|

市場調查報告書

商品編碼

1885799

微生物組調節劑市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Microbiome Modulators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

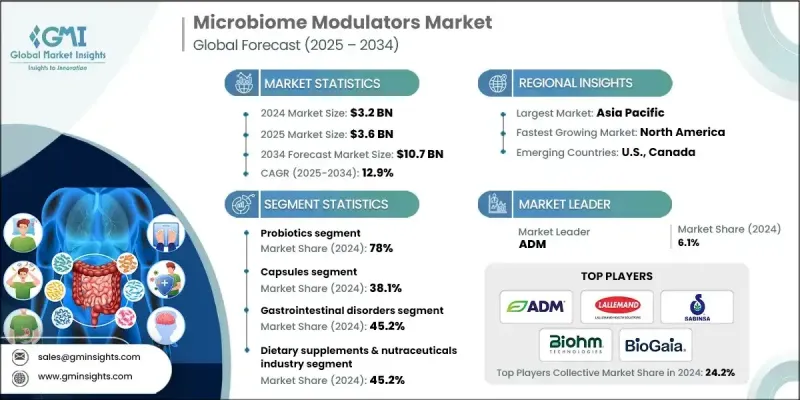

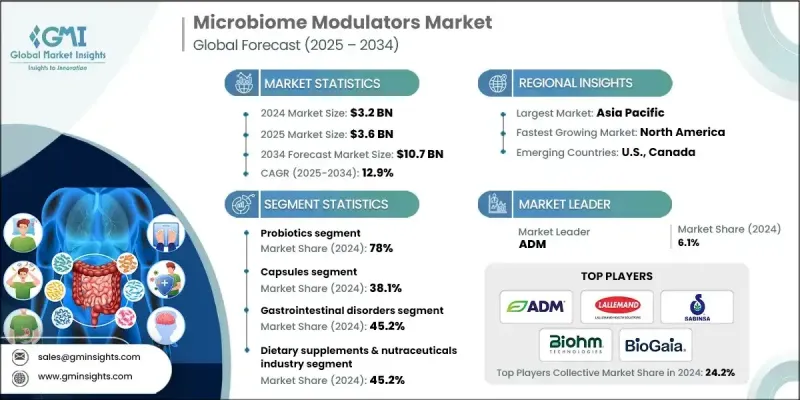

2024 年全球微生物組調節劑市場價值為 32 億美元,預計到 2034 年將以 12.9% 的複合年成長率成長至 107 億美元。

隨著科學界和商業界對人體微生物組的興趣日益濃厚,市場持續擴張,凸顯了微生物平衡在維持長期健康方面的重要作用。益生菌、益生元、合生元和後生元等微生物組調節劑旨在支持和恢復可能因生活方式因素、壓力、抗生素暴露或不良飲食習慣而失衡的微生物平衡。這些產品與消化舒適、增強免疫力、降低發炎以及改善與糖尿病和肥胖等疾病相關的代謝結果的關聯日益緊密。隨著消費者傾向於天然的預防性解決方案和個人化營養,針對微生物組的產品需求在膳食補充劑、功能性食品和健康配方等領域正加速成長。微生物組科學的不斷進步,加上健康意識的不斷提高,持續推動產品創新和細分市場的多元化,確保市場持續發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 107億美元 |

| 複合年成長率 | 12.9% |

益生菌產品佔了78%的市場佔有率,預計到2034年將以12.9%的複合年成長率成長。菌株的持續研發和專業配方不斷強化了益生菌在免疫支持、消化調節和整體健康方面的應用。隨著消費者興趣的成長,益生菌在膳食補充劑、功能性飲料和強化食品中的應用也不斷擴展。

2024年,膠囊劑市佔率佔比達38.1%,預計2025年至2034年將以13%的複合年成長率成長。膠囊因服用方便、易於吞嚥以及能提高敏感生物體穩定性的保護屏障,仍是首選的給藥方式。這種劑型可支持靶向釋放,使其非常適用於膳食補充劑和藥品。

北美微生物組調節劑市場預計到2024年將佔據30.2%的市場佔有率,這主要得益於人們對腸道健康及其對整體健康影響的日益關注。該地區的消費者擴大購買富含益生菌和益生元的產品,推動了膳食補充劑、食品和飲料等相關產品的需求成長。

微生物組調節劑市場的主要參與者包括AB-Biotics、Ritual、4D Pharma Plc、BioGaia、DSM-Firmenich、Sabinsa Corporation、ADM、Biohm Technologies、Modulate Biosystems、Second Genome, Inc.、Ferring、Lallemand Health Solutions和TCI Co., Ltd.。為了鞏固市場地位,微生物組調節劑市場的企業正採取以科學驗證、多元化產品發布和拓展分銷網路為核心的策略。許多公司正在投資先進的菌株研究和臨床試驗,以證實其健康功效並提升信譽度。與食品、飲料和膳食補充劑生產商的合作有助於拓寬應用領域,同時,個人化配方的開發也正在滿足日益成長的針對性健康解決方案的需求。此外,各公司還透過加強電子商務管道、最佳化供應鏈以及進行策略合作來擴大其全球影響力,從而加速創新並確保符合監管要求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 益生菌

