|

市場調查報告書

商品編碼

1876812

微膠囊化市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Microencapsulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

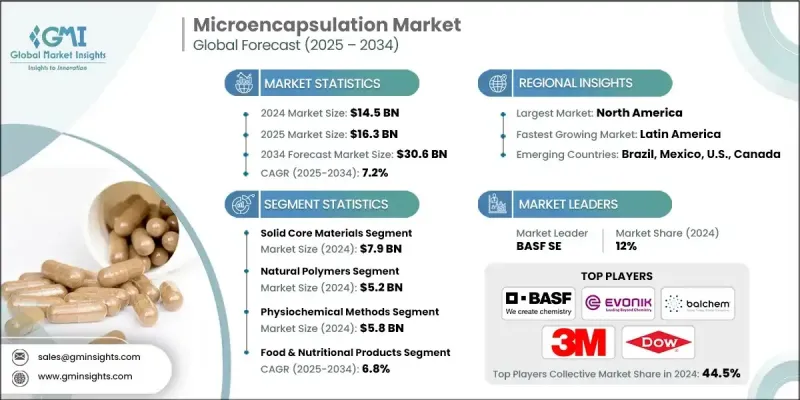

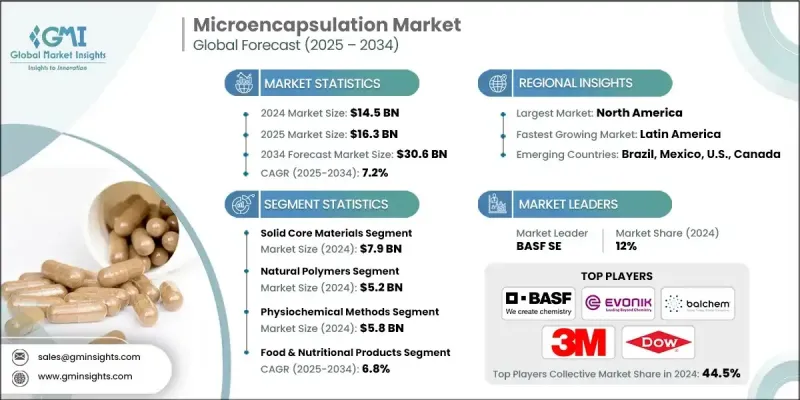

2024 年全球微膠囊化市場價值為 145 億美元,預計到 2034 年將以 7.2% 的複合年成長率成長至 306 億美元。

控釋藥物系統的日益普及推動了微膠囊技術的需求成長,因為它能夠精準保護活性成分並實現可控釋放。各國日益重視營養強化和食品營養化,並實施相關計畫以解決營養缺乏問題,進一步促進了市場成長。食品、保健品和藥品中功能性成分穩定性、生物利用度和保存期限的提升需求不斷成長,也凸顯了這項技術的重要性。此外,全球永續發展計劃正在加速推廣可生物分解和生物基包衣材料(例如藻酸鹽和木質素衍生物)的應用,這些材料符合環境和監管標準。隨著各行業向健康環保配方轉型,微膠囊技術在提高成分效率和消費者吸引力方面變得至關重要。強力的監管支持、日益成長的健康趨勢以及膠囊技術的進步,共同推動該市場在全球範圍內的穩步擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 145億美元 |

| 預測值 | 306億美元 |

| 複合年成長率 | 7.2% |

2024年,固體包覆材料市場規模達79億美元,佔全球市場最大佔有率。其主導地位主要歸功於其在醫藥、保健品和食品領域的廣泛應用。礦物質、酵素、益生菌和維生素等固體活性成分通常採用包覆技術,以防止氧化、提高穩定性並確保營養成分的緩慢釋放。這些材料可與多種包覆技術(例如噴霧乾燥和流化床包覆)高效配合,實現均勻的顆粒形成並延長產品保存期限。

2024年,天然聚合物市場規模達52億美元,佔據塗料市場最大佔有率。由於天然聚合物具有可生物分解、安全且符合食品級標準等特性,其市場需求日益成長。澱粉、明膠、海藻酸鹽、阿拉伯膠和纖維素衍生物等物質因其良好的成膜性能和與活性成分的優異相容性,在食品、醫藥和化妝品領域得到越來越廣泛的應用。對永續和清潔標籤材料需求的激增,也持續推動著各行業對天然聚合物基塗料的採用。

