|

市場調查報告書

商品編碼

1876817

形狀記憶聚合物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Shape Memory Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

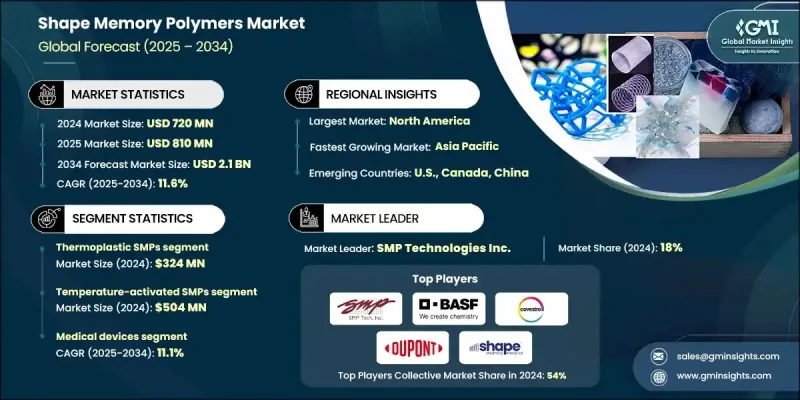

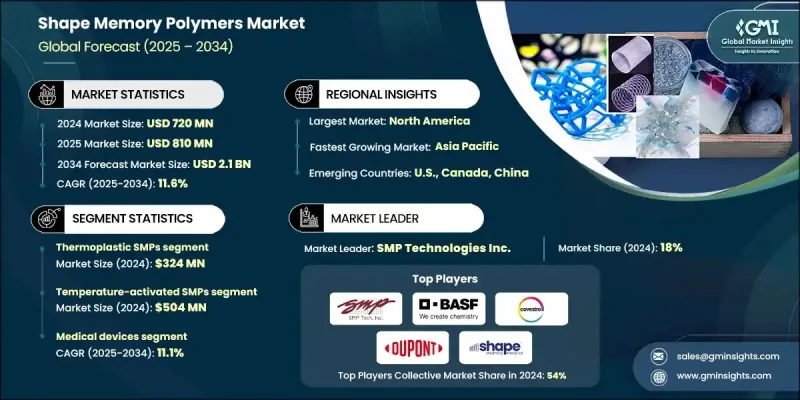

2024 年全球形狀記憶聚合物市場價值為 7.2 億美元,預計到 2034 年將以 11.6% 的複合年成長率成長至 21 億美元。

隨著各行業日益重視智慧響應材料的應用,市場也不斷擴張。形狀記憶聚合物(SMP)具有獨特的恢復原狀的能力,即在受到外部刺激後能夠恢復到原始形狀,這使其在需要高性能和自適應材料的先進領域中得到廣泛應用。對智慧材料設計的日益重視正在推動SMP在製造業、醫療保健、汽車和航太等行業的應用。這些聚合物支持永續性、能源效率和自修復能力方面的創新,使製造商能夠設計出更輕、更耐用的結構。在生物醫學領域,SMP擴大用於先進醫療器材、自膨脹支架和微創植入物,從而提升性能並促進患者康復。航太和國防領域也大力投資於SMP基材料,因為它們重量輕、抗疲勞且具有可編程的機械性能,所有這些都有助於提高運作效率和長期可靠性。隨著持續的研發投入和材料技術的突破,SMP正穩步成為下一代材料技術的基石。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.2億美元 |

| 預測值 | 21億美元 |

| 複合年成長率 | 11.6% |

熱塑性形狀記憶聚合物(SMP)市場預計在2024年將創造3.24億美元的收入。這些材料因其可回收性、易加工性和在永續產品開發方面的潛力而日益受到歡迎。儘管熱塑性SMP通常強度較低且耐溫性有限,但配方創新以及混合型和多響應型SMP的引入正在提升其性能。隨著永續性成為設計和製造的關鍵因素,市場對可生物分解和複合型SMP的興趣也日益濃厚。隨著聚合物化學和加工技術的不斷進步,預計具有卓越功能的可編程SMP在工業應用領域的需求將持續成長。

2024年,溫度活化形狀記憶聚合物市場規模預計將達5.04億美元。此類別之所以佔據主導地位,是因為其活化過程簡單,且與標準生產技術相容。這些材料對熱刺激反應迅速,廣泛應用於汽車、航太和生物醫學等領域。其熱激活特性使其能夠更好地控制形狀恢復、柔韌性和自修復性能,從而適用於多種工程和結構應用。

2024年,北美形狀記憶聚合物市場規模達2.88億美元,佔全球40%的市佔率。美國在該地區佔據最大佔有率,這得益於其強大的工業基礎、技術創新和完善的研發體系。航太、醫療器材和汽車等關鍵領域的廣泛應用持續推動市場成長。此外,該地區還聚集了多家先進材料生產商和聚合物開發商,致力於將自適應聚合物商業化應用於工業和醫療領域。主要聚合物製造商的存在以及持續的研發投入,進一步鞏固了該地區在全球形狀記憶聚合物市場的領先地位。

