|

市場調查報告書

商品編碼

1876569

氫電混合動力系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Hybrid Hydrogen-Electric Powertrain Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

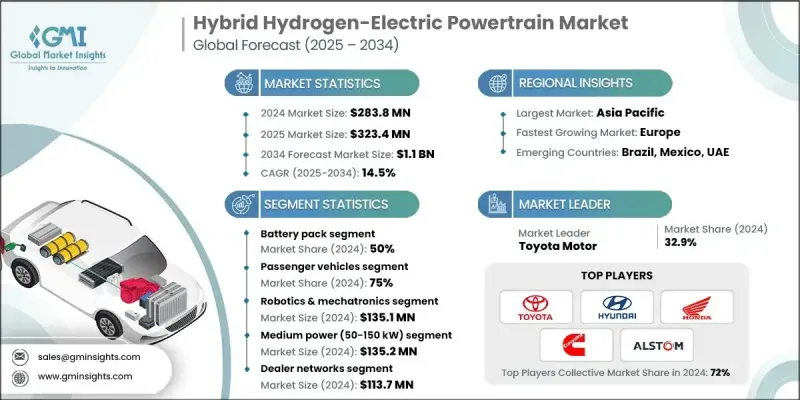

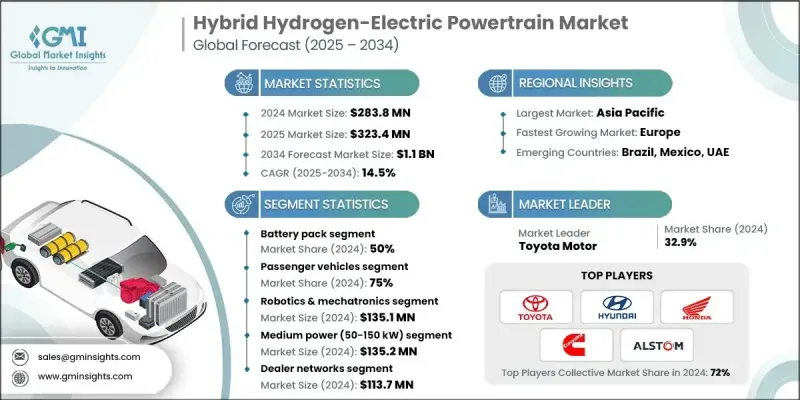

2024 年,混合動力氫電動力總成市場價值為 2.838 億美元,預計到 2034 年將以 14.5% 的複合年成長率成長至 11 億美元。

全球對永續、節能出行方式日益成長的關注以及向低排放交通系統的轉型,推動了市場的快速成長。乘用車、商用車和專用車輛對氫電混合動力系統的日益普及,受到政府嚴格政策、燃油經濟性目標不斷提高以及對更清潔出行方式需求的推動。輕量化材料、儲能系統和先進動力系統架構的持續進步,進一步推動了技術創新。智慧製造和數位自動化的日益融合,正在改變製造商設計和生產這些系統的方式。透過物聯網監控、人工智慧驅動的流程管理和預測性維護,汽車製造商正在實現更高的效率、更少的生產停機時間和更高的品質標準。先進的燃料電池技術、高效能馬達和智慧能源管理平台正在提升氫電混合動力系統的整體性能。數位化工廠生態系統、雲端營運和可互通自動化平台的採用,正使市場與全球脫碳和淨零排放計劃保持一致。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.838億美元 |

| 預測值 | 11億美元 |

| 複合年成長率 | 14.5% |

2024年,電池組市佔率達到50%,預計2025年至2034年間將以14.5%的複合年成長率成長。電池組對於氫燃料電池和電動混合動力系統至關重要,是高效儲能和配能的主要來源。固態電池和高密度鋰離子電池等先進電池技術的日益普及,有助於實現能量回收、延長續航里程,並與氫燃料電池和電力驅動系統無縫銜接。汽車製造商和供應商將繼續優先研發高性能電池組,以確保系統具有穩定的可靠性、卓越的能源效率和更佳的混合動力性能。

