|

市場調查報告書

商品編碼

1871320

工業風機及鼓風機市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Industrial Fans and Blowers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

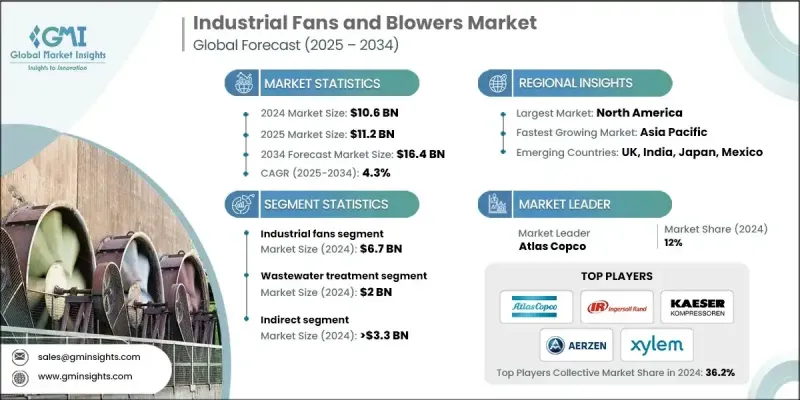

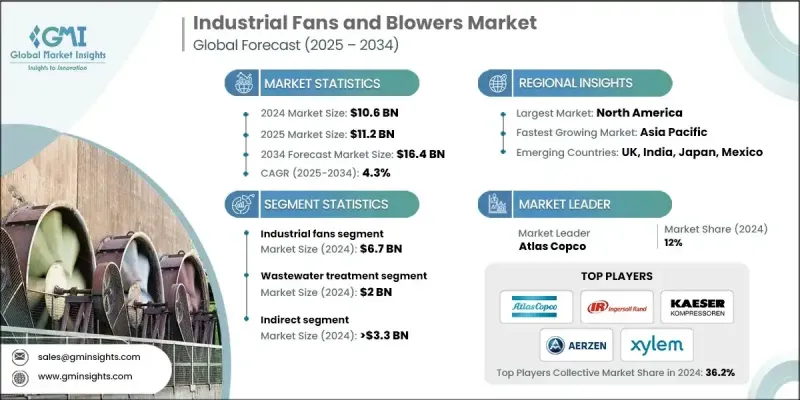

2024 年全球工業風扇和鼓風機市場價值為 106 億美元,預計到 2034 年將以 4.3% 的複合年成長率成長至 164 億美元。

工業風機和鼓風機是眾多行業不可或缺的組件,它們確保良好的通風,提升工作場所安全,並維持最佳的空氣品質。隨著各行業日益認知到健康工作環境的重要性,他們正投資於能夠降低營運成本、同時提升效率和生產力的技術。製造商也積極響應,不斷創新,研發節能高效的系統。豪頓(Howden)和阿特拉斯·科普柯(Atlas Copco)等領先企業致力於提供滿足關鍵行業不斷變化的需求的解決方案,涵蓋從重型製造業到廢水處理等各個領域,並著重強調永續性、安全性和運行可靠性。日益增強的環保意識和更嚴格的監管標準進一步加速了風機和鼓風機的應用,使其成為現代工業運作中不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 106億美元 |

| 預測值 | 164億美元 |

| 複合年成長率 | 4.3% |

2024年,工業風扇市場規模預計將達67億美元。由於其在空氣循環、排氣系統、冷卻和除塵等方面的多功能應用,市場需求不斷成長。風扇能夠更好地調節溫度和濕度,改善空氣質量,從而顯著提高製造工廠、化工廠和資料中心等環境的安全性和生產效率。

預計到2024年,廢水處理產業將創造20億美元的產值。世界各國政府都在加大對廢水處理設施的投資,以應對城市人口成長和日益嚴格的環境法規。風扇和鼓風機在提供曝氣、通風和除臭方面至關重要,有助於實現高效合規的廢水管理。

預計到2024年,美國工業風機和鼓風機市佔率將達到78.7%。該國的工業基礎設施推動了包括製造業、化學、能源和暖通空調在內的關鍵產業的需求。風機和鼓風機對於空氣循環、冷卻和污染控制至關重要。監管框架和環境政策促進了節能創新解決方案的發展,而持續的城市化和基礎設施建設也為市場的持續擴張提供了支持。

