|

市場調查報告書

商品編碼

1876818

再生碳纖維市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Recycled Carbon Fiber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

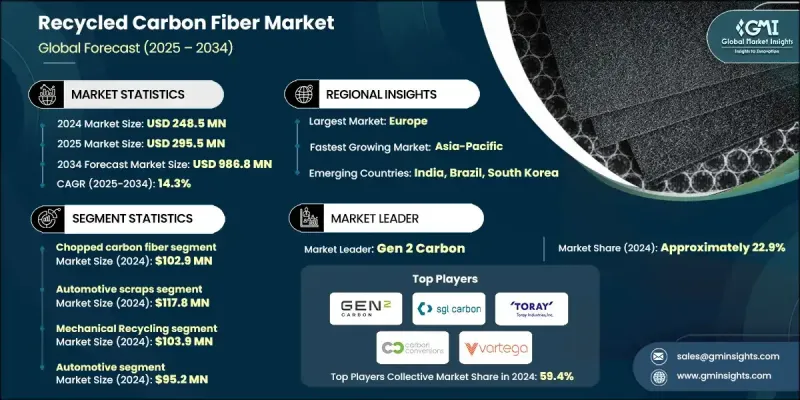

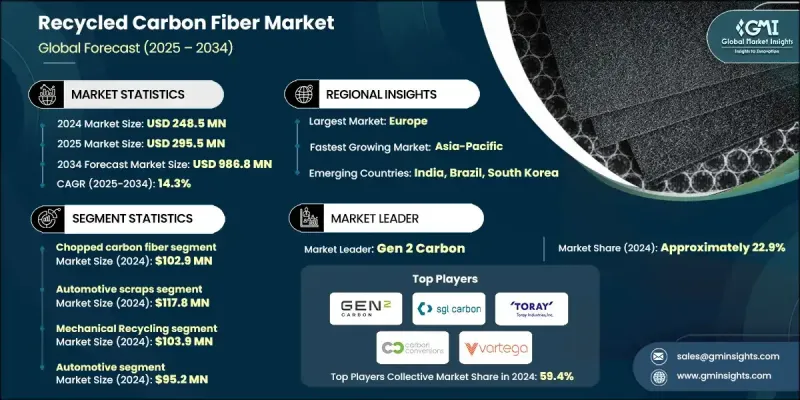

2024 年全球再生碳纖維市場價值為 2.485 億美元,預計到 2034 年將以 14.3% 的複合年成長率成長至 9.868 億美元。

市場成長的驅動力在於人們日益重視減少原生碳纖維生產對環境的影響,這促使原始設備製造商(OEM)將再生碳纖維(rCF)應用於電動車零件和輕量化汽車內裝。 Vartega 和 ELG Carbon Fibre 等公司已擴大產能以滿足不斷成長的需求。政府支持的研究項目,尤其是在交通運輸領域,正在推廣 rCF 的應用,以提高車輛效率並降低排放。熱解和溶劑分解技術的進步使得更長的纖維束成為可能,使其在結構應用方面更具可行性。航太和汽車產業正在擴大 rCF 在內飾、塑膠增強材料和底盤部件中的應用。中國也加大了投入,建立了回收中心來處理風力渦輪機葉片和複合材料廢棄物。循環經濟政策和更清潔的複合材料加工技術為從利基應用到可規模化商業化生產的轉變提供了支持。纖維回收技術的創新,包括低溫熱解和化學溶劑分解,正在提高纖維的長度和強度。 Vartega 和 Carbon Conversions 等公司生產的再生碳纖維 (rCF) 品質接近原生材料,適用於熱塑性塑膠和片狀模塑膠,可應用於對錶面光潔度和性能要求極高的高性能消費電子產品和體育用品領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.485億美元 |

| 預測值 | 9.868億美元 |

| 複合年成長率 | 14.3% |

2024年,短切碳纖維市場規模為1.029億美元,預計到2034年將以13.1%的複合年成長率成長。短切和研磨後的再生碳纖維(rCF)因其易於與熱塑性塑膠和樹脂混合而被廣泛應用,尤其是在汽車和電子製造領域。這些纖維的注塑成型過程實現了輕量化零件的大規模生產,而纖維尺寸的一致性是原始設備製造商(OEM)的重點。

