|

市場調查報告書

商品編碼

1876610

儲油氣回收裝置市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Storage Vapor Recovery Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

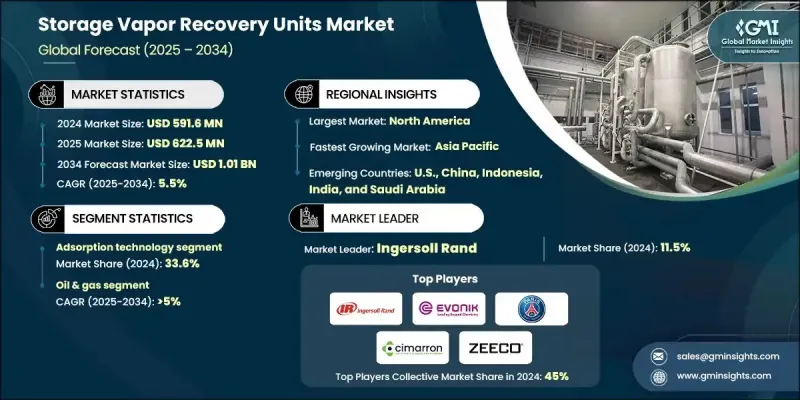

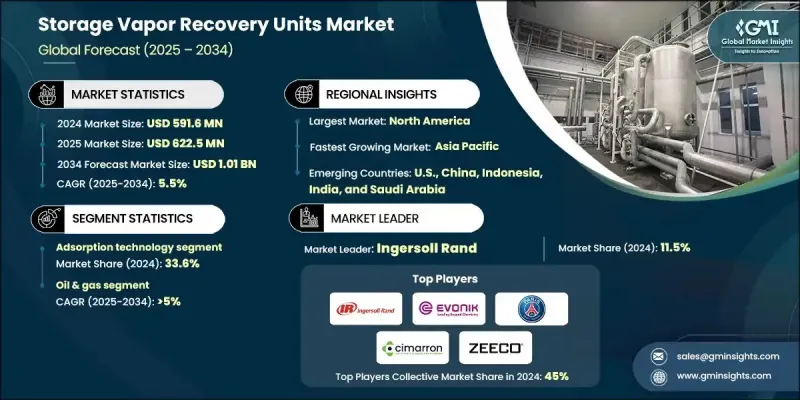

2024 年全球儲氣回收裝置市值為 5.916 億美元,預計到 2034 年將以 5.5% 的複合年成長率成長至 10.1 億美元。

模組化和節能系統設計的進步,以及各行業對低維護回收解決方案日益成長的需求,共同推動了市場的穩定擴張。儲槽蒸汽回收裝置 (VRU) 的設計旨在捕獲和回收儲槽在灌裝或溫度變化等操作過程中釋放的碳氫化合物蒸氣。這些蒸氣含有揮發性有機化合物 (VOC),不僅造成環境污染,也意味著寶貴碳氫化合物的損失。智慧感測器和遠端監控系統的日益普及,透過實現預測性維護和提高透明度,正在改變營運格局。對化學和製藥儲存設施中 VOC 排放控制的日益重視,持續推動高效回收技術的應用。專為小型和城市設施設計的緊湊型 VRU 正在迅速普及,而活性碳基系統因其卓越的回收效率和靈活性而日益受到青睞。此外,低溫冷凝技術在溫度敏感型儲存作業的應用,為特殊應用領域創造了新的機會。針對傳統油氣產業以外的排放控制監管框架的不斷擴展,進一步推動了多個產業對先進蒸汽回收基礎設施的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.916億美元 |

| 預測值 | 10.1億美元 |

| 複合年成長率 | 5.5% |

2024年,基於冷凝技術的產業市場規模預計為1.371億美元。對低溫蒸汽回收需求的不斷成長,推動了基於冷凝技術的蒸汽回收裝置(VRU)的應用,尤其是在化學和製藥公司中。機械冷凝和低溫冷凝技術的持續創新,顯著提高了蒸汽捕集率,並增強了工業排放控制的效率。

