|

市場調查報告書

商品編碼

1876592

人工智慧驅動的視網膜篩檢設備市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)AI-Driven Retinal Screening Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

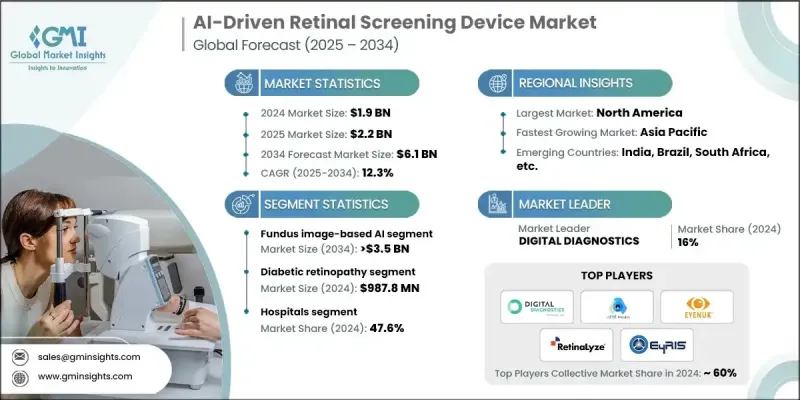

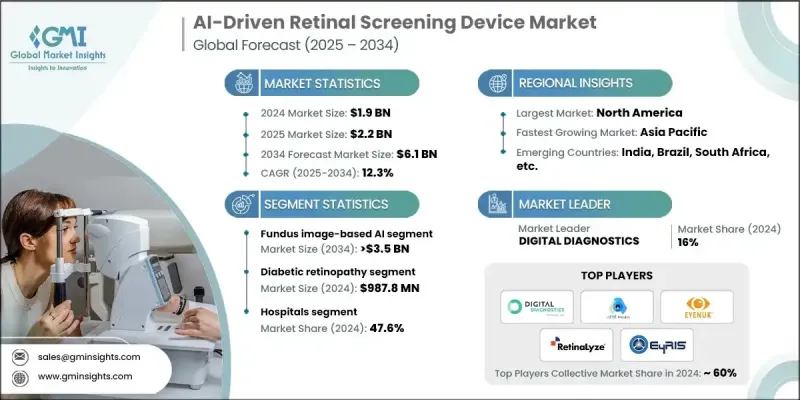

2024 年全球人工智慧驅動的視網膜篩檢設備市場價值為 19 億美元,預計到 2034 年將以 12.3% 的複合年成長率成長至 61 億美元。

糖尿病盛行率上升、技術創新不斷進步以及人工智慧醫學影像工具的日益普及是推動這一成長的主要因素。政府和私人醫療系統支持的、不斷擴大的宣傳項目和篩檢計劃進一步刺激了市場需求。將人工智慧應用於視網膜診斷,能夠實現精準的即時篩檢,並有助於早期發現多種眼部疾病。隨著醫療服務提供者轉向預防性護理和遠端診斷,人工智慧驅動的視網膜設備正成為改善全球眼部健康狀況和提高醫療服務可近性(尤其是在資源匱乏地區)的關鍵工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 61億美元 |

| 複合年成長率 | 12.3% |

深度學習演算法、影像技術和可攜式診斷設備的進步顯著提升了基於人工智慧的視網膜篩檢系統的效能和易用性。這些設備現在能夠提供即時分析,同時檢測多種眼部疾病,並與數位健康記錄系統無縫整合。小型化和雲端成像工具的出現,使得視網膜篩檢更加快速、經濟,並在各種醫療機構中更容易進行。新一代人工智慧演算法日趨完善,能夠辨識細微的視網膜變化,進而實現早期介入和個人化治療方案的發展。這些演算法正與全球衛生組織、地方政府和醫療機構攜手合作,進行宣傳活動和大規模篩檢,以對抗可預防的失明。配備人工智慧技術的行動診斷單元正在惠及服務不足的社區,而人工智慧篩檢工具也被納入常規體檢,以加強早期發現和預防性眼部保健。人工智慧驅動的視網膜篩檢設備依靠機器學習演算法來解讀視網膜影像,從而準確、及時地識別主要眼部疾病,並提高高品質眼科診斷的可及性。

2024年,基於眼底影像的人工智慧(AI)市佔率達到56.7%,預計到2034年將達到35億美元,年複合成長率(CAGR)為12.7%。該領域的領先地位歸功於人們對早期檢測威脅視力的眼部疾病日益成長的需求。基於眼底影像的AI工具利用高解析度2D視網膜影像來檢測表面異常,包括微動脈瘤、出血和視盤異常。這些模型經過訓練,能夠識別糖尿病視網膜病變和高血壓視網膜病變等疾病,從而透過自動影像評估實現快速可靠的診斷。