全球形狀記憶聚合物市場的主要活躍企業包括 Coating Place Inc.、贏創工業集團 (Evonik Industries AG)、3M 公司、帝斯曼集團 (DSM NV)、先正達集團 (Syngenta AG)、Aveka Inc.、巴斯夫公司 (BASF SE)、亞什蘭全球控股公司 (Ashland Global Holdings Inc.)、陶氏康寧公司Capsugel(龍沙集團旗下)。全球形狀記憶聚合物市場的領導者正採取多種策略來鞏固其市場地位。這些策略包括加強研發投入,以提升聚合物的柔韌性、可重編程性和生物分解性等性能。企業也積極尋求與學術機構和產業夥伴進行策略合作,以加速材料創新和應用拓展。許多公司正致力於產品多元化,開發多重刺激響應型形狀記憶聚合物,並將其應用於醫療保健和航太等高成長領域。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 智慧材料的需求不斷成長

- 生物醫學應用的進展

- 不斷發展的航太和國防領域

- 產業陷阱與挑戰

- 與形狀記憶合金相比,其復原力有限

- 特殊配方產品生產成本高

- 溫度敏感度和環境穩定性挑戰

- 市場機遇

- 氣候適應建築圍護結構系統

- 永續和生物基配方開發

- 物聯網整合和智慧基礎設施應用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 材料類型

- 刺激類型

- 應用

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 熱塑性形狀記憶聚合物

- 聚氨酯基體系

- 聚酯基體系

- 聚己內酯體系

- 熱固性形狀記憶聚合物

- 環氧樹脂基體系

- 氰酸酯體系

- 聚醯亞胺體系

- 可生物分解的SMPs

- 聚己內酯基

- 基於PLGA的系統

- 基於PHA的系統

- 複合形狀記憶聚合物

- 碳纖維增強

- 玻璃纖維增強

- 奈米顆粒增強

第6章:市場估算與預測:依刺激類型分類,2021-2034年

- 主要趨勢

- 溫度啟動型SMP

- 玻璃轉換觸發系統

- 熔點觸發系統

- 體溫活化系統

- 光激活SMP

- 紫外線觸發系統

- 可見光系統

- 近紅外線激活系統

- 電激活SMP

- 焦耳加熱系統

- 導電填料整合

- 電阻加熱應用

- 磁激活形狀記憶聚合物

- 氧化鐵奈米顆粒體系

- 鐵磁性填料整合

- 遠端啟動應用程式

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 醫療器材

- 血管栓塞裝置

- 支架和導管

- 骨科植入物

- 手術器械

- 藥物輸送系統

- 航太與國防

- 可部署結構

- 變形飛機部件

- 空間應用

- 自修復複合材料

- 執行器系統

- 汽車

- 自修復組件

- 自適應空氣動力學

- 室內應用

- 安全系統

- 輕量化應用

- 建築與基礎設施

- 管道改造系統

- 自適應建築圍護結構

- 抗震韌性應用

- 智慧基礎設施系統

- 自癒混凝土

- 工業與製造業

- 執行器系統

- 智慧組件

- 製程設備

- 自動化應用

- 紡織應用

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Shape Memory Medical Inc.

- Covestro AG

- BASF SE

- SMP Technologies Inc.

- Dupont De Nemours, Inc.

- Natureworks LLC

- Lubrizol Corporation

- Evonik Industries AG

- Spintech, LLC

- Huntsman International LLC

The Global Shape Memory Polymers Market was valued at USD 720 million in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 2.1 billion by 2034.

The market is expanding as industries increasingly focus on the use of smart and responsive materials. The unique ability of shape memory polymers (SMPs) to return to their original form when exposed to external stimuli has led to their adoption in advanced sectors requiring high-performance and adaptive materials. Growing emphasis on intelligent material design is promoting their use across manufacturing, healthcare, automotive, and aerospace industries. These polymers support innovations in sustainability, energy efficiency, and self-healing capabilities, allowing manufacturers to design lighter and more durable structures. In the biomedical field, SMPs are increasingly being used for advanced medical devices, self-expanding stents, and minimally invasive implants, offering enhanced performance and patient recovery. The aerospace and defense sectors are also investing heavily in SMP-based materials due to their low weight, fatigue resistance, and programmable mechanical behavior, all of which contribute to operational efficiency and long-term reliability. With ongoing R&D initiatives and material breakthroughs, SMPs are steadily becoming a cornerstone of next-generation material technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $720 Million |

| Forecast Value | $2.1 Billion |

| CAGR | 11.6% |

Thermoplastic shape memory polymers segment generated USD 324 million in 2024. These materials are gaining popularity due to their recyclability, ease of processing, and potential in sustainable product development. Although thermoplastic SMPs generally have lower strength and limited temperature tolerance, innovations in formulation and the introduction of hybrid and multi-responsive variants are improving their performance. The market is also witnessing growing interest in biodegradable and composite SMPs, as sustainability becomes a key factor in design and manufacturing. With continuous advancements in polymer chemistry and processing, the demand for reprogrammable SMPs with superior functionality is expected to expand across industrial applications.

