|

市場調查報告書

商品編碼

1876570

輪轂馬達控制半導體市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)In-Wheel Motor Control Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

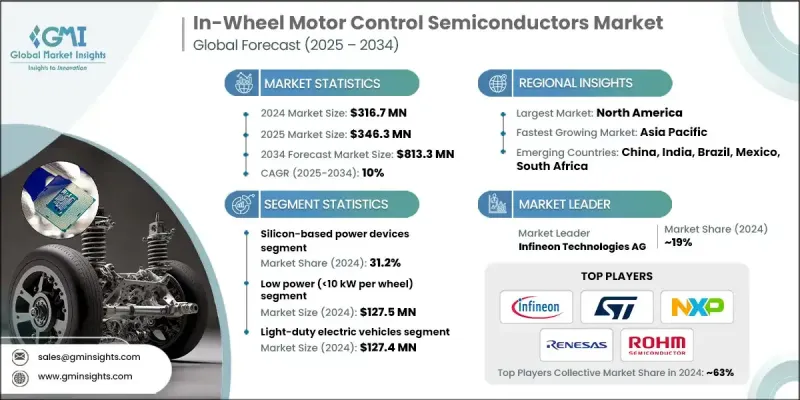

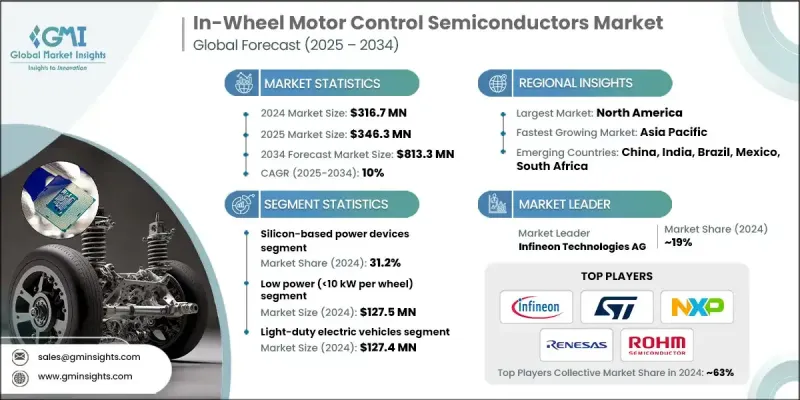

2024 年全球輪轂馬達控制半導體市場價值為 3.167 億美元,預計到 2034 年將以 10% 的複合年成長率成長至 8.133 億美元。

電動轉型以及對高效能、輕量化、緊湊型動力傳動系統的需求是推動該市場擴張的關鍵因素。這些半導體是控制和最佳化電動車內部動力分配的關鍵組件,能夠確保更好的扭力控制、更高的能源效率和更優異的車輛性能。人們對永續交通和節能型汽車的日益關注,以及電力電子技術的快速創新,持續加速著市場應用。碳化矽 (SiC) 和氮化鎵 (GaN) 等寬禁帶半導體材料的日益普及,透過降低能量損耗和改善熱管理,進一步提升了輪轂馬達系統的性能。電動車產業的強勁推動、消費者對高性能汽車不斷成長的期望以及電機控制技術的持續進步,共同塑造全球輪轂馬達控制半導體市場的未來前景。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.167億美元 |

| 預測值 | 8.133億美元 |

| 複合年成長率 | 10% |

預計到2024年,矽基功率元件市場佔有率將達31.2%。由於其成本效益高、可靠性強且生產基礎設施完善,這些元件仍然是應用最廣泛的選擇。矽基半導體因其性能穩定、易於整合和市場供應充足而備受汽車製造商青睞,與價格更高的碳化矽(SiC)和氮化鎵(GaN)等新興材料相比,它們是一種更可靠的選擇。

2024年,低功率(每輪10千瓦)輪轂馬達市場規模達1.275億美元。此細分市場佔據主導地位,主要得益於其對小型電動出行應用的適用性。低功率輪轂馬達控制系統是緊湊型和輕型車輛的理想之選,具有高效的能量輸出、更低的發熱量和經濟實惠的設計。其在城市出行領域的適應性,包括共享電動車和小型電動車型,持續推動其廣泛應用。

預計到2024年,北美輪轂馬達控制半導體市場佔有率將達到28.5%。該地區受益於強大的汽車製造能力、研發創新以及對電動車和自動駕駛技術不斷成長的投資。輕型和重型電動車動力系統對先進半導體解決方案的需求持續推動著區域市場的成長。

