|

市場調查報告書

商品編碼

1885809

整體硬質合金刀具市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Solid Carbide Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

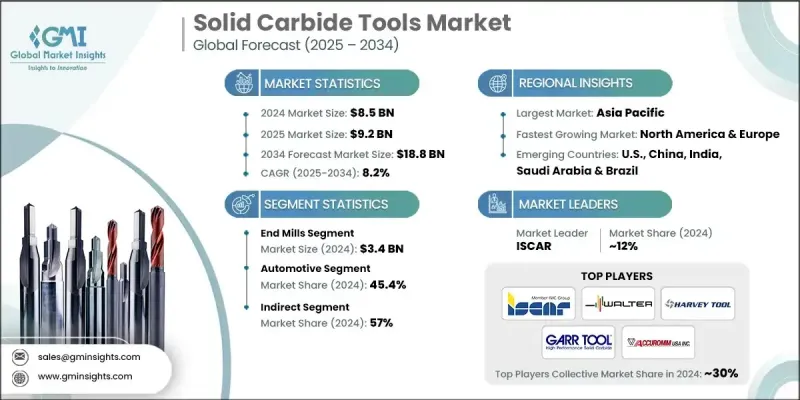

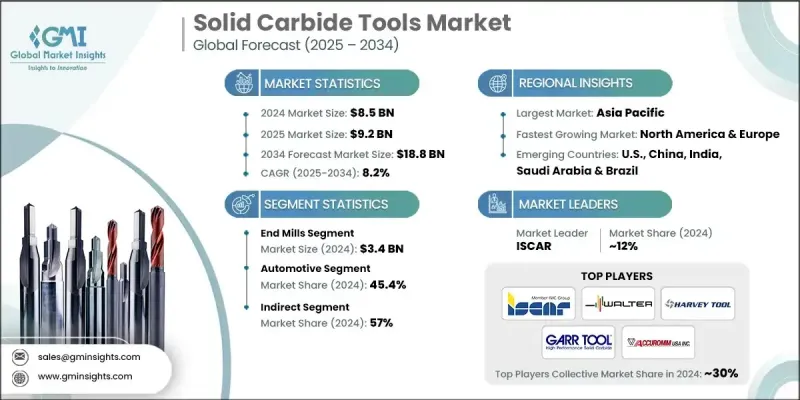

2024 年全球整體硬質合金刀具市場價值為 85 億美元,預計到 2034 年將以 8.2% 的複合年成長率成長至 188 億美元。

汽車和電動車 (EV) 製造領域日益成長的需求是推動市場成長的主要動力。隨著汽車製造商致力於減輕車身重量並提高性能效率,對高性能材料和精密零件的需求也日益成長,這反過來又提升了對先進切削刀具的需求。整體硬質合金刀具具有無與倫比的硬度、耐熱性和耐用性,使其成為加工鋁、複合材料和先進合金的理想選擇。自動化、數控加工和智慧製造技術的應用進一步推動了市場需求。高速工具機和機器人系統需要能夠在極端條件下保持精度的刀具。整體硬質合金刀具通常採用先進塗層和最佳化幾何形狀,專為應對這些嚴苛的製造環境而設計,同時確保加工結果的一致性和高品質。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 85億美元 |

| 預測值 | 188億美元 |

| 複合年成長率 | 8.2% |

2024年,立銑刀市場規模達34億美元,預計2025年至2034年將以8.7%的複合年成長率成長。立銑刀在輪廓加工、開槽、成型和複雜表面精加工等操作中至關重要。電動車產量的成長和輕量化趨勢推動了對加工鋁、鈦和複合材料等先進材料的需求,這些材料需要具有卓越硬度和耐磨性的刀具。整體硬質合金立銑刀能夠很好地滿足這些嚴苛的要求,尤其是在汽車、航太和電子製造領域。

汽車產業佔據45.4%的市場佔有率,預計到2034年將以8.6%的複合年成長率成長。電動車的生產提高了對輕質零件(如鋁、鎂合金和複合材料)加工的需求,而這些零件都需要耐用且耐磨的整體硬質合金刀具。汽車製造商正擴大採用高速數控加工和自動化技術來縮短加工週期並滿足嚴格的品質標準,這進一步推動了對精密刀具解決方案的需求。

