|

市場調查報告書

商品編碼

1876551

膜市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Membranes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

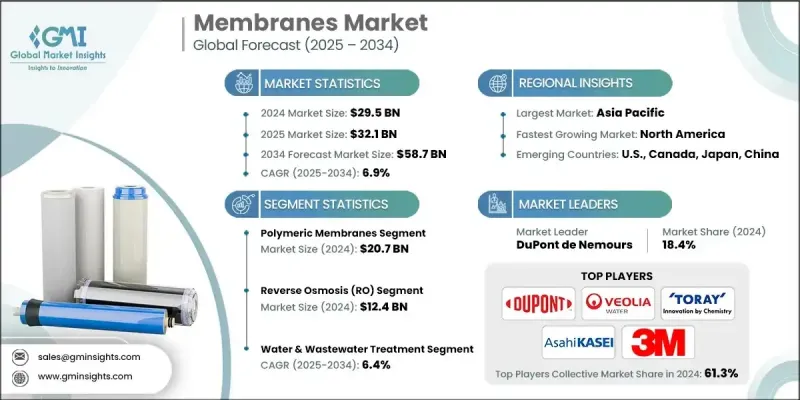

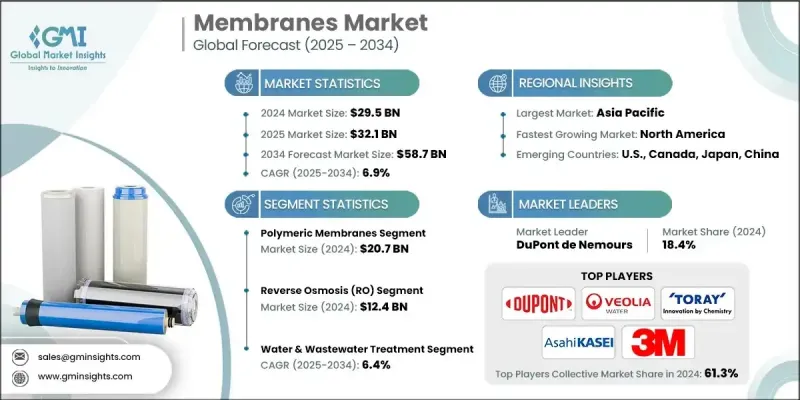

2024年全球膜市場價值為295億美元,預計2034年將以6.9%的複合年成長率成長至587億美元。

由於排放標準日益嚴格,新的廢水排放目標訂定,各行業正擴大將膜技術整合到廢水處理過程中。監管指南鼓勵使用薄膜生物反應器和逆滲透等先進系統,以實現近零液體排放,這促使各行業採用高回收率薄膜以提高成本效益。淡水資源日益短缺,促使政府和企業投資海水淡化和回收技術。各地海水和微鹹水逆滲透工廠的成長推動了薄膜技術的應用。薄膜複合膜(TFC)和聚偏氟乙烯(PVDF)薄膜的不斷改進,包括提高滲透性、抗污染性和耐久性,降低了營運成本,並使其能夠應用於各種具有挑戰性的場合。持續的研發和試點計畫進一步支持了市場的長期擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 295億美元 |

| 預測值 | 587億美元 |

| 複合年成長率 | 6.9% |

2024年,聚合物薄膜市場規模預計將達207億美元。這些膜產品憑藉其適應性和優異的性能佔據主導地位。聚偏氟乙烯(PVDF)、聚醯胺(PA)和聚醚碸(PES)材料因其高化學穩定性、高滲透性和易結垢性,被廣泛應用於工業和市政領域的各種過濾製程。防污塗層和表面改質技術的不斷創新,進一步提升了這些膜產品的可靠性和使用壽命。

2024年,逆滲透(RO)市場規模預計將達到124億美元。逆滲透系統能夠高效去除溶解鹽和雜質,因此在水淨化和工業循環利用領域至關重要。低能耗逆滲透系統和薄膜複合材料(TFC)薄膜技術的進步進一步提高了效率,同時降低了營運成本。這些改進正在鞏固逆滲透技術在已開發經濟體和新興經濟體中的主導地位。

