|

市場調查報告書

商品編碼

1876607

垂直軸風力渦輪機市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Vertical Wind Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

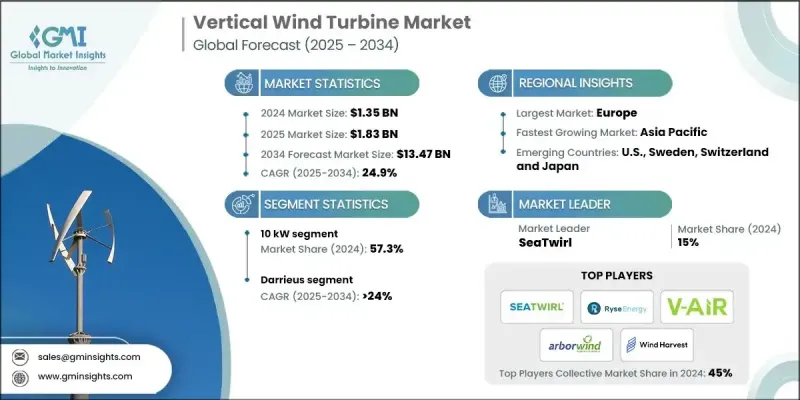

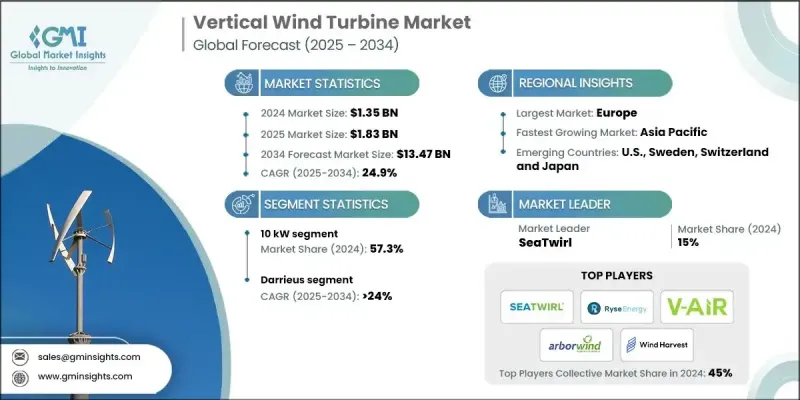

2024 年全球垂直風力渦輪機市場價值為 13.5 億美元,預計到 2034 年將以 24.9% 的複合年成長率成長至 134.7 億美元。

垂直軸風力渦輪機(VAWT)日益受到關注,這主要得益於人們對永續和分散式能源系統的需求不斷成長,這些系統能夠適應各種風況和地形條件。 VAWT在湍流或風向變化的情況下也能高效運行,因此非常適合海岸、城市和地形崎嶇的地區。隨著VAWT在分散式發電網路中的部署不斷擴大,以及人們對緊湊型再生能源解決方案的日益青睞,住宅、商業和混合電網系統中的VAWT安裝量也在不斷成長。由於VAWT佔用空間小、運作噪音低,且能夠適應人口密集或工業區,發展中經濟體對其表現出了濃厚的興趣。空氣動力學、先進複合材料和現代電力電子技術的持續創新不斷提升VAWT的可靠性和輸出功率。新型垂直軸風力渦輪機設計致力於提高扭力輸出、增強耐久性以及改善低風速環境下的性能。基於物聯網的監控和預測性維護解決方案的整合有助於降低營運成本,而融合多種設計原理的混合型垂直軸風力渦輪機系統的興起,則提高了VAWT在不同風速範圍內的效率,進一步鞏固了VAWT在分散式和混合能源網路中的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13.5億美元 |

| 預測值 | 134.7億美元 |

| 複合年成長率 | 24.9% |

2024年,10千瓦級空調的市佔率達到57.3%,預計到2034年將以25.5%的複合年成長率成長。此功率範圍尤其適用於緊湊型住宅和小規模商業場所,在這些場所,噪音限制和空間限制使得垂直式設計更具優勢。 10千瓦級空調機組安裝簡單、核准流程簡單、基礎設施成本較低,這些優勢持續推動其普及。生產成本的下降、效率的提高以及住宅再生能源解決方案的廣泛接受度(得益於有利的淨計量政策),都在促進市場擴張。