乘用車市場佔75%的市場佔有率,預計到2034年將以14.4%的複合年成長率成長。此細分市場的主導地位得益於混合動力和氫燃料電池乘用車產量的成長、日益嚴格的排放標準以及智慧製造技術的推廣應用。汽車製造商正大力投資智慧工廠解決方案,例如機器人技術、人工智慧分析和雲端監控系統,以提高生產精度、能源效率並確保符合環保法規。

2024年,日本氫電混合動力系統市場規模達6,960萬美元,市佔率為33%。日本強大的製造業基礎,以及來自原始設備製造商、一級和二級供應商以及技術開發商的旺盛需求,支撐著市場的穩定擴張。日本企業正在整個動力系統價值鏈中應用先進的數位化解決方案,包括預測分析、基於物聯網的監控系統和能源管理平台。對模組化和可擴展動力系統系統的重視,使製造商能夠在滿足嚴格的環保要求的同時,提升營運效率、可靠性和永續性。

全球氫燃料電池混合動力系統市場的主要參與者包括阿爾斯通公司(Alstom SA)、巴拉德動力系統公司(Ballard Power Systems)、寶馬集團(BMW Group)、康明斯公司(Cummins)、本田汽車公司(Honda Motor)、現代汽車公司(Hyundai Motorden)、川崎重工(Kawasaki Heavym)、瑞典汽車公司(瑞典汽車公司(Awasa)今天”汽車公司(Awasaki Heavy)、瑞典汽車公司(瑞典汽車公司(Awaspet)) Motor)。這些領先製造商正透過創新、合作和擴張來鞏固其競爭地位。許多企業正加大研發投入,以提高系統效率、氫燃料電池性能和電池整合度。汽車製造商、零件供應商和能源公司之間的策略合作正在加速技術商業化和大規模部署。各公司正著力推動數位化轉型,整合以人工智慧為基礎的能源最佳化技術,並採用模組化設計,以提高可擴展性和靈活性。此外,對在地化生產設施和永續發展措施的長期投資,正幫助領先企業獲得成本優勢,並與全球減排目標保持一致。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 政府脫碳政策與氫能策略

- 技術成熟度與商業可行性論證

- 與純電池解決方案相比,重型應用具有優勢。

- 基礎建設投資與公私合作

- 產業陷阱與挑戰

- 高昂的系統成本和組件溢價

- 氫氣加註基礎設施有限

- 市場機遇

- 鐵路電氣化缺口及柴油替代潛力

- 海洋脫碳要求

- 工業和固定式電源應用

- 鐵路和海運脫碳

- 成長促進因素

- 成長潛力分析

- 監管環境

- 全球氫能與燃料電池政策

- 排放和脫碳法規

- 安全與車輛標準

- 基礎設施和加油合規性

- 研發與創新激勵措施

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 燃料電池技術

- 電池和儲能

- 電力電子和控制單元

- 電動機和傳動系統

- 數位與智慧製造整合

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 最佳情況

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 電池組

- 燃料電池堆

- 馬達和傳動系統

- 電力電子控制單元

- 氫氣儲存系統

- 工廠平衡(BoP)

第6章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第7章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 質子交換膜(PEM)燃料電池系統

- 固態氧化物燃料電池(SOFC)系統

- 磷酸燃料電池(PAFC)系統

- 熔融碳酸鹽燃料電池(MCFC)系統

- 鹼性燃料電池(AFC)系統

第8章:市場估計與預測:依發電量分類,2021-2034年

- 主要趨勢

- 中等功率(50-150千瓦)

- 高功率(150-300千瓦)

- 低功率(<50千瓦)

- 超高功率(>300千瓦)

第9章:市場估算與預測:依混合動力配置分類,2021-2034年

- 主要趨勢

- 串聯式混合動力(燃料電池為電池充電,電池驅動馬達)

- 並聯式混合動力(燃料電池和電池共同驅動馬達)

- 串並聯混合式(組合配置)

- 插電式混合動力(具備外部充電功能)

