|

市場調查報告書

商品編碼

1876633

特種化學品回收市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Specialty Chemicals Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

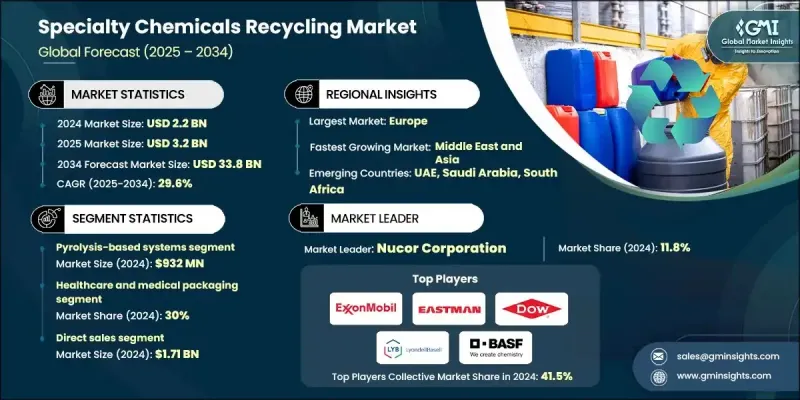

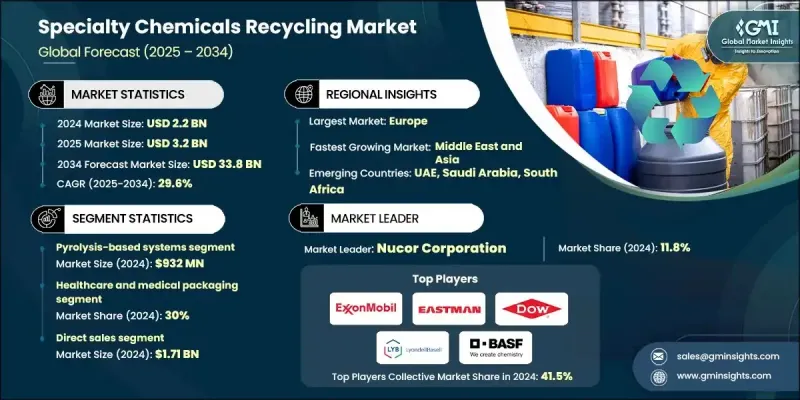

2024 年全球特用化學品回收市場價值為 22 億美元,預計到 2034 年將以 29.6% 的複合年成長率成長至 338 億美元。

隨著各行業日益重視回收溶劑、催化劑、顏料和其他特殊化學品副產品等原本會成為廢棄物的有價值材料,市場需求正在不斷成長。將這些材料回收為可重複使用的原料或中間體化學品,不僅能顯著降低原料消耗和製造成本,還能促進環境永續性和循環經濟目標的實現。蒸餾、薄膜分離、解聚和純化方法的創新正在改變回收格局,提高回收材料的效率和純度。自動化、數位化監控和流程最佳化軟體進一步提升了回收的一致性,降低了能源消耗,並增強了成本效益。這些因素使得特種化學品回收成為包括製藥、水處理、黏合劑、塗料和電子等行業在內的眾多行業中更具商業可行性和環境責任感的解決方案。已開發經濟體正以嚴格的永續發展法規引領潮流,而新興市場也穩定採用這些回收系統,以最大限度地減少浪費、降低生產成本並實現環境目標。向閉迴路生產系統的轉變,正使特種化學品回收成為全球工業永續發展的關鍵推動因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 338億美元 |

| 複合年成長率 | 29.6% |

2024年,基於熱解技術的系統創造了9.32億美元的產值。這些系統之所以引領市場,是因為它們能夠處理傳統回收方法無法處理的複雜且受污染的廢物流。熱解技術將混合化學材料轉化為可重複利用的原料,從而支持那些致力於循環生產模式和提高材料回收效率的產業。解聚技術緊隨其後,其優勢在於能夠回收高純度單體,這些單體可用於製造性能與原生材料相同的再生材料。對永續原料日益成長的關注以及減少對化石燃料依賴的努力,是推動熱解和解聚製程在多個工業領域廣泛應用的關鍵因素。

