|

市場調查報告書

商品編碼

1871324

瓷器餐具市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Porcelain Tableware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

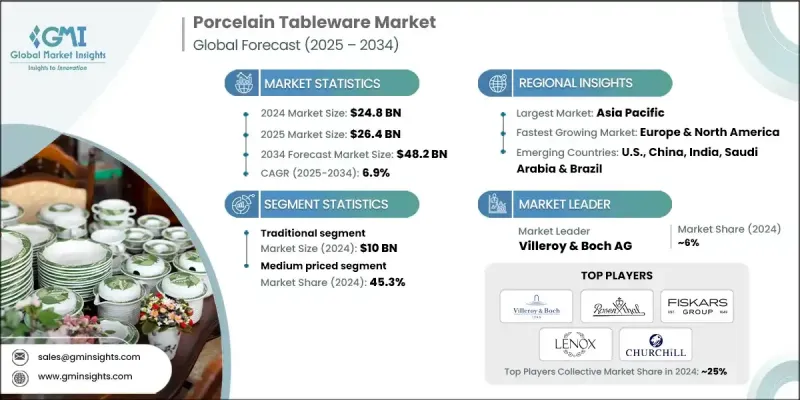

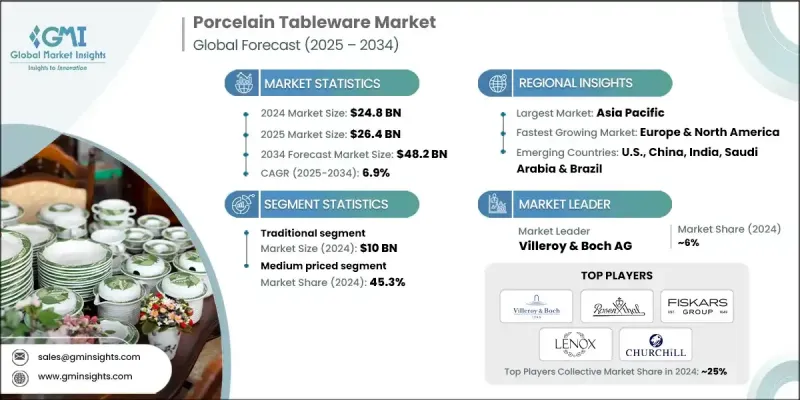

2024 年全球瓷器餐具市場價值為 248 億美元,預計到 2034 年將以 6.9% 的複合年成長率成長至 482 億美元。

推動這一成長的關鍵因素之一是高階化趨勢的興起,尤其是在富裕的都市消費者中,他們將瓷器餐具視為特殊場合的精緻之選,以及慶祝活動和公司活動中備受青睞的高階禮品。此外,社群媒體平台的推波助瀾,使得精心策劃的家庭用餐體驗日益盛行,也顯著提升了消費者對奢華美觀餐具的需求。消費者越來越願意投資兼具實用性、藝術性和創新性的產品,以契合現代生活方式的趨勢。文化和禮儀價值也發揮了重要作用,尤其是在亞洲和中東地區,瓷器在傳統的家庭聚會、宗教儀式和節慶活動中扮演著至關重要的角色。此外,市場也越來越重視客製化、個人化、永續性和極簡主義美學。那些透過整合環保材料和獨特設計進行創新的製造商,將有望引領這個不斷發展的市場走向未來。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 248億美元 |

| 預測值 | 482億美元 |

| 複合年成長率 | 6.9% |

傳統瓷器設計市場在2024年創造了100億美元的收入,預計從2025年到2034年將以7.5%的複合年成長率成長。這些設計通常以精美的圖案、花卉紋樣和經典的藍白配色為特色,深受欣賞永恆優雅和文化傳承的消費者的喜愛。在亞洲、歐洲和中東的許多地區,傳統瓷器仍然與宗教儀式、正式宴會和節日慶典緊密相連,在婚禮和文化慶典等特殊場合中保持著強大的吸引力。

中價位餐具市場佔有率為45.3%,預計到2034年將以6.9%的複合年成長率成長。該細分市場吸引了廣泛的消費群體,包括中等收入家庭、休閒餐飲場所和精品酒店,他們都希望購買既耐用又時尚的餐具,但價格又不會過高。這些產品通常融合了傳統工藝和現代設計,使其既適合日常使用,也適合正式場合。製造技術的進步使生產商能夠以實惠的價格提供精緻的表面處理、複雜的圖案和更高的耐用性,從而提升了該細分市場的吸引力。