由於北美擁有成熟的工業基礎和嚴格的水處理法規,預計到2024年,北美膜市場將佔據26.1%的佔有率。市政水回用、海水淡化項目以及各行業工業過濾系統升級改造的投資,都推動了市場擴張。日益增強的環保意識也促使超濾和逆滲透系統得到更廣泛的應用,以滿足更嚴格的污染物排放標準。

全球膜市場的主要參與者包括杜邦公司、東麗株式會社、Hydranautics(日東集團旗下)、科赫膜系統公司、頗爾公司(丹納赫旗下)、旭化成株式會社、LG化學有限公司、威立雅水務技術公司、濱特爾公司、3M公司、Iono Innovations、Aquaporin A/SadiMode、Aquaporin、SadiModeant公司和SadiModeing公司、Aquaporin、SadiModeant公司和SadiModeing公司。膜市場企業採取的關鍵策略包括:大力投資研發以提高薄膜的效率和使用壽命;建立策略聯盟和合作夥伴關係以擴大全球業務;以及不斷創新產品以滿足不同的產業需求。此外,各公司也專注於收購以鞏固市場地位,並進入新興市場以抓住新的成長機會。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 嚴格的水質法規和環保署合規要求

- 水資源日益短缺及海水淡化需求

- 工業廢水處理要求

- 膜材料的技術進步

- 產業陷阱與挑戰

- 高昂的初始資本投資和系統成本

- 膜污染及運作挑戰

- 市場機遇

- 與再生能源系統整合

- 智慧膜技術與物聯網整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 材料類型

- 科技

- 應用

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 聚合物薄膜

- 陶瓷膜

- 複合膜和混合膜

- 其他

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 微濾(MF)

- 超濾(UF)

- 奈米過濾(NF)

- 逆滲透(RO)

- 電滲析(ED)

- 其他

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 水和廢水處理

- 市政飲用水處理

- 工業廢水處理

- 膜生物反應器(MBR)系統

- 水資源再利用與回收

- 海水淡化應用

- 海水逆滲透(SWRO)

- 苦鹹水處理

- 能量回收與最佳化

- 工業加工

- 食品飲料應用

- 製藥與生物技術

- 化學和石油化學加工

- 石油和天然氣生產水處理

- 採礦和金屬回收

- 氣體分離及能源應用

- 氫氣純化和燃料電池

- 天然氣加工

- 空氣分離應用

- 儲能和電池隔膜

- 醫療和生物技術應用

- 血液透析及醫療器材

- 無菌過濾與生物加工

- 體外診斷(IVD)

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

- Hydranautics (Nitto Group)

- Koch Membrane Systems

- Pall Corporation (Danaher)

- Asahi Kasei Corporation

- LG Chem Ltd.

- Veolia Water Technologies

- Pentair plc

- 3M Company

- Ionomr Innovations Inc.

- Aquaporin A/S

- Modern Water plc

- Gradiant Corporation

- Membrion, Inc.

The Global Membranes Market was valued at USD 29.5 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 58.7 billion by 2034.

Industries are increasingly integrating membrane technologies into wastewater treatment processes due to stricter discharge standards and new effluent targets. Regulatory guidelines encourage the use of advanced systems, such as membrane bioreactors and reverse osmosis, to achieve near-zero liquid discharge, prompting industries to adopt high-recovery membranes for cost efficiency. Rising freshwater scarcity is driving both governments and businesses to invest in water desalination and recycling technologies. Growth in seawater and brackish water reverse osmosis plants across various regions is boosting membrane adoption. Continuous improvements in thin-film composite (TFC) and PVDF membranes, including enhanced permeability, fouling resistance, and durability, are reducing operational costs and enabling their use in challenging applications. Ongoing R&D and pilot initiatives further support long-term market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.5 Billion |

| Forecast Value | $58.7 Billion |

| CAGR | 6.9% |

The polymeric membranes segment generated USD 20.7 billion in 2024. These membranes dominate due to their adaptability and superior performance. PVDF, PA, and PES materials are widely used in various filtration processes for industrial and municipal applications because of their high chemical stability, permeability, and ease of scaling. Continuous innovations in antifouling coatings and surface modifications are further extending their reliability and lifespan.