2024年美國整體硬質合金刀具市場規模達20億美元,預計2034年將以8.5%的複合年成長率成長。美國的汽車和航太工業是精密刀具的主要消費產業,這主要得益於鋁、鈦和複合材料等輕質材料的加工。此外,工業4.0技術的廣泛應用,包括自動化、數控系統和智慧工廠解決方案,也增加了對高精度、高耐用性整體硬質合金刀具的需求。

全球整體硬質合金刀具市場的主要參與者包括 Accuromm、Accusharp、Birla Precision Technologies、DIC Tools、Fullerton Tool、Garr Tool、Hannibal Carbide Tool、Harvey Tool、ISCAR、Johnson Carbide、Mitsubishi、Orient Tools、Samtec Tools、ISCARB、Tixna Tools。這些公司正透過專注於產品創新來鞏固其市場地位,例如採用先進塗層、最佳化幾何形狀以及開發用於輕質和複合材料的專用刀具。許多公司正在投資開發自動化相容解決方案和數控刀具,以滿足高速製造環境日益成長的需求。與汽車、航太和電子製造商的策略合作有助於擴大市場覆蓋範圍,並確保為複雜的加工需求提供客製化解決方案。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 汽車和電動車製造需求不斷成長

- 採用自動化/數控加工/智慧製造技術

- 日益關注生產力和成本效益

- 產業陷阱與挑戰

- 原料和生產成本高昂

- 供應鏈中斷與複雜性

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 立銑刀

- 球頭立銑刀

- 方頭銑刀

- 圓角立銑刀

- 演習

- 麻花鑽

- 階梯訓練

- 微型鑽頭

- 槍砲演習

- 擴孔器

- 直槽鉸刀

- 螺旋槽鉸刀

- 可調式鉸刀

- 水龍頭

- 插入件

- 其他(無聊的酒吧等)

第6章:市場估算與預測:依塗料類型分類,2021-2034年

- 主要趨勢

- 氮化鈦(TiN)

- TiCN(碳氮化鈦)

- TiAlN(氮化鈦鋁)

- AlCrN(氮化鋁鉻)

- 鑽石塗層

- 未塗層硬質合金

- 標準等級

- 微晶粒級

- 奈米晶粒級

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 銑削

- 鑽孔

- 擴孔

- 螺紋

- 轉彎

- 其他(雕刻等)

第8章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 航太

- 汽車

- 醫療器材

- 電子與半導體

- 通用工程

- 其他

第9章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第11章:公司簡介

- Accuromm

- Accusharp

- Birla Precision Technologies

- DIC Tools

- Fullerton Tool

- Garr Tool

- Hannibal Carbide Tool

- Harvey Tool

- ISCAR

- Johnson Carbide

- Mitsubishi

- Orient Tools

- Samtec Tools

- SwiftCARB

- Tixna Tools

- Walter Tools

The Global Solid Carbide Tools Market was valued at USD 8.5 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 18.8 billion by 2034.

The market growth is driven by increasing demand in automotive and electric vehicle (EV) manufacturing. As automakers focus on reducing vehicle weight and improving performance efficiency, there is a growing preference for high-performance materials and precision components, which in turn elevates the need for advanced cutting tools. Solid carbide tools offer unmatched hardness, heat resistance, and durability, making them ideal for machining aluminum, composites, and advanced alloys. The adoption of automation, CNC machining, and smart manufacturing technologies is further propelling market demand. High-speed machines and robotic systems require tools capable of maintaining precision under extreme conditions. Solid carbide tools, often enhanced with advanced coatings and optimized geometries, are specifically designed to sustain these demanding manufacturing environments while delivering consistent, high-quality results.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.5 Billion |

| Forecast Value | $18.8 Billion |

| CAGR | 8.2% |

The end mills segment generated USD 3.4 billion in 2024 and is expected to grow at a CAGR of 8.7% from 2025 to 2034. End mills are critical for operations such as profiling, slotting, contouring, and finishing complex surfaces. Rising EV production and lightweighting trends are driving demand for machining advanced materials such as aluminum, titanium, and composites, which require tools with superior hardness and wear resistance. Solid carbide end mills excel in meeting these demanding requirements, particularly in automotive, aerospace, and electronics manufacturing.

