|

市場調查報告書

商品編碼

1876814

滑雪裝備市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Ski Gear and Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

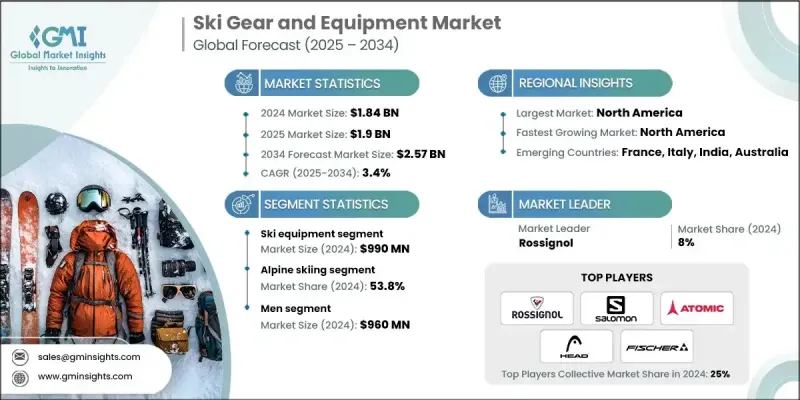

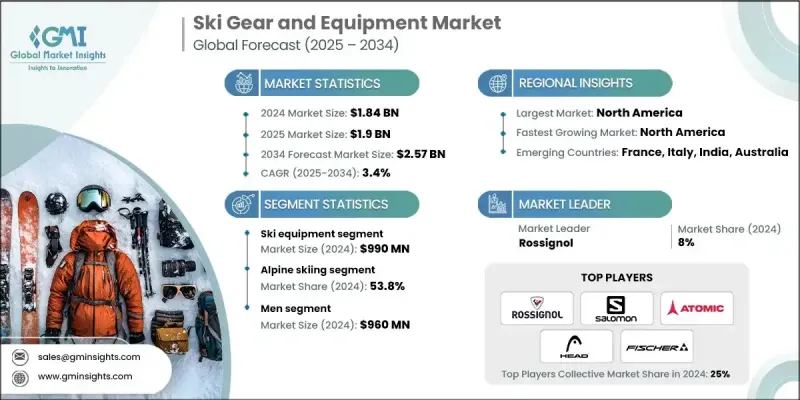

2024 年全球滑雪裝備市場價值為 18.4 億美元,預計到 2034 年將以 3.4% 的複合年成長率成長至 25.7 億美元。

人們對冬季休閒活動的日益熱情正在推動市場擴張,滑雪、雪鞋行走和其他冬季運動在更廣泛的人群中越來越受歡迎。青少年參與度持續上升,越來越多的女性和家庭也因數位平台曝光度的提高和生活方式的轉變而參與冬季運動。各國政府透過培訓計畫和設施升級來推廣這些活動,進一步增強了消費者的參與。人們生活方式的轉變,尤其是積極、戶外生活方式的興起,以及探險旅行的蓬勃發展,都增強了滑雪對尋求獨特體驗的旅行者的吸引力。成熟和新興滑雪勝地的度假村開發和現代化也加速了對滑雪裝備的需求。隨著越來越多的消費者將安全、性能和舒適度放在首位,滑雪裝備製造商也不斷推出先進的裝備、材料和技術。在這些因素的推動下,滑雪裝備市場在全球休閒和競技運動領域的影響力持續擴大。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18.4億美元 |

| 預測值 | 25.7億美元 |

| 複合年成長率 | 3.4% |

2024年,滑雪裝備市場規模達9.9億美元。隨著各大品牌優先考慮以提升安全性、符合人體工學的貼合度和穩定性能為核心的設計改進,產品創新持續發展。頭盔、雪鏡和其他防護裝備如今都採用了整合技術、升級塗層和改進的通風系統,以提升使用者的舒適度。滑雪板固定器和雪鞋的改進,包括精準的脫扣機制和可調節的貼合組件,正被追求更高操控性和穩定性的滑雪愛好者和專業運動員廣泛採用。

