|

市場調查報告書

商品編碼

1876659

智慧窗戶用熱致變色材料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Thermochromic Materials for Smart Windows Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

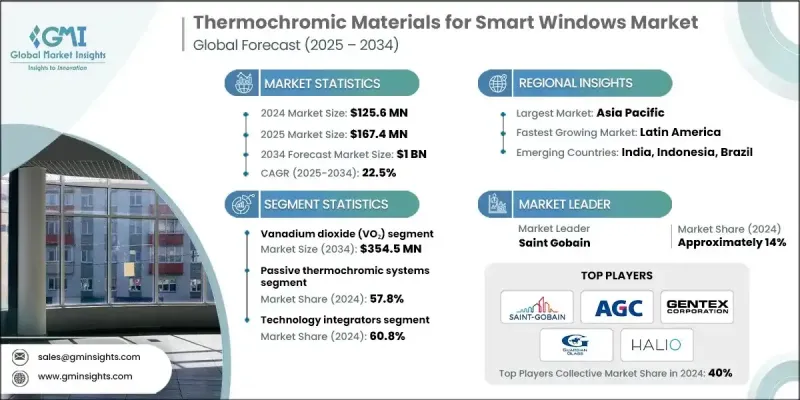

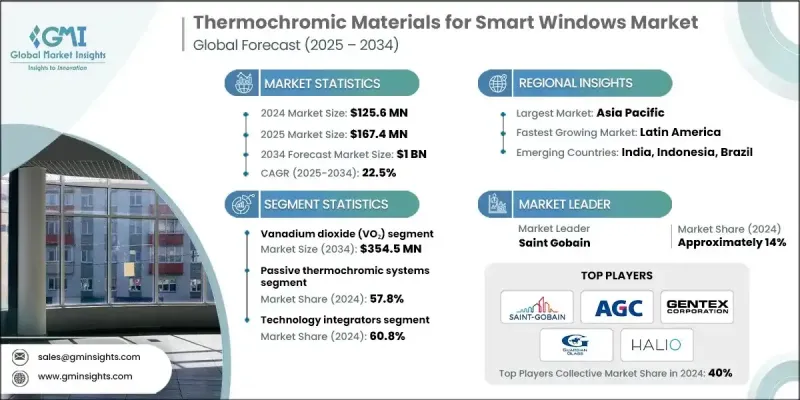

2024 年全球智慧窗戶用熱致變色材料市場價值為 1.256 億美元,預計到 2034 年將以 22.5% 的複合年成長率成長至 10 億美元。

智慧窗戶的快速成長反映了日益嚴格的建築能耗法規、熱致變色化學技術的加速發展以及智慧建築技術的廣泛應用。能夠根據溫度自動調節顏色的智慧窗戶擴大與自動化建築平台結合使用,以更有效率地調節室內環境。鑑於暖通空調系統可能佔商業設施能耗的40%至60%,智慧窗戶的優勢尤其顯著。推廣淨零能耗建築的專案持續鼓勵使用熱致變色玻璃,因為它無需外部電源即可工作,並且與標準窗戶系統相比,可以顯著降低總能耗。整合多層材料(例如鈣鈦礦混合物、VO2塗層和其他可調薄膜)的平台正在不斷發展,這些平台具有高可見光透過率和更強的太陽能控制能力。強勁的年成長率與更新的建築規範、材料的持續突破以及新興的混合技術密切相關。研究工作仍在持續進行,提高耐久性和加快切換速度的現代熱致變色薄膜有望獲得更廣泛的商業應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.256億美元 |

| 預測值 | 10億美元 |

| 複合年成長率 | 22.5% |

2024年,二氧化釩市場規模達4,370萬美元,預計2034年將達3.545億美元,年複合成長率達22.3%。二氧化釩在68°C附近發生的天然金屬-絕緣體轉變可以透過選擇性摻雜進行改造,使其在更低的溫度下激活,目前可擴展的生產過程已能實現接近22°C的轉變溫度。濺鍍技術的進步正在提高塗層的穩定性,並延長其在不同氣候條件下的長期性能。

被動式熱致變色解決方案在2024年佔據了57.8%的市場佔有率,預計到2034年將維持22.4%的複合年成長率。其吸引力在於零能耗和極低的維護成本,符合淨零能耗建築的理念。設計合理的此類系統可節省15%至25%的暖通空調能源,使其對面臨營運成本上升的業主更具吸引力。