2024年美國瓷器餐具市場規模達46億美元,預計2025年至2034年將以6.8%的複合年成長率成長。美國消費者重視高品質、設計精良的家居用品,並將瓷器餐具視為優雅和精緻生活方式的象徵。受社群媒體和生活風格潮流的影響,居家娛樂日益盛行,進一步提升了消費者對優雅實用餐具的需求。此外,美國眾多高級餐廳、精品旅館和餐飲服務機構也持續投資於高階餐具,以提升顧客體驗和品牌形象。

全球瓷器餐具市場的主要企業包括:赫倫瓷器廠(Herend Porcelain Manufactory)、諾利塔克株式會社(Noritake Co., Limited)、羅森塔爾有限公司(Rosenthal GmbH)、BHS Tabletop AG、唯寶株式會社(Villeroy & Boch AG)、菲克斯卡納集團(FenBernard Group)、諾伯納貝納伯納辛納伯納伯納伯納森集團(FenBernarden Corporation) Porcelain)、雷諾利摩日瓷器(Raynaud Limoges)、邱吉爾中國有限公司(Churchill China plc)、Vista Alegre Atlantis、皇家哥本哈根(Royal Copenhagen)和德格倫巴黎(Degrenne Paris)。為了鞏固其在瓷器餐具市場的地位,各公司正致力於多項策略性措施。他們大力投資研發,推出融合傳統工藝與現代美學的創新設計。永續發展也備受重視,許多製造商採用環保材料和生產流程,以吸引環保意識的消費者。客製化和個人化服務也不斷拓展,以滿足消費者對獨特且富有意義的產品的日益成長的需求。此外,各公司也透過與高階零售商、電商平台和飯店餐飲業建立合作關係,加強分銷網路,從而擴大市場覆蓋率。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 對耐腐蝕材料的需求日益成長

- 石油和天然氣產業的成長

- 對水和廢水管理的投資不斷增加

- 產業陷阱與挑戰

- 認知和技術感知能力有限

- 易受極端溫度和紫外線照射的影響

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 盤子

- 碗

- 杯子和碟子

- 馬克杯

- 餐具

- 其他

第6章:市場估算與預測:依設計與風格分類,2021-2034年

- 主要趨勢

- 傳統的

- 當代的

- 現代的

- 優質的

- 藝術/裝飾

- 客製化/個人化

第7章:市場估算與預測:依形狀分類,2021-2034年

- 主要趨勢

- 圓形的

- 方塊

- 矩形的

第8章:市場估算與預測:依價格分類,2021-2034年

- 主要趨勢

- 低的

- 中等的

- 高的

第9章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 家庭

- 商業的

- 飯店

- 餐廳

- 餐飲服務

- 咖啡廳

第10章:市場估價與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 線上

- 電子商務網站

- 公司網站

- 離線

- 超市/大型超市

- 專賣店

- 實體零售商

- 其他(例如,直接面對消費者、快閃店)

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第12章:公司簡介

- Bernardaud

- BHS Tabletop AG

- Churchill China plc

- Degrenne Paris

- Fiskars Group

- Haviland & Cie

- Herend Porcelain Manufactory

- Lenox Corporation

- Meissen Porcelain

- Noritake Co., Limited

- Raynaud Limoges

- Rosenthal GmbH

- Royal Copenhagen

- Villeroy & Boch AG

- Vista Alegre Atlantis

The Global Porcelain Tableware Market was valued at USD 24.8 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 48.2 billion by 2034.

One of the key drivers fueling this growth is the rising trend of premiumization, especially among affluent urban consumers who regard porcelain dinnerware as a sophisticated choice for special occasions and a favored premium gift for celebrations and corporate events. Additionally, the surge in curated home dining experiences, amplified by social media platforms, has significantly boosted demand for luxurious and aesthetically pleasing tableware. Consumers are increasingly willing to invest in products that blend practicality with artistic and innovative designs, aligning with modern lifestyle trends. Cultural and ceremonial values also contribute notably, particularly across Asia and the Middle East, where porcelain plays a vital role in traditional family gatherings, religious rituals, and festivities. Furthermore, the market is witnessing a growing emphasis on customization, personalization, sustainability, and minimalist aesthetics. Manufacturers who innovate by integrating eco-friendly materials and unique designs are positioned to lead the future of this evolving market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.8 billion |

| Forecast Value | $48.2 billion |

| CAGR | 6.9% |

The traditional porcelain designs segment generated USD 10 billion in 2024 and is expected to grow at a CAGR of 7.5% from 2025 to 2034. These designs typically feature elaborate patterns, floral motifs, and classic color schemes such as blue and white. They resonate with consumers who appreciate timeless elegance and cultural heritage. In many parts of Asia, Europe, and the Middle East, traditional porcelain remains closely linked to religious ceremonies, formal dining, and festive occasions, maintaining its strong appeal for special events like weddings and cultural celebrations.