預計到2024年,醫療保健和醫療包裝領域將佔據30%的市場。該領域的成長主要得益於市場對藥品、醫療器材和一次性用品所需的無菌、耐用且易於操作的包裝解決方案的需求不斷成長。人口老化加劇、醫療保健支出不斷攀升以及衛生法規日益嚴格,都進一步強化了醫療保健生態系統對先進可回收包裝材料的需求。此外,由於電動車和自動駕駛汽車技術的快速發展,汽車產業也取得了顯著進展,這些技術需要創新且永續的包裝和化學解決方案來保護其複雜的電子和感測器系統。

2024年,美國特用化學品回收市場規模達5.694億美元。在北美,由於建築和汽車行業的強勁需求,特種化學品回收行業持續擴張。在美國,電動車的快速普及和節能建築實踐的推廣,增加了對鋼鐵和鋁等再生材料的需求。加拿大在工業廢料和廢棄物中金屬和化學品的回收利用方面取得了顯著進展,這得益於其對永續發展和循環經濟實踐的國家承諾。這些因素共同推動該地區轉型為資源高效型製造和永續工業營運。

全球特種化學品回收市場的主要參與者包括科思創、雪佛龍菲利普斯化學公司、巴斯夫公司、伊士曼化學公司、陶氏公司、帝斯曼-菲美意公司、阿科瑪公司、贏創工業集團、埃克森美孚公司、利安德巴塞爾公司、江蘇東方盛宏公司、Indorama Ventures公司、馬來西亞國家石油化學集團、三菱工業公司。這些市場領導者正致力於創新、合作和產能擴張,以鞏固其市場地位。許多企業正在投資先進的回收技術,例如熱解、解聚和溶劑回收,以提高製程效率和材料品質。它們正與工業製造商和研究機構建立策略聯盟和合資企業,以加速高純度再生化學品的商業化。此外,各公司也正在採用數位化和自動化技術來最佳化回收操作、降低成本並提高可追溯性。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 原料成本上漲

- 回收製程的技術進步

- 終端用戶產業的需求不斷成長

- 成長促進因素

- 產業陷阱與挑戰

- 高初始投資

- 市場對再生化學品的需求波動

- 市場機遇

- 先進回收技術的發展

- 用於化學廢棄物交易的數位平台

- 利用回收化學品進行產品創新

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依技術類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依技術類型分類,2021-2034年

- 主要趨勢

- 基於熱解的系統

- 解聚技術

- 溶解和純化

- 氣化和熱處理

- 新興和混合技術

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 醫療保健和醫療包裝

- 汽車應用

- 電子和半導體

- 包裝產業

- 建築材料

- 其他工業應用

第7章:市場估計與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直銷

- 線上

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Arkema

- BASF SE

- Chevron Phillips Chemical

- Covestro

- DSM-Firmenich

- Dow Inc.

- Eastman Chemical

- Evonik Industrie

- ExxonMobil

- Indorama Ventures

- Jiangsu Eastern Shenghong

- LyondellBasell

- Mitsubishi Chemical

- PETRONAS Chemical Group

- SABIC

The Global Specialty Chemicals Recycling Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 29.6% to reach USD 33.8 billion by 2034.

The market is gaining traction as industries increasingly focus on recovering valuable materials such as solvents, catalysts, pigments, and other specialty chemical by-products that would otherwise become waste. Recycling these materials into reusable feedstocks or intermediate chemicals significantly reduces raw material consumption and manufacturing costs while promoting environmental sustainability and circular economy goals. Technological advancements are transforming the recycling landscape through innovations in distillation, membrane separation, depolymerization, and purification methods, enabling greater efficiency and purity in recovered materials. Automation, digital monitoring, and process optimization software are further improving consistency, reducing energy usage, and enhancing cost-effectiveness. These factors make specialty chemical recycling a more commercially viable and environmentally responsible solution across industries, including pharmaceuticals, water treatment, adhesives, coatings, and electronics. Developed economies are taking the lead with stringent sustainability regulations, while emerging markets are steadily adopting these recycling systems to minimize waste, lower production costs, and meet environmental targets. The shift toward closed-loop production systems is positioning specialty chemical recycling as a key enabler of global industrial sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $33.8 Billion |

| CAGR | 29.6% |

The pyrolysis-based systems generated USD 932 million in 2024. These systems are leading the market due to their capability to process complex and contaminated waste streams that conventional recycling methods cannot manage. Pyrolysis technology converts mixed chemical materials into reusable feedstocks, supporting industries striving for circular production models and material recovery efficiency. Depolymerization technologies closely follow, offering the advantage of recovering high-purity monomers that can be used to manufacture recycled materials with identical performance to their virgin counterparts. The rising focus on sustainable raw materials and the drive to reduce dependency on fossil-based inputs are key factors encouraging the widespread adoption of both pyrolysis and depolymerization processes across multiple industrial sectors.

