|

市場調查報告書

商品編碼

1876627

電動車充電負載管理系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Electric Vehicle Charging Load Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

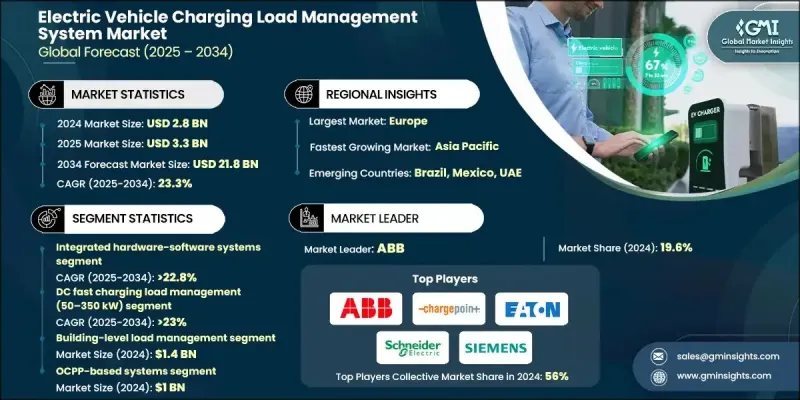

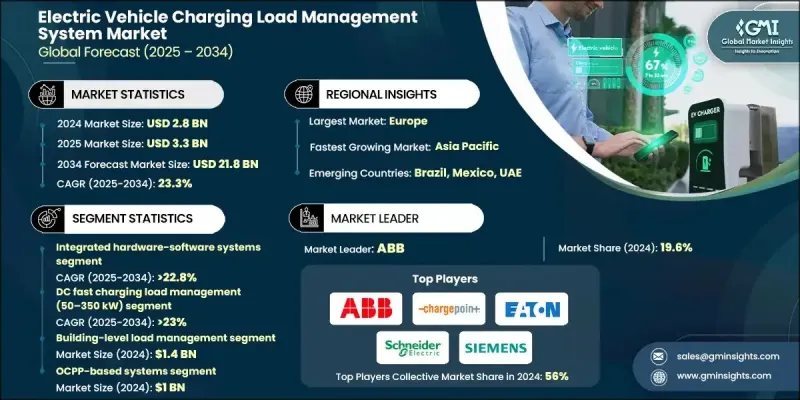

2024 年全球電動車充電負載管理系統市場價值為 28 億美元,預計到 2034 年將以 23.3% 的複合年成長率成長至 218 億美元。

電動車的快速普及、電動車保有量的不斷擴大以及對智慧能源管理解決方案日益成長的需求,共同推動了市場成長。隨著充電基礎設施、電網連接和儲能系統的進步,各利益相關方正致力於最大限度地提高營運效率、整合智慧電網解決方案並最佳化負載分配,以確保充電網路的可靠性和成本效益。該產業正朝著互聯、自動化和數據驅動的營運模式發展,不僅改變了傳統的能源管理方式,也重新定義了充電網路的監控和維護方式。對數位平台、預測性能源調度和人工智慧控制系統的投資不斷增加,為建構更具可擴展性、彈性和效率的電動車充電生態系統創造了機會。物聯網連接的充電站、基於人工智慧的負載平衡解決方案以及雲端能源管理平台的日益普及,正在重塑整個產業格局。這些技術有助於即時監控電網需求、預測負載分配,並實現公用事業公司、充電營運商和車隊管理人員之間的無縫協調。透過利用智慧電錶、遠端資訊處理和人工智慧分析,營運商可以提高能源效率,降低峰值負載壓力,降低營運成本,從而打造更智慧、更具彈性的充電網路。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 218億美元 |

| 複合年成長率 | 23.3% |

2024年,軟硬體一體化系統市佔率佔比達37%,預計2025年至2034年將以22.8%的複合年成長率成長。該細分市場透過將智慧充電器、動態負載控制器、儲能介面和通訊模組整合到統一平台中,對於確保電動車的最佳充電、電網可靠性和能源效率至關重要。高壓充電網路日益複雜,對人工智慧驅動的控制演算法、先進的監控技術和熟練的操作人員的需求也隨之增加,以實現精準的能源分配。

直流快速充電負載管理領域(50-350千瓦)在2024年佔據36%的市場佔有率,預計到2034年將以23%的複合年成長率成長。該領域的成長主要得益於大容量充電器的部署、對縮短電動車充電時間的需求以及對電網最佳化智慧負載平衡解決方案的需求。營運商正大力投資人工智慧驅動的負載最佳化、預測性調度、即時監控和雲端管理平台,以提高充電器利用率、緩解高峰需求壓力並提升營運效率。

預計2024年,德國電動車充電負載管理系統市場規模將達到2.878億美元,佔31%的市場。德國擁有強大的工業實力、智慧電網應用的領先地位以及先進的高功率充電技術。德國的發展趨勢包括基於人工智慧的負載平衡、即時快速充電樁監控、預測性能源管理以及在商業、公共和車隊充電網路中整合車網互動(V2G)技術。