The medium-priced segment held 45.3% share and is anticipated to grow at a CAGR of 6.9% through 2034. This segment appeals to a wide demographic, including middle-income families, casual dining establishments, and boutique hotels that seek durable yet stylish tableware without the high-end price. These products often marry traditional craftsmanship with contemporary designs, making them suitable for both everyday use and formal occasions. Advances in manufacturing have allowed producers to offer sophisticated finishes, intricate patterns, and enhanced durability at affordable prices, boosting this segment's attractiveness.

United States Porcelain Tableware Market generated USD 4.6 billion in 2024 and is forecasted to grow at a CAGR of 6.8% from 2025 to 2034. American consumers value high-quality and thoughtfully designed homeware, viewing porcelain tableware as a symbol of elegance and lifestyle refinement. The increasing popularity of home entertaining, inspired by social media and lifestyle trends, has further amplified demand for elegant and functional dinnerware. The presence of numerous upscale restaurants, boutique hotels, and catering services in the U.S. also fuels consistent investment in premium tableware to enhance guest experience and brand identity.

Leading companies in the Global Porcelain Tableware Market include Herend Porcelain Manufactory, Noritake Co., Limited, Rosenthal GmbH, BHS Tabletop AG, Villeroy & Boch AG, Fiskars Group, Bernardaud, Lenox Corporation, Meissen Porcelain, Raynaud Limoges, Churchill China plc, Vista Alegre Atlantis, Royal Copenhagen, and Degrenne Paris. To fortify their position in the Porcelain Tableware Market, companies are focusing on several strategic initiatives. They invest substantially in research and development to introduce innovative designs that merge traditional artistry with modern aesthetics. Emphasis is placed on sustainability, with many manufacturers adopting eco-friendly materials and production processes to appeal to environmentally conscious consumers. Customization and personalization services are being expanded to meet growing consumer demand for unique and meaningful products. Firms are also enhancing their distribution networks through partnerships with high-end retailers, e-commerce platforms, and hospitality sectors to broaden market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Design and style

- 2.2.4 Shape

- 2.2.5 Price

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for corrosion-resistant materials

- 3.2.1.2 Growth in oil & gas industry

- 3.2.1.3 Rising investment in water and wastewater management

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Limited awareness and technological perception

- 3.2.2.2 Vulnerability to extreme temperatures and UV exposure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Plates

- 5.3 Bowls

- 5.4 Cups and saucers

- 5.5 Mugs

- 5.6 Serving dishes

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Design and Style, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Traditional

- 6.3 Contemporary

- 6.4 Modern

- 6.5 Vintage

- 6.6 Artistic/decorative

- 6.7 Custom/personalized

Chapter 7 Market Estimates & Forecast, By Shape, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Round

- 7.3 Square

- 7.4 Rectangular

Chapter 8 Market Estimates & Forecast, By Price, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Household

- 9.3 Commercial

- 9.3.1 Hotels

- 9.3.2 Restaurants

- 9.3.3 Catering services

- 9.3.4 Cafes

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce website

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Supermarkets / hypermarkets

- 10.3.2 Specialty stores

- 10.3.3 Brick-and-mortar retailers

- 10.3.4 Others (e.g., direct-to-consumer, pop-up shops)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Bernardaud

- 12.2 BHS Tabletop AG

- 12.3 Churchill China plc

- 12.4 Degrenne Paris

- 12.5 Fiskars Group

- 12.6 Haviland & Cie

- 12.7 Herend Porcelain Manufactory

- 12.8 Lenox Corporation

- 12.9 Meissen Porcelain

- 12.10 Noritake Co., Limited

- 12.11 Raynaud Limoges

- 12.12 Rosenthal GmbH

- 12.13 Royal Copenhagen

- 12.14 Villeroy & Boch AG

- 12.15 Vista Alegre Atlantis