全球工業風機和鼓風機市場的主要參與者包括英格索蘭 (Ingersoll Rand)、索法科 (Sofaco)、凱撒 (Kaeser)、凱國際 (Kay International)、皮勒 (Piller)、艾爾岑 (Aerzen)、布施 (Busch)、紐約鼓風機 (New York Blower)、賽萊默 (Xyda)、歐萊默 (Dicheng). (Savio)、珠峰 (Everest)、阿特拉斯·科普柯 (Atlas Copco) 和大西洋鼓風機 (Atlantic Blower)。這些公司致力於創新、提高效率和拓展市場,以鞏固其市場地位。對研發的投入使其能夠開發出節能、高性能且維護成本低的產品。與工業製造商、建築公司和廢水處理設施建立策略合作夥伴關係,有助於拓展分銷管道並擴大專案覆蓋範圍。各公司強調永續性和合規性,並將產品定位為對環境負責的解決方案。產品組合的多元化,以滿足多個產業和應用的需求,有助於鞏固市場地位。行銷活動著重宣傳營運效率、成本節約和效能可靠性,以建立客戶信任。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 工業通風需求不斷成長

- 不斷擴展的工業應用

- 都市化和基礎設施發展

- 安全問題

- 產業陷阱與挑戰

- 維護和營運成本

- 競爭性定價壓力

- 機會

- 節能智慧通風系統

- 暖通空調和污染控制應用領域的成長

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼-8414.59.30)

- 主要進口國

- 主要出口國

- 差距分析

- 風險評估與緩解

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 工業風扇

- 離心風扇

- 前彎

- 向後彎曲

- 軸流風扇

- 混流風扇

- 橫流風扇

- 其他(通風風扇等)

- 離心風扇

- 工業鼓風機

- 容積式鼓風機

- 離心式鼓風機

- 高速渦輪鼓風機

- 多段式離心式鼓風機

- 其他(再生式鼓風機等)

第6章:市場估算與預測:依電源類型分類,2021-2034年

- 主要趨勢

- 繩索

- 無線

第7章:市場估計與預測:依產能分類,2021-2034年

- 主要趨勢

- 高的

- 中等的

- 低的

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 餐飲

- 廢水處理

- 水泥廠

- 鋼鐵廠

- 礦業

- 發電廠

- 化學

- 石油和天然氣

- 航太與國防

- 食品加工

- 紙漿和造紙

- 水處理廠

- 其他

第9章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Aerzen

- Atlantic Blower

- Atlas Copco

- Busch

- Dicheng

- Everest

- Howden

- Ingersoll Rand

- Kaeser

- Kay International

- New York Blower

- Piller

- Savio

- Sofaco

- Xylem

The Global Industrial Fans and Blowers Market was valued at USD 10.6 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 16.4 billion by 2034.

Industrial fans and blowers are essential components across numerous sectors, ensuring proper ventilation, enhancing workplace safety, and maintaining optimal air quality. As industries increasingly recognize the importance of healthier work environments, they are investing in technologies that reduce operational costs while boosting efficiency and productivity. Manufacturers are responding with innovations in energy-efficient and high-performance systems. Leading companies such as Howden and Atlas Copco focus on delivering solutions that meet the evolving needs of critical industries, ranging from heavy manufacturing to wastewater treatment, emphasizing sustainability, safety, and operational reliability. Rising environmental awareness and stricter regulatory standards have further accelerated adoption, making fans and blowers a vital part of modern industrial operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.6 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 4.3% |

The industrial fans category generated USD 6.7 billion in 2024. Demand is rising due to their multifunctional use in air circulation, exhaust systems, cooling, and dust control. Fans enable better temperature and humidity regulation while improving air quality, which significantly enhances safety and productivity in environments such as manufacturing facilities, chemical plants, and data centers.

The wastewater treatment segment generated USD 2 billion in 2024. Governments worldwide are increasing investments in treatment facilities to address urban population growth and stricter environmental regulations. Fans and blowers are critical in providing aeration, ventilation, and odor control, supporting efficient and compliant wastewater management.

U.S. Industrial Fans and Blowers Market held 78.7% share in 2024. The country's industrial infrastructure drives demand across key sectors, including manufacturing, chemicals, energy, and HVAC. Fans and blowers are critical for air circulation, cooling, and pollution control. Regulatory frameworks and environmental policies promote energy-efficient and innovative solutions, while ongoing urbanization and infrastructure development support continued market expansion.

Major players in the Global Industrial Fans and Blowers Market include Ingersoll Rand, Sofaco, Kaeser, Kay International, Piller, Aerzen, Busch, New York Blower, Xylem, Dicheng, Howden, Savio, Everest, Atlas Copco, and Atlantic Blower. Companies in the Industrial Fans and Blowers Market focus on innovation, efficiency, and market expansion to strengthen their presence. Investment in research and development enables the creation of energy-efficient, high-performance, and low-maintenance products. Strategic partnerships with industrial manufacturers, construction companies, and wastewater management facilities enhance distribution channels and project reach. Companies emphasize sustainability and regulatory compliance, positioning products as environmentally responsible solutions. Diversification of product portfolios to cater to