2024年,糖尿病視網膜病變市場規模達9.878億美元。作為糖尿病患者視力喪失的主要原因之一,糖尿病視網膜病變仍然是人工智慧驅動的篩檢解決方案最常見的應用領域。這些設備能夠快速、非侵入性地分析視網膜影像,無需專科醫生干預即可在基層醫療機構有效運作。它們在糖尿病護理機構和社區診所的應用極大地擴大了篩檢覆蓋範圍,尤其是在眼科服務資源有限的地區。糖尿病視網膜病變的高發生率和可預防性使其成為該行業中最具影響力的細分市場。

預計到2024年,北美人工智慧驅動的視網膜篩檢設備市佔率將達到47.3%。該地區市場擴張的驅動力包括廣泛的創新、先進的醫療保健生態系統以及對利用人工智慧技術加速診斷的高度重視。該地區完善的基礎設施、對預防性眼保健的高度重視以及眾多人工智慧醫療新創企業的存在,都為這些系統的穩步普及提供了支持。糖尿病和與老化相關的眼部疾病發生率的不斷上升,也推動了對能夠快速、準確地檢測疾病的智慧視網膜篩檢工具的需求。

全球人工智慧驅動型視網膜篩檢設備市場的主要企業包括iCare、RetinaLyze、Heart Eye、EYENUK、Retmarker、Airdoc、AEYE Health、Evolucare、Topcon Healthcare、Remidio、MONA Health、Forus Health、Identifeye Health、Visionix、Digital Diagnostics和EyRIS。這些企業持續投資於技術創新和市場拓展,以鞏固其全球地位。人工智慧驅動型視網膜篩檢設備市場的領導者正採用多種策略來提升其競爭優勢。其中一個重點是研發,旨在創建能夠更精準地檢測更多視網膜疾病的先進人工智慧演算法。許多公司正與醫院、診所和遠距醫療服務提供者建立策略聯盟,以擴大人工智慧篩檢工具的部署。此外,各公司也致力於將其系統與電子健康記錄平台整合,以實現無縫的臨床工作流程。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 糖尿病盛行率不斷上升

- 老年人口不斷增加

- 技術進步

- 提高公眾意識和篩檢計劃

- 產業陷阱與挑戰

- 資料隱私和安全問題

- 嚴格的監管準則

- 機會

- 多病種檢測平台開發

- 與行動醫療(mHealth)的整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 投資環境

- 報銷方案

- 技術演進時間軸

- 新興用例和應用

- 利用視網膜影像進行全身性疾病篩檢

- 心血管風險評估

- 神經系統疾病檢測

- 價值鏈分析

- 硬體製造商

- 人工智慧演算法開發人員

- 軟體平台供應商

- 醫療保健服務提供者

- 最終用戶整合合作夥伴

- 波特的分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 基於眼底影像的人工智慧

- 基於OCT的AI

- 多模態人工智慧

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 糖尿病視網膜病變

- 老年性黃斑部病變

- 青光眼

- 白內障

- 其他應用

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 眼科診所

- 流動診所/鄉村營地

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AEYE Health

- Airdoc

- DIGITAL DIAGNOSTICS

- evolucare

- EYENUK

- EyRIS

- Forus Health

- HEART EYE

- iCare

- identifeye HEALTH

- MONA.health

- remidio

- RetinaLyze

- Retmarker

- Topcon Healthcare

- Visionix

The Global AI-Driven Retinal Screening Device Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 12.3% to reach USD 6.1 billion by 2034.

Rising diabetes prevalence, growing technological innovation, and increasing adoption of AI-based medical imaging tools are among the major forces driving this growth. Expanding awareness programs and screening initiatives, supported by government and private healthcare systems, are further propelling demand. The integration of artificial intelligence into retinal diagnostics enables precise, real-time screening and supports early detection of multiple eye conditions. As healthcare providers move toward preventive care and remote diagnostics, AI-powered retinal devices are becoming essential tools for improving global eye health outcomes and enhancing accessibility, especially in low-resource regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 12.3% |

Advancements in deep learning algorithms, imaging technologies, and portable diagnostic equipment have significantly enhanced the performance and usability of AI-based retinal screening systems. These devices now provide real-time analytics, detect multiple eye disorders simultaneously, and seamlessly integrate with digital health record systems. The emergence of compact and cloud-enabled imaging tools has made retinal screening faster, more affordable, and more accessible across various healthcare settings. Next-generation AI algorithms are becoming more refined, capable of identifying subtle retinal changes that allow for earlier interventions and personalized treatment planning. Alongside global health organizations, local authorities, and medical institutions, they are implementing awareness drives and mass screening campaigns to fight preventable blindness. Mobile diagnostic units with AI technology are reaching underserved communities, while AI screening tools are being incorporated into standard checkups to strengthen early detection and preventive eye care. AI-driven retinal screening devices rely on machine learning algorithms to interpret images of the retina, providing accurate and timely identification of major ocular diseases and improving accessibility to quality eye diagnostics.