阻力式薩沃紐斯風力發電機市佔率為14.1%,預計到2034年將以25.5%的複合年成長率成長。由於其安裝簡單且無需大型基礎,因此在低風速、城市和離網應用領域越來越受歡迎。透過採用扭曲葉片和多級轉子結構,對這些風力發電機進行持續改進,提高了其自啟動能力和扭矩輸出,從而推動了其在各種環境中的更廣泛應用。

亞太地區垂直軸風力渦輪機市場預計到2034年將以28.5%的複合年成長率成長,主要成長動力來自中國、印度和東南亞市場。這一成長得益於加速的城市化進程、日益成長的能源安全需求以及積極的可再生能源發展舉措。中國具有競爭力的製造成本和本土創新能力正在推動區域和全球產業發展。同時,印度對分散式發電和農村電氣化的重視,持續為小型社區部署垂直軸風力渦輪機創造了新的成長路徑。

塑造全球垂直軸風力渦輪機市場格局的關鍵參與者包括WindHarvest International、Urban Green Energy、Flower Turbines、Ryse Energy、Windspire Energy、V-Air、Windside Production、Aeolos Wind Energy、Hi-VAWT Technology、Vertogen、SeaTwirl、Whirlwind Windlos Wind Energy、Hi-VAWT Technology、Vertogen、SeaTwirl、Whirlwind Windbines、ArborWind和Mariah。垂直軸風力渦輪機市場的營運公司正積極致力於技術創新、策略合作和地理擴張,以提升市場佔有率。許多公司正在投資先進的空氣動力學建模、輕質複合材料和下一代電力電子技術,以提高能量捕獲效率和可靠性。與再生能源開發商、政府機構和智慧城市規劃者的策略聯盟有助於擴大產品覆蓋範圍。製造商也在優先考慮模組化和可擴展的設計,以滿足住宅、商業和混合電網應用的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系統

- 監管環境

- 垂直軸風力渦輪機項目

- 操作

- 計劃

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀錶板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依渦輪機額定功率分類,2021-2034年

- 主要趨勢

- 小於 10 千瓦

- 10千瓦 - 200千瓦

- 200千瓦至1兆瓦

- 大於 1 兆瓦

第6章:市場規模及預測:以連結方式分類,2021-2034年

- 主要趨勢

- 並網

- 獨立版

- 混合

第7章:市場規模及預測:以安裝量計算,2021-2034年

- 主要趨勢

- 陸上

- 離岸

第8章:市場規模及預測:依產品類型分類,2021-2034年

- 主要趨勢

- 達里厄斯

- 薩沃尼烏斯

- 混合

第9章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 住宅

- 商業和工業

- 公用事業

第10章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 瑞士

- 瑞典

- 法國

- 英國

- 芬蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

第11章:公司簡介

- ArborWind

- Aeolos Wind Energy

- Hi-VAWT Technology

- Flower Turbines

- Ryse Energy

- SeaTwirl

- Mariah Power

- Urban Green Energy

- Whirlwind Wind Turbines

- Wind Harvest International

- Windside Production

- Windspire Energy

- V-Air

- Vertogen

The Global Vertical Wind Turbine Market was valued at USD 1.35 billion in 2024 and is estimated to grow at a CAGR of 24.9% to reach USD 13.47 billion by 2034.

Growing interest in vertical-axis wind turbines (VAWTs) is being fueled by the push toward sustainable and decentralized energy systems suitable for various wind and terrain conditions. These turbines perform effectively in turbulent or shifting wind directions, making them well-suited for coastal, urban, and uneven landscapes. Expanding deployment across distributed power generation networks and the increasing preference for compact renewable solutions are driving installations across residential, commercial, and hybrid grid setups. Developing economies are showing notable interest due to smaller space needs, quieter operations, and adaptability to dense or industrial areas. Ongoing innovation in aerodynamics, advanced composite materials, and modern power electronics continues to enhance turbine reliability and output. Novel vertical turbine designs are focusing on improved torque generation, higher durability, and better performance in low-wind environments. The integration of IoT-based monitoring and predictive maintenance solutions is helping reduce operational costs, while the rise of hybrid vertical turbine systems combining multiple design principles-broadens efficiency across varying wind ranges, reinforcing the role of VAWTs in decentralized and hybrid energy networks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.35 Billion |

