|

市場調查報告書

商品編碼

1876622

Transformer最佳化型AI晶片市場機會、成長促進因素、產業趨勢分析及2025-2034年預測Transformer-Optimized AI Chip Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

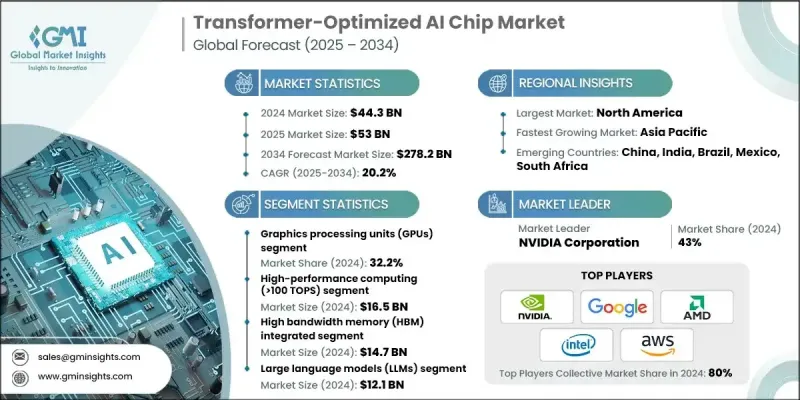

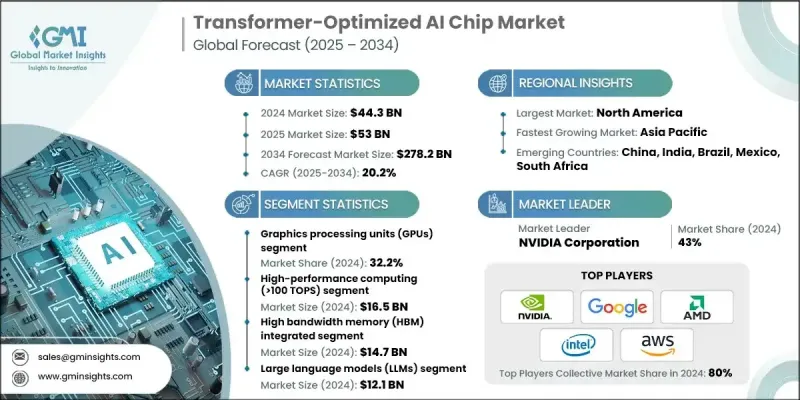

2024 年全球 Transformer 最佳化型 AI 晶片市值為 443 億美元,預計到 2034 年將以 20.2% 的複合年成長率成長至 2782 億美元。

隨著各行業對專用硬體的需求日益成長,市場正經歷快速成長,這些硬體旨在加速基於Transformer的架構和大型語言模型(LLM)的運算。在AI訓練和推理工作負載中,高吞吐量、低延遲和高能源效率至關重要,而這些晶片正變得不可或缺。採用Transformer最佳化運算單元、高頻寬記憶體和先進互連技術的領域特定架構的興起,正在推動下一代AI生態系統的廣泛應用。雲端運算、邊緣AI和自主系統等領域正在整合這些晶片,以處理即時分析、生成式AI和多模態應用。晶片整合和領域特定加速器的出現正在改變AI系統的擴展方式,從而實現更高的性能和效率。同時,記憶體層次結構和封裝技術的進步正在降低延遲並提高運算密度,使Transformer能夠更靠近處理單元運作。這些進步正在重塑全球AI基礎設施,Transformer最佳化晶片正處於高性能、高能源效率和可擴展AI處理的核心地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 443億美元 |

| 預測值 | 2782億美元 |

| 複合年成長率 | 20.2% |

到2024年,圖形處理器(GPU)市佔率將達到32.2%。 GPU之所以被廣泛採用,是因為其生態系統成熟、平行運算能力強大,並且在執行基於Transformer的工作負載方面久經考驗。 GPU能夠為大型語言模式的訓練和推理提供大量吞吐量,這使其成為金融、醫療保健和雲端服務等行業不可或缺的工具。憑藉其靈活性、廣泛的開發者支援和高運算密度,GPU仍然是資料中心和企業環境中人工智慧加速的基礎。

2024年,算力超過100 TOPS的高效能運算(HPC)市場規模將達到165億美元,佔37.2%的市佔率。這些晶片對於訓練需要極高並行性和吞吐量的大型Transformer模型至關重要。 HPC級處理器被部署在人工智慧驅動的企業、超大規模資料中心和研究機構中,用於處理諸如複雜的多模態人工智慧、大批量推理以及涉及數十億參數的LLM訓練等高要求應用。它們對加速運算工作負載的貢獻,使HPC晶片成為人工智慧創新和基礎設施可擴展性的基石。