The automotive sector held a 45.4% share and is projected to grow at a CAGR of 8.6% through 2034. The production of electric vehicles has heightened the need for machining lightweight components like aluminum, magnesium alloys, and composites, all of which demand durability and wear resistance of solid carbide tools. Automotive manufacturers are increasingly deploying high-speed CNC machining and automation to reduce cycle times and meet stringent quality standards, further boosting demand for precision-tooling solutions.

U.S. Solid Carbide Tools Market generated USD 2 billion in 2024 and is expected to grow at a CAGR of 8.5% through 2034. The country's automotive and aerospace industries are major consumers of precision tools, driven by the machining of lightweight materials such as aluminum, titanium, and composites. Additionally, the widespread adoption of Industry 4.0 practices, including automation, CNC systems, and smart factory solutions, has increased reliance on high-precision and durable solid carbide tools.

Key players in the Global Solid Carbide Tools Market include Accuromm, Accusharp, Birla Precision Technologies, DIC Tools, Fullerton Tool, Garr Tool, Hannibal Carbide Tool, Harvey Tool, ISCAR, Johnson Carbide, Mitsubishi, Orient Tools, Samtec Tools, SwiftCARB, Tixna Tools, and Walter Tools. Companies in the Solid Carbide Tools Market are strengthening their presence by focusing on product innovation, such as advanced coatings, optimized geometries, and specialized tools for lightweight and composite materials. Many firms are investing in automation-compatible solutions and CNC-ready tools to serve the growing demand from high-speed manufacturing environments. Strategic collaborations with automotive, aerospace, and electronics manufacturers help expand market reach and ensure tailored solutions for complex machining requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Coating type

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand in automotive & EV manufacturing

- 3.2.1.2 Adoption of automation / CNC machining / smart manufacturing

- 3.2.1.3 Rising focus on productivity & cost efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High raw material & production costs

- 3.2.2.2 Supply chain disruptions & complexity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 End mills

- 5.2.1 Ball nose end mills

- 5.2.2 Square end mills

- 5.2.3 Corner radius end mills

- 5.3 Drills

- 5.3.1 Twist drills

- 5.3.2 Step drills

- 5.3.3 Micro drills

- 5.3.4 Gun drills

- 5.4 Reamers

- 5.4.1 Straight flute reamers

- 5.4.2 Spiral flute reamers

- 5.4.3 Adjustable reamers

- 5.5 Taps

- 5.6 Inserts

- 5.7 Others (boring bars etc.)

Chapter 6 Market Estimates & Forecast, By Coating Type, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 TiN (Titanium nitride)

- 6.3 TiCN (Titanium carbonitride)

- 6.4 TiAlN (Titanium aluminum nitride)

- 6.5 AlCrN (Aluminum chromium nitride)

- 6.6 Diamond coatings

- 6.7 Uncoated carbide

- 6.7.1 Standard grades

- 6.7.2 Micro-grain grades

- 6.7.3 Nano-grain grades

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Milling

- 7.3 Drilling

- 7.4 Reaming

- 7.5 Threading

- 7.6 Turning

- 7.7 Others (engraving etc.)

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Aerospace

- 8.3 Automotive

- 8.4 Medical devices

- 8.5 Electronics & semiconductors

- 8.6 General engineering

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Accuromm

- 11.2 Accusharp

- 11.3 Birla Precision Technologies

- 11.4 DIC Tools

- 11.5 Fullerton Tool

- 11.6 Garr Tool

- 11.7 Hannibal Carbide Tool

- 11.8 Harvey Tool

- 11.9 ISCAR

- 11.10 Johnson Carbide

- 11.11 Mitsubishi

- 11.12 Orient Tools

- 11.13 Samtec Tools

- 11.14 SwiftCARB

- 11.15 Tixna Tools

- 11.16 Walter Tools