|

市場調查報告書

商品編碼

1876577

微流控市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Microfluidics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

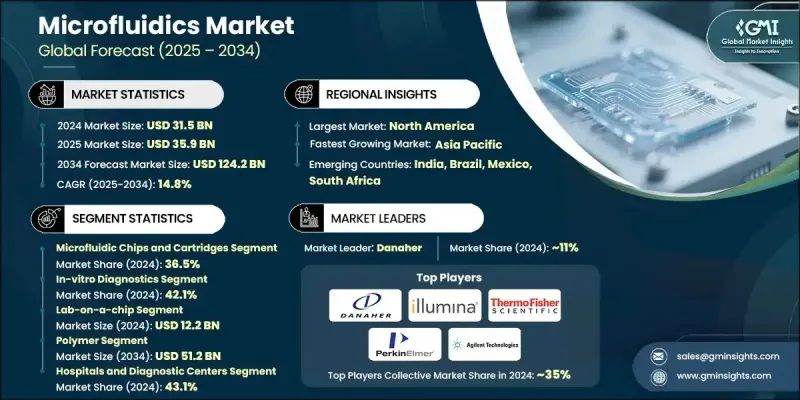

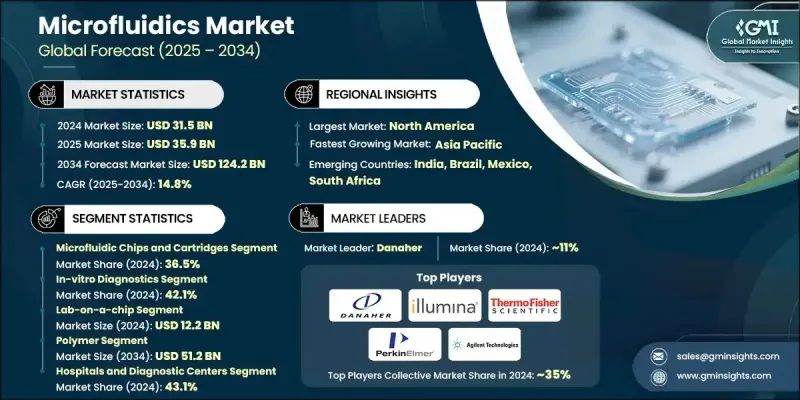

2024 年全球微流控市場價值為 315 億美元,預計到 2034 年將以 14.8% 的複合年成長率成長至 1242 億美元。

市場擴張的驅動力來自即時診斷系統的日益普及、精準醫療的興起以及對更快、更準確的樣本分析日益成長的需求。包括癌症、心血管疾病和糖尿病在內的慢性疾病盛行率不斷上升,顯著增加了對既能提供高效結果又能確保患者舒適度的診斷技術的需求。微流控裝置因其能夠以極少的樣本量提供快速、高精度的結果,在臨床和研究應用中得到廣泛認可。數位微流控、微型晶片實驗室系統和3D細胞培養模型等創新技術的出現,正在拓展該技術在藥物研發、生物醫學研究和臨床診斷等多個領域的應用。此外,不斷完善的醫療基礎設施和強大的研發投入也在加速微流控技術的應用。微流控技術涉及在微尺度通道內操控極小體積的流體,具有精確控制、試劑消耗量低和成本效益高等優勢,使其成為現代診斷和治療研發中不可或缺的工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 315億美元 |

| 預測值 | 1242億美元 |

| 複合年成長率 | 14.8% |

微流控晶片和晶片盒在2024年佔據了36.5%的市場佔有率,這主要得益於它們在實現攜帶式、高效且經濟的診斷應用方面發揮的關鍵作用。這些晶片對於晶片實驗室系統和即時檢測至關重要,為分散式醫療機構提供了可擴展的解決方案。在診斷基礎設施有限的地區,微流控晶片盒的日益普及進一步推動了該領域的成長,因為這些設備無需複雜的實驗室設備即可提供快速、準確的檢測結果。

體外診斷(IVD)領域預計在2024年佔據42.1%的市場佔有率,這主要得益於慢性病和傳染病領域對經濟實惠、精準高效且高通量檢測的需求不斷成長。基於微流控技術的IVD解決方案因其多重檢測能力和卓越的靈敏度,被廣泛應用於液體活體組織切片、基因分析和傳染病檢測。將其整合到現代實驗室工作流程中,可提高診斷效率並縮短週轉時間,從而顯著推動市場擴張。