2024年,北美微膠囊市場規模達49億美元,佔全球市佔率的34%。預計到2034年,該地區將保持強勁成長勢頭,其中美國將引領這一成長,美國擁有成熟的製藥和營養保健品產業。對強化食品、先進藥物傳輸技術和個人化營養產品的需求不斷成長,持續推動市場需求。美國食品藥物管理局(FDA)的監管支援以及該地區對研發的投入,正在促進膠囊封裝流程的創新。日益成長的健康意識,加上先進膠囊封裝材料的獲取,使北美成為全球市場發展的重要貢獻者。

微膠囊市場的主要參與者包括 Coating Place Inc.、Aveka Inc.、先正達 (Syngenta AG)、陶氏康寧 (DOW Corning)、帝斯曼 (DSM NV)、亞什蘭全球控股公司 (Ashland Global Holdings Inc.)、巴斯夫 (BASF SE)、3M 公司、贏創 (Evonik Industries Corporation Inc.)、巴斯夫 (BASF SE)、3M 公司、贏創 (Evonik Industries Corporation Inc.)。微膠囊市場的領導者正致力於產品創新、建立合作夥伴關係以及開發永續技術,以鞏固其市場地位。許多企業正大力投資研發,以開發能夠提高生物利用度、穩定性和控釋性能的新型膠囊材料。與食品、製藥和化妝品製造商的策略合作也有助於拓展應用領域。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 對控釋藥物輸送系統的需求不斷成長

- 食品強化與營養保健品應用

- 生物分解塗料的應用日益廣泛

- 在紡織品和功能塗層領域的應用不斷擴展

- 產業陷阱與挑戰

- 高昂的製造成本和設備投資

- 複雜的法規核准流程

- 規模化營運中的技術挑戰

- 市場機遇

- 自修復材料的新興應用

- 對個人化醫療的需求日益成長

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 核心材料類型

- 塗層材料

- 科技

- 應用

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依核心材料分類,2021-2034年

- 主要趨勢

- 實心材料

- 藥物原料藥

- 維生素和礦物質

- 酵素和益生菌

- 液態芯材

- 精油和香精

- 調味劑

- 液體藥物

- 氣體芯材

- 氧氣和醫用氣體

- 推進劑

- 特殊芯材

- 疏水性活性物質

- 生物材料(疫苗、噬菌體)

- 相變材料(PCM)

第6章:市場估算與預測:依塗料類型分類,2021-2034年

- 主要趨勢

- 天然聚合物

- 明膠

- 殼聚醣-海藻酸鹽複合材料

- 絲素蛋白

- 植物性材料

- 合成聚合物

- 聚乙烯醇(PVA)

- 乙基纖維素

- 醋酸鄰苯二甲酸纖維素(CAP)

- PLGA(聚乳酸-羥基乙酸共聚物)

- 卡波姆聚合物

- 複合材料

- 蛋白質-碳水化合物組合

- 二氧化矽基材料

- 甲醛-三聚氰胺樹脂

- 其他

- 可生物分解聚合物混合物

- 智慧響應聚合物

- 無機-有機雜化材料

第7章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 化學方法

- 原位聚合

- 介面聚合

- 複雜凝聚

- 簡單凝聚

- 物理化學方法

- 噴霧乾燥

- 流體化床塗層

- 溶劑蒸發

- 靜電方法

- 電噴塗

- 電液動力處理

- 機械方法

- 空氣懸浮塗層

- 平底鍋塗層

- 離心擠出

- 先進技術方法

- 超臨界流體方法(RESS、SAS、GSSP)

- 三流體噴嘴噴霧乾燥

- Pickering乳液基封裝

- 離子凝膠化

- 膜乳化

- 溶膠-凝膠法

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 藥品及藥物輸送

- 口服藥物遞送系統

- 注射劑

- 局部及經皮給藥

- 疫苗和生物製劑遞送

- 食品和營養產品

- 功能性食品及營養保健品

- 食品添加物和防腐劑

- 益生菌輸送系統

- 農業化學品和殺蟲劑

- 控釋肥料

- 農藥配方

- 種子包衣應用

- 工業應用

- 紡織品和功能性塗層

- 建築和自修復材料

- 石油和天然氣應用

- 天氣改造

- 消費品

- 化妝品和皮膚化妝品

- 居家及個人護理

- 香氛與芳香療法

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- DOW Corning

- BASF SE

- Evonik Industries AG

- DSM NV

- Syngenta AG

- 3M Company

- Ashland Global Holdings Inc.