2024年,北美變壓器最佳化型人工智慧晶片市佔率達到40.2%。該地區的領先地位源於雲端服務提供者、人工智慧研究實驗室以及政府支持的促進國內半導體生產的舉措的大量投資。晶片設計商、代工廠和人工智慧解決方案提供商之間的緊密合作持續推動著市場成長。主要技術領導者的存在以及對人工智慧基礎設施建設的持續投入,正在增強北美在高效能運算和基於變壓器的技術領域的競爭優勢。

全球Transformer最佳化型AI晶片市場的主要參與者包括NVIDIA公司、英特爾公司、AMD公司、三星電子有限公司、Google(Alphabet公司)、微軟公司、特斯拉公司、高通科技公司、百度公司、華為科技有限公司、阿里巴巴集團、亞馬遜網路服務公司、蘋果公司、Cerebras Systems、GraphcoreN、SiMa、Astoren、SiMa. Systems、Astoren、Spaunran、Astoren、SiMama、Mythic、Sambau Systems、Sambaui、SiMa.這些領先企業正致力於創新、策略聯盟和擴大生產規模,以鞏固其全球地位。各公司正大力投資研發,以打造針對Transformer和LLM工作負載最佳化的節能高效、高吞吐量晶片。與超大規模資料中心、雲端服務供應商和AI新創公司的合作正在促進運算生態系統的整合。許多企業正透過將軟體框架與硬體解決方案結合,實現垂直整合,從而提供完整的AI加速平台。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 對LLM和Transformer架構的需求不斷成長

- 人工智慧訓練和推理工作負載的快速成長

- Transformer 計算的特定領域加速器

- 邊緣和分散式變壓器部署

- 先進的封裝與記憶體層次結構創新

- 產業陷阱與挑戰

- 高昂的開發成本與研發複雜性

- 熱管理和功率效率限制

- 市場機遇

- 擴展到大型語言模型(LLM)和生成式人工智慧

- 邊緣和分散式人工智慧部署

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

- 技術格局

- 當前趨勢

- 新興技術

- 管道分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依晶片類型分類,2021-2034年

- 主要趨勢

- 神經處理單元(NPU)

- 圖形處理單元(GPU)

- 張量處理單元(TPU)

- 專用積體電路(ASIC)

- 現場可程式閘陣列(FPGA)

第6章:市場估算與預測:依性能等級分類,2021-2034年

- 主要趨勢

- 高效能運算(>100 TOPS)

- 中等性能(10-100 TOPS)

- 邊緣/移動性能(1-10 TOPS)

- 超低功耗(<1 TOPS)

第7章:市場估算與預測:依記憶體容量分類,2021-2034年

- 主要趨勢

- 高頻寬記憶體 (HBM) 整合

- 片上SRAM最佳化

- 記憶體處理(PIM)

- 分散式記憶體系統

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 大型語言模型(LLM)

- 電腦視覺 Transformer (ViTs)

- 多模態人工智慧系統

- 生成式人工智慧應用

- 其他

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 科技與雲端服務

- 汽車與運輸

- 醫療保健與生命科學

- 金融服務

- 電信

- 工業與製造業

- 其他

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Advanced Micro Devices (AMD)

- Alibaba Group

- Amazon Web Services

- Apple Inc.

- Baidu, Inc.

- Cerebras Systems, Inc.

- Google (Alphabet Inc.)

- Groq, Inc.

- Graphcore Ltd.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Microsoft Corporation

- Mythic AI

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- SiMa.ai

- SambaNova Systems, Inc.

- Tenstorrent Inc.

- Tesla, Inc.

The Global Transformer-Optimized AI Chip Market was valued at USD 44.3 billion in 2024 and is estimated to grow at a CAGR of 20.2% to reach USD 278.2 billion by 2034.

The market is witnessing rapid growth as industries increasingly demand specialized hardware designed to accelerate transformer-based architectures and large language model (LLM) operations. These chips are becoming essential in AI training and inference workloads where high throughput, reduced latency, and energy efficiency are critical. The shift toward domain-specific architectures featuring transformer-optimized compute units, high-bandwidth memory, and advanced interconnect technologies is fueling adoption across next-generation AI ecosystems. Sectors such as cloud computing, edge AI, and autonomous systems are integrating these chips to handle real-time analytics, generative AI, and multi-modal applications. The emergence of chiplet integration and domain-specific accelerators is transforming how AI systems scale, enabling higher performance and efficiency. At the same time, developments in memory hierarchies and packaging technologies are reducing latency while improving computational density, allowing transformers to operate closer to processing units. These advancements are reshaping AI infrastructure globally, with transformer-optimized chips positioned at the center of high-performance, energy-efficient, and scalable AI processing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.3 Billion |

| Forecast Value | $278.2 Billion |

| CAGR | 20.2% |

The graphics processing unit (GPU) segment held a 32.2% share in 2024. GPUs are widely adopted due to their mature ecosystem, strong parallel computing capability, and proven effectiveness in executing transformer-based workloads. Their ability to deliver massive throughput for training and inference of large language models makes them essential across industries such as finance, healthcare, and cloud-based services. With their flexibility, extensive developer support, and high computational density, GPUs remain the foundation of AI acceleration in data centers and enterprise environments.

