|

市場調查報告書

商品編碼

1876828

伴隨診斷市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Companion Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

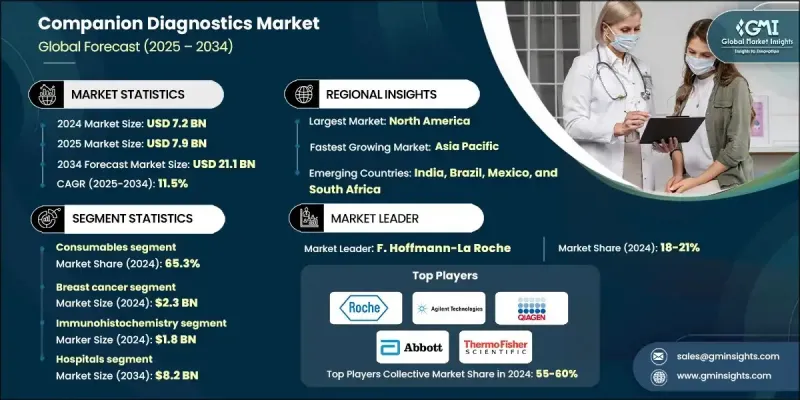

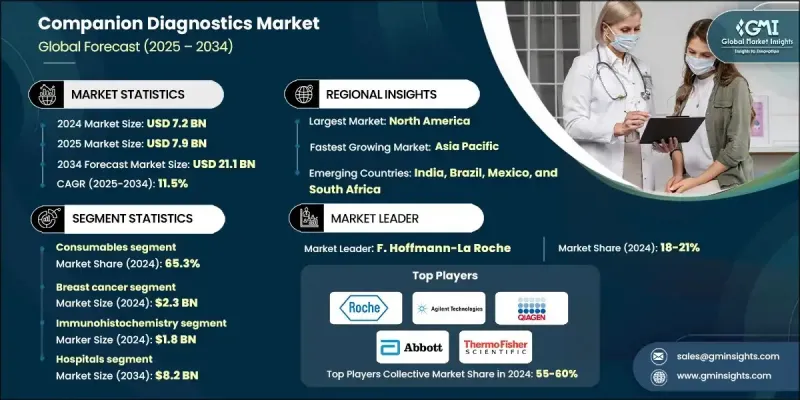

2024 年全球伴隨診斷市場價值為 72 億美元,預計到 2034 年將以 11.5% 的複合年成長率成長至 211 億美元。

伴隨診斷市場成長的促進因素包括癌症發生率上升、藥物不良反應發生率增加、精準醫療的快速普及。伴隨診斷是一種專門的醫學檢測,有助於識別最有可能對特定療法產生積極反應的患者。透過檢測影響藥物反應的特定生物標記或基因變異,這些診斷方法能夠實現更精準、更個人化的治療決策。伴隨診斷的使用可以降低副作用風險,提高治療效果,並符合全球向個人化醫療轉變的趨勢。伴隨診斷在臨床方案中的應用日益廣泛,尤其是在腫瘤學、免疫學和慢性病管理領域,這反映了其在最佳化治療效果方面日益重要的作用。由於藥物不良反應持續對現代醫療保健構成重大挑戰,監管機構和醫療服務提供者都在強調採用能夠最大限度降低患者風險並提高藥物安全性的診斷方法。這種日益增強的意識,加上技術進步和生物標記研究的拓展,持續推動全球伴隨診斷市場的發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 72億美元 |

| 預測值 | 211億美元 |

| 複合年成長率 | 11.5% |

2024年,耗材市佔率佔比達65.3%。此類別包括一次性產品,例如試劑盒、檢測試劑、測試試劑盒和樣本製備材料,這些產品對於進行診斷檢測至關重要。臨床實驗室對耗材的持續需求推動了穩定的收入來源,因為每項檢測都需要耗材。與一次性資本支出的診斷儀器不同,耗材確保了持續的產品需求,使其成為整個行業供應商和製造商的關鍵成長驅動力。

2024年,乳癌市場規模預計將達23億美元。乳癌的高發生率催生了對能夠識別特定分子標記以指導治療方案選擇的診斷工具的迫切需求。針對HER2陽性和荷爾蒙受體陽性等亞型乳癌的個人化治療方案的興起,導致檢測量不斷成長。此外,製藥公司和診斷公司之間的合作正在推動生物標記驅動型解決方案的發展,促進腫瘤診斷市場的擴張和創新。

受癌症負擔日益加重和標靶治療日益普及的推動,美國伴隨診斷市場預計將在2024年達到27億美元。隨著全美癌症發生率持續上升,精準高效診斷平台的需求也日益成長。伴隨診斷正快速融入精準腫瘤學,幫助醫師根據腫瘤基因和患者個別情況制定個人化的治療方案。這種方法能夠提高治療成功率並最大限度地減少不良反應,使診斷指導治療成為美國現代癌症治療的核心組成部分。

全球伴隨診斷市場的主要參與者包括輝瑞、默克、阿斯特捷利康、賽默飛世爾科技、羅氏、雅培、安進、強生、百時美施貴寶、禮來、Myriad Genetics、Guardant Health、Foundation Medicine、百健和貝克頓迪金森公司。伴隨診斷市場的關鍵參與者正採取一系列策略來鞏固其競爭地位。許多公司正與製藥公司建立長期合作關係,共同開發與新藥上市相配合的標靶療法和伴隨檢測。此外,各公司在生物標記發現和新一代定序技術方面投入巨資,以提高診斷檢測的準確性和預測能力。策略性併購正在拓展其全球業務範圍並豐富其產品組合。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 發展中國家疾病盛行率呈上升趨勢