- Coating Place Inc.

- Capsugel (Lonza Group)

- Balchem Corporation

- Aveka Inc.

The Global Microencapsulation Market was valued at USD 14.5 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 30.6 billion by 2034.

The increasing adoption of controlled drug delivery systems is driving demand for microencapsulation, as it offers precise protection and controlled release of active compounds. Rising focus on nutritional enhancement and food fortification has further fueled market growth, with countries implementing programs to address nutrient deficiencies. The growing need for improved stability, bioavailability, and shelf life of functional ingredients in foods, nutraceuticals, and pharmaceuticals has boosted the importance of this technology. Moreover, global sustainability initiatives are accelerating the use of biodegradable and bio-based coating materials, such as alginates and lignin derivatives, which align with environmental and regulatory standards. As industries shift toward health-conscious and eco-friendly formulations, microencapsulation technologies are becoming vital in enhancing ingredient efficiency and consumer appeal. Strong regulatory support, rising wellness trends, and advancements in encapsulation techniques are shaping this market's steady expansion worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.5 Billion |

| Forecast Value | $30.6 Billion |

| CAGR | 7.2% |

The solid core materials segment accounted for USD 7.9 billion in 2024, holding the largest share of the global market. This dominance is attributed to their extensive application in pharmaceuticals, nutraceuticals, and food products. Solid actives like minerals, enzymes, probiotics, and vitamins are widely encapsulated to prevent oxidation, enhance stability, and ensure slow release of nutrients. These materials work efficiently with multiple coating technologies such as spray drying and fluidized bed coating, delivering uniform particle formation and extended product shelf life.

The natural polymers segment was valued at USD 5.2 billion in 2024, representing the leading share of coating materials. The preference for natural polymers is growing due to their biodegradable, safe, and food-grade characteristics. Substances such as starch, gelatin, alginate, gum Arabic, and cellulose derivatives are increasingly utilized in food, pharmaceutical, and cosmetic applications because of their film-forming capabilities and excellent compatibility with active ingredients. The surge in demand for sustainable and clean-label materials continues to strengthen the adoption of natural polymer-based coatings across industries.

North America Microencapsulation Market reached USD 4.9 billion in 2024, representing 34% share. The region is expected to witness strong growth through 2034, led by the United States, which benefits from a well-established pharmaceutical and nutraceutical sector. The increasing need for fortified foods, advanced drug delivery technologies, and personalized nutrition products continues to boost market demand. Regulatory support from the FDA and the region's investment in R&D are encouraging innovation in encapsulation processes. The growing focus on wellness, coupled with access to advanced encapsulation materials, has positioned North America as a major contributor to global market development.

Major players operating in the Microencapsulation Market include Coating Place Inc., Aveka Inc., Syngenta AG, DOW Corning, DSM N.V., Ashland Global Holdings Inc., BASF SE, 3M Company, Evonik Industries AG, Balchem Corporation, and Capsugel (Lonza Group). Leading companies in the Microencapsulation Market are focusing on product innovation, partnerships, and sustainable technology development to strengthen their market foothold. Many are investing heavily in R&D to develop new encapsulation materials that improve bioavailability, stability, and controlled release properties. Strategic collaborations with food, pharmaceutical, and cosmetic manufacturers are helping expand application areas.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Core Material Type

- 2.2.3 Coating Material

- 2.2.4 Technology

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for controlled drug delivery systems

- 3.2.1.2 Growing food fortification & nutraceutical applications

- 3.2.1.3 Increasing adoption of biodegradable coating materials

- 3.2.1.4 Expanding applications in textiles & functional coating

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs & equipment investment

- 3.2.2.2 Complex regulatory approval processes

- 3.2.2.3 Technical challenges in scale-up operations

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging applications in self-healing materials

