|

市場調查報告書

商品編碼

1876824

雲端微服務市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Cloud Microservices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

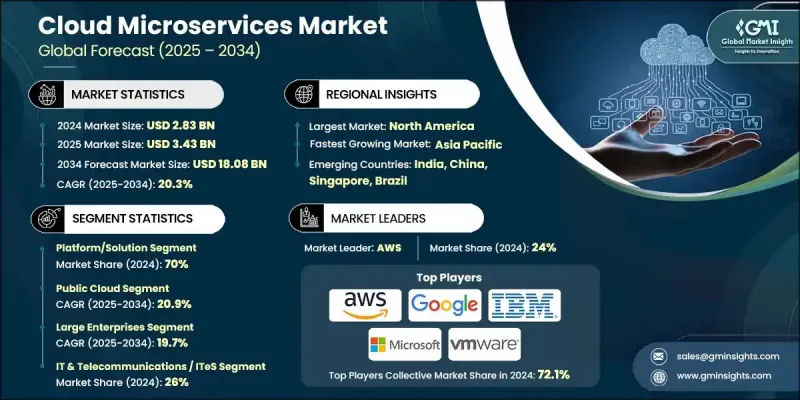

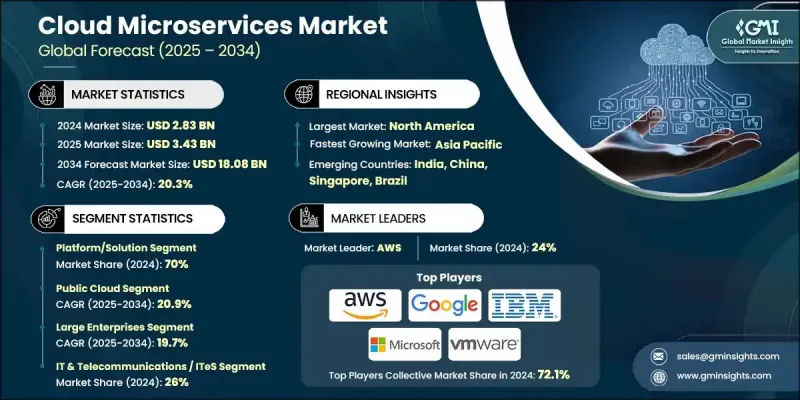

2024 年全球雲端微服務市場價值為 28.3 億美元,預計到 2034 年將以 20.3% 的複合年成長率成長至 180.8 億美元。

企業應用程式從傳統單體系統到現代雲端原生架構的遷移日益增多,推動了微服務的快速發展。約 62.3% 的企業已採用微服務和容器化技術,以增強靈活性、簡化應用程式開發並加速跨分散式環境的軟體部署。微服務的模組化設計使開發團隊能夠更有效率地擴展服務和部署更新。然而,維運挑戰依然存在;36% 的企業表示有整合難題,35% 的企業則指出在不同的服務環境中應用一致的安全策略十分複雜。人工智慧維運 (AIOps) 的出現可望重塑市場格局,基於人工智慧的自動化將提升預測性擴展、異常檢測和系統效能。透過將機器學習與 IT 維運結合,企業能夠更聰明、更可靠、更經濟高效地管理微服務環境。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28.3億美元 |

| 預測值 | 180.8億美元 |

| 複合年成長率 | 20.3% |

到了2024年,平台和解決方案細分市場佔據70%的市場佔有率,成為市場成長的主要驅動力。對安全、可互通且高度可擴展的開發框架日益成長的依賴,推動了這一領域的領先地位。企業正在採用容器編排技術來管理分散式應用程式,而整合自動化、可觀測性和API管理功能的平台也越來越受歡迎。這些進步使企業能夠提高效率、保持可擴展性並簡化複雜的基於微服務的工作流程,從而鞏固了該細分市場在全球市場中的顯著佔有率。

預計到2034年,公有雲市場將以20.9%的複合年成長率成長。這一市場的成長主要得益於公有雲環境提供的彈性託管基礎設施服務的廣泛應用。約76%的企業選擇透過公有雲框架部署微服務應用,因為公有雲框架具有成本效益高、可擴展性強和運行速度快等優勢。隨著公有雲生態系統的日趨成熟,該市場持續成長。公有雲生態系統提供增強的DevOps整合、自動化編排和原生容器支援等功能,簡化了全球企業的部署和效能管理。

2024年,美國雲端微服務市場規模預計將達到11.1億美元。美國商業領域,尤其是資訊科技和製造業,對雲端技術的廣泛採用是其市場領先地位的關鍵因素。超過60%的資訊產業企業表示正在積極使用雲端應用,而製造業的中小型企業與往年相比,在雲端應用方面遇到的障礙也越來越少。各行業雲端應用的持續成長,使美國成為微服務部署和創新的重要中心。

