|

市場調查報告書

商品編碼

1876614

鑽井廢棄物處理與處置市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Treatment and Disposal Drilling Waste Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

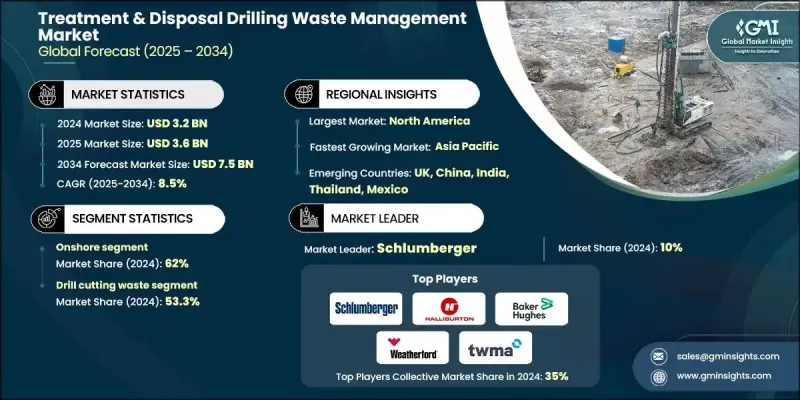

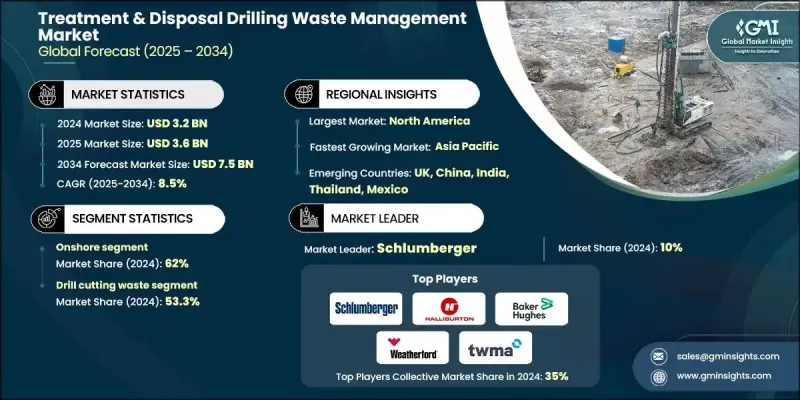

2024 年全球鑽井廢棄物處理和處置市場價值為 32 億美元,預計到 2034 年將以 8.5% 的複合年成長率成長至 75 億美元。

全球日益嚴格的環境法規推動了石油和天然氣產業的擴張,迫使石油和天然氣業者遵守更嚴格的危險廢棄物處理、排放控制和水污染預防標準。這些不斷變化的法規正在推動對創新廢棄物處理系統和合規基礎設施的大規模投資。強調減少垃圾掩埋、控制排放和回收利用的框架正在重塑整個產業的服務模式。此外,對生產者延伸責任和廢棄物最小化目標的日益重視也促使油田業者將永續技術融入其工作流程。隨著水力壓裂和水平鑽井等非常規鑽井方法的日益普及,鑽井廢棄物的數量和複雜性顯著增加。這些技術會產生更高濃度的受污染岩屑、泥漿和採出水,加劇了對先進處理、封存和回收系統的需求。預計未來幾年,北美和亞洲頁岩油和緻密油探勘的持續成長將加速對鑽井廢棄物管理解決方案的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 75億美元 |

| 複合年成長率 | 8.5% |

2024年,陸上鑽井業務佔比達62%,預計到2034年將以8%的複合年成長率成長。陸上鑽井廢棄物管理需求激增源自於非常規能源生產的擴張,其產生的岩屑、採出水和鑽井液量遠超過傳統探勘。緻密頁岩地層產生的廢棄物成分複雜,需採用離心、固化和生物修復等先進處理技術。

鑽屑廢棄物市場佔有率佔比達53.3%,預計到2034年將以7.8%的複合年成長率成長。作為鑽井作業中產生的最主要廢棄物之一,鑽屑的處理方式正從傳統的異地處置轉向現場處理和再利用。熱脫附和固控系統等技術正被擴大應用於鑽井現場直接處理廢棄物,回收可用流體,並最大限度地減少運輸需求,從而提高效率和永續性。

2024年,美國鑽井廢棄物處理與處置市場規模預計將達7億美元。該國市場成長的主要驅動力是監管力度加大以及主要油氣產區鑽井活動的增加。美國環保署(EPA)和土地管理局(BLM)已實施新的甲烷控制和廢棄物處理指南,促使營運商採用固化、熱脫附和生物修復等現代處理技術。

活躍於鑽井廢棄物處理與處置管理市場的知名企業包括貝克休斯(Baker Hughes)、奧吉安公司(Augean Plc)、潔淨港灣公司(Clean Harbors, Inc.)、哈里伯頓公司(Halliburton)、斯倫貝謝公司(Schlumberger)、威德福公司(Weatherford Energy)、TWMA、Secverford Energy, Inc. Services、Derrick Equipment Company、Newpark Resources Inc.、NOV Inc.、GN Solids Control、Imdex Limited、Ridgeline Canada Inc.、Select Water Solutions、Soli-Bond, Inc.、Tidal Logistics 和 Environmental Development Company Ltd.。市場領導者正致力於技術創新、產能擴張和策略合作,以鞏固其在鑽井廢棄物管理領域的地位。各公司正大力投資先進的處理技術,例如熱脫附、生物修復和離心分離,以提供經濟高效且符合環保要求的解決方案。許多公司正與探勘和生產公司建立長期服務聯盟,以確保穩定的需求,同時擴大其區域影響力。向新興鑽井區域擴張以及數位化監控系統的整合,正在幫助企業提高營運效率和廢棄物可追溯性。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭性標竿分析

- 戰略儀錶板

- 創新與技術格局

第5章:市場規模及預測:依廢棄物類型分類,2021-2034年

- 主要趨勢

- 廢滑油

- 鑽屑

- 其他

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 陸上

- 離岸

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Augean Plc

- Baker Hughes

- Clean Harbors, Inc.

