|

市場調查報告書

商品編碼

1876652

巴特氏症候群治療市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Barth Syndrome Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

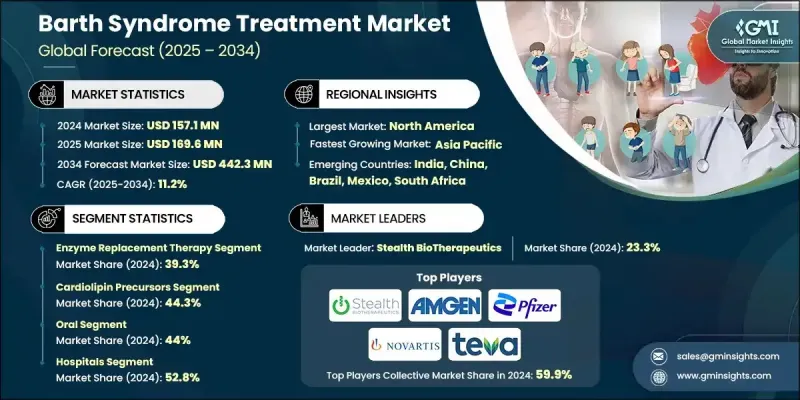

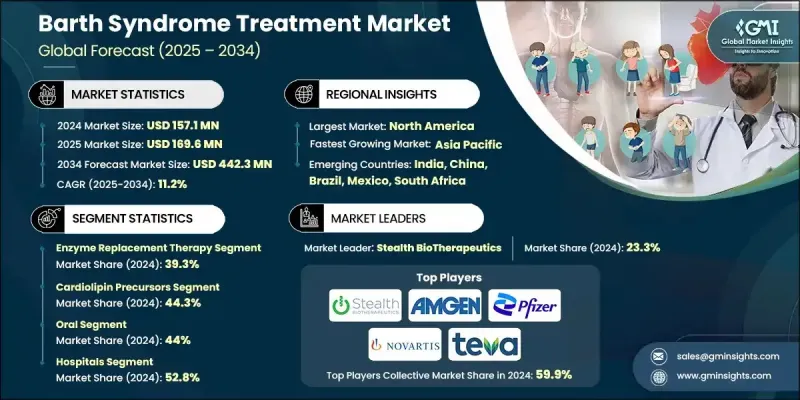

2024 年全球巴特氏症候群治療市場價值為 1.571 億美元,預計到 2034 年將以 11.2% 的複合年成長率成長至 4.423 億美元。

隨著確診病例數的增加、臨床醫生和患者家屬對疾病認知的提高,以及基因療法和酵素療法的顯著進展,市場持續擴張。該行業透過提供基因研究、治療開發和患者護理方面的專業解決方案,為生物技術開發商、製藥公司、研究機構和醫療保健提供者提供支援。治療方案涵蓋基因療法、酵素替代療法和支持性護理,旨在改善心臟和肌肉症狀,同時提高患者的整體生活品質。基因療法的進展增強了市場成長勢頭,新興療法旨在糾正導致疾病的TAZ基因突變,有望帶來長期的治療益處。酵素替代療法也在快速發展,致力於恢復粒線體功能並解決潛在的生化缺陷。支持性護理,包括心肌病變和血液系統併發症的藥物治療,在改善生存結果和維持市場成長方面繼續發揮至關重要的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.571億美元 |

| 預測值 | 4.423億美元 |

| 複合年成長率 | 11.2% |

由於酵素替代療法在解決他法辛缺乏症方面發揮直接作用,顯著改善粒線體活性並提升患者預後,預計到2024年,該療法將佔據39.3%的市場佔有率。其標靶機制是透過補充缺失的酵素來支持心臟和肌肉功能,使其成為巴特氏症候群患者的主要治療選擇之一。

2024 年,心磷脂前驅物市場佔 44.3% 的佔有率,預計在 2025 年至 2034 年期間將達到 2.088 億美元。這些療法之所以廣泛應用,是因為它們有助於恢復粒線體膜的穩定性,補償由 TAZ 基因突變引起的受損的心磷脂重塑,而 TAZ 基因突變會破壞能量產生和細胞功能。

2024年,北美巴特氏症候群治療市場佔35.3%的佔有率,這得益於高度發展的醫療保健基礎設施和罕見遺傳疾病診斷檢測的普及。新一代定序和其他先進實驗室工具實現的早期檢測有助於及時進行治療干預,從而改善患者的長期預後。

活躍於全球巴特氏症治療市場的主要公司包括 Stealth BioTherapeutics、TransCellular Therapeutics (TCT)、雅培、紐迪希亞、Amneal Pharmaceuticals、勃林格殷格翰、安進、梯瓦、諾華、Scenic Biotech、輝瑞和貝朗。巴特氏症治療市場的公司採取多種策略措施來鞏固其市場地位。許多公司專注於擴大以基因療法和酵素替代療法為中心的研究項目,以開發能夠解決該疾病根本原因的療法。製藥公司、學術研究團隊和生物技術創新者之間的合作有助於加速臨床開發和法規核准進程。此外,各公司也投資於先進的生產製造技術,以支持專業療法的穩定生產。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 意識提高和診斷水平提高