2024年,北美智慧窗用熱致變色材料市場佔據了顯著佔有率。隨著IECC 2021和ASHRAE 90.1等法規的更新,高效節能建築圍護結構的需求日益成長,智慧窗的普及應用也隨之加速。美國各州層級的舉措,包括主要建築市場不斷變化的法規要求,都在加速智慧窗在美國的應用;而加拿大協調一致的政策則支持其長期的碳減排目標。該地區受益於物聯網賦能的建築管理平台的深度整合,以及在下一代玻璃安裝方面經驗豐富的成熟安裝網路。

智慧窗用熱致變色材料市場的主要企業包括 ChromoGenics AB、Guardian Glass LLC、View Inc.、PPG Industries Inc.、Kinestral Technologies、Saint-Gobain SA、AGC Inc.、日本板硝子株式會社、Gentex Corporation 和 Halio Inc.。這些企業在智慧窗用熱致變色材料市場中競爭,並專注於多個策略支柱以鞏固其市場地位。許多企業強調持續的研發投入,以提高轉變溫度、材料耐久性和光學清晰度,從而更好地滿足現代建築的要求。各公司不斷最佳化生產技術,以降低製造成本並支援大規模部署。與玻璃製造商和智慧建築解決方案提供者建立策略合作夥伴關係,有助於拓展商業項目。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按產品形式

- 未來市場趨勢

- 專利格局

- 貿易統計(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 二氧化釩(VO2)系統

- 純VO2系統

- 鎢摻雜的VO2

- 鉬摻雜的VO2

- 共摻雜VO2系統

- 核殼結構的VO2奈米結構

- 基於水凝膠的系統

- PNIPAM水凝膠

- HPC(羥丙基纖維素)系統

- 複合水凝膠

- 物理交聯系統

- 化學交聯體系

- 鈣鈦礦材料

- 鹵化物鈣鈦礦

- 甲胺可切換系統

- 水合響應材料

- 液晶系統

- 熱致液晶

- 膽固醇型液晶

- 液晶聚合物複合材料

- 有機染料體系

- LEUCO染料

- 吡喃糖系統

- LETC(配體交換熱致變色)系統

第6章:市場估算與預測:依產品形式分類,2021-2034年

- 主要趨勢

- 薄膜塗層

- 濺鍍膜

- 溶液法製備的薄膜

- 化學氣相沉積薄膜

- 多層堆疊和法布里-珀羅腔

- 層壓中間層

- PVB(聚乙烯醇縮丁醛)層

- EVA(乙烯-醋酸乙烯酯共聚物)夾層

- TPU(熱塑性聚氨酯)中間層

- 改造膜

- 自黏膜

- 靜電吸附膜

- 液態塗覆薄膜

- 完整的窗戶系統

- 單層玻璃單元

- 雙層玻璃的

- 三層玻璃的伊古斯

- 真空玻璃單元

第7章:市場估算與預測:依技術與控制方式分類,2021-2034年

- 主要趨勢

- 被動式熱致變色系統

- 固定轉變溫度

- 寬範圍切換

- 多級開關

- 活性熱致變色系統

- 電動輔助系統

- 物聯網智慧窗戶

- 感測器控制系統

- 混合系統

- 熱致變色-電致變色

- 熱致變色光伏

- 熱致變色-光致變色

第8章:市場估算與預測:依製造流程分類,2021-2034年

- 主要趨勢

- 基於真空的方法

- 磁控濺射

- 高功率脈衝磁控濺鍍(HIPIMS)

- 脈衝雷射沉積(PLD)

- 化學氣相沉積(CVD)

- 原子層沉積(ALD)

- 基於解決方案的方法

- 溶膠-凝膠加工

- 水熱合成

- 旋塗

- 卷對卷塗佈

- 積層製造

- 噴墨列印

- 網版印刷

- 3D列印技術

第9章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 建築與設計

- 總承包商

- 玻璃安裝承包商

- 建築師和設計公司

- 設施管理公司

- 汽車製造

- 原始設備製造商(OEM)

- 一級零件供應商

- 售後及改造服務

- 玻璃製造

- 浮法玻璃製造商

- 鍍膜玻璃製造商

- 夾層玻璃製造商

- 技術整合商

- 建築自動化系統供應商

- 智慧家庭科技公司

- 物聯網平台供應商

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第11章:公司簡介

- AGC Inc.