In 2024, the fundus image-based AI segment held 56.7% and is projected to reach USD 3.5 billion by 2034, growing at a CAGR of 12.7%. This segment's dominance is attributed to the rising demand for early detection of vision-threatening eye diseases. Fundus image-based AI tools use high-resolution 2D retinal images to detect surface-level irregularities, including microaneurysms, hemorrhages, and optic disc abnormalities. These models are trained to recognize conditions such as diabetic and hypertensive retinopathy, enabling rapid and reliable diagnostics through automated image assessment.

The diabetic retinopathy segment reached USD 987.8 million in 2024. As one of the primary causes of vision loss among individuals with diabetes, diabetic retinopathy continues to be the most common application for AI-driven screening solutions. These devices deliver rapid, non-invasive analysis of retinal images and can function effectively in primary healthcare environments without requiring specialist intervention. Their implementation in diabetes care facilities and community clinics has greatly expanded screening outreach, particularly in regions with limited access to ophthalmology services. The high prevalence and preventable nature of diabetic retinopathy continue to make it the most influential segment within the industry.

North America AI-Driven Retinal Screening Device Market held a 47.3% share in 2024. Market expansion in the region is driven by widespread innovation, an advanced healthcare ecosystem, and a heightened focus on accelerating diagnosis using AI technologies. The region's established infrastructure, coupled with strong awareness of preventive eye health and the presence of numerous AI healthcare startups, supports steady adoption of these systems. A growing incidence of diabetes and aging-related eye conditions is also fueling demand for intelligent retinal screening tools capable of fast and accurate disease detection.

Prominent companies operating in the Global AI-Driven Retinal Screening Device Market include iCare, RetinaLyze, Heart Eye, EYENUK, Retmarker, Airdoc, AEYE Health, Evolucare, Topcon Healthcare, Remidio, and MONA. Health, Forus Health, Identifeye Health, Visionix, Digital Diagnostics, and EyRIS. These players continue to invest in technological innovation and market expansion to strengthen their global presence. Leading companies in the AI-driven retinal screening device market are employing multiple strategies to enhance their competitive position. A major focus lies in research and development to create advanced AI algorithms capable of detecting a wider range of retinal conditions with greater accuracy. Many firms are forming strategic alliances with hospitals, clinics, and telemedicine providers to expand the deployment of AI-based screening tools. Companies are also emphasizing the integration of their systems with electronic health record platforms to enable seamless clinical workflows.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes

- 3.2.1.2 Rising geriatric population

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising awareness and screening programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 Stringent regulatory guidelines

- 3.2.3 Opportunities

- 3.2.3.1 Multi-disease detection platform development

- 3.2.3.2 Integration with mobile health (mHealth)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Investment landscape

- 3.7 Reimbursement scenario

- 3.8 Technology evolution timeline

- 3.9 Emerging use cases & applications

- 3.9.1 Systemic disease screening from retinal images

- 3.9.2 Cardiovascular risk assessment

- 3.9.3 Neurological condition detection

- 3.10 Value chain analysis

- 3.10.1 Hardware manufacturers

- 3.10.2 AI algorithm developers

- 3.10.3 Software platform providers

- 3.10.4 Healthcare service providers

- 3.10.5 End use integration partners

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

- 3.14 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fundus image-based AI

- 5.3 OCT-based AI

- 5.4 Multi-modal AI

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diabetic retinopathy

- 6.3 Age-related macular degeneration

- 6.4 Glaucoma

- 6.5 Cataract

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ophthalmology clinics

- 7.4 Mobile clinics/Rural camps

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AEYE Health

- 9.2 Airdoc

- 9.3 DIGITAL DIAGNOSTICS

- 9.4 evolucare

- 9.5 EYENUK

- 9.6 EyRIS

- 9.7 Forus Health

- 9.8 HEART EYE

- 9.9 iCare

- 9.10 identifeye HEALTH

- 9.11 MONA.health

- 9.12 remidio

- 9.13 RetinaLyze

- 9.14 Retmarker

- 9.15 Topcon Healthcare

- 9.16 Visionix