- Derrick Equipment Company

- GN Solids Control

- Halliburton

- Imdex Limited

- Newpark Resources Inc.

- NOV Inc.

- Ridgeline Canada Inc.

- Schlumberger

- Secure Energy Services, Inc.

- Select Water Solutions

- Soli-Bond, Inc.

- TWMA

- Weatherford

- Ecoserv LLC

- Milestone Environmental Services

- Pure Environmental

- Tidal Logistics

- Environmental Development Company Ltd

The Global Treatment & Disposal Drilling Waste Management Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 7.5 billion by 2034.

The industry's expansion is influenced by the growing stringency of environmental laws worldwide, which are compelling oil and gas operators to comply with tighter standards on hazardous waste handling, emissions mitigation, and water contamination prevention. These evolving regulations are driving large-scale investments in innovative waste treatment systems and compliance infrastructure. Frameworks emphasizing landfill diversion, emission controls, and recycling initiatives are reshaping service models across the sector. In addition, the increasing focus on extended producer responsibility and waste minimization goals is prompting oilfield operators to integrate sustainable technologies into their workflows. As unconventional drilling methods such as hydraulic fracturing and horizontal drilling become more prevalent, the quantity and complexity of drilling waste have increased significantly. These techniques produce higher levels of contaminated cuttings, muds, and produced water, intensifying the need for advanced treatment, containment, and recycling systems. The continued rise of shale and tight oil exploration across North America and Asia is expected to accelerate demand for drilling waste management solutions over the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 8.5% |

The onshore segment accounted for a 62% share in 2024 and is projected to grow at an 8% CAGR through 2034. The surge in onshore drilling waste management stems from the expansion of unconventional energy production, which generates greater volumes of cuttings, produced water, and drilling fluids than traditional exploration. The complexity of waste generated from dense shale formations calls for sophisticated treatment technologies such as centrifugation, solidification, and bioremediation.

The drill cuttings segment held a 53.3% share and is projected to grow at a CAGR of 7.8% through 2034. As one of the most significant waste types produced during drilling operations, drill cuttings are undergoing a shift from conventional offsite disposal to onsite treatment and reuse. Technologies such as thermal desorption and solids control systems are being increasingly utilized to process waste directly at drilling locations, recover usable fluids, and minimize transportation requirements, improving both efficiency and sustainability.

United States Treatment & Disposal Drilling Waste Management Market captured USD 700 million in 2024. The country's growth is driven by regulatory enforcement and elevated drilling activity across key oil- and gas-producing regions. The Environmental Protection Agency (EPA) and the Bureau of Land Management (BLM) have implemented new guidelines addressing methane control and waste containment, pushing operators to adopt modern treatment technologies like solidification, thermal desorption, and bioremediation.

Prominent companies active in the Treatment & Disposal Drilling Waste Management Market include Baker Hughes, Augean Plc, Clean Harbors, Inc., Halliburton, Schlumberger, Weatherford, TWMA, Secure Energy Services, Inc., Ecoserv LLC, Pure Environmental, Milestone Environmental Services, Derrick Equipment Company, Newpark Resources Inc., NOV Inc., GN Solids Control, Imdex Limited, Ridgeline Canada Inc., Select Water Solutions, Soli-Bond, Inc., Tidal Logistics, and Environmental Development Company Ltd. Leading market players are focusing on technological innovation, capacity expansion, and strategic partnerships to reinforce their presence in the drilling waste management landscape. Companies are investing heavily in advanced treatment technologies such as thermal desorption, bioremediation, and centrifugation to deliver cost-effective and environmentally compliant solutions. Many are forming long-term service alliances with exploration and production firms to secure steady demand while enhancing their regional footprint. Expansions into emerging drilling regions and the integration of digital monitoring systems are helping firms improve operational efficiency and waste traceability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Waste trends

- 2.1.3 Application trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Waste, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Waste lubricants

- 5.3 Drill cuttings

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.5.3 UAE

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Augean Plc

- 8.2 Baker Hughes

- 8.3 Clean Harbors, Inc.

- 8.4 Derrick Equipment Company

- 8.5 GN Solids Control

- 8.6 Halliburton

- 8.7 Imdex Limited

- 8.8 Newpark Resources Inc.

- 8.9 NOV Inc.

- 8.10 Ridgeline Canada Inc.

- 8.11 Schlumberger

- 8.12 Secure Energy Services, Inc.

- 8.13 Select Water Solutions

- 8.14 Soli-Bond, Inc.

- 8.15 TWMA

- 8.16 Weatherford

- 8.17 Ecoserv LLC

- 8.18 Milestone Environmental Services

- 8.19 Pure Environmental

- 8.20 Tidal Logistics

- 8.21 Environmental Development Company Ltd