- 北美配備先進診斷設備的病理實驗室和服務機構數量激增

- 技術進步

- 增加研發投資

- 產業陷阱與挑戰

- 嚴格的監管框架

- 產品開發成本高

- 市場機遇

- 偏遠和農村地區的需求不斷成長

- 與數位健康平台整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術格局

- 目前技術

- 新興技術

- 未來市場趨勢

- 專利分析

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 儀器

- 消耗品

- 服務

第6章:市場估計與預測:依疾病適應症分類,2021-2034年

- 主要趨勢

- 乳癌

- 肺癌

- 大腸直腸癌

- 皮膚癌

- 其他疾病適應症

第7章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 免疫組織化學

- 原位雜合技術

- 聚合酶鍊式反應

- 基因定序

- 其他技術

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 診斷實驗室

- 其他最終用途

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott Laboratories

- Amgen

- AstraZeneca

- Becton, Dickinson and Company

- Biogen

- Bristol Myers Squibb

- Eli Lilly and Company

- F. Hoffmann-La Roche

- Foundation Medicine

- Guardant Health

- Johnson & Johnson

- Merck

- Myriad Genetics

- Pfizer

- Thermo Fisher Scientific

The Global Companion Diagnostics Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 21.1 billion by 2034.

Market growth is driven by the rising prevalence of cancer, the growing incidence of adverse drug reactions, and the rapid adoption of precision medicine. Companion diagnostics are specialized medical tests that help identify patients who are most likely to respond positively to a particular therapy. By detecting specific biomarkers or genetic variations that influence drug response, these diagnostics enable more accurate, personalized treatment decisions. The use of companion diagnostics reduces the risk of side effects, enhances therapeutic efficacy, and aligns with the global shift toward individualized healthcare. Their increasing integration into clinical protocols, especially in oncology, immunology, and chronic disease management, reflects their growing role in optimizing treatment outcomes. As adverse drug reactions continue to pose major challenges in modern healthcare, both regulatory agencies and healthcare providers are emphasizing the adoption of diagnostics that minimize patient risk and improve drug safety. This growing awareness, combined with technological progress and the expansion of biomarker research, continues to strengthen the companion diagnostics market worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 11.5% |

The consumables segment accounted for a 65.3% share in 2024. This category includes single-use products such as cartridges, assay reagents, test kits, and sample preparation materials that are vital for conducting diagnostic assays. The continuous demand for consumables in clinical laboratories drives consistent revenue streams, as they are required for every test performed. Unlike diagnostic instruments, which represent a one-time capital expense, consumables ensure ongoing product demand, making them a crucial growth driver for suppliers and manufacturers across the sector.

The breast cancer segment was valued at USD 2.3 billion in 2024. The widespread incidence of breast cancer has created a strong need for diagnostic tools capable of identifying specific molecular markers that guide therapy selection. The move toward personalized treatment approaches for subtypes such as HER2-positive and hormone receptor-positive breast cancers has resulted in increasing testing volumes. Additionally, collaborations between pharmaceutical and diagnostic companies are advancing biomarker-driven solutions, boosting market expansion and innovation in oncology diagnostics.

U.S. Companion Diagnostics Market reached USD 2.7 billion in 2024, supported by the rising cancer burden and increasing focus on targeted medicine. With cancer rates continuing to rise across the nation, the demand for accurate and efficient diagnostic platforms is intensifying. Companion diagnostics are being rapidly integrated into precision oncology, helping physicians customize treatment strategies based on tumor genetics and individual patient profiles. This approach enhances therapy success rates and minimizes adverse effects, making diagnostic-guided treatment a central part of modern cancer care in the United States.

Leading companies operating within the Global Companion Diagnostics Market include Pfizer, Merck, AstraZeneca, Thermo Fisher Scientific, F. Hoffmann-La Roche, Abbott Laboratories, Amgen, Johnson & Johnson, Bristol Myers Squibb, Eli Lilly and Company, Myriad Genetics, Guardant Health, Foundation Medicine, Biogen, and Becton, Dickinson and Company. Key players in the Companion Diagnostics Market are employing a range of strategies to strengthen their competitive positions. Many are forming long-term collaborations with pharmaceutical firms to co-develop targeted therapies and companion tests that align with new drug launches. Companies are also investing heavily in biomarker discovery and next-generation sequencing technologies to enhance the accuracy and predictive power of diagnostic assays. Strategic mergers and acquisitions are expanding their global reach and diversifying product portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Products trends

- 2.2.3 Disease indication trends

- 2.2.4 Technology trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Upward trend in disease prevalence among developing countries

- 3.2.1.2 Surging number of pathology labs and services equipped with advanced diagnostic equipment in North America

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing R&D investment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of product development

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand in remote and rural areas

- 3.2.3.2 Integration with digital health platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Disease Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Breast cancer

- 6.3 Lung cancer

- 6.4 Colorectal cancer

- 6.5 Skin cancer

- 6.6 Other diseases indications

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Immunohistochemistry

- 7.3 In situ hybridization

- 7.4 Polymerase chain reaction

- 7.5 Genetic sequencing

- 7.6 Other technologies

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic laboratories

- 8.4 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Amgen

- 10.3 AstraZeneca

- 10.4 Becton, Dickinson and Company

- 10.5 Biogen

- 10.6 Bristol Myers Squibb

- 10.7 Eli Lilly and Company

- 10.8 F. Hoffmann-La Roche

- 10.9 Foundation Medicine

- 10.10 Guardant Health

- 10.11 Johnson & Johnson

- 10.12 Merck

- 10.13 Myriad Genetics

- 10.14 Pfizer

- 10.15 Thermo Fisher Scientific