預計2025年至2034年間,石油天然氣產業將以5%的複合年成長率成長。上游和中游儲能基礎設施的不斷發展是推動石油天然氣應用領域對油氣回收裝置需求的主要因素。旨在減少油罐區、煉油廠和裝卸碼頭碳氫化合物排放的環保法規日益嚴格,使得油氣回收裝置的整合成為合規的必然要求。隨著甲烷和揮發性有機化合物(VOC)減量策略的日益受到重視,這些系統正成為整個能源產業排放管理框架中的關鍵組成部分。

2024年,歐洲儲氣庫油氣回收裝置市場規模預估為1.724億美元。歐盟揮發性有機化合物(VOC)指令下嚴格的監管標準,為工業儲氣庫採用油氣回收裝置創造了有利環境。對永續物流和環保基礎設施的投資不斷成長,並持續推動該地區市場的擴張。先進的膜技術和吸附技術的持續應用,提高了系統效率,並支持該地區向低排放工業實踐轉型。

全球儲氣罐蒸汽回收裝置市場的主要企業包括Cimarron Energy、KAPPA GI、Koch Engineered Solutions、Cool Sorption、Ingersoll Rand、Tecam、ALMA Group、Kilburn Engineering、BORSIG、Evonik、Zeeco、VOCZero、Flogistix、SCS Technologies、BORSIG、Evonik、Zeeco、VOCZero、Flogistix、SCS Technologies、SUSPE Technologies、SPES、LexDivU特性、SPEC、BUUS樂、B.STIT、STIT、MITSIT、SPES特性、SEXSPE併這些市場領導者正致力於產品創新、技術進步和策略合作,以鞏固其市場地位。許多公司正在開發配備智慧感測器和數位監控系統的模組化即插即用型儲氣罐蒸汽回收裝置,以提高運作效率並減少維護需求。各公司強調能源最佳化和系統緊湊性,以滿足空間受限的工業環境的需求。與終端用戶和EPC承包商建立策略合作夥伴關係,有助於拓展分銷網路並改善售後服務。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 原物料供應及採購分析

- 製造能力評估

- 供應鏈韌性與風險因素

- 配電網路分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 蒸汽回收裝置的成本結構分析

- 新興機會與趨勢

- 數位化和物聯網整合

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀錶板

- Key partnerships & collaborations

- Major M&A activities

- Product innovations & launches

- Market expansion strategies

- 策略舉措

- 競爭性標竿分析

- 創新與技術格局

第5章:市場規模及預測:依技術分類,2021-2034年

- 主要趨勢

- 縮合

- 吸附

- 吸收

- 壓縮

第6章:市場規模及預測:依最終用途分類,2021-2034年

- 主要趨勢

- 石油和天然氣

- 化工及石油化工

- 其他

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 挪威

- 波蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 阿曼

- 南非

- 奈及利亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第8章:公司簡介

- ALMA Group

- BORSIG

- Cimarron Energy

- Cool Sorption

- Evonik

- Flogistix

- Ingersoll Rand

- KAPPA GI

- Kilburn Engineering

- Koch Engineered Solutions

- LeROI

- PETROGAS

- PSG

- Reynold India

- S&S Technical

- SCS Technologies

- SYMEX Technologies

- Tecam

- VOCZero

- Zeeco

The Global Storage Vapor Recovery Units Market was valued at USD 591.6 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 1.01 billion by 2034.

