|

市場調查報告書

商品編碼

1876784

醫院病號服市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Hospital Gowns Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

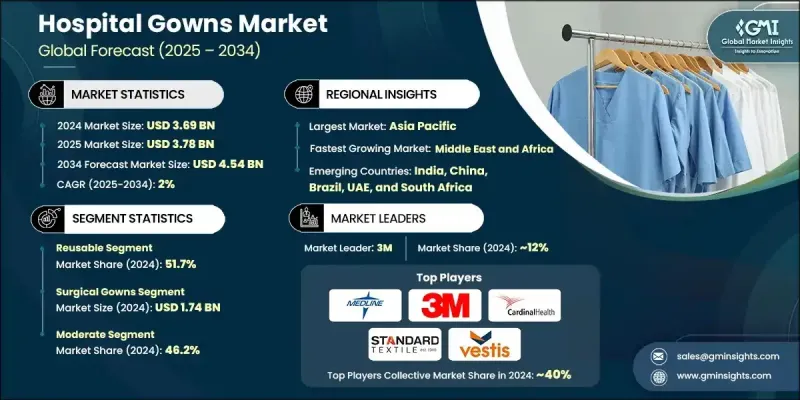

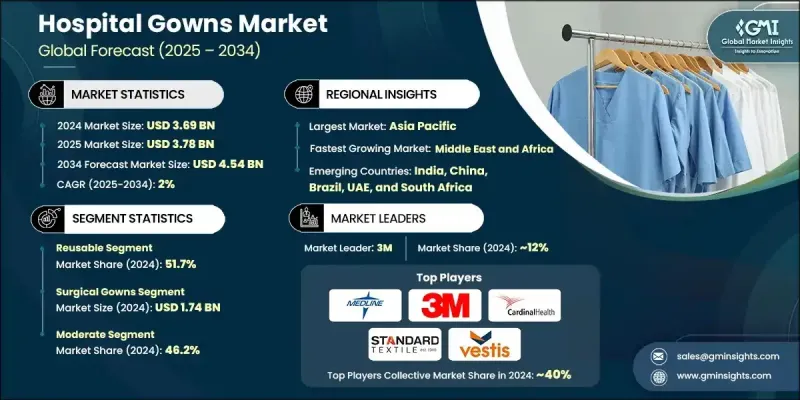

2024 年全球醫院病號服市場價值為 36.9 億美元,預計到 2034 年將以 2% 的複合年成長率成長至 45.4 億美元。

手術數量的增加、醫院感染(HAI)發生率的上升以及老年人口的成長正在推動市場成長。政府對醫療防護服的強制性規定、對病人安全的日益重視以及對一次性防護服日益成長的需求,都是推動產業擴張的關鍵因素。此外,醫療監管機構制定的嚴格感染控制標準也持續鼓勵在醫療環境中使用防護衣。隨著病患和醫護人員對感染預防和控制意識的提高,醫院更加重視防護衣的品質、衛生規範的遵守情況以及使用頻率,這進一步刺激了全球市場需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 36.9億美元 |

| 預測值 | 45.4億美元 |

| 複合年成長率 | 2% |

包括擇期手術和急診手術在內的各類手術數量的持續成長,顯著推高了對醫用防護服的需求。這一成長主要歸因於全球人口老化、慢性病發病率上升以及醫療基礎設施的改善。在醫療和外科手術過程中,無菌防護衣對於保護病患和醫護人員免受潛在污染至關重要。因此,預計手術量的穩定成長將在預測期內持續推高對醫用防護服的需求。

2024年,可重複使用防護衣市佔率達51.7%。可重複使用防護服因其成本效益和環境永續性而日益普及。它們採用耐用布料製成,可經受多次洗滌和消毒循環,同時保持有效的防護性能。許多醫療機構為了最大限度地減少醫療廢物和營運成本,正擴大轉向使用可重複使用防護服,將其作為實用且環保的解決方案。