- 益生元

- 合生元

- 後生元

- 活體生物治療產品(LBPs)

- 噬菌體療法

第6章:市場估算與預測:依形式分類,2021-2034年

- 主要趨勢

- 膠囊

- 片劑

- 粉末

- 液體

- 其他

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 傳染病

- 胃腸道疾病

- 免疫系統疾病

- 癌症治療

- 代謝性疾病

- 皮膚病

第8章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 製藥與生物技術

- 膳食補充品和營養保健品

- 餐飲

- 動物飼料與營養

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- AB-Biotics, SA

- ADM

- BioGaia

- Biohm Technologies

- DSM-Firmenich

- Ferring

- Lallemand Health Solutions

- Modulate Biosystems

- Ritual

- Sabinsa Corporation

- Second Genome, Inc.

- TCI Co., Ltd.

- 4D Pharma Plc

The Global Microbiome Modulators Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 12.9% to reach USD 10.7 billion by 2034.

The market continues to expand as scientific and commercial interest in the human microbiome strengthens, highlighting the essential role of microbial balance in maintaining long-term health. Microbiome modulators such as probiotics, prebiotics, synbiotics, and postbiotics are designed to support and restore microbial harmony that may be disrupted by lifestyle factors, stress, antibiotic exposure, or poor dietary patterns. These products are increasingly associated with digestive comfort, immune reinforcement, lowered inflammation, and improved metabolic outcomes linked to conditions such as diabetes and obesity. As consumers gravitate toward natural, preventive solutions and personalized nutrition, demand for microbiome-focused products is accelerating across supplements, functional foods, and wellness formulations. Ongoing advancements in microbiome science, combined with rising health consciousness, continue to broaden product innovation and segment diversity, ensuring sustained market progression.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 12.9% |

The probiotics segment held a 78% share and is set to grow at a CAGR of 12.9% through 2034. Continuous strain development and specialized formulations are reinforcing their use in immune support, digestive regulation, and overall wellness. Their integration into dietary supplements, functional beverages, and fortified foods is expanding as consumer interest rises.

The capsules segment accounted for a 38.1% share in 2024 and is forecast to grow at a CAGR of 13% from 2025 to 2034. Capsules remain a preferred delivery mode due to convenience, ease of ingestion, and their protective barrier that improves the stability of sensitive organisms. This format supports targeted release, making it highly suitable for both supplement and pharmaceutical applications.

North America Microbiome Modulators Market captured 30.2% share in 2024, backed by growing awareness about gut health and its influence on overall wellness. Consumers across the region are increasingly purchasing probiotic and prebiotic-enriched products, driving reinforced demand across supplements, foods, and beverages.

Key players active in the Microbiome Modulators Market include AB-Biotics, SA, Ritual, 4D Pharma Plc, BioGaia, DSM-Firmenich, Sabinsa Corporation, ADM, Biohm Technologies, Modulate Biosystems, Second Genome, Inc., Ferring, Lallemand Health Solutions, and TCI Co., Ltd. To strengthen their position, companies in the Microbiome Modulators Market are adopting strategies centered on scientific validation, diversified product launches, and expanded distribution networks. Many firms are investing in advanced strain research and clinical studies to substantiate health claims and enhance credibility. Partnerships with food, beverage, and supplement manufacturers are helping broaden application possibilities, while personalized formulations are being developed to meet the rising demand for targeted wellness solutions. Companies are also expanding their global reach by strengthening e-commerce channels, optimizing supply chains, and engaging in strategic collaborations to accelerate innovation and regulatory compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End Use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Probiotics

- 5.3 Prebiotics

- 5.4 Synbiotics

- 5.5 Postbiotics

- 5.6 Live biotherapeutic products (LBPs)

- 5.7 Bacteriophage therapies

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Capsules

- 6.3 Tablets

- 6.4 Powders

- 6.5 Liquids

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Infectious diseases

- 7.3 Gastrointestinal disorders

- 7.4 Immune system disorders

- 7.5 Cancer therapy

- 7.6 Metabolic diseases

- 7.7 Dermatological conditions

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceutical & biotechnology

- 8.3 Dietary supplements & nutraceuticals

- 8.4 Food & beverage

- 8.5 Animal feed & nutrition

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 AB-Biotics, SA

- 10.2 ADM

- 10.3 BioGaia

- 10.4 Biohm Technologies

- 10.5 DSM-Firmenich

- 10.6 Ferring

- 10.7 Lallemand Health Solutions

- 10.8 Modulate Biosystems

- 10.9 Ritual

- 10.10 Sabinsa Corporation

- 10.11 Second Genome, Inc.

- 10.12 TCI Co., Ltd.

- 10.13 4D Pharma Plc