2024年,北美微流控市場佔43.5%的比重。該地區的領先地位源於美國和加拿大先進的醫療保健體系、大規模的研發投入以及對創新診斷技術的廣泛應用。研究機構、醫院和學術中心對微流控平台的日益普及,為科技的持續發展創造了有利環境。此外,政府支持的分子診斷、個人化醫療和基於人工智慧的健康分析等舉措,進一步加速了市場滲透,並促進了微流控設備在醫療保健和生命科學領域的應用。

全球微流控市場的主要參與者包括丹納赫(Danaher)、Illumina、Bio-Rad Laboratories、羅氏(F. Hoffmann-La Roche)、凱傑(Qiagen)、貝克頓·迪金森(Becton Dickinson)、賽默飛世爾科技(Thermo Fisher Scients)、安捷倫科技生物(Agil 這些科技)、MicHoria)、梅梅里科技生物) Microfluidics、Fluigent、Standard BioTools、珀金埃爾默(PerkinElmer)、波士頓製藥(Boston Pharmaceutical,旗下品牌Nanomix)、Emulate、uFluidix、Sphere Fluidics和Xona Microfluidics。為了鞏固其在全球微流控市場的地位,各大公司正致力於產品創新、自動化整合以及與診斷和製藥公司的合作。許多公司正在投資開發多功能晶片實驗室平台、數位微流控系統以及可擴展的基於晶片盒的解決方案,這些方案旨在實現快速、高精度的檢測。設備製造商和生物技術公司之間的策略合作正在幫助拓展產品組合併加速臨床驗證。為了順應去中心化診斷和個人化醫療的發展趨勢,各公司也優先考慮小型化和互聯互通。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 對即時診斷的需求不斷成長

- 個人化醫療和基因組學的擴展

- 與人工智慧和數位健康平台的整合

- 微加工和材料技術的進步

- 產業陷阱與挑戰

- 高昂的研發和製造成本

- 監管和標準化方面的障礙

- 市場機遇

- 晶片器官和3D細胞培養平台的發展

- 在資源匱乏和分散的環境中採用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 未來市場趨勢

- 技術格局

- 目前技術

- 新興技術

- 專利分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 微流控晶片和晶片盒

- 儀器和分析儀

- 幫浦、閥門和感測器

- 試劑和耗材

- 其他產品

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 製藥

- 醫療器材

- 體外診斷

- 其他應用

第7章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 晶片實驗室

- 器官晶片

- 連續流微流控

- 其他技術

第8章:市場估算與預測:依材料分類,2021-2034年

- 主要趨勢

- 矽

- 玻璃

- 聚合物

- 其他材料

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院和診斷中心

- 學術和研究中心

- 製藥和生物技術公司

- 其他最終用途

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Agilent Technologies

- Bartels Mikrotechnik

- Becton Dickinson

- bioMerieux

- Bio-Rad Laboratories

- Boston Pharmaceutical (Nanomix)

- Danaher

- Dolomite Microfluidics

- Emulate

- F. Hoffmann-La Roche

- Fluigent

- Illumina

- PerkinElmer

- Qiagen

- Sphere Fluidics

- Standard BioTools

- Thermo Fisher Scientific

- uFluidix

- Xona Microfluidics

The Global Microfluidics Market was valued at USD 31.5 billion in 2024 and is estimated to grow at a CAGR of 14.8% to reach USD 124.2 billion by 2034.

The market's expansion is driven by increasing adoption of point-of-care diagnostic systems, the rise of precision medicine, and the growing demand for faster and more accurate sample analysis. The increasing prevalence of chronic diseases, including cancer, cardiovascular disorders, and diabetes, has significantly amplified the need for diagnostic technologies that deliver efficient results while ensuring patient comfort. Microfluidic devices are gaining widespread acceptance in clinical and research applications due to their ability to provide rapid results with high accuracy using minimal sample quantities. The emergence of innovations such as digital microfluidics, miniaturized lab-on-a-chip systems, and 3D cell culture models is extending the technology's use across diverse domains, including drug discovery, biomedical research, and clinical diagnostics. Furthermore, expanding healthcare infrastructure and strong R&D investments are accelerating the adoption of microfluidic technologies. Microfluidics, which involves manipulating extremely small fluid volumes within microscale channels, offers advantages such as precision control, low reagent consumption, and cost efficiency, making it indispensable for modern diagnostics and therapeutic development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $31.5 Billion |

| Forecast Value | $124.2 Billion |

| CAGR | 14.8% |

The microfluidic chips and cartridges segment held 36.5% share in 2024, because of their critical role in enabling portable, efficient, and cost-effective diagnostic applications. These chips are vital for lab-on-a-chip systems and point-of-care testing, offering scalable solutions for decentralized healthcare settings. The rising adoption of microfluidic cartridges in regions with limited diagnostic infrastructure is further supporting this segment's growth, as these devices provide rapid, accurate results without requiring complex laboratory setups.