- 3.2.3.2 Growing demand for personalized medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Core Material Type

- 3.7.3 Coating Material

- 3.7.4 Technology

- 3.7.5 Application

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Core Material, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Solid core materials

- 5.2.1 Pharmaceutical APIs

- 5.2.2 Vitamins & minerals

- 5.2.3 Enzymes & probiotics

- 5.3 Liquid core materials

- 5.3.1 Essential oils & fragrances

- 5.3.2 Flavoring agents

- 5.3.3 Liquid pharmaceuticals

- 5.4 Gas core materials

- 5.4.1 Oxygen & medical gases

- 5.4.2 Propellants

- 5.5 Specialized core materials

- 5.5.1 Hydrophobic actives

- 5.5.2 Biological materials (vaccines, bacteriophages)

- 5.5.3 Phase change materials (PCMs)

Chapter 6 Market Estimates and Forecast, By Coating Material, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Natural polymers

- 6.2.1 Gelatin

- 6.2.2 Chitosan-alginate composites

- 6.2.3 Silk fibroin

- 6.2.4 Plant-based materials

- 6.3 Synthetic polymers

- 6.3.1 Polyvinyl alcohol (PVA)

- 6.3.2 Ethyl cellulose

- 6.3.3 Cellulose acetate phthalate (CAP)

- 6.3.4 PLGA (Poly Lactic-co-Glycolic Acid)

- 6.3.5 Carbopol polymers

- 6.4 Composite materials

- 6.4.1 Protein-carbohydrate combinations

- 6.4.2 Silica-based materials

- 6.4.3 Formaldehyde-melamine resins

- 6.5 Others

- 6.5.1 Biodegradable polymer blends

- 6.5.2 Smart responsive polymers

- 6.5.3 Inorganic-organic hybrids

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Chemical methods

- 7.2.1 In-situ polymerization

- 7.2.2 Interfacial polymerization

- 7.2.3 Complex coacervation

- 7.2.4 Simple coacervation

- 7.3 Physiochemical methods

- 7.3.1 Spray drying

- 7.3.2 Fluid bed coating

- 7.3.3 Solvent evaporation

- 7.4 Electrostatic methods

- 7.4.1 Electro spraying

- 7.4.2 Electrohydrodynamic processing

- 7.5 Mechanical methods

- 7.5.1 Air suspension coating

- 7.5.2 Pan coating

- 7.5.3 Centrifugal extrusion

- 7.6 Advanced technology methods

- 7.6.1 Supercritical fluid methods (RESS, SAS, GSSP)

- 7.6.2 Three-fluid nozzle spray drying

- 7.6.3 Pickering emulsion-based encapsulation

- 7.6.4 Ionic gelation

- 7.6.5 Membrane emulsification

- 7.6.6 Sol-gel methods

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceuticals & drug delivery

- 8.2.1 Oral drug delivery systems

- 8.2.2 Parenteral formulations

- 8.2.3 Topical & transdermal applications

- 8.2.4 Vaccine & biological delivery

- 8.3 Food & nutritional products

- 8.3.1 Functional foods & nutraceuticals

- 8.3.2 Food additives & preservatives

- 8.3.3 Probiotic delivery systems

- 8.4 Agrochemicals & pesticides

- 8.4.1 Controlled release fertilizers

- 8.4.2 Pesticide formulations

- 8.4.3 Seed coating applications

- 8.5 Industrial applications

- 8.5.1 Textiles & functional coatings

- 8.5.2 Construction & self-healing materials

- 8.5.3 Oil & gas applications

- 8.5.4 Weather modification

- 8.6 Consumer products

- 8.6.1 Cosmetics & dermo cosmetics

- 8.6.2 Household & personal care

- 8.6.3 Fragrance & aromatherapy

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 DOW Corning

- 10.2 BASF SE

- 10.3 Evonik Industries AG

- 10.4 DSM N.V.

- 10.5 Syngenta AG

- 10.6 3M Company

- 10.7 Ashland Global Holdings Inc.

- 10.8 Coating Place Inc.

- 10.9 Capsugel (Lonza Group)

- 10.10 Balchem Corporation

- 10.11 Aveka Inc.