|

市場調查報告書

商品編碼

1876605

汽車防碰撞雷達市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Collision Avoidance Radar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

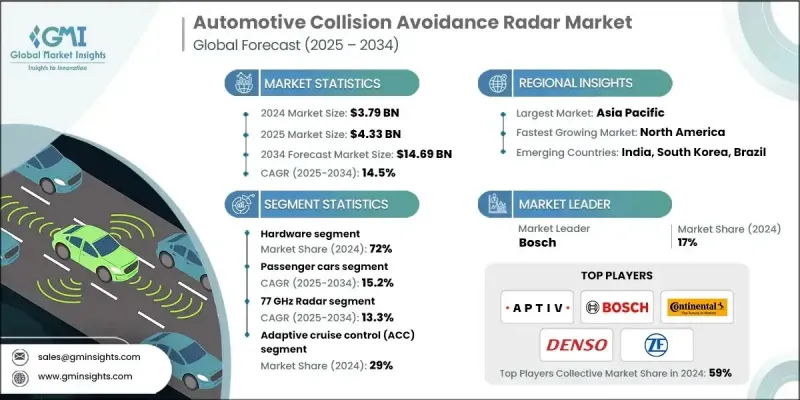

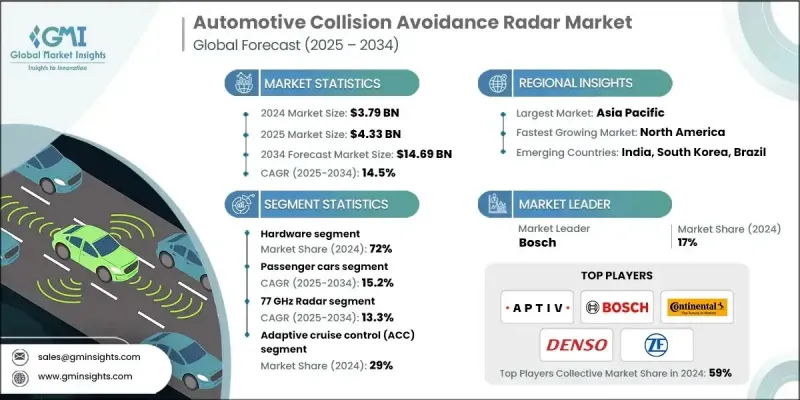

2024 年全球汽車防碰撞雷達市場價值為 37.9 億美元,預計到 2034 年將以 14.5% 的複合年成長率成長至 146.9 億美元。

道路安全日益受到重視,以及減少人為失誤導致的交通事故的需求不斷成長,推動了基於雷達的安全系統在車輛中的應用。這些系統具備主動探測和反應能力,能夠識別靜止和移動的障礙物,使車輛能夠有效應對潛在危險。感測器技術的進步推動了雷達在現代車輛中的穩步整合,使得雷達能夠應用於短程和遠程探測,從而在複雜的交通環境中探測行人、騎行者和其他車輛。儘管雷達系統已相當有效,但某些應用仍需要更遠的探測距離,尤其是在探測較小或隱藏的障礙物時。然而,隨著雷達技術的不斷發展和製造成本的下降,其在商用車隊、售後市場系統和自動駕駛平台中的應用潛力正在迅速擴大。在交通安全資料分析和主要交通管理機構研究的日益支持下,基於雷達的防撞系統正成為下一代車輛安全和自動駕駛技術的基石。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37.9億美元 |

| 預測值 | 146.9億美元 |

| 複合年成長率 | 14.5% |

到2024年,硬體部分將佔據72%的市場。硬體仍然是防碰撞雷達系統的核心要素,因為法規通常要求配備實體感測器,以確保可靠的偵測和響應功能。隨著製造商為滿足更高的性能和合規性要求而做好準備,車輛安全監管標準預計也將推動新車型對雷達組件的額外需求。

2025年至2034年間,乘用車市場將以15.2%的複合年成長率成長。該市場的主導地位歸功於乘用車的大規模生產以及先進安全系統在該類別中日益普及。乘用車雷達應用的增加也促進了強大的售後市場生態系統的發展,該系統支援雷達硬體、整合感測器融合軟體和服務解決方案,使供應商能夠在保持成本效益的同時高效擴大生產規模。

2024年,美國汽車防碰撞雷達市場規模預計將達7.318億美元。監管政策仍然是該地區雷達應用的重要促進因素。雷達與高級駕駛輔助系統(ADAS)的日益融合,進一步鞏固了其在提升駕駛意識和降低道路交通事故風險的關鍵作用。能夠在各種駕駛條件下識別車輛、行人和騎乘者的雷達安全解決方案,正日益成為新型車型的標配,助力美國實現提升交通安全性和可靠性的宏偉目標。