The temperature-activated shape memory polymers segment generated USD 504 million in 2024. This category dominates due to its simple activation process and compatibility with standard production techniques. These materials respond efficiently to thermal triggers and are widely used in automotive, aerospace, and biomedical applications. Their thermal activation enables superior control over shape recovery, flexibility, and self-healing behavior, making them suitable for multiple engineering and structural applications.

North America Shape Memory Polymers Market accounted for USD 288 million in 2024 and held 40% share. The United States holds the largest share in the region, supported by a strong industrial foundation, technological innovation, and a well-established R&D framework. Extensive usage in key sectors such as aerospace, medical devices, and automotive continues to drive market growth. Additionally, the region is home to several advanced material producers and polymer developers focusing on the commercialization of adaptive polymers for industrial and medical use. The presence of major polymer manufacturers and ongoing investments in research are further enhancing the region's leadership position in the Global Shape Memory Polymers Market.

Major companies active in the Global Shape Memory Polymers Market include Coating Place Inc., Evonik Industries AG, 3M Company, DSM N.V., Syngenta AG, Aveka Inc., BASF SE, Ashland Global Holdings Inc., DOW Corning, Balchem Corporation, and Capsugel (Lonza Group). Leading companies in the Global Shape Memory Polymers Market are adopting multiple strategies to strengthen their market foothold. These include investments in R&D to enhance polymer properties such as flexibility, reprogramming capability, and biodegradability. Strategic collaborations with academic institutions and industrial partners are being pursued to accelerate material innovation and application expansion. Many firms are focusing on product diversification by developing multi-stimuli-responsive SMPs and integrating them into high-growth sectors like healthcare and aerospace.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Stimulus Type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for smart materials

- 3.2.1.2 Advancements in biomedical applications

- 3.2.1.3 Growing aerospace and defense sector

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited recovery force compared to shape memory alloys

- 3.2.2.2 High production costs for specialty formulations

- 3.2.2.3 Temperature sensitivity & environmental stability challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Climate-adaptive building envelope systems

- 3.2.3.2 Sustainable & bio-based formulation development

- 3.2.3.3 IoT integration & smart infrastructure applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Material Type

- 3.7.3 Stimulus Type

- 3.7.4 Application

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Thermoplastic SMPs

- 5.2.1 Polyurethane-based systems

- 5.2.2 Polyester-based systems

- 5.2.3 Polycaprolactone systems

- 5.3 Thermoset SMPs

- 5.3.1 Epoxy-based systems

- 5.3.2 Cyanate ester systems

- 5.3.3 Polyimide systems

- 5.4 Biodegradable SMPs

- 5.4.1 Poly(ε-caprolactone) based

- 5.4.2 PLGA-based systems

- 5.4.3 PHA-based systems

- 5.5 Composite SMPs

- 5.5.1 Carbon fiber reinforced

- 5.5.2 Glass fiber reinforced

- 5.5.3 Nanoparticle enhanced

Chapter 6 Market Estimates and Forecast, By Stimulus Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Temperature-activated SMPs

- 6.2.1 Glass transition triggered systems

- 6.2.2 Melting temperature triggered systems

- 6.2.3 Body temperature activated systems

- 6.3 Light-activated SMPs

- 6.3.1 UV-triggered systems

- 6.3.2 Visible light systems

- 6.3.3 Nir-activated systems

- 6.4 Electrically activated SMPs

- 6.4.1 Joule heating systems

- 6.4.2 Conductive filler integration

- 6.4.3 Resistive heating applications

- 6.5 Magnetically activated SMPs

- 6.5.1 Iron oxide nanoparticle systems

- 6.5.2 Ferromagnetic filler integration

- 6.5.3 Remote activation applications

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Medical devices

- 7.2.1 Vascular embolization devices

- 7.2.2 Stents & catheters

- 7.2.3 Orthopedic implants

- 7.2.4 Surgical instruments

- 7.2.5 Drug delivery systems

- 7.3 Aerospace & defense

- 7.3.1 Deployable structures

- 7.3.2 Morphing aircraft components

- 7.3.3 Space applications

- 7.3.4 Self-healing composites

- 7.3.5 Actuator systems

- 7.4 Automotive

- 7.4.1 Self-repairable components

- 7.4.2 Adaptive aerodynamics

- 7.4.3 Interior applications

- 7.4.4 Safety systems

- 7.4.5 Lightweighting applications

- 7.5 Construction & infrastructure

- 7.5.1 Pipeline renovation systems

- 7.5.2 Adaptive building envelopes

- 7.5.3 Seismic resilience applications

- 7.5.4 Smart infrastructure systems

- 7.5.5 Self-healing concrete

- 7.6 Industrial & manufacturing

- 7.6.1 Actuator systems

- 7.6.2 Smart components

- 7.6.3 Process equipment

- 7.6.4 Automation applications

- 7.6.5 Textile applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Shape Memory Medical Inc.

- 9.2 Covestro AG

- 9.3 BASF SE

- 9.4 SMP Technologies Inc.

- 9.5 Dupont De Nemours, Inc.

- 9.6 Natureworks LLC

- 9.7 Lubrizol Corporation

- 9.8 Evonik Industries AG

- 9.9 Spintech, LLC

- 9.10 Huntsman International LLC