預計到2024年,手術服市場規模將達17.4億美元。手術頻率的不斷增加和嚴格的感染防治標準推動了對高品質手術服的需求。這些手術服旨在提供最大程度的防護,防止液體和病原體的侵入,醫院通常會根據其無菌性、耐用性和是否符合安全指南來選擇。骨科、心臟科和腫瘤科手術量的增加進一步增強了全球醫療保健系統對無菌高性能手術服的需求。

2024年,北美醫院手術服市佔率達29.5%。該地區的領先地位得益於先進的醫療基礎設施、龐大的手術量以及嚴格的感染控制法規。由於一次性手術服方便實用且能有效防止交叉感染,北美各地的醫院越來越傾向於使用此類產品。部分醫療機構引進抗菌布料技術,進一步推動了產品創新。此外,人口老化加劇和慢性病發病率上升也促進了該地區市場的發展。

全球醫院防護衣市場的主要企業包括:Surgiene Healthcare、Cardinal Health、3M、MEDLINE、HALYARD、STANDARD TEXTILE、HARTMANN、Molnlycke、KIMTECH(Ansell)、PRI-MED MEDICAL PRODUCTS、STERIS、Vestis、TIDI、VRPGON、LohIA & GRP,Y這些市場參與者正採取多種策略來鞏固其市場地位。許多公司正在擴大產能並採用自動化技術來提高效率,以滿足不斷成長的需求。他們也加強研發投入,推出具有更強防護性、舒適性和抗菌性能的防護服。與醫院和醫療保健分銷商的策略合作有助於加強分銷網路。此外,一些企業正致力於永續發展,開發可重複使用的防護服和環保材料,以響應全球減少浪費的目標,同時保持合規性和產品創新。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 全球手術數量上升

- 院內感染(HAI)病例不斷增加

- 近期技術進步

- 慢性病住院人數增加

- 產業陷阱與挑戰

- 居家照護服務的需求不斷成長

- 機器人手術數量上升

- 機會

- 新興國家醫療衛生基礎設施的擴建

- 抗菌技術整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 投資環境

- 永續材料創新

- 生物分解聚合物的開發

- 循環經濟一體化

- 廢棄物減量技術

- 波特的分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依可用性分類,2021-2034年

- 主要趨勢

- 一次性的

- 可重複使用的

第6章:市場估價與預測:依禮服類型分類,2021-2034年

- 主要趨勢

- 手術服

- 非手術服

- 病人服

第7章:市場估計與預測:依保護等級分類,2021-2034年

- 主要趨勢

- 極簡主義

- 低的

- 緩和

- 高的

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 3M

- ANGGIA CORPORATION

- Cardinal Health

- HALYARD

- HARTMANN

- JPS MEDICAL

- KIMTECH (Ansell)

- Lohmann & Rauscher

- MEDLINE

- Molnlycke

- PRI-MED MEDICAL PRODUCTS

- Sara+Care

- STANDARD TEXTILE

- STERIS

- Surgiene Healthcare

- TIDI

- vestis

- VYGON

The Global Hospital Gowns Market was valued at USD 3.69 billion in 2024 and is estimated to grow at a CAGR of 2% to reach USD 4.54 billion by 2034.

Market growth is being propelled by the increasing number of surgical procedures, the rising incidence of hospital-acquired infections (HAIs), and the expanding elderly population. Mandatory government regulations on protective healthcare apparel, heightened emphasis on patient safety, and growing preference for single-use gowns are key drivers supporting industry expansion. Furthermore, stringent infection control standards set by healthcare regulatory agencies continue to encourage the use of gowns in medical environments. As awareness of infection prevention and control rises among both patients and medical staff, hospitals are prioritizing gown quality, compliance with hygiene protocols, and usage frequency, further stimulating market demand worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.69 Billion |

| Forecast Value | $4.54 Billion |

| CAGR | 2% |

The consistent rise in surgeries across multiple categories, including elective and emergency operations, is significantly boosting the need for hospital gowns. This increase is largely attributed to the aging global population, growing rates of chronic diseases, and improved access to healthcare infrastructure. During medical and surgical procedures, sterile gowns are essential to protect patients and healthcare workers from potential contamination. Consequently, the steady growth in surgical volume is expected to reinforce product demand through the forecast period.