2024年,歐洲輪轂馬達控制半導體市場規模預計將達到6,790萬美元。該地區在電動車普及方面的領先地位,加上嚴格的排放標準和高超的汽車工程技術,正在推動對緊湊高效馬達控制解決方案的需求。歐洲領先汽車製造商對下一代電動動力傳動系統的持續投資,也進一步促進了市場的擴張。

全球輪轂馬達控制半導體市場的主要參與者包括英飛凌科技股份公司 (Infineon Technologies AG)、恩智浦半導體市場的主要參與者包括英飛凌科技股份公司 (Infineon Technologies AG)、恩智浦半導體公司 (NXP Semiconductors NV)、意法半導體公司 (STMicroelectronics NV)、德州儀器公司 (Texas Instruments Incorporated)、安森式半導體? Corporation)、羅姆半導體株式會社 (ROHM Semiconductor Co., Ltd.)、三菱電機株式會社 (Mitsubishi Electric Corporation)、Wolfspeed, Inc.、亞德諾半導體公司 (Analog Devices, Inc.)、Allegro MicroSystems, Inc.、Fumeris Corporation, Inc. (Melte) Corporation、Hexteam (Mirk) Corporation (Mexte) Corporation (Mexte))、東芝式公司 (Toshite)? Co., Ltd.)、大陸集團 (Continental AG)、羅伯特博世有限公司 (Robert Bosch GmbH)、法雷奧公司 (Valeo SA)、麥格納國際公司 (Magna International Inc.) 和博格華納公司 (BorgWarner Inc.)。這些領導企業正致力於創新、策略聯盟和技術拓展,以鞏固其市場地位。許多企業正大力投資研發,以提升半導體效率、熱管理和功率密度。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 電動車的日益普及對高效緊湊的馬達控制解決方案提出了更高的要求。

- GaN和SiC等寬禁帶半導體材料的進步提高了系統性能。

- 日益重視車輛電氣化和能源效率。

- 對改進扭矩控制和駕駛動態性能的需求日益成長。

- 產業陷阱與挑戰

- 先進半導體材料的高生產成本。

- 輪轂馬達系統複雜設計與整合挑戰。

- 市場機遇

- 對下一代電動和自動駕駛汽車的需求不斷成長。

- 人工智慧和物聯網技術在智慧馬達控制系統中的融合應用。

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

- 技術格局

- 當前趨勢

- 新興技術

- 管道分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依半導體技術類型分類,2021-2034年

- 主要趨勢

- 碳化矽(SiC)功率元件

- 矽基功率元件

- 閘極驅動器積體電路

- 馬達控制微控制器

- 電源管理積體電路

- 感測器和執行器

第6章:市場估算與預測:依功率等級分類,2021-2034年

- 主要趨勢

- 低功率(每輪<10千瓦)

- 中等功率(每輪10-50千瓦)

- 高功率(每輪>50千瓦)

第7章:市場估價與預測:依車輛應用分類,2021-2034年

- 主要趨勢

- 輕型電動車

- 中型電動車

- 重型電動車

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Infineon Technologies AG

- NXP Semiconductors NV

- STMicroelectronics NV

- Texas Instruments Incorporated

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- ROHM Semiconductor Co., Ltd.

- Mitsubishi Electric Corporation

- Wolfspeed, Inc.

- Analog Devices, Inc.

- Allegro MicroSystems, Inc.

- Melexis NV

- Maxim Integrated Inc.

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Continental AG

- Robert Bosch GmbH

- Valeo SA

- Magna International Inc.

- BorgWarner Inc.

The Global In-Wheel Motor Control Semiconductors Market was valued at USD 316.7 million in 2024 and is estimated to grow at a CAGR of 10% to reach USD 813.3 million by 2034.

The growing transition toward electric mobility and the demand for efficient, lightweight, and compact drivetrain systems are key drivers behind this market's expansion. These semiconductors are essential components in controlling and optimizing power distribution within electric vehicles, ensuring better torque control, higher energy efficiency, and enhanced vehicle performance. The rising focus on sustainable transportation and energy-efficient vehicles, coupled with rapid innovation in power electronics, continues to accelerate market adoption. Increasing integration of wide-bandgap semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN) is further transforming the performance of in-wheel motor systems by reducing energy loss and improving heat management. The strong push from the electric vehicle industry, evolving consumer expectations for high-performance vehicles, and the ongoing advancements in motor control technology are shaping the global outlook for the in-wheel motor control semiconductors market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $316.7 Million |

| Forecast Value | $813.3 Million |

| CAGR | 10% |

The silicon-based power devices segment held a 31.2% share in 2024. These devices remain the most widely adopted due to their cost-effectiveness, proven dependability, and established production infrastructure. Silicon-based semiconductors are preferred by automakers for their stable performance, ease of integration, and broad market availability, making them a reliable option compared with more expensive emerging materials like SiC and GaN.