電動車充電負載管理系統市場的主要參與者包括 Wallbox NV、Enel X、ABB、EV Connect、伊頓公司、特斯拉、施耐德電氣、ChargePoint Holdings、西門子股份公司和殼牌充電解決方案。這些公司致力於技術創新、策略合作和地理擴張,以鞏固其市場地位。他們投資研發,開發基於人工智慧、雲端和物聯網的解決方案,以最佳化能源利用和負載分配。與公用事業公司、車隊營運商和政府專案的合作有助於更快地滲透市場並遵守不斷變化的法規。各公司正在擴展基礎設施和服務網路,以提高可及性和營運效率。併購和聯盟有助於產品組合多元化、增強技術能力並鞏固市場佔有率。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電動車普及率上升及車隊規模擴張

- 先進的充電基礎設施

- 物聯網與人工智慧整合

- 電網可靠性和能源效率

- 產業陷阱與挑戰

- 高額基礎建設投資

- 整合的複雜性

- 市場機遇

- 預測性和遠端管理服務

- 永續發展和循環經濟計劃

- 軟體驅動與人工智慧賦能的解決方案

- 公私合營基礎建設

- 成長促進因素

- 成長潛力分析

- 監管環境

- 政府政策促進電動車普及

- 電網規範與能源管理標準

- 減排和永續發展法規

- 安全和高壓系統合規性

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 人工智慧驅動的負載最佳化

- 物聯網賦能的監控與連接

- 雲端整合管理平台

- 基於標準的通訊協議

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 最佳情況

- 未來展望與策略建議

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依技術架構分類,2021-2034年

- 主要趨勢

- 整合硬體-軟體系統

- 基於硬體的負載管理系統

- 基於軟體的負載管理系統

第6章:市場估算與預測:依功率管理等級分類,2021-2034年

- 主要趨勢

- 建築級負載管理

- 面板級負載管理

- 電路級負載管理

- 電網級負載管理

第7章:市場估算與預測:依通訊協定分類,2021-2034年

- 主要趨勢

- 基於OCPP的系統

- 基於 ISO 15118 的系統

- 專有協定系統

- 基於IEEE 5的系統

第8章:市場估算與預測:依功率等級分類,2021-2034年

- 主要趨勢

- 直流快速充電負載管理(50-350千瓦)

- 二級交流負載管理(3.3-22千瓦)

- 1 級交流負載管理(≤1.9 kW)

- 兆瓦級充電系統負載管理(>1兆瓦)

第9章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 公共收費

- 車隊充電

- 住宅收費

- 其他

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第11章:公司簡介

- Global Player

- ABB

- BP Pulse

- ChargePoint Holdings

- Eaton Corporation

- Schneider Electric SE

- Shell Recharge Solutions

- Siemens AG

- Tesla

- Regional Player

- Allego NV

- EV Connect

- EVBox (ENGIE)

- Gridserve Holdings

- gridX GmbH

- InstaVolt Limited

- SWTCH Energy

- Virta

- Wallbox

- 新興參與者

- Ampcontrol Pty

- Bolt.Earth

- CyberSwitching

- Enphase Energy

- Wevo Energy

The Global Electric Vehicle Charging Load Management System Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 23.3% to reach USD 21.8 billion by 2034.

The market's growth is propelled by the rapid rise of electric vehicle adoption, expanding EV fleets, and the increasing requirement for intelligent energy management solutions. As charging infrastructure, grid connectivity, and energy storage systems advance, stakeholders are focusing on maximizing operational efficiency, integrating smart grid solutions, and optimizing load distribution to ensure reliable and cost-effective charging networks. The sector is moving toward connected, automated, and data-driven operations, transforming conventional approaches to energy management and redefining how charging networks are monitored and maintained. Rising investments in digital platforms, predictive energy scheduling, and AI-enabled control systems are creating opportunities for more scalable, resilient, and efficient EV charging ecosystems. The increasing deployment of IoT-connected charging stations, AI-based load balancing solutions, and cloud-enabled energy management platforms is reshaping the industry. These technologies facilitate real-time monitoring of grid demand, predictive load allocation, and seamless coordination between utilities, charging operators, and fleet managers. By leveraging smart meters, telematics, and AI analytics, operators can enhance energy efficiency, reduce peak load stress, and lower operational costs, enabling a smarter, more resilient charging network.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $21.8 Billion |

| CAGR | 23.3% |

The integrated hardware-software systems segment accounted for 37% share in 2024 and is expected to grow at a CAGR of 22.8% from 2025 to 2034. This segment is central to ensuring optimal EV charging, grid reliability, and energy efficiency by combining smart chargers, dynamic load controllers, energy storage interfaces, and communication modules into unified platforms. The rising complexity of high-voltage charging networks has increased demand for AI-driven control algorithms, advanced monitoring, and skilled operators to manage precise energy distribution.