第10章:市場估價與預測:依銷售管道分類,2021-2034年

- 主要趨勢

- 經銷商網路

- 車隊銷售

- 租賃公司

- OEM直銷

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- Global Player

- Alstom SA

- Ballard Power Systems

- BMW

- Bosch

- Cummins

- Honda Motor

- Hyundai Motor

- Kawasaki Heavy

- Symbio

- Toyota Motor

- Regional Player

- Bloom Energy Corporation

- BYD

- Daimler AG

- FuelCell Energy

- Hexagon Composites ASA

- Magna International

- Nissan Motor

- Stellantis NV

- Volvo Group AB

- Worthington Enterprises

- 新興參與者

- ITM Power PLC

- Nel ASA

- Plug Power

- PowerCell Sweden AB

- Viritech

The Hybrid Hydrogen-Electric Powertrain Market was valued at USD 283.8 million in 2024 and is estimated to grow at a CAGR of 14.5% to reach USD 1.1 billion by 2034.

The market's rapid growth is propelled by the rising global focus on sustainable, energy-efficient mobility and the shift toward low-emission transportation systems. Increasing adoption of hybrid hydrogen-electric powertrains in passenger, commercial, and specialized vehicles is being influenced by stringent government policies, improved fuel economy goals, and the demand for cleaner mobility options. Ongoing progress in lightweight materials, energy storage systems, and advanced powertrain architectures is further driving technological innovation. The expanding integration of smart manufacturing and digital automation is transforming the way manufacturers design and produce these systems. Through IoT-enabled monitoring, AI-powered process management, and predictive maintenance, automotive producers are achieving greater efficiency, reduced production downtime, and improved quality standards. Advanced fuel cell technology, high-efficiency electric motors, and intelligent energy management platforms are enhancing the overall capability of hybrid hydrogen-electric systems. The adoption of digital factory ecosystems, cloud-based operations, and interoperable automation platforms is aligning the market with global decarbonization and net-zero emission initiatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $283.8 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 14.5% |

In 2024, the battery pack segment held a 50% share and is forecast to grow at a CAGR of 14.5% between 2025 and 2034. Battery packs remain vital to hybrid hydrogen-electric powertrains, serving as the primary source for efficient energy storage and distribution. The increasing use of advanced battery technologies such as solid-state and high-density lithium-ion systems supports regenerative energy capture, extended driving range, and seamless coordination with hydrogen fuel cells and electric propulsion systems. Automakers and suppliers continue to prioritize high-performance battery packs to ensure consistent reliability, strong energy efficiency, and enhanced hybrid performance.

The passenger vehicle segment held a 75% share and is projected to grow at a CAGR of 14.4% through 2034. This segment's dominance is supported by growing production of hybrid and hydrogen-electric passenger cars, tighter emissions standards, and the expansion of smart manufacturing practices. Automotive manufacturers are investing heavily in intelligent factory solutions such as robotics, AI-based analytics, and cloud-connected monitoring systems to enhance production precision, energy efficiency, and compliance with environmental regulations.

Japan Hybrid Hydrogen-Electric Powertrain Market generated USD 69.6 million in 2024 and held a 33% share. The country's strong manufacturing base, along with extensive demand from original equipment manufacturers, Tier-1 and Tier-2 suppliers, and technology developers, supports steady market expansion. Japanese companies are implementing advanced digital solutions, including predictive analytics, IoT-based monitoring systems, and energy management platforms, across the entire powertrain value chain. The focus on modular and scalable powertrain systems enables manufacturers to meet strict environmental requirements while improving operational efficiency, reliability, and sustainability performance.