The healthcare and medical packaging segment held a 30% share in 2024. This segment's growth is fueled by increasing demand for sterile, durable, and easy-to-handle packaging solutions for pharmaceuticals, medical devices, and disposable products. The expanding aging population, along with rising healthcare expenditure and stricter hygiene regulations, has strengthened the need for advanced recyclable packaging materials in the healthcare ecosystem. The automotive sector is also witnessing significant progress due to technological evolution in electric and autonomous vehicles, which require innovative and sustainable packaging and chemical solutions for intricate electronic and sensor systems.

U.S. Specialty Chemicals Recycling Market accounted for USD 569.4 million in 2024. In North America, the specialty chemicals recycling industry continues to expand due to strong demand from the construction and automotive sectors. In the U.S., the rapid adoption of electric vehicles and energy-efficient building practices is increasing the need for recycled materials such as steel and aluminum. Canada is advancing in metal and chemical recovery from both industrial and obsolete waste, driven by its national commitment to sustainability and circular economy practices. Together, these factors are propelling the region's transition toward resource-efficient manufacturing and sustainable industrial operations.

Prominent players active in the Global Specialty Chemicals Recycling Market include Covestro, Chevron Phillips Chemical, BASF SE, Eastman Chemical, Dow Inc., DSM-Firmenich, Arkema, Evonik Industries, ExxonMobil, LyondellBasell, Jiangsu Eastern Shenghong, Indorama Ventures, PETRONAS Chemical Group, Mitsubishi Chemical, and SABIC. Leading companies in the Specialty Chemicals Recycling Market are focusing on innovation, collaboration, and capacity expansion to strengthen their market foothold. Many are investing in advanced recycling technologies such as pyrolysis, depolymerization, and solvent recovery to enhance process efficiency and material quality. Strategic alliances and joint ventures with industrial manufacturers and research organizations are being formed to accelerate the commercialization of high-purity recycled chemicals. Firms are also adopting digitalization and automation to optimize recycling operations, reduce costs, and improve traceability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology type

- 2.2.2 Application

- 2.2.3 Distribution channel

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising raw material costs

- 3.2.1.2 Technological advancements in recycling processes

- 3.2.1.3 Growing demand from End use industries

- 3.2.1 Growth drivers

- 3.3 Industry pitfalls and challenges

- 3.3.1 High initial investment

- 3.3.2 Fluctuating market demand for recycled chemicals

- 3.4 Market opportunities

- 3.4.1 Development of advanced recycling technologies

- 3.4.2 Digital platforms for chemical waste trading

- 3.4.3 Product innovation using recycled chemicals

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By technology type

- 3.11 Future market trends

- 3.12 Technology and innovation landscape

- 3.12.1 Current technological trends

- 3.12.2 Emerging technologies

- 3.13 Patent landscape

- 3.14 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.14.1 Major importing countries

- 3.14.2 Major exporting countries

- 3.15 Sustainability and environmental aspects

- 3.15.1 Sustainable practices

- 3.15.2 Waste reduction strategies

- 3.15.3 Energy efficiency in production

- 3.15.4 Eco-friendly initiatives

- 3.16 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Pyrolysis-based systems

- 5.3 Depolymerization technologies

- 5.4 Dissolution and purification

- 5.5 Gasification and thermal processing

- 5.6 Emerging and hybrid technologies

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Healthcare and medical packaging

- 6.3 Automotive applications

- 6.4 Electronics and semiconductors

- 6.5 Packaging industries

- 6.6 Construction and building materials

- 6.7 Other industrial applications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Online

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arkema

- 9.2 BASF SE

- 9.3 Chevron Phillips Chemical

- 9.4 Covestro

- 9.5 DSM-Firmenich

- 9.6 Dow Inc.

- 9.7 Eastman Chemical

- 9.8 Evonik Industrie

- 9.9 ExxonMobil

- 9.10 Indorama Ventures

- 9.11 Jiangsu Eastern Shenghong

- 9.12 LyondellBasell

- 9.13 Mitsubishi Chemical

- 9.14 PETRONAS Chemical Group

- 9.15 SABIC