The market's steady expansion is driven by advancements in modular and energy-efficient system design, coupled with the rising need for low-maintenance recovery solutions across industries. Storage vapor recovery units (VRUs) are engineered to capture and reclaim hydrocarbon vapors released from storage tanks during operations such as filling or temperature variations. These vapors contain volatile organic compounds that not only contribute to environmental pollution but also represent a loss of valuable hydrocarbons. The growing integration of smart sensors and remote monitoring systems is transforming the operational landscape by enabling predictive maintenance and improving transparency. Increasing emphasis on controlling VOC emissions in chemical and pharmaceutical storage facilities continues to propel the adoption of high-efficiency recovery technologies. Compact VRUs designed for small-scale and urban installations are witnessing rapid uptake, while activated carbon-based systems are gaining popularity due to their superior recovery efficiency and flexibility. Furthermore, the deployment of cryogenic condensation technologies in temperature-sensitive storage operations is creating new opportunities in specialized applications. Expanding regulatory frameworks addressing emission control beyond traditional oil and gas sectors are further driving demand for advanced vapor recovery infrastructure across multiple industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $591.6 Million |

| Forecast Value | $1.01 Billion |

| CAGR | 5.5% |

The condensation-based technology segment was valued at USD 137.1 million in 2024. Rising requirements for low-temperature vapor recovery are fueling the adoption of condensation-based VRUs, especially in chemical and pharmaceutical facilities. Continued innovation in mechanical and cryogenic condensation techniques is significantly improving vapor capture rates and enhancing the efficiency of industrial emission control.

The oil & gas sector is projected to grow at a CAGR of 5% between 2025 and 2034. The increasing development of upstream and midstream storage infrastructure is a major factor driving the need for vapor recovery units in oil and gas applications. Strengthening environmental regulations aimed at reducing hydrocarbon emissions from tank farms, refineries, and loading terminals has made the integration of VRUs a compliance imperative. With a growing emphasis on methane and VOC reduction strategies, these systems are becoming vital components in emission management frameworks throughout the energy industry.

Europe Storage Vapor Recovery Units Market was valued at USD 172.4 million in 2024. Strict regulatory standards under EU VOC directives are creating a robust environment for VRU adoption across industrial storage sites. Rising investment in sustainable logistics and environmentally responsible infrastructure continues to contribute to the region's market expansion. Ongoing adoption of advanced membrane and adsorption technologies is improving system efficiency and supporting the region's transition toward low-emission industrial practices.

Prominent companies operating in the Global Storage Vapor Recovery Units Market include Cimarron Energy, KAPPA GI, Koch Engineered Solutions, Cool Sorption, Ingersoll Rand, Tecam, ALMA Group, Kilburn Engineering, BORSIG, Evonik, Zeeco, VOCZero, Flogistix, SCS Technologies, S&S Technical, LeROI, PETROGAS, SYMEX Technologies, PSG, and Reynold India. Leading players in the Storage Vapor Recovery Units Market are focusing on product innovation, technological advancement, and strategic collaborations to strengthen their market position. Many companies are developing modular, plug-and-play VRUs equipped with smart sensors and digital monitoring to enhance operational efficiency and reduce maintenance needs. Firms are emphasizing energy optimization and system compactness to cater to space-constrained industrial settings. Strategic partnerships with end-users and EPC contractors are helping expand distribution networks and improve after-sales service.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Technology trends

- 2.4 End Use trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of vapor recovery units

- 3.8 Emerging opportunities & trends

- 3.9 Digitalization and IoT integration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Condensation

- 5.3 Adsorption

- 5.4 Absorption

- 5.5 Compression

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Oil & gas

- 6.3 Chemical & petrochemical

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.3.7 Norway

- 7.3.8 Poland

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Malaysia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Egypt

- 7.5.5 Oman

- 7.5.6 South Africa

- 7.5.7 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 ALMA Group

- 8.2 BORSIG

- 8.3 Cimarron Energy

- 8.4 Cool Sorption

- 8.5 Evonik

- 8.6 Flogistix

- 8.7 Ingersoll Rand

- 8.8 KAPPA GI

- 8.9 Kilburn Engineering

- 8.10 Koch Engineered Solutions

- 8.11 LeROI

- 8.12 PETROGAS

- 8.13 PSG

- 8.14 Reynold India

- 8.15 S&S Technical

- 8.16 SCS Technologies

- 8.17 SYMEX Technologies

- 8.18 Tecam

- 8.19 VOCZero

- 8.20 Zeeco