全球雲端微服務市場的主要企業包括微軟、甲骨文、VMware、Salesforce、戴爾科技、Google、阿里巴巴、亞馬遜AWS、SAP和IBM。為了鞏固在全球雲端微服務市場的地位,各大公司正實施以創新、合作和服務拓展為核心的策略。它們正大力投資開發整合平台,將自動化、分析和人工智慧驅動的編排相結合,以最佳化雲端原生營運。與軟體開發商、企業和雲端服務供應商的策略合作,正在增強互通性並加快產品部署速度。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 雲端原生應用程式擴大採用微服務。

- 容器化和 Kubernetes 編排的興起

- 持續整合和持續交付(CI/CD)的需求

- 需要具有彈性和容錯能力的架構

- 產業陷阱與挑戰

- 管理分散式服務的複雜性

- 微服務架構中的安全漏洞

- 市場機遇

- 邊緣運算中微服務的擴展

- 與人工智慧/機器學習整合以實現智慧服務編排

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 碳足跡評估

- 循環經濟一體化

- 電子垃圾管理要求

- 綠色製造計劃

- 用例和應用

- 最佳情況

- 產業特定成長機會

- 自動駕駛車輛和運輸系統

- 智慧製造與工業物聯網

- 再生能源與電網管理

- 供應鏈與物流最佳化

- 零售與電子商務平台演變

- 數位健康與個人化醫療

- 科技融合與整合趨勢

- 多雲和混合架構標準化

- 零信任安全模型實施

- 可觀測性和 AIOps 平台整合

- GitOps 和基礎架構即程式碼的採用

- 永續計算與綠色技術

- 量子安全密碼學與安全準備

- 開源解決方案與專有解決方案分析

- 資料管理與分析平台演進

- 投資與融資環境分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 平台/解決方案

- 容器編排平台

- API管理平台

- DevOps 和 CI/CD 整合工具

- 其他

- 服務

- 部署與整合服務

- 諮詢與顧問服務

- 維護與支援服務

- 培訓與認證服務

第6章:市場估算與預測:依部署模式分類,2021-2034年

- 主要趨勢

- 公共雲端

- 私有雲端

- 混合雲端

第7章:市場估算與預測:依組織規模分類,2021-2034年

- 主要趨勢

- 大型企業

- 中小企業

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 資訊科技與電信/ITeS

- 零售與電子商務

- 衛生保健

- 銀行、金融服務和保險業 (BFSI)

- 製造業

- 媒體與娛樂

- 政府和公共部門

- 運輸與物流

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- AWS (Amazon)

- Microsoft

- IBM / Red Hat

- VMware

- Oracle

- Alibaba

- SAP

- Salesforce

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems

- Adobe

- Intel

- Tencent Cloud

- 區域玩家

- Huawei Cloud

- Baidu Cloud

- NTT Communications

- Fujitsu

- T-Systems

- Orange Business Services

- Capgemini

- Atos

- Rackspace Technology

- DigitalOcean

- 新興參與者/顛覆者

- Snowflake

- Databricks

- HashiCorp

- Pulumi

- Cloudify

The Global Cloud Microservices Market was valued at USD 2.83 billion in 2024 and is estimated to grow at a CAGR of 20.3% to reach USD 18.08 billion by 2034.

The rapid expansion is driven by the increasing migration of enterprise applications from traditional monolithic systems to modern, cloud-native architectures. Around 62.3% of organizations have adopted microservices and container-based technologies to enhance flexibility, streamline application development, and accelerate software deployment across distributed environments. The modular design of microservices empowers development teams to scale services and deploy updates more efficiently. However, operational challenges remain; 36% of enterprises report integration difficulties, while 35% cite the complexity of applying consistent security policies across diverse service environments. The emergence of artificial intelligence for IT operations (AIOps) is expected to reshape the market, with AI-based automation improving predictive scaling, anomaly detection, and system performance. By combining machine learning with IT operations, organizations are achieving smarter, more reliable, and cost-effective management of microservices environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.83 Billion |

| Forecast Value | $18.08 Billion |

| CAGR | 20.3% |

The platform and solution segment accounted for a 70% share in 2024, establishing itself as the leading contributor to market growth. The increasing reliance on secure, interoperable, and highly scalable development frameworks has fueled this dominance. Enterprises are embracing container orchestration technologies for managing distributed applications, while integrated platforms combining automation, observability, and API management capabilities are gaining traction. These advancements enable businesses to improve efficiency, maintain scalability, and streamline complex microservice-based workflows, reinforcing the segment's substantial share in the global market.

The public cloud segment is forecast to grow at a CAGR of 20.9% through 2034. The growth of this segment is supported by the strong adoption of elastic, managed infrastructure services offered through public cloud environments. Approximately 76% of enterprises deploy their microservice applications through public cloud frameworks due to their cost-effectiveness, scalability, and operational speed. This market segment continues to gain strength due to the maturity of public cloud ecosystems, which provide enhanced DevOps integration, automated orchestration, and native container support factors that simplify deployment and performance management for enterprises worldwide.