The reverse osmosis (RO) segment generated USD 12.4 billion in 2024. RO systems are highly effective in removing dissolved salts and impurities, making them critical for water purification and industrial recycling. Advances in low-energy RO systems and TFC membranes have further enhanced efficiency while reducing operational costs. These improvements are strengthening RO's dominance in both developed and emerging economies.

North America Membranes Market captured 26.1% share in 2024 owing to its established industrial base and stringent water treatment regulations. Market expansion is supported by investments in municipal water reuse, desalination projects, and upgrades to industrial filtration systems across various industries. Rising environmental awareness has increased the adoption of ultrafiltration and RO systems to comply with stricter contaminant standards.

Major players in the Global Membranes Market include DuPont de Nemours, Inc., Toray Industries, Inc., Hydranautics (Nitto Group), Koch Membrane Systems, Pall Corporation (Danaher), Asahi Kasei Corporation, LG Chem Ltd., Veolia Water Technologies, Pentair plc, 3M Company, Ionomr Innovations Inc., Aquaporin A/S, Modern Water plc, Gradiant Corporation, and Membrion, Inc. Key strategies adopted by companies in the Membranes Market include investing heavily in research and development to improve membrane efficiency and lifespan, forming strategic alliances and partnerships to expand global reach, and continuously innovating product offerings to meet diverse industrial requirements. Companies are also focusing on acquisitions to consolidate market position and entering emerging markets to capture new growth opportunities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Technology

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent water quality regulations & epa compliance requirements

- 3.2.1.2 Growing water scarcity & desalination demand

- 3.2.1.3 Industrial wastewater treatment mandates

- 3.2.1.4 Technological advancements in membrane materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial capital investment & system costs

- 3.2.2.2 Membrane fouling & operational challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with renewable energy systems

- 3.2.3.2 Smart membrane technologies & IoT integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Material Type

- 3.7.3 Technology

- 3.7.4 Application

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polymeric membranes

- 5.3 Ceramic membranes

- 5.4 Composite & hybrid membranes

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Microfiltration (MF)

- 6.3 Ultrafiltration (UF)

- 6.4 Nanofiltration (NF)

- 6.5 Reverse Osmosis (RO)

- 6.6 Electrodialysis (ED)

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Water & wastewater treatment

- 7.2.1 Municipal drinking water treatment

- 7.2.2 Industrial wastewater processing

- 7.2.3 Membrane bioreactor (MBR) systems

- 7.2.4 Water reuse & reclamation

- 7.3 Desalination applications

- 7.3.1 Seawater reverse osmosis (SWRO)

- 7.3.2 Brackish water treatment

- 7.3.3 Energy recovery & optimization

- 7.4 Industrial processing

- 7.4.1 Food & beverage applications

- 7.4.2 Pharmaceutical & biotechnology

- 7.4.3 Chemical & petrochemical processing

- 7.4.4 Oil & gas produced water treatment

- 7.4.5 Mining & metal recovery

- 7.5 Gas separation & energy applications

- 7.5.1 Hydrogen purification & fuel cells

- 7.5.2 Natural gas processing

- 7.5.3 Air separation applications

- 7.5.4 Energy storage & battery separators

- 7.6 Medical & biotechnology applications

- 7.6.1 Hemodialysis & medical devices

- 7.6.2 Sterile filtration & bioprocessing

- 7.6.3 In-vitro diagnostics (IVD)

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 DuPont de Nemours, Inc.

- 9.2 Toray Industries, Inc.

- 9.3 Hydranautics (Nitto Group)

- 9.4 Koch Membrane Systems

- 9.5 Pall Corporation (Danaher)

- 9.6 Asahi Kasei Corporation

- 9.7 LG Chem Ltd.

- 9.8 Veolia Water Technologies

- 9.9 Pentair plc

- 9.10 3M Company

- 9.11 Ionomr Innovations Inc.

- 9.12 Aquaporin A/S

- 9.13 Modern Water plc

- 9.14 Gradiant Corporation

- 9.15 Membrion, Inc.