|

市場調查報告書

商品編碼

1885824

水產養殖飼料中蛋白質水解物的市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Protein Hydrolysates in Aquaculture Feed Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

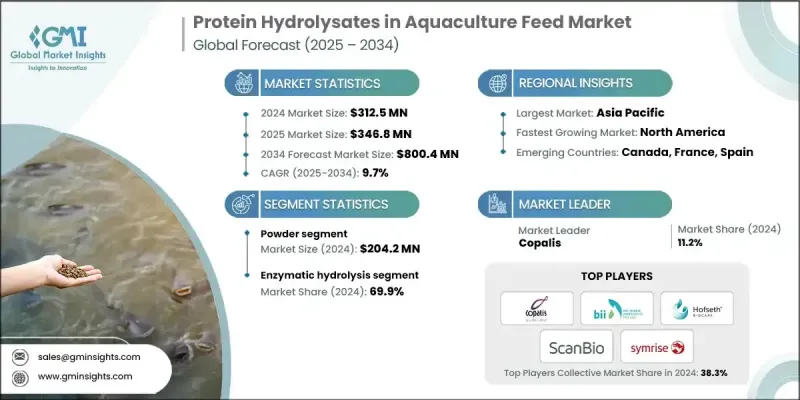

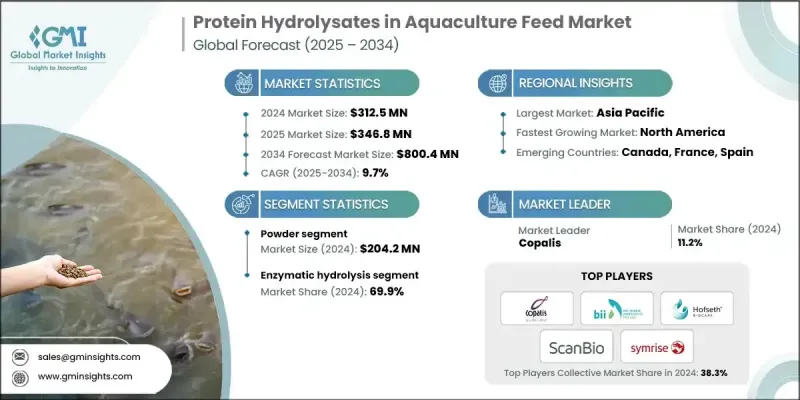

2024 年全球水產養殖飼料用蛋白質水解物市場價值為 3.125 億美元,預計到 2034 年將以 9.7% 的複合年成長率成長至 8.004 億美元。

這些成分是透過對富含蛋白質的海洋和陸地資源進行可控的酶解或化學分解,將其轉化為更小、更易消化的胜肽和氨基酸而製成的。它們的使用能夠增強養殖水生生物的營養吸收、提高生長性能並增強其抗病能力,使其成為現代永續水產養殖系統不可或缺的一部分。市場擴張受到日益重視的負責任養殖實踐的強烈推動,而鼓勵循環資源利用的監管框架也為此提供了支持。北美正在成為成長最快的地區,因為相關政策鼓勵將漁業廢棄物轉化為高價值的水解物,從而減少對環境的影響並支持符合永續發展標準。對環保飼料原料的需求不斷成長,以及對天然高性能添加劑的轉向,正在推動這些成分的廣泛應用。全球水產養殖業對健康、免疫力和飼料高效利用的日益關注,進一步加速了對生物活性蛋白水解物的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.125億美元 |

| 預測值 | 8.004億美元 |

| 複合年成長率 | 9.7% |

2024年,粉末狀水解物創造了2.042億美元的市場價值。粉狀產品在長期儲存過程中能夠保持穩定性和營養完整性,並且由於其濃縮特性,更便於運輸。飼料生產商更青睞粉末配方,因為它們能夠順利融入先進的混合工藝,從而支持持續的品質控制,並促進各地區市場的穩定成長。

2024年,酵素水解法佔了69.9%的市佔率。此方法能夠生產具有可控肽譜、優異消化率和生物利用度的高功能性水解產物。該工藝保留了關鍵的生物活性成分,並可製備出靶向肽段,從而支持水產養殖物種的最佳健康和生產性能。

預計2025年至2034年,北美水產飼料用蛋白水解物市場將以10%的複合年成長率成長。人們對永續水產養殖實踐的認知不斷提高,以及對天然、可生物分解飼料成分的偏好日益成長,是推動市場強勁需求的主要因素。區域生產商和飼料製造商正優先考慮對環境負責的原料,這些原料既能提高飼料質量,又能降低對生態環境的影響。

水產飼料用蛋白水解物市場的主要企業包括 Scanbio、Symrise、Kemin Industries、Copalis、SAMPI、Alfa Laval AB、Hofseth Biocare、Bio-Marine Ingredients Ireland Ltd、Sopropeche 和 Janatha Fish Meal。這些企業透過投資先進的酵素加工技術、擴大產能和最佳化原料利用率來提升競爭力。許多企業強調永續採購,將漁業副產品轉化為高價值的水解物,以符合循環經濟的目標。與水產養殖戶的策略合作有助於針對特定物種和生長階段客製化水解物配方,從而提高養殖效果。各企業採用嚴格的品質認證體系,以滿足全球監管要求並建立客戶信任。產品多元化,專注於功能性、營養豐富的胜肽解決方案,鞏固了其在高階飼料領域的地位。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 水產養殖產量和飼料需求不斷成長