The in-vitro diagnostics segment held 42.1% share in 2024, fueled by increasing demand for affordable, precise, and high-throughput testing across chronic and infectious diseases. Microfluidic-based IVD solutions are widely used for liquid biopsies, genetic analyses, and infectious disease detection due to their multiplexing capabilities and exceptional sensitivity. Their integration into modern laboratory workflows enhances diagnostic efficiency while reducing turnaround times, contributing significantly to market expansion.

North America Microfluidics Market held a 43.5% share in 2024. The region's dominance stems from advanced healthcare systems, large-scale R&D spending, and strong adoption of innovative diagnostic technologies in the U.S. and Canada. Growing utilization of microfluidic platforms in research institutes, hospitals, and academic centers has created a fertile environment for continued technological development. Additionally, government-backed initiatives supporting molecular diagnostics, personalized medicine, and AI-based health analytics are further accelerating market penetration and enhancing the adoption of microfluidic devices across healthcare and life sciences sectors.

Key players active in the Global Microfluidics Market include Danaher, Illumina, Bio-Rad Laboratories, F. Hoffmann-La Roche, Qiagen, Becton Dickinson, Thermo Fisher Scientific, Agilent Technologies, bioMerieux, Bartels Mikrotechnik, Dolomite Microfluidics, Fluigent, Standard BioTools, PerkinElmer, Boston Pharmaceutical (Nanomix), Emulate, uFluidix, Sphere Fluidics, and Xona Microfluidics. To strengthen their foothold in the Global Microfluidics Market, major companies are focusing on product innovation, automation integration, and partnerships with diagnostic and pharmaceutical firms. Many are investing in the development of multifunctional lab-on-chip platforms, digital microfluidic systems, and scalable cartridge-based solutions designed for rapid, high-precision testing. Strategic collaborations between device manufacturers and biotechnology companies are helping expand product portfolios and accelerate clinical validation. Firms are also prioritizing miniaturization and connectivity to align with the growing trend of decentralized diagnostics and personalized medicine.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Technology trends

- 2.2.5 Material trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for point-of-care diagnostics

- 3.2.1.2 Expansion of personalized medicine and genomics

- 3.2.1.3 Integration with AI and digital health platforms

- 3.2.1.4 Advancements in microfabrication and materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Regulatory and standardization hurdles

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in organ-on-chip and 3D cell culture platforms

- 3.2.3.2 Adoption in low-resource and decentralized settings

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Microfluidic chips and cartridges

- 5.3 Instruments and analyzers

- 5.4 Pumps, valves and sensors

- 5.5 Reagents and consumables

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pharmaceuticals

- 6.3 Medical devices

- 6.4 In-vitro diagnostics

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Lab-on-a-chip

- 7.3 Organs-on-chips

- 7.4 Continuous flow microfluidics

- 7.5 Other technologies

Chapter 8 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Silicon

- 8.3 Glass

- 8.4 Polymer

- 8.5 Other materials

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and diagnostic centers

- 9.3 Academic and research centers

- 9.4 Pharmaceutical and biotechnology companies

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Agilent Technologies

- 11.2 Bartels Mikrotechnik

- 11.3 Becton Dickinson

- 11.4 bioMerieux

- 11.5 Bio-Rad Laboratories

- 11.6 Boston Pharmaceutical (Nanomix)

- 11.7 Danaher

- 11.8 Dolomite Microfluidics

- 11.9 Emulate

- 11.10 F. Hoffmann-La Roche

- 11.11 Fluigent

- 11.12 Illumina

- 11.13 PerkinElmer

- 11.14 Qiagen

- 11.15 Sphere Fluidics

- 11.16 Standard BioTools

- 11.17 Thermo Fisher Scientific

- 11.18 uFluidix

- 11.19 Xona Microfluidics