2024年,以汽車廢棄物為基礎的再生碳纖維(rCF)市值達1.178億美元,預計2025年至2034年複合年成長率將達到17%。電動車的蓬勃發展和日益嚴格的垃圾掩埋法規加速了汽車和工業廢棄物數量的成長,推動了這個細分市場的發展。破碎的碳纖維增強複合材料(CFRP)廢料擴大被加工成短切和研磨纖維,用於注塑成型。風力渦輪機葉片的回收利用在歐洲也日益普及,目前正在試驗採用先進方法從混合來源中回收材料。

2024年美國再生碳纖維市場規模為5,850萬美元,預計2034年將以14.4%的複合年成長率成長。輕量化措施、電動車普及率的提高以及對垃圾掩埋場廢棄物的監管壓力是推動市場需求成長的主要因素。 Carbon Conversions和Vartega等公司已與美國本土汽車製造商建立了合作關係,而美國能源部也支持汽車產業再生碳纖維回收技術的創新。隨著汽車製造商擴大採用循環製造模式,美國本土的工業回收中心為擴大生產規模提供了機會。

全球再生碳纖維市場的主要參與者包括Vartega、Gen 2 Carbon、東麗株式會社、Carbon Conversions和SGL Carbon。為了鞏固市場地位,再生碳纖維產業的企業正大力投資研發,以提高纖維回收率、維持結構完整性並提升再生碳纖維(rCF)的品質。與汽車和航太設備製造商(OEM)建立策略合作夥伴關係,使企業能夠獲得長期供應合約並擴大生產規模。此外,企業也正在擴大全球產能以滿足不斷成長的需求,並採用循環經濟實踐來吸引具有環保意識的客戶。熱解、溶劑解和低溫加工等技術的創新確保了纖維接近原生纖維的質量,使其能夠進入消費性電子產品和運動器材等高價值應用領域。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2025-2034年

- 短切碳纖維

- 銑削碳纖維

- 碳纖維墊

- 其他

第6章:市場估算與預測:依來源分類,2025-2034年

- 主要趨勢

- 汽車廢料

- 航太廢料

- 其他

第7章:市場估算與預測:依回收方式分類,2025-2034年

- 主要趨勢

- 機械回收

- 化學回收

- 熱解

- 溶劑分解

- 其他

第8章:市場估算與預測:依最終用途分類,2025-2034年

- 主要趨勢

- 航太與國防

- 汽車

- 風能

- 運動與休閒

- 建造

- 電子

- 其他

第9章:市場估計與預測:依地區分類,2025-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Gen 2 Carbon

- Carbon Conversions

- Vartega

- SGL Carbon

- Toray Industries

- Mitsubishi Chemical

- Procotex Corporation

- Shocker Composites

- Carbon Fiber Recycling

- CFK Valley Stade

- Zoltek (Toray Group)

- Karborek

- Alpha Recyclage

- Sigmatex

- Carbon Clean Tech

- Recycled Carbon Fiber Ltd

- Composite Recycling Ltd

- Adherent Technologies

- Carbon Fiber Remanufacturing

- Fiberline Composites

The Global Recycled Carbon Fiber Market was valued at USD 248.5 million in 2024 and is estimated to grow at a CAGR of 14.3% to reach USD 986.8 million by 2034.

Market growth is fueled by the increasing push to reduce the environmental impact of primary carbon fiber production, prompting Original Equipment Manufacturers to integrate rCF in electric vehicle components and lightweight automotive interiors. Companies such as Vartega and ELG Carbon Fibre have expanded their production capacities to meet growing demand. Government-backed research initiatives, particularly in the transportation sector, are promoting rCF for enhanced vehicle efficiency and lower emissions. Advances in pyrolysis and solvolysis are enabling longer fiber strands, making structural applications more feasible. Aerospace and automotive industries are scaling the use of rCF in interiors, plastic reinforcements, and underbody components. China has also intensified efforts, developing recycling hubs to manage wind turbine blades and composite waste. The transition from niche applications to scalable commercial production is supported by circular economy policies and cleaner composite processing technologies. Innovations in fiber recovery, including low-temperature pyrolysis and chemical solvolysis, are enhancing fiber length and strength. Companies such as Vartega and Carbon Conversions are producing rCF with near-virgin quality suitable for thermoplastics and sheet molding compounds, enabling applications in high-performance consumer electronics and sporting goods where finish and performance are critical.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $248.5 Million |