- 針對孤兒/罕見疾病的監管激勵措施

- 治療科學的進展

- 加大對罕見疾病醫療保健的投資

- 產業陷阱與挑戰

- 患者數量極少

- 臨床試驗和招募挑戰

- 市場機遇

- 開發治癒性/新型療法

- 病人登記和真實世界證據計劃

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前技術趨勢

- 新興科技及其影響

- 未來市場趨勢

- 監管里程碑加速市場准入

- 研發投資活動增加

- 加強粒線體療法的臨床驗證

- 定價分析

- 投資和融資環境

- 管道格局

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 擴張計劃

第5章:市場估計與預測:依治療方法分類,2021-2034年

- 主要趨勢

- 酵素替代療法

- 基因治療

- 支持性護理

- 幹細胞療法

- 其他治療方法

第6章:市場估計與預測:依藥物類別分類,2021-2034年

- 主要趨勢

- 心磷脂前驅物

- 抗氧化劑

- 免疫調節劑

- 膳食補充劑

- 抗生素

- 其他藥物類別

第7章:市場估計與預測:依給藥途徑分類,2021-2034年

- 主要趨勢

- 口服

- 靜脈

- 皮下

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 專科診所

- 其他最終用途

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott

- Amgen

- Amneal Pharmaceuticals

- B. Braun

- Boehringer Ingelheim

- Novartis

- Nutricia

- Pfizer

- Scenic Biotech

- Stealth BioTherapeutics

- Teva

- TransCellular Therapeutics (TCT)

The Global Barth Syndrome Treatment Market was valued at USD 157.1 million in 2024 and is estimated to grow at a CAGR of 11.2% to reach USD 442.3 million by 2034.

The market continues to expand as the number of diagnosed cases rises, awareness improves among clinicians and families, and significant advancements occur in gene-based and enzyme-focused therapies. The industry supports biotechnology developers, pharmaceutical companies, research institutions, and healthcare providers by offering specialized solutions for genetic research, therapeutic development, and patient care. Treatment options span gene therapy, enzyme replacement therapy, and supportive care aimed at improving cardiac and muscular symptoms while enhancing overall quality of life. Progress in gene therapy has strengthened market momentum, with emerging methods designed to correct TAZ gene mutations that drive the condition, potentially delivering long-term therapeutic benefits. Enzyme replacement therapies are evolving rapidly as they work to restore mitochondrial function and address the underlying biochemical defects. Supportive care, including pharmacologic management of cardiomyopathy and hematologic complications, continues to play a vital role in improving survival outcomes and sustaining market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $157.1 Million |

| Forecast Value | $442.3 Million |

| CAGR | 11.2% |

The enzyme replacement therapy segment held a 39.3% share in 2024 owing to its direct role in addressing tafazzin deficiency, which significantly improves mitochondrial activity and enhances patient outcomes. Its targeted mechanism, which replenishes the missing enzyme to support cardiac and muscular function, has positioned it as a leading treatment option for individuals with Barth syndrome.

The cardiolipin precursors segment held a 44.3% share in 2024 and is expected to reach USD 208.8 million during 2025-2034. These treatments command substantial usage because they help restore mitochondrial membrane stability, compensating for impaired cardiolipin remodeling caused by TAZ gene mutations, which disrupt energy production and cellular performance.

North America Barth Syndrome Treatment Market held a 35.3% share in 2024, supported by a highly developed healthcare infrastructure and widespread access to diagnostic testing for rare genetic disorders. Early detection enabled by next-generation sequencing and other advanced laboratory tools contributes to prompt therapeutic intervention and better long-term outcomes for patients.

Key companies active in the Global Barth Syndrome Treatment Market include Stealth BioTherapeutics, TransCellular Therapeutics (TCT), Abbott, Nutricia, Amneal Pharmaceuticals, Boehringer Ingelheim, Amgen, Teva, Novartis, Scenic Biotech, Pfizer, and B. Braun. Companies in the Barth Syndrome Treatment Market pursue several strategic approaches to reinforce their presence. Many focus on expanding research programs centered on gene therapy and enzyme replacement therapy to develop treatments capable of addressing the root cause of the disorder. Collaborations between pharmaceutical firms, academic research teams, and biotechnology innovators help accelerate clinical development and regulatory progress. Firms also invest in advanced manufacturing technologies to support consistent production of specialized therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Therapeutic approaches trends

- 2.2.3 Drug class trends

- 2.2.4 Route of administration trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising awareness & improved diagnostics

- 3.2.1.2 Regulatory incentives for orphan/rare diseases

- 3.2.1.3 Advances in therapeutic science

- 3.2.1.4 Growing healthcare investment in rare diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Extremely small patient population

- 3.2.2.2 Clinical trial & recruitment challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Development of curative/novel therapies

- 3.2.3.2 Patient registry & real-world evidence initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies and their impacts

- 3.6 Future market trends

- 3.6.1 Regulatory milestone accelerating market entry

- 3.6.2 Increased R&D and investment activity

- 3.6.3 Enhanced clinical validation for mitochondrial therapies

- 3.7 Pricing analysis

- 3.8 Investment and funding landscape

- 3.9 Pipeline landscape

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Therapeutic Approaches, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Enzyme replacement therapy

- 5.3 Gene therapy

- 5.4 Supportive care

- 5.5 Stem cell therapy

- 5.6 Other therapeutic approaches

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiolipin precursors

- 6.3 Antioxidants

- 6.4 Immunomodulators

- 6.5 Dietary supplements

- 6.6 Antibiotics

- 6.7 Other drug classes

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Intravenous

- 7.4 Subcutaneous

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Amgen

- 10.3 Amneal Pharmaceuticals

- 10.4 B. Braun

- 10.5 Boehringer Ingelheim

- 10.6 Novartis

- 10.7 Nutricia

- 10.8 Pfizer

- 10.9 Scenic Biotech

- 10.10 Stealth BioTherapeutics

- 10.11 Teva

- 10.12 TransCellular Therapeutics (TCT)