引領全球汽車防碰撞雷達市場的主要企業包括法雷奧 (Valeo)、維諾 (Veoneer)、安波福 (Aptiv)、電裝 (Denso)、博世 (Bosch)、海拉 (Hella)、採埃孚 (ZF Friedrichshafen)、現代摩比斯 (Hyundai Mobisbis)、大陸集團 (ZF Friedrichshafen)、現代摩比斯 (Hyundai Mobis)、大陸集團 (Continalctor) 和智性半導體 SNX)。這些企業正致力於創新、提升成本效益和策略合作,以鞏固其競爭優勢。許多企業正在投資研發先進的雷達晶片組、多模式雷達系統和4D成像雷達,以提高偵測精度和偵測範圍。它們還與汽車製造商和技術供應商建立戰略合作夥伴關係,以實現雷達與高級駕駛輔助系統 (ADAS) 和自動駕駛系統的無縫整合。此外,各公司也努力實現組件小型化和成本降低,以促進雷達技術在各類車型中的廣泛應用。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 高級駕駛輔助系統(ADAS)的需求不斷成長

- 全球嚴格的政府安全法規

- 電動車和自動駕駛汽車市場不斷成長

- 雷達感測器(短程和遠程)的技術進步

- 產業陷阱與挑戰

- 高系統整合複雜性

- 在惡劣條件下降低感測器可靠性

- 市場機遇

- 與基於人工智慧的預測分析整合

- 拓展至商用車和卡車運輸領域

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 碳足跡評估

- 循環經濟一體化

- 電子垃圾管理要求

- 綠色製造計劃

- 用例和應用

- 最佳情況

- 投資環境與融資趨勢

- 創投與私募股權投資雷達新創企業

- 政府為汽車安全技術研發提供的資金支持項目

- 雷達基礎設施開發的公私合作模式

- 併購趨勢與策略融資分析

- 經濟影響評估

- 創造就業機會和技能型勞動力需求

- 雷達製造對區域GDP貢獻的影響

- 雷達部件的進出口動態

- 各區域成本競爭力分析

- 風險和敏感度分析

- 供給側脆弱性

- 需求面對OEM生產週期的敏感性

- 政策和貿易敏感度(關稅、進出口限制)

- 雷達軟體中的網路安全和資料隱私漏洞

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 硬體

- 雷達感測器

- 控制單元/ECU

- 軟體

- 碰撞避免演算法

- 駕駛輔助軟體

- 服務

- 整合與安裝服務

- 維護與支援服務

第6章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 緊湊型/經濟型

- 中型/家庭

- 豪華/高級

- SUV/跨界車

- 商用車輛

- 輕型商用

- 重型卡車

- 公車/大眾運輸

第7章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 24 GHz 雷達

- 77 GHz 雷達

- 79 GHz 雷達

- 超寬頻 (UWB)

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 自適應巡航控制(ACC)

- 自動緊急煞車(AEB)

- 盲點偵測(BSD)

- 車道變換輔助系統(LCA)

- 停車協助

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Aptiv

- Bosch

- Continental

- Denso

- Hyundai Mobis

- Infineon Technologies

- Magna

- Mobileye

- NXP Semiconductors

- Renesas Electronics

- Valeo

- ZF Friedrichshafen

- 區域玩家

- Adient

- Autoliv

- Gentherm

- Hella

- JTEKT

- Keihin

- Lear

- Marelli

- Panasonic Automotive

- Visteon

- 新興參與者/顛覆者

- AEye

- Analog Devices

- Arbe Robotics

- Echodyne

- Qorvo

- Texas Instruments

- Uhnder

- Veoneer

The Global Automotive Collision Avoidance Radar Market was valued at USD 3.79 billion in 2024 and is estimated to grow at a CAGR of 14.5% to reach USD 14.69 billion by 2034.

The increasing focus on road safety and the ongoing need to reduce vehicle collisions caused by human error are driving the adoption of radar-based safety systems in vehicles. These systems provide active detection and response capabilities to identify both stationary and moving obstacles, enabling vehicles to react effectively to potential hazards. The steady integration of radar into modern vehicles is supported by advancements in sensor technology, which have enabled both short-range and long-range radar applications for detecting pedestrians, cyclists, and other vehicles in complex traffic environments. Despite their effectiveness, certain applications still require improved detection range, particularly for smaller or hidden obstacles. However, as radar technology continues to evolve and manufacturing costs decline, the potential for adoption in commercial fleets, aftermarket systems, and autonomous vehicle platforms is expanding rapidly. With growing support from traffic safety data analytics and research from leading transportation authorities, radar-based collision avoidance systems are becoming a cornerstone of next-generation vehicle safety and automated driving technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.79 Billion |

| Forecast Value | $14.69 Billion |

| CAGR | 14.5% |

The hardware segment held 72% share in 2024. Hardware remains the core element of collision avoidance radar systems, as regulations often mandate the inclusion of physical sensors to ensure reliable detection and response functions. Regulatory standards for vehicle safety are also expected to drive additional demand for radar components in new vehicle models as manufacturers prepare for enhanced performance and compliance requirements.

The passenger vehicle segment will grow at a CAGR of 15.2% between 2025 and 2034. The dominance of this segment is attributed to the large-scale production of passenger cars and the growing incorporation of advanced safety systems within this category. Increased radar deployment in passenger vehicles has also stimulated the growth of a strong aftermarket ecosystem that supports radar hardware, integrated sensor fusion software, and service solutions, allowing suppliers to scale production efficiently while maintaining cost-effectiveness.