| Forecast Value | $986.8 Million |

| CAGR | 14.3% |

The chopped carbon fiber segment was valued at USD 102.9 million in 2024 and is expected to grow at a CAGR of 13.1% through 2034. Chopped and milled rCF is widely used due to its ease of integration with thermoplastics and resins, particularly in automotive and electronics manufacturing. Injection molding of these fibers has enabled mass production of lightweight components, with consistent fiber sizing being a key focus for OEMs.

The automotive scrap-based rCF was valued at USD 117.8 million in 2024, with a projected CAGR of 17% from 2025 to 2034. Rising volumes of automotive and industrial waste, accelerated by the electric vehicle boom and stricter landfill regulations, are driving this segment. Shredded CFRP waste is increasingly processed into chopped and milled fibers for injection molding applications. Wind turbine blade recycling is also gaining traction in Europe, with advanced methods being piloted to recover materials from mixed sources.

U.S. Recycled Carbon Fiber Market was valued at USD 58.5 million in 2024 and is expected to grow at a CAGR of 14.4% through 2034. Demand is driven by lightweighting initiatives, increased EV adoption, and regulatory pressure on landfill waste. Companies like Carbon Conversions and Vartega have partnered with domestic automakers, while the Department of Energy supports innovation in automotive-focused recycling. U.S.-based industrial recycling hubs offer opportunities to scale production as OEMs increasingly adopt circular manufacturing practices.

Key players in the Global Recycled Carbon Fiber Market include Vartega, Gen 2 Carbon, Toray Industries, Carbon Conversions, and SGL Carbon. To strengthen their foothold, companies in the recycled carbon fiber sector are investing heavily in research and development to improve fiber recovery, maintain structural integrity, and enhance the quality of rCF. Strategic partnerships with automotive and aerospace OEMs allow firms to secure long-term supply contracts and scale production. Firms are also expanding their global production capacity to meet rising demand and adopting circular economy practices to attract environmentally conscious clients. Technological innovation in pyrolysis, solvolysis, and low-temperature processing ensures near-virgin quality fibers, enabling entry into high-value applications like consumer electronics and sports equipment.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Source

- 2.2.4 Recycling Method

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2025 - 2034 (USD Million, Kilo Tons)

- 5.1 Chopped carbon fiber

- 5.2 Milled carbon fiber

- 5.3 Carbon fiber mat

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Source, 2025 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive scrap

- 6.3 Aerospace scrap

- 6.4 Other

Chapter 7 Market Estimates and Forecast, By Recycling Method, 2025 - 2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Mechanical Recycling

- 7.3 Chemical Recycling

- 7.4 Pyrolysis

- 7.5 Solvolysis

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2025 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 Aerospace and Defense

- 8.3 Automotive

- 8.4 Wind Energy

- 8.5 Sports and Leisure

- 8.6 Construction

- 8.7 Electronics

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Million, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Gen 2 Carbon

- 10.2 Carbon Conversions

- 10.3 Vartega

- 10.4 SGL Carbon

- 10.5 Toray Industries

- 10.6 Mitsubishi Chemical

- 10.7 Procotex Corporation

- 10.8 Shocker Composites

- 10.9 Carbon Fiber Recycling

- 10.10 CFK Valley Stade

- 10.11 Zoltek (Toray Group)

- 10.12 Karborek

- 10.13 Alpha Recyclage

- 10.14 Sigmatex

- 10.15 Carbon Clean Tech

- 10.16 Recycled Carbon Fiber Ltd

- 10.17 Composite Recycling Ltd

- 10.18 Adherent Technologies

- 10.19 Carbon Fiber Remanufacturing

- 10.20 Fiberline Composites