2024年,高山滑雪佔了53.8%的市場佔有率,成為業界的領頭羊。這個細分市場之所以持續保持影響力,是因為它擁有龐大的全球受眾群體,並涵蓋了多種休閒和競技形式。高山滑雪在許多山區有著深厚的文化底蘊,並且常常是冬季運動新手入門的理想選擇。其經久不衰的受歡迎程度持續支撐著對高山滑雪專用裝備的穩定需求,使其成為各大品牌和零售商重點關注的領域。

美國滑雪裝備市場佔84.7%的市場佔有率,預計2024年市場規模將達5.9億美元。這一強勁的市場地位反映了美國成熟的冬季運動社群以及眾多設施完善的滑雪勝地。消費者群體涵蓋休閒愛好者到專業運動員,他們都十分注重裝備的耐用性、安全性和高階技術。消費者對永續裝備材料和科技驅動型裝備功能的持續關注,推動了產業的成長;同時,室內滑雪設施的興起也讓城市居民有機會接觸到這項運動,並擴大了市場參與度。

滑雪裝備市場的主要競爭公司包括 Blizzard、Nordica、Salomon Group、Atomic Austria、Black Crows Skis、Burton Snowboards、Dynastar、Rossignol Group、Elan、Scott Sports、Fischer Sports、K2 Sports、Head Sport、Marker Volkl(Tecnica Group 公司)以及 Tecnica Group。這些公司正透過投資先進材料、改進安全功能和提升性能技術來鞏固其市場地位。許多公司正在拓展產品客製化選項,提供量身定做的尺寸和可調節的裝備,以吸引更廣泛的用戶群。與滑雪學校、運動員和度假村經營者建立合作關係,有助於品牌提升知名度並加速產品推廣。永續性是另一個重點,各公司正致力於整合回收材料和採用環保的生產方式,以吸引具有環保意識的消費者。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 冬季運動日益普及

- 滑雪旅遊和基礎設施的擴張

- 技術進步

- 產業陷阱與挑戰

- 季節性和氣候依賴性

- 設備和差旅費用高昂

- 機會

- 租賃和訂閱模式

- 產品創新與客製化

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 滑雪裝備

- 滑雪板固定器

- 滑雪靴

- 滑雪杖

- 滑雪頭盔

- 滑雪鏡

- 滑雪手套和連指手套

- 其他(滑雪包和滑雪背帶等)

- 防護裝備

- 頭盔

- 面罩

- 護膝

- 其他(背部保護器等)

- 滑雪服

- 夾克

- 褲子

- 基礎層

- 滑雪襪

- 其他(保暖手套和連指手套等)

第6章:市場估算與預測:依運動類型分類,2021-2034年

- 主要趨勢

- 高山滑雪

- 越野滑雪

- 自由式滑雪

- 滑雪旅行

- 其他

第7章:市場估計與預測:依價格分類,2021-2034年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 男人

- 女性

- 孩子們

第9章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 線上

- 電子商務平台

- 公司網站

- 離線

- 百貨公司

- 專業體育用品店

- 運動用品零售商

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Atomic Austria

- Black Crows Skis

- Blizzard

- Burton Snowboards

- Dynastar

- Elan

- Fischer Sports

- Head Sport

- K2 Sports

- Marker Volkl (part of Tecnica Group)

- Nordica

- Rossignol

- Salomon

- Scott Sports

- Tecnica

The Global Ski Gear and Equipment Market was valued at USD 1.84 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 2.57 billion by 2034.

Growing enthusiasm for winter recreation is playing a key role in expanding the market as skiing, snowshoeing, and other cold-weather activities gain traction across broader demographics. Youth participation continues to rise, and an increasing number of women and families are engaging with winter sports due to heightened visibility across digital platforms and evolving lifestyle trends. Governments promoting these activities through training programs and upgraded facilities are further contributing to stronger consumer engagement. The shift toward active, outdoor-focused lifestyles, combined with a booming interest in adventure travel, has strengthened skiing's appeal among travelers looking for unique experiences. Resort development and modernization across both established and emerging ski destinations are also accelerating equipment demand. As more consumers prioritize safety, performance, and comfort, ski manufacturers are responding with advanced gear, materials, and technologies. With these dynamics in place, the ski gear market continues to expand its influence across recreational and competitive sports communities worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.84 Billion |

| Forecast Value | $2.57 Billion |

| CAGR | 3.4% |

In 2024, the ski equipment segment generated USD 990 million. Product innovation continues to evolve as brands prioritize design improvements centered around enhanced safety, ergonomic fit, and consistent performance. Helmets, goggles, and other protective gear now feature integrated technology, upgraded coatings, and improved ventilation systems to support user comfort. Advancements in bindings and boots, including precision release mechanisms and adjustable fit components, are being adopted widely by both dedicated enthusiasts and professional athletes seeking elevated control and stability on the slopes.