United States Automotive Collision Avoidance Radar Market generated USD 731.8 million in 2024. Regulatory influence remains a significant driver for radar adoption in the region. The growing integration of radar with Advanced Driver Assistance Systems (ADAS) reinforces its critical role in enhancing driver awareness and minimizing the risk of road accidents. Radar-enabled safety solutions capable of identifying vehicles, pedestrians, and cyclists under diverse driving conditions are becoming increasingly standard in new vehicle models, supporting the nation's broader goal of improving transportation safety and reliability.

Leading companies shaping the Global Automotive Collision Avoidance Radar Market include Valeo, Veoneer, Aptiv, Denso, Bosch, Hella, ZF Friedrichshafen, Hyundai Mobis, Continental, and NXP Semiconductors. Major companies in the Automotive Collision Avoidance Radar Market are focusing on innovation, cost efficiency, and strategic collaboration to reinforce their competitive positioning. Many are investing in advanced radar chipsets, multi-mode radar systems, and 4D imaging radar to enhance detection accuracy and range. Strategic partnerships with automakers and technology providers are being formed to integrate radar seamlessly with ADAS and autonomous driving systems. Firms are also working toward the miniaturization of components and cost reduction to enable broader adoption across various vehicle classes.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced driver-assistance systems (ADAS)

- 3.2.1.2 Stringent government safety regulations globally

- 3.2.1.3 Growing EV and autonomous vehicle market

- 3.2.1.4 Technological advancements in radar sensors (short- and long-range)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system integration complexity

- 3.2.2.2 Reduces sensor reliability in harsh conditions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with AI-based predictive analytics

- 3.2.3.2 Expansion into commercial vehicles and trucking

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability & environmental aspects

- 3.10.1 Carbon Footprint Assessment

- 3.10.2 Circular Economy Integration

- 3.10.3 E-Waste Management Requirements

- 3.10.4 Green Manufacturing Initiatives

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Investment landscape & funding trends

- 3.13.1 Venture capital and private equity investments in radar start-ups

- 3.13.2 Government R&D funding programs for automotive safety tech

- 3.13.3 Public-private partnerships for radar infrastructure development

- 3.13.4 M&A trends and strategic funding analysis

- 3.14 Economic impact assessment

- 3.14.1 Employment generation and skilled workforce requirements

- 3.14.2 Impact on regional gdp contribution from radar manufacturing

- 3.14.3 Export-import dynamics of radar components

- 3.14.4 Cost competitiveness analysis across regions

- 3.15 Risk and sensitivity analysis

- 3.15.1 Supply-side vulnerabilities

- 3.15.2 Demand-side sensitivity to oem production cycles

- 3.15.3 Policy and trade sensitivity (tariffs, import/export restrictions)

- 3.15.4 Cybersecurity and data privacy vulnerabilities in radar software

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Radar Sensor

- 5.2.2 Control Unit / ECU

- 5.3 Software

- 5.3.1 Collision Avoidance Algorithms

- 5.3.2 Driver Assistance Software

- 5.4 Services

- 5.4.1 Integration & Installation Services

- 5.4.2 Maintenance & Support Services

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger Cars

- 6.2.1 Compact/Economy

- 6.2.2 Mid-size/Family

- 6.2.3 Luxury/Premium

- 6.2.4 SUVs/Crossovers

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial

- 6.3.2 Heavy Trucks

- 6.3.3 Buses/Transit

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 24 GHz Radar

- 7.3 77 GHz Radar

- 7.4 79 GHz Radar

- 7.5 UWB (Ultra-Wideband)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Adaptive Cruise Control (ACC)

- 8.3 Automatic Emergency Braking (AEB)

- 8.4 Blind Spot Detection (BSD)

- 8.5 Lane Change Assist (LCA)

- 8.6 Parking Assistance

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Aptiv

- 10.1.2 Bosch

- 10.1.3 Continental

- 10.1.4 Denso

- 10.1.5 Hyundai Mobis

- 10.1.6 Infineon Technologies

- 10.1.7 Magna

- 10.1.8 Mobileye

- 10.1.9 NXP Semiconductors

- 10.1.10 Renesas Electronics

- 10.1.11 Valeo

- 10.1.12 ZF Friedrichshafen

- 10.2 Regional Players

- 10.2.1 Adient

- 10.2.2 Autoliv

- 10.2.3 Gentherm

- 10.2.4 Hella

- 10.2.5 JTEKT

- 10.2.6 Keihin

- 10.2.7 Lear

- 10.2.8 Marelli

- 10.2.9 Panasonic Automotive

- 10.2.10 Visteon

- 10.3 Emerging Players / Disruptors

- 10.3.1 AEye

- 10.3.2 Analog Devices

- 10.3.3 Arbe Robotics

- 10.3.4 Echodyne

- 10.3.5 Qorvo

- 10.3.6 Texas Instruments

- 10.3.7 Uhnder

- 10.3.8 Veoneer