United States Cloud Microservices Market generated USD 1.11 billion in 2024. The high rate of cloud adoption across the U.S. business landscape, particularly within information technology and manufacturing industries, is a key contributor to this leadership. More than 60% of firms in the information sector reported active use of cloud-based applications, while small and mid-sized enterprises in manufacturing continue to show fewer adoption barriers compared to earlier years. The steady expansion of cloud usage across various industries positions the U.S. as a major hub for microservices deployment and innovation.

Leading companies in the Global Cloud Microservices Market include Microsoft, Oracle, VMware, Salesforce, Dell Technologies, Google, Alibaba, AWS (Amazon), SAP, and IBM. To strengthen their position in the Global Cloud Microservices Market, major companies are implementing strategies focused on innovation, partnerships, and service expansion. Firms are heavily investing in developing integrated platforms that combine automation, analytics, and AI-driven orchestration to optimize cloud-native operations. Strategic collaborations with software developers, enterprises, and cloud service providers are enabling enhanced interoperability and faster product deployment.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment model

- 2.2.4 Organization Size

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of microservices for cloud-native applications

- 3.2.1.2 Rise of containerization and Kubernetes orchestration

- 3.2.1.3 Demand for continuous integration and continuous delivery (CI/CD)

- 3.2.1.4 Need for resilient and fault-tolerant architectures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexity in managing distributed services

- 3.2.2.2 Security vulnerabilities in microservices architectures

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of microservices in edge computing

- 3.2.3.2 Integration with AI/ML for intelligent service orchestration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability & environmental aspects

- 3.10.1 Carbon Footprint Assessment

- 3.10.2 Circular Economy Integration

- 3.10.3 E-Waste Management Requirements

- 3.10.4 Green Manufacturing Initiatives

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Industry-specific growth opportunities

- 3.13.1 Autonomous vehicle & transportation systems

- 3.13.2 Smart manufacturing & industrial iot

- 3.13.3 Renewable energy & grid management

- 3.13.4 Supply chain & logistics optimization

- 3.13.5 Retail & e-commerce platform evolution

- 3.13.6 Digital health & personalized medicine

- 3.14 Technology convergence & integration trends

- 3.14.1 Multi-cloud & hybrid architecture standardization

- 3.14.2 Zero trust security model implementation

- 3.14.3 Observability & AIops platform integration

- 3.14.4 Gitops & infrastructure-as-code adoption

- 3.14.5 Sustainable computing & green technology

- 3.14.6 Quantum-safe cryptography & security preparation

- 3.15 Open source vs proprietary solution analysis

- 3.16 Data management & analytics platform evolution

- 3.17 Investment & funding landscape analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Platform/Solution

- 5.2.1 Container Orchestration Platforms

- 5.2.2 API Management Platforms

- 5.2.3 DevOps & CI/CD Integration Tools

- 5.2.4 Others

- 5.3 Services

- 5.3.1 Deployment & Integration Services

- 5.3.2 Consulting & Advisory Services

- 5.3.3 Maintenance & Support Services

- 5.3.4 Training & Certification Services

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Public cloud

- 6.3 Private cloud

- 6.4 Hybrid cloud

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 Small & Medium Enterprises (SMEs)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 IT & Telecommunications / ITeS

- 8.3 Retail & e-Commerce

- 8.4 Healthcare

- 8.5 BFSI (Banking, Financial Services & Insurance)

- 8.6 Manufacturing

- 8.7 Media & Entertainment

- 8.8 Government & Public Sector

- 8.9 Transportation & Logistics

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 AWS (Amazon)

- 10.1.2 Microsoft

- 10.1.3 Google

- 10.1.4 IBM / Red Hat

- 10.1.5 VMware

- 10.1.6 Oracle

- 10.1.7 Alibaba

- 10.1.8 SAP

- 10.1.9 Salesforce

- 10.1.10 Dell Technologies

- 10.1.11 Hewlett Packard Enterprise (HPE)

- 10.1.12 Cisco Systems

- 10.1.13 Adobe

- 10.1.14 Intel

- 10.1.15 Tencent Cloud

- 10.2 Regional Players

- 10.2.1 Huawei Cloud

- 10.2.2 Baidu Cloud

- 10.2.3 NTT Communications

- 10.2.4 Fujitsu

- 10.2.5 T-Systems

- 10.2.6 Orange Business Services

- 10.2.7 Capgemini

- 10.2.8 Atos

- 10.2.9 Rackspace Technology

- 10.2.10 DigitalOcean

- 10.3 Emerging Players / Disruptors

- 10.3.1 Snowflake

- 10.3.2 Databricks

- 10.3.3 HashiCorp

- 10.3.4 Pulumi

- 10.3.5 Cloudify