Prominent companies participating in the Global Hybrid Hydrogen-Electric Powertrain Market include Alstom SA, Ballard Power Systems, BMW Group, Cummins, Honda Motor, Hyundai Motor, Kawasaki Heavy, PowerCell Sweden AB, Symbio, and Toyota Motor. Leading manufacturers in the Global Hybrid Hydrogen-Electric Powertrain Market are strengthening their competitive positions through a combination of innovation, collaboration, and expansion. Many are investing in R&D to enhance system efficiency, hydrogen fuel cell performance, and battery integration. Strategic partnerships between automakers, component suppliers, and energy firms are accelerating technology commercialization and large-scale deployment. Companies are emphasizing digital transformation, integrating AI-based energy optimization, and adopting modular designs to improve scalability and flexibility. Furthermore, long-term investments in localized production facilities and sustainability-driven initiatives are helping leading players achieve cost advantages and align with global emission reduction goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Power Output

- 2.2.6 Hybrid Configuration

- 2.2.7 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government decarbonization policies & hydrogen strategies

- 3.2.1.2 Technology maturation & commercial viability demonstration

- 3.2.1.3 Heavy-duty application advantages over battery-only solutions

- 3.2.1.4 Infrastructure investment & public-private partnerships

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system costs & component price premiums

- 3.2.2.2 Limited hydrogen refueling infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Rail electrification gap & diesel replacement potential

- 3.2.3.2 Marine decarbonization requirements

- 3.2.3.3 Industrial & stationary power applications

- 3.2.3.4 Rail and marine decarbonization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global hydrogen & fuel cell policies

- 3.4.2 Emission & decarbonization regulations

- 3.4.3 Safety & vehicle standards

- 3.4.4 Infrastructure & refueling compliance

- 3.4.5 R&D & innovation incentives

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Fuel cell technologies

- 3.7.2 Battery & energy storage

- 3.7.3 Power electronics & control units

- 3.7.4 Electric motors & drivetrains

- 3.7.5 Digital & smart manufacturing integration

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

- 3.14 Best case scenarios

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Battery pack

- 5.3 Fuel cell stack

- 5.4 Electric motor & drivetrain

- 5.5 Power electronics & control unit

- 5.6 Hydrogen storage system

- 5.7 Balance of plant (BoP)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Proton exchange membrane (PEM) fuel cell systems

- 7.3 Solid oxide fuel cell (SOFC) systems

- 7.4 Phosphoric acid fuel cell (PAFC) systems

- 7.5 Molten carbonate fuel cell (MCFC) systems

- 7.6 Alkaline fuel cell (AFC) systems

Chapter 8 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 Medium power (50-150 kW)

- 8.3 High power (150-300 kW)

- 8.4 Low power (<50 kW)

- 8.5 Ultra-High power (>300 kW)

Chapter 9 Market Estimates & Forecast, By Hybrid Configuration, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 Series hybrid (FC charges battery, battery drives motor)

- 9.3 Parallel hybrid (FC and battery both drive motor)

- 9.4 Series-Parallel hybrid (Combined configuration)

- 9.5 Plug-in hybrid (External charging capability)

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($ Mn, Units)

- 10.1 Key trends

- 10.2 Dealer Networks

- 10.3 Fleet Sales

- 10.4 Leasing Companies

- 10.5 OEM Direct Sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Belgium

- 11.3.7 Netherlands

- 11.3.8 Sweden

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 Singapore

- 11.4.6 South Korea

- 11.4.7 Vietnam

- 11.4.8 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Global Player

- 12.1.1 Alstom SA

- 12.1.2 Ballard Power Systems

- 12.1.3 BMW

- 12.1.4 Bosch

- 12.1.5 Cummins

- 12.1.6 Honda Motor

- 12.1.7 Hyundai Motor

- 12.1.8 Kawasaki Heavy

- 12.1.9 Symbio

- 12.1.10 Toyota Motor

- 12.2 Regional Player

- 12.2.1 Bloom Energy Corporation

- 12.2.2 BYD

- 12.2.3 Daimler AG

- 12.2.4 FuelCell Energy

- 12.2.5 Hexagon Composites ASA

- 12.2.6 Magna International

- 12.2.7 Nissan Motor

- 12.2.8 Stellantis N.V.

- 12.2.9 Volvo Group AB

- 12.2.10 Worthington Enterprises

- 12.3 Emerging Players

- 12.3.1 ITM Power PLC

- 12.3.2 Nel ASA

- 12.3.3 Plug Power

- 12.3.4 PowerCell Sweden AB

- 12.3.5 Viritech