- ChromoGenics AB

- Gentex Corporation

- Guardian Glass LLC

- Halio Inc.

- Heliotrope Technologies

- Innovative Glass Corporation

- Kinestral Technologies

- Miru Smart Technologies

- NEXT Energy Technologies

- Nippon Sheet Glass Co. Ltd.

- Pleotint LLC

- Polytronix Inc.

- PPG Industries Inc.

- RavenWindow

- Research Frontiers Inc.

- Saint-Gobain SA

- Scienstry Inc.

- Smartglass International Ltd.

- View Inc.

- Others

The Global Thermochromic Materials for Smart Windows Market was valued at USD 125.6 million in 2024 and is estimated to grow at a CAGR of 22.5% to reach USD 1 billion by 2034.

The rapid rise reflects stricter building-energy rules, accelerating advances in thermochromic chemistry, and expanding deployment of intelligent building technologies. Smart windows that shift tint based on temperature are increasingly paired with automated building platforms to regulate indoor conditions more efficiently, a major advantage given that HVAC systems can account for 40-60% of commercial facility energy consumption. Programs promoting net-zero energy buildings continue to encourage thermochromic glazing because it functions without external power and can significantly lower total energy use compared with standard window systems. Material platforms integrating multiple layers, such as perovskite blends, VO2 coatings, and other tunable films, are progressing, offering high visible light transmission and enhanced solar control. Strong year-over-year momentum is tied to updated building codes, continuous material breakthroughs, and emerging hybrid technologies. Research efforts remain intensive, with improved durability and faster switching speeds positioning modern thermochromic films for broader commercial acceptance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $125.6 Million |

| Forecast Value | $1 Billion |

| CAGR | 22.5% |

The vanadium dioxide segment generated USD 43.7 million in 2024 and is expected to reach USD 354.5 million by 2034 at a 22.3% CAGR. The natural metal-insulator shift near 68°C can be re-engineered to activate at lower temperatures through selective doping, with scalable production now achieving transitions near 22°C. Advances in sputtering approaches are enhancing coating stability and extending long-term performance across different climates.

The passive thermochromic solutions segment accounted for a 57.8% share in 2024 and is anticipated to maintain a 22.4% CAGR through 2034. Their appeal is rooted in zero-power functionality and minimal upkeep, aligning with net-zero construction priorities. When designed correctly, these systems have demonstrated 15-25% HVAC savings, making them increasingly attractive for owners facing rising operational costs.

North America Thermochromic Materials for Smart Windows Market held a significant share in 2024. The smart window adoption, as regulatory updates such as IECC 2021 and ASHRAE 90.1 reinforce high-efficiency building envelopes. State-level initiatives, including evolving requirements across major construction markets, accelerate usage in the United States, while coordinated Canadian policies support long-term carbon-reduction goals. The region benefits from strong integration of IoT-enabled building management platforms and a mature installation network experienced with next-generation glazing.

Key companies in the Thermochromic Materials for Smart Windows Market include ChromoGenics AB, Guardian Glass LLC, View Inc., PPG Industries Inc., Kinestral Technologies, Saint-Gobain S.A., AGC Inc., Nippon Sheet Glass Co. Ltd., Gentex Corporation, and Halio Inc. Companies competing in the Thermochromic Materials for Smart Windows Market focus on several strategic pillars to reinforce their market standing. Many emphasize sustained R&D investment to enhance transition temperatures, material durability, and optical clarity, ensuring greater compatibility with modern building requirements. Firms increasingly streamline production technologies to reduce manufacturing costs and support large-scale deployment. Strategic partnerships with glazing manufacturers and smart-building solution providers help expand access to commercial projects.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Product form

- 2.2.4 Technology & control

- 2.2.5 Manufacturing process

- 2.2.6 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product form

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Vanadium dioxide (vo2) systems