The high-performance computing (HPC) segment exceeding 100 TOPS segment generated USD 16.5 billion in 2024, capturing a 37.2% share. These chips are indispensable for training large transformer models that require enormous parallelism and extremely high throughput. HPC-class processors are deployed across AI-driven enterprises, hyperscale data centers, and research facilities to handle demanding applications such as complex multi-modal AI, large-batch inference, and LLM training involving billions of parameters. Their contribution to accelerating computing workloads has positioned HPC chips as a cornerstone of AI innovation and infrastructure scalability.

North America Transformer-Optimized AI Chip Market held a 40.2% share in 2024. The region's leadership stems from substantial investments by cloud service providers, AI research labs, and government-backed initiatives promoting domestic semiconductor production. Strong collaboration among chip designers, foundries, and AI solution providers continues to propel market growth. The presence of major technology leaders and continued funding in AI infrastructure development are strengthening North America's competitive advantage in high-performance computing and transformer-based technologies.

Prominent companies operating in the Global Transformer-Optimized AI Chip Market include NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD), Samsung Electronics Co., Ltd., Google (Alphabet Inc.), Microsoft Corporation, Tesla, Inc., Qualcomm Technologies, Inc., Baidu, Inc., Huawei Technologies Co., Ltd., Alibaba Group, Amazon Web Services, Apple Inc., Cerebras Systems, Inc., Graphcore Ltd., SiMa.ai, Mythic AI, Groq, Inc., SambaNova Systems, Inc., and Tenstorrent Inc. Leading companies in the Transformer-Optimized AI Chip Market are focusing on innovation, strategic alliances, and manufacturing expansion to strengthen their global presence. Firms are heavily investing in research and development to create energy-efficient, high-throughput chips optimized for transformer and LLM workloads. Partnerships with hyperscalers, cloud providers, and AI startups are fostering integration across computing ecosystems. Many players are pursuing vertical integration by combining software frameworks with hardware solutions to offer complete AI acceleration platforms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Chip types trends

- 2.2.2 Performance class trends

- 2.2.3 Memory trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.2.6 Regional trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for LLMs and transformer architectures

- 3.2.1.2 Rapid growth of AI training and inference workloads

- 3.2.1.3 Domain-specific accelerators for transformer compute

- 3.2.1.4 Edge and distributed transformer deployment

- 3.2.1.5 Advanced packaging and memory-hierarchy innovations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Development Costs and R&D Complexity

- 3.2.2.2 Thermal Management and Power Efficiency Constraints

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into Large Language Models (LLMs) and Generative AI

- 3.2.3.2 Edge and Distributed AI Deployment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Chip Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Neural Processing Units (NPUs)

- 5.3 Graphics Processing Units (GPUs)

- 5.4 Tensor Processing Units (TPUs)

- 5.5 Application-Specific Integrated Circuits (ASICs)

- 5.6 Field-Programmable Gate Arrays (FPGAs)

Chapter 6 Market Estimates and Forecast, By Performance Class, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 High-Performance Computing (>100 TOPS)

- 6.3 Mid-Range Performance (10-100 TOPS)

- 6.4 Edge/Mobile Performance (1-10 TOPS)

- 6.5 Ultra-Low Power (<1 TOPS)

Chapter 7 Market Estimates and Forecast, By Memory, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 High Bandwidth Memory (HBM) Integrated

- 7.3 On-Chip SRAM Optimized

- 7.4 Processing-in-Memory (PIM)

- 7.5 Distributed Memory Systems

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Large Language Models (LLMs)

- 8.3 Computer Vision Transformers (ViTs)

- 8.4 Multimodal AI Systems

- 8.5 Generative AI Applications

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 Technology & Cloud Services

- 9.3 Automotive & Transportation

- 9.4 Healthcare & Life Sciences

- 9.5 Financial Services

- 9.6 Telecommunications

- 9.7 Industrial & Manufacturing

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Advanced Micro Devices (AMD)

- 11.2 Alibaba Group

- 11.3 Amazon Web Services

- 11.4 Apple Inc.

- 11.5 Baidu, Inc.

- 11.6 Cerebras Systems, Inc.

- 11.7 Google (Alphabet Inc.)

- 11.8 Groq, Inc.

- 11.9 Graphcore Ltd.

- 11.10 Huawei Technologies Co., Ltd.

- 11.11 Intel Corporation

- 11.12 Microsoft Corporation

- 11.13 Mythic AI

- 11.14 NVIDIA Corporation

- 11.15 Qualcomm Technologies, Inc.

- 11.16 Samsung Electronics Co., Ltd.

- 11.17 SiMa.ai

- 11.18 SambaNova Systems, Inc.

- 11.19 Tenstorrent Inc.

- 11.20 Tesla, Inc.