| Forecast Value | $13.47 Billion |

| CAGR | 24.9% |

The 10 kW segment held a 57.3% share in 2024 and is forecasted to grow at a 25.5% CAGR through 2034. This capacity range is particularly attractive for compact residential and small-scale commercial setups where noise limits and space constraints make vertical designs advantageous. These 10 kW units offer simplified installation, minimal permitting challenges, and lower infrastructure expenses, which continue to boost their adoption. Falling production costs, greater efficiency levels, and wider acceptance of residential renewable solutions supported by favorable net metering initiatives are fostering market expansion.

The drag-type Savonius segment accounted for a 14.1% share and is expected to register a 25.5% CAGR through 2034. Its popularity is increasing across low-wind, urban, and off-grid applications due to simple installation needs and the absence of large foundation requirements. Ongoing reengineering of these turbines using twisted blades and multi-stage rotor configurations has enhanced self-start capabilities and torque generation, driving broader adoption in diverse environments.

Asia Pacific Vertical Wind Turbine Market will grow at a CAGR of 28.5% by 2034, primarily led by markets across China, India, and Southeast Asia. This expansion is influenced by accelerated urbanization, rising energy security priorities, and proactive renewable energy initiatives. Competitive manufacturing costs and domestic innovation within China are supporting both regional and global industry development. Meanwhile, India's focus on distributed power generation and rural electrification continues to create new growth pathways for VAWT deployment across smaller communities.

Key players shaping the Global Vertical Wind Turbine Market landscape include WindHarvest International, Urban Green Energy, Flower Turbines, Ryse Energy, Windspire Energy, V-Air, Windside Production, Aeolos Wind Energy, Hi-VAWT Technology, Vertogen, SeaTwirl, Whirlwind Wind Turbines, ArborWind, and Mariah Power. Companies operating in the Vertical Wind Turbine Market are actively focusing on technological innovation, strategic collaborations, and geographic expansion to enhance market share. Many are investing in advanced aerodynamic modeling, lightweight composite materials, and next-generation power electronics to improve energy capture efficiency and reliability. Strategic alliances with renewable energy developers, government bodies, and smart city planners are helping expand product reach. Manufacturers are also prioritizing modular and scalable designs to cater to residential, commercial, and hybrid grid applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Turbine rating trends

- 2.4 Connectivity trends

- 2.5 Installation trends

- 2.6 Product type trends

- 2.7 Application trends

- 2.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Vertical wind turbine projects

- 3.3.1 Operational

- 3.3.2 Planned

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Turbine rating, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 < 10 kW

- 5.3 10 kW - 200 kW

- 5.4 >200 kW - 1 MW

- 5.5 > 1 MW

Chapter 6 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Grid connected

- 6.3 Standalone

- 6.4 Hybrid

Chapter 7 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Onshore

- 7.3 Offshore

Chapter 8 Market Size and Forecast, By Product Type, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 Darrieus

- 8.3 Drag type Savonius

- 8.4 Hybrid

Chapter 9 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial and Industrial

- 9.4 Utility

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Switzerland

- 10.3.2 Sweden

- 10.3.3 France

- 10.3.4 UK

- 10.3.5 Finland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.5 Middle East & Africa

- 10.5.1 UAE

- 10.5.2 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

Chapter 11 Company Profiles

- 11.1 ArborWind

- 11.2 Aeolos Wind Energy

- 11.3 Hi-VAWT Technology

- 11.4 Flower Turbines

- 11.5 Ryse Energy

- 11.6 SeaTwirl

- 11.7 Mariah Power

- 11.8 Urban Green Energy

- 11.9 Whirlwind Wind Turbines

- 11.10 Wind Harvest International

- 11.11 Windside Production

- 11.12 Windspire Energy

- 11.13 V-Air

- 11.14 Vertogen