Alpine skiing accounted for a 53.8% share in 2024, representing the leading category within the industry. This segment remains influential because it resonates with a large global audience and supports numerous recreational and competitive formats. Alpine skiing holds a deep cultural connection in many mountainous regions and frequently serves as an entry point for newcomers exploring winter sport activities. Its long-standing popularity continues to sustain consistent demand for alpine-specific equipment, making it a vital focus area for major brands and retailers.

U.S. Ski Gear and Equipment Market held 84.7% share and generated USD 590 million in 2024. This strong position reflects the country's established winter sports community and widespread access to well-developed ski destinations. Consumer segments range from casual participants to high-performance athletes, all placing emphasis on durability, safety enhancements, and premium technology. Ongoing interest in sustainable gear materials and tech-driven equipment features is helping support industry growth, while indoor skiing facilities are introducing the sport to urban populations and broadening overall market participation.

Major companies competing in the Ski Gear and Equipment Market include Blizzard, Nordica, Salomon Group, Atomic Austria, Black Crows Skis, Burton Snowboards, Dynastar, Rossignol Group, Elan, Scott Sports, Fischer Sports, K2 Sports, Head Sport, Marker Volkl (part of Tecnica Group), and Tecnica Group. Companies in the ski gear and equipment market are strengthening their foothold by investing in advanced materials, improved safety features, and performance-enhancing technologies. Many are expanding product customization options, offering tailored fits and adjustable equipment to appeal to broader user groups. Partnerships with ski schools, athletes, and resort operators help brands boost visibility and accelerate product adoption. Sustainability is another focal point, with firms integrating recycled inputs and eco-focused manufacturing practices to attract environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Sport type

- 2.2.4 Price

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising popularity of winter sports

- 3.2.1.2 Expansion of ski tourism and infrastructure

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Seasonality and climate dependency

- 3.2.2.2 High cost of equipment and travel

- 3.2.3 Opportunities

- 3.2.3.1 Rental and subscription models

- 3.2.3.2 Product innovation and customization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Ski equipment

- 5.2.1 Ski bindings

- 5.2.2 Ski boots

- 5.2.3 Ski poles

- 5.2.4 Ski helmets

- 5.2.5 Ski goggles

- 5.2.6 Ski gloves & mittens

- 5.2.7 Others (ski bags & carriers, etc)

- 5.3 Protective gear

- 5.3.1 Helmets

- 5.3.2 Face guards

- 5.3.3 Knee pads

- 5.3.4 Others (back protectors, etc)

- 5.4 Ski apparel

- 5.4.1 Jackets

- 5.4.2 Pants

- 5.4.3 Base layers

- 5.4.4 Ski socks

- 5.4.5 Others (insulated gloves and mittens, etc)

Chapter 6 Market Estimates and Forecast, By Sport Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Alpine skiing

- 6.3 Cross-country skiing

- 6.4 Freestyle skiing

- 6.5 Ski touring

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Men

- 8.3 Women

- 8.4 Kids

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce platform

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Department stores

- 9.3.2 Specialty sports stores

- 9.3.3 Sporting good retailers

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Atomic Austria

- 11.2 Black Crows Skis

- 11.3 Blizzard

- 11.4 Burton Snowboards

- 11.5 Dynastar

- 11.6 Elan

- 11.7 Fischer Sports

- 11.8 Head Sport

- 11.9 K2 Sports

- 11.10 Marker Volkl (part of Tecnica Group)

- 11.11 Nordica

- 11.12 Rossignol

- 11.13 Salomon

- 11.14 Scott Sports

- 11.15 Tecnica