The reusable gowns segment held a 51.7% share in 2024. Reusable gowns are gaining popularity due to their cost efficiency and environmental sustainability. They are made from durable fabrics that can withstand numerous washing and sterilization cycles while maintaining effective protection. Many healthcare institutions aiming to minimize medical waste and operational costs are increasingly transitioning toward reusable gowns as a practical, eco-friendly solution.

The surgical gowns segment generated USD 1.74 billion in 2024. The growing frequency of surgical interventions and strict infection prevention standards is driving the demand for high-quality surgical gowns. These gowns are designed to provide maximum protection against fluids and pathogens, and hospitals tend to select them based on sterility, durability, and compliance with safety guidelines. The rise in surgical cases across orthopedics, cardiology, and oncology is further strengthening the demand for sterile and high-performance surgical gowns across global healthcare systems.

North America Hospital Gowns Market accounted for a 29.5% share in 2024. The region's dominance is supported by advanced healthcare infrastructure, high surgical volumes, and rigorous infection control regulations. Hospitals across North America show a growing preference for disposable gowns due to their convenience and effectiveness in preventing cross-contamination. The introduction of antimicrobial fabric technology in certain medical institutions further enhances product innovation. Additionally, the expanding elderly population and higher incidence of chronic diseases are bolstering the market's progress in this region.

Leading companies operating in the Global Hospital Gowns Market include Surgiene Healthcare, Cardinal Health, 3M, MEDLINE, HALYARD, STANDARD TEXTILE, HARTMANN, Molnlycke, KIMTECH (Ansell), PRI-MED MEDICAL PRODUCTS, STERIS, Vestis, TIDI, VYGON, Lohmann & Rauscher, JPS MEDICAL, Sara+Care, and ANGGIA CORPORATION. Key market players in the Hospital Gowns Market are implementing several strategies to enhance their market foothold. Many companies are expanding production capacities and adopting automation to improve efficiency and meet growing demand. They are also investing in research and development to introduce gowns with improved barrier protection, comfort, and antimicrobial properties. Strategic collaborations with hospitals and healthcare distributors are helping strengthen distribution networks. In addition, several players are focusing on sustainability initiatives by developing reusable gowns and eco-friendly materials, aligning with global waste reduction goals while maintaining regulatory compliance and product innovation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Usability trends

- 2.2.3 Gown type trends

- 2.2.4 Protection level trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in number of surgeries across the world

- 3.2.1.2 Growing instances of hospital acquired infections (HAIs)

- 3.2.1.3 Recent technological advancements

- 3.2.1.4 Rise in the number of hospitalizations due to chronic diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Growing demand for homecare services

- 3.2.2.2 Rise in robotic surgeries

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of healthcare infrastructure in emerging countries

- 3.2.3.2 Antimicrobial technology integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Investment landscape

- 3.7 Sustainable Material Innovation

- 3.7.1 Biodegradable polymer development

- 3.7.2 Circular economy integration

- 3.7.3 Waste reduction technologies

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Disposable

- 5.3 Reusable

Chapter 6 Market Estimates and Forecast, By Gown Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Surgical gowns

- 6.3 Non-surgical gowns

- 6.4 Patient gowns

Chapter 7 Market Estimates and Forecast, By Protection Level, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Minimal

- 7.3 Low

- 7.4 Moderate

- 7.5 High

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 ANGGIA CORPORATION

- 9.3 Cardinal Health

- 9.4 HALYARD

- 9.5 HARTMANN

- 9.6 JPS MEDICAL

- 9.7 KIMTECH (Ansell)

- 9.8 Lohmann & Rauscher

- 9.9 MEDLINE

- 9.10 Molnlycke

- 9.11 PRI-MED MEDICAL PRODUCTS

- 9.12 Sara+Care

- 9.13 STANDARD TEXTILE

- 9.14 STERIS

- 9.15 Surgiene Healthcare

- 9.16 TIDI

- 9.17 vestis

- 9.18 VYGON