The low-power (10 kW per wheel) segment generated USD 127.5 million in 2024. This category dominates because of its suitability for smaller electric mobility applications. Low-power in-wheel motor control systems are ideal for compact and light-duty vehicles, offering efficient energy delivery, reduced heat generation, and affordable design. Their adaptability for urban mobility, including shared EVs and small electric models, continues to promote widespread deployment.

North America In-Wheel Motor Control Semiconductors Market held 28.5% share in 2024. The region benefits from strong automotive manufacturing capabilities, research innovation, and increasing investments in electric mobility and autonomous vehicle technologies. The demand for advanced semiconductor solutions in electric vehicle propulsion systems across both light-duty and heavy-duty categories continues to support regional market growth.

Europe In-Wheel Motor Control Semiconductors Market generated USD 67.9 million in 2024. The region's leadership in electric vehicle adoption, coupled with stringent emission standards and high automotive engineering expertise, is driving demand for compact and efficient motor control solutions. Continuous investment from leading European automakers in next-generation electric drivetrain systems is propelling further expansion of the market.

Key participants operating in the Global In-Wheel Motor Control Semiconductors Market include Infineon Technologies AG, NXP Semiconductors N.V., STMicroelectronics N.V., Texas Instruments Incorporated, ON Semiconductor Corporation, Renesas Electronics Corporation, ROHM Semiconductor Co., Ltd., Mitsubishi Electric Corporation, Wolfspeed, Inc., Analog Devices, Inc., Allegro MicroSystems, Inc., Melexis NV, Maxim Integrated Inc., Toshiba Corporation, Fuji Electric Co., Ltd., Continental AG, Robert Bosch GmbH, Valeo SA, Magna International Inc., and BorgWarner Inc. Leading companies in the In-Wheel Motor Control Semiconductors Market are focusing on innovation, strategic alliances, and technological expansion to strengthen their market position. Many are investing heavily in research and development to advance semiconductor efficiency, thermal management, and power density.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Semiconductor Technology Type Trends

- 2.2.3 Vehicle Application Trends

- 2.2.4 Power Rating Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Adoption of Electric Vehicles Demanding Efficient and Compact Motor Control Solutions.

- 3.2.1.2 Advancements in Wide-Bandgap Semiconductor Materials such as Gan and SiC Enhancing System Performance.

- 3.2.1.3 Growing Focus on Vehicle Electrification and Energy Efficiency.

- 3.2.1.4 Increasing Demand for Improved Torque Control and Driving Dynamics.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Production Costs Associated with Advanced Semiconductor Materials.

- 3.2.2.2 Complex Design and Integration Challenges in In-wheel Motor Systems.

- 3.2.3 Market opportunities

- 3.2.3.1 Rising Demand for Next-generation Electric and Autonomous Vehicles.

- 3.2.3.2 Integration of AI and IoT Technologies for Smart Motor Control Systems.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Semiconductor Technology Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Silicon Carbide (SiC) Power Devices

- 5.3 Silicon-Based Power Devices

- 5.4 Gate Driver ICs

- 5.5 Motor Control Microcontrollers

- 5.6 Power Management ICs

- 5.7 Sensors & Actuators

Chapter 6 Market Estimates and Forecast, By Power Rating, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Low Power (<10 kW per wheel)

- 6.3 Medium Power (10-50 kW per wheel)

- 6.4 High Power (>50 kW per wheel)

Chapter 7 Market Estimates and Forecast, By Vehicle Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Light-Duty Electric Vehicles

- 7.3 Medium-Duty Electric Vehicles

- 7.4 Heavy-Duty Electric Vehicles

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Infineon Technologies AG

- 9.2 NXP Semiconductors N.V.

- 9.3 STMicroelectronics N.V.

- 9.4 Texas Instruments Incorporated

- 9.5 ON Semiconductor Corporation

- 9.6 Renesas Electronics Corporation

- 9.7 ROHM Semiconductor Co., Ltd.

- 9.8 Mitsubishi Electric Corporation

- 9.9 Wolfspeed, Inc.

- 9.10 Analog Devices, Inc.

- 9.11 Allegro MicroSystems, Inc.

- 9.12 Melexis NV

- 9.13 Maxim Integrated Inc.

- 9.14 Toshiba Corporation

- 9.15 Fuji Electric Co., Ltd.

- 9.16 Continental AG

- 9.17 Robert Bosch GmbH

- 9.18 Valeo SA

- 9.19 Magna International Inc.

- 9.20 BorgWarner Inc.