The DC fast charging load management segment (50-350 kW) held 36% share in 2024 and is forecasted to grow at a CAGR of 23% through 2034. Growth in this segment is fueled by the deployment of high-capacity chargers, the need for reduced EV charging times, and the demand for grid-optimized, smart load balancing solutions. Operators are investing heavily in AI-powered load optimization, predictive scheduling, real-time monitoring, and cloud management platforms to enhance charger utilization, ease peak demand pressure, and improve operational efficiency.

Germany Electric Vehicle Charging Load Management System Market generated USD 287.8 million and held a 31% share in 2024. The country benefits from strong industrial capabilities, leadership in smart grid adoption, and advanced high-power charging technologies. Trends in Germany include AI-based load balancing, real-time fast charger monitoring, predictive energy management, and vehicle-to-grid (V2G) integration across commercial, public, and fleet charging networks.

Key players in the Electric Vehicle Charging Load Management System Market include Wallbox N.V., Enel X, ABB, EV Connect, Eaton Corporation, Tesla, Schneider Electric SE, ChargePoint Holdings, Siemens AG, and Shell Recharge Solutions. Companies in the Electric Vehicle Charging Load Management System Market are focusing on technological innovation, strategic partnerships, and geographic expansion to strengthen their market presence. They invest in R&D to develop AI-driven, cloud-based, and IoT-enabled solutions that optimize energy use and load distribution. Collaborations with utilities, fleet operators, and government programs allow faster market penetration and compliance with evolving regulations. Firms are expanding infrastructure and service networks to improve accessibility and operational efficiency. Mergers, acquisitions, and alliances help diversify product portfolios, enhance technological capabilities, and consolidate market share.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology Architecture

- 2.2.3 Power Management Level

- 2.2.4 Communication Protocol

- 2.2.5 Power Rating

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising EV adoption & fleet expansion

- 3.2.1.2 Advanced charging infrastructure

- 3.2.1.3 IoT & AI integration

- 3.2.1.4 Grid reliability & energy efficiency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High infrastructure investment

- 3.2.2.2 Complexity of integration

- 3.2.3 Market opportunities

- 3.2.3.1 Predictive & remote management services

- 3.2.3.2 Sustainability & circular economy initiatives

- 3.2.3.3 Software-driven and AI-enabled solutions

- 3.2.3.4 Public-private infrastructure expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Government policies promoting EV adoption

- 3.4.2 Grid codes and energy management standards

- 3.4.3 Emission reduction and sustainability regulations

- 3.4.4 Safety and high-voltage system compliance

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 AI-powered load optimization

- 3.7.2 IoT-enabled monitoring and connectivity

- 3.7.3 Cloud-integrated management platforms

- 3.7.4 Standards-based communication protocols

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Best case scenarios

- 3.14 Future Outlook & Strategic Recommendations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Technology Architecture, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Integrated hardware-software system

- 5.3 Hardware-based load management system

- 5.4 Software-based load management system

Chapter 6 Market Estimates & Forecast, By Power Management Level, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Building-level load management

- 6.3 Panel-level load management

- 6.4 Circuit-level load management

- 6.5 Grid-level load management

Chapter 7 Market Estimates & Forecast, By Communication Protocol, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 OCPP-based system

- 7.3 ISO 15118-based system

- 7.4 Proprietary protocol system

- 7.5 IEEE 2030.5-based system

Chapter 8 Market Estimates & Forecast, By Power Rating, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 DC fast charging load management (50-350 kW)

- 8.3 Level 2 ac load management (3.3-22 kW)

- 8.4 Level 1 ac load management (≤1.9 kW)

- 8.5 Megawatt charging system load management (>1 MW)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 Public charging

- 9.3 Fleet charging

- 9.4 Residential charging

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 ABB

- 11.1.2 BP Pulse

- 11.1.3 ChargePoint Holdings

- 11.1.4 Eaton Corporation

- 11.1.5 Schneider Electric SE

- 11.1.6 Shell Recharge Solutions

- 11.1.7 Siemens AG

- 11.1.8 Tesla

- 11.2 Regional Player

- 11.2.1 Allego N.V.

- 11.2.2 EV Connect

- 11.2.3 EVBox (ENGIE)

- 11.2.4 Gridserve Holdings

- 11.2.5 gridX GmbH

- 11.2.6 InstaVolt Limited

- 11.2.7 SWTCH Energy

- 11.2.8 Virta

- 11.2.9 Wallbox

- 11.3 Emerging Players

- 11.3.1 Ampcontrol Pty

- 11.3.2 Bolt.Earth

- 11.3.3 CyberSwitching

- 11.3.4 Enphase Energy

- 11.3.5 Wevo Energy