- 疾病預防與免疫系統增強

- 魚類加工副產品的永續利用

- 產業陷阱與挑戰

- 生產成本高且加工要求複雜

- 原料供應限制和季節性因素

- 市場機遇

- 物種特異性水解物的開發

- 生物活性胜肽組分的應用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按形式

- 未來市場趨勢

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依形式分類,2021-2034年

- 主要趨勢

- 粉末

- 液體

- 貼上

第6章:市場估算與預測:依製程分類,2021-2034年

- 主要趨勢

- 酵素水解

- 化學水解

- 酸水解

- 鹼性水解

- 自溶水解

- 其他

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 幼蟲攝食

- 雛雞飼料

- 育肥飼料

- 功能性飼料

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Alfa Laval AB

- Bio-Marine Ingredients Ireland Ltd

- Copalis

- Hofseth Biocare

- Janatha Fish Meal

- Kemin Industries

- SAMPI

- Scanbio

- Sopropeche

- Symrise

The Global Protein Hydrolysates in Aquaculture Feed Market was valued at USD 312.5 million in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 800.4 million by 2034.

The ingredients are produced through controlled enzymatic or chemical breakdown of protein-rich marine and terrestrial sources into smaller, highly digestible peptides and amino acids. Their use enhances nutrient absorption, boosts growth performance, and strengthens disease resistance in farmed aquatic species, making them essential for modern, sustainable aquaculture systems. Market expansion is strongly influenced by growing emphasis on responsible farming practices, supported by regulatory frameworks that encourage circular resource use. North America is emerging as the fastest-growing region as policies encourage transforming fishery waste into high-value hydrolysates, reducing environmental impact, and supporting compliance with sustainability standards. Rising demand for eco-friendly feed inputs and the shift toward natural, high-performance additives are driving increased adoption. The global aquaculture sector's heightened focus on health, immunity, and efficient feed utilization further accelerates the need for bioactive protein hydrolysates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $312.5 Million |

| Forecast Value | $800.4 Million |

| CAGR | 9.7% |

The powder-based hydrolysates generated USD 204.2 million in 2024. The powdered form maintains stability and nutritional integrity over long storage periods and is easier to transport due to its concentrated nature. Feed manufacturers prefer powder formulations because they integrate smoothly into advanced mixing operations, supporting consistent quality control and enabling steady market growth across regions.

The enzymatic hydrolysis accounted for a 69.9% share in 2024. This method produces highly functional hydrolysates with controlled peptide profiles and superior digestibility and bioavailability. The process preserves key bioactive components and allows the creation of targeted peptide fractions that support optimal health and performance in aquaculture species.

North America Protein Hydrolysates in Aquaculture Feed Market is projected to grow at a CAGR of 10% from 2025 to 2034. Rising awareness of sustainable aquaculture practices and the increasing preference for natural, biodegradable feed ingredients are contributing to strong demand. Regional producers and feed manufacturers are prioritizing environmentally responsible inputs that enhance feed quality while lowering ecological impact.

Key companies in the Protein Hydrolysates in Aquaculture Feed Market include Scanbio, Symrise, Kemin Industries, Copalis, SAMPI, Alfa Laval AB, Hofseth Biocare, Bio-Marine Ingredients Ireland Ltd, Sopropeche, and Janatha Fish Meal. Companies in the protein hydrolysates in aquaculture feed market enhance their competitiveness through investments in advanced enzymatic processing, expansion of production capacity, and optimization of raw material utilization. Many emphasize sustainable sourcing by converting fishery by-products into high-value hydrolysates, aligning with circular economy goals. Strategic collaborations with aquaculture producers help tailor hydrolysate profiles for specific species and life stages, improving performance outcomes. Firms adopt strict quality certification systems to meet global regulatory expectations and build customer confidence. Product diversification aimed at functional, nutrient-dense peptide solutions strengthens their presence across premium feed categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Form trends

- 2.2.2 Process trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing aquaculture production & feed demand

- 3.2.1.2 Disease prevention & immune system enhancement

- 3.2.1.3 Sustainable utilization of fish processing by-products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & complex processing requirements

- 3.2.2.2 Raw material supply constraints & seasonal availability

- 3.2.3 Market opportunities

- 3.2.3.1 Species-specific hydrolysate development

- 3.2.3.2 Bioactive peptide fraction applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By form

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Liquid

- 5.4 Paste

Chapter 6 Market Estimates and Forecast, By Process, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.3 Chemical hydrolysis

- 6.3.1 Acid hydrolysis

- 6.3.2 Alkaline hydrolysis

- 6.4 Autolytic hydrolysis

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Larval feeds

- 7.3 Starter feeds

- 7.4 Grow-out feeds

- 7.5 Functional feeds

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Alfa Laval AB

- 9.2 Bio-Marine Ingredients Ireland Ltd

- 9.3 Copalis

- 9.4 Hofseth Biocare

- 9.5 Janatha Fish Meal

- 9.6 Kemin Industries

- 9.7 SAMPI

- 9.8 Scanbio

- 9.9 Sopropeche

- 9.10 Symrise