demand is being led by emerging economies investing heavily in roads, energy projects, and housing, while established markets are modernizing fleets with fuel-efficient, digitally connected, and technologically advanced machinery. Automation, telematics, and electrification are transforming operations, helping companies achieve sustainability goals while reducing operational costs. The growing emphasis on efficiency and productivity, coupled with technological integration, is reshaping the heavy equipment landscape and enabling smarter, greener operations across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $184.2 Billion |

| Forecast Value | $337.9 Billion |

| CAGR | 6.4% |

The rental segment is witnessing strong growth as companies seek flexible, cost-effective solutions, avoiding large upfront investments. However, the industry faces challenges, including fluctuating raw material prices, labor shortages, and stricter emission regulations, which are pushing manufacturers to accelerate innovation while maintaining compliance and competitiveness. Despite these challenges, the market outlook remains strong.

The construction companies segment held 42% share in 2024. Machinery such as excavators, loaders, bulldozers, and cranes is heavily utilized in earthmoving, material handling, site preparation, and structural assembly. Rising urbanization and government infrastructure projects are steadily boosting demand for these machines.

The diesel-powered equipment segment generated significant share in 2024, supported by high torque, reliability, and established performance in construction, mining, and agricultural operations. Diesel engines benefit from a well-developed fuel supply infrastructure, extended operational range, and operator familiarity, making them essential in remote or hard-to-access areas where electric charging networks are limited. Diesel remains critical for continuous heavy-duty operations.

U.S. Heavy Equipment Market held 82% share with USD 39.2 billion in 2024. The region emphasizes advanced machinery, automation, and telematics, with large-scale infrastructure and mining projects driving high demand. Strong replacement demand and a mature rental equipment sector ensure steady revenue streams, while ongoing investment in research and development reinforces North America's global market position.

Major players in the Global Heavy Equipment Market include Hitachi Construction Machinery, Tadano Ltd., Volvo Construction Equipment, Liebherr Group, Komatsu Ltd., Sany Heavy Industry, Caterpillar Inc., Zoomlion Heavy Industry, JCB, John Deere, Develon (formerly Doosan Infracore), Terex Corporation, HD Hyundai Construction Equipment, Manitowoc Company, and other leading manufacturers. Companies in the heavy equipment market are focusing on technological innovation, including automation, telematics, and electrification, to differentiate their products and attract environmentally conscious customers. Strategic partnerships and collaborations with contractors, rental service providers, and fleet operators help expand market reach and strengthen distribution networks. Manufacturers are investing in research and development to improve fuel efficiency, durability, and operational performance while complying with stricter emission regulations. Expanding into high-growth emerging markets ensures access to large infrastructure and industrial projects.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Mobility

- 2.2.4 Power source

- 2.2.5 Application

- 2.2.6 End Use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure development and urbanization

- 3.2.1.2 Technological advancements and automation

- 3.2.1.3 Sustainability and emission regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Supply chain disruptions and raw material volatility

- 3.2.3 Opportunities

- 3.2.3.1 Electrification and green equipment solutions

- 3.2.3.2 Digitalization and predictive maintenance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Machine Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Excavators

- 5.3 Cranes

- 5.4 Backhoe Loaders

- 5.5 Bulldozers/Dozers

- 5.6 Wheel loaders

- 5.7 Motor Graders

- 5.8 Dump Trucks

- 5.9 Compactors/Rollers

- 5.10 Others

Chapter 6 Market Estimates and Forecast, By Mobility, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Mobile equipment

- 6.3 Stationary equipment

- 6.4 Semi-mobile equipment

Chapter 7 Market Estimates and Forecast, By Power Source, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Diesel-powered

- 7.3 Electric-powered

- 7.4 Hybrid-powered

Chapter 8 Market Estimates and Forecast, By Application 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Mining

- 8.4 Infrastructure development

- 8.5 Industrial manufacturing

- 8.6 Material handling

- 8.7 Demolition

- 8.8 Others (agriculture, forestry, utilities, etc.)

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Construction companies

- 9.3 Rental service providers

- 9.4 Mining companies

- 9.5 Infrastructure developers

- 9.6 Manufacturing plants

- 9.7 Others (utilities, government, etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Caterpillar Inc.

- 12.2 Doosan Infracore (now Develon)

- 12.3 Hitachi Construction Machinery

- 12.4 Hyundai Construction Equipment (now HD Hyundai Construction Equipment)

- 12.5 JCB

- 12.6 John Deere

- 12.7 Komatsu Ltd.

- 12.8 Liebherr Group

- 12.9 Manitowoc Company

- 12.10 Sany Heavy Industry

- 12.11 Tadano Ltd.

- 12.12 Terex Corporation

- 12.13 Volvo Construction Equipment

- 12.14 XCMG Group

- 12.15 Zoomlion Heavy Industry