- 5.2.1 Pure vo2 systems

- 5.2.2 Tungsten-doped vo2

- 5.2.3 Molybdenum-doped vo2

- 5.2.4 Co-doped vo2 systems

- 5.2.5 Core-shell vo2 nanostructures

- 5.3 Hydrogel-based systems

- 5.3.1 PNIPAM hydrogels

- 5.3.2 HPC (hydroxypropyl cellulose) systems

- 5.3.3 Composite hydrogels

- 5.3.4 Physically cross-linked systems

- 5.3.5 Chemically cross-linked systems

- 5.4 Perovskite materials

- 5.4.1 Halide perovskites

- 5.4.2 Methylamine-switchable systems

- 5.4.3 Hydration-responsive materials

- 5.5 Liquid crystal systems

- 5.5.1 Thermotropic liquid crystals

- 5.5.2 Cholesteric liquid crystals

- 5.5.3 Lc-polymer composites

- 5.6 Organic dye systems

- 5.6.1 LEUCO dyes

- 5.6.2 SPIROPYRAN systems

- 5.6.3 LETC (ligand exchange thermochromism) systems

Chapter 6 Market Estimates and Forecast, By Product Form, 2021 - 2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Thin film coatings

- 6.2.1 Sputtered films

- 6.2.2 Solution-processed films

- 6.2.3 CVD films

- 6.2.4 Multilayer stacks & fabry-perot cavities

- 6.3 Laminated interlayers

- 6.3.1 PVB (polyvinyl butyral) interlayers

- 6.3.2 EVA (ethylene vinyl acetate) interlayers

- 6.3.3 TPU (thermoplastic polyurethane) interlayers

- 6.4 Retrofit films

- 6.4.1 Self-adhesive films

- 6.4.2 Static-cling films

- 6.4.3 Liquid-applied films

- 6.5 Complete window systems

- 6.5.1 Single-glazed units

- 6.5.2 Double-glazed igus

- 6.5.3 Triple-glazed igus

- 6.5.4 Vacuum-glazed units

Chapter 7 Market Estimates and Forecast, By Technology & Control, 2021 - 2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Passive thermochromic systems

- 7.2.1 Fixed transition temperature

- 7.2.2 Broad-range switching

- 7.2.3 Multi-stage switching

- 7.3 Active thermochromic systems

- 7.3.1 Electrically assisted systems

- 7.3.2 IoT-enabled smart windows

- 7.3.3 Sensor-controlled systems

- 7.4 Hybrid systems

- 7.4.1 Thermochromic-electrochromic

- 7.4.2 Thermochromic-photovoltaic

- 7.4.3 Thermochromic-photochromic

Chapter 8 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Vacuum-based methods

- 8.2.1 Magnetron sputtering

- 8.2.2 Hipims (high-power impulse magnetron sputtering)

- 8.2.3 Pulsed laser deposition (PLD)

- 8.2.4 Chemical vapor deposition (CVD)

- 8.2.5 Atomic layer deposition (ALD)

- 8.3 Solution-based methods

- 8.3.1 Sol-gel processing

- 8.3.2 Hydrothermal synthesis

- 8.3.3 Spin coating

- 8.3.4 Roll-to-roll coating

- 8.4 Additive manufacturing

- 8.4.1 Inkjet printing

- 8.4.2 Screen printing

- 8.4.3 3d printing technologies

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 Construction & architecture

- 9.2.1 General contractors

- 9.2.2 Glazing contractors

- 9.2.3 Architects & design firms

- 9.2.4 Facility management companies

- 9.3 Automotive manufacturing

- 9.3.1 Original equipment manufacturers (OEMs)

- 9.3.2 Tier 1 component suppliers

- 9.3.3 Aftermarket & retrofit services

- 9.4 Glass manufacturing

- 9.4.1 Float glass manufacturers

- 9.4.2 Coated glass manufacturers

- 9.4.3 Laminated glass manufacturers

- 9.5 Technology integrators

- 9.5.1 Building automation system providers

- 9.5.2 Smart home technology companies

- 9.5.3 Iot platform providers

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 AGC Inc.

- 11.2 ChromoGenics AB

- 11.3 Gentex Corporation

- 11.4 Guardian Glass LLC

- 11.5 Halio Inc.

- 11.6 Heliotrope Technologies

- 11.7 Innovative Glass Corporation

- 11.8 Kinestral Technologies

- 11.9 Miru Smart Technologies

- 11.10 NEXT Energy Technologies

- 11.11 Nippon Sheet Glass Co. Ltd.

- 11.12 Pleotint LLC

- 11.13 Polytronix Inc.

- 11.14 PPG Industries Inc.

- 11.15 RavenWindow

- 11.16 Research Frontiers Inc.

- 11.17 Saint-Gobain S.A.

- 11.18 Scienstry Inc.

- 11.19 Smartglass International Ltd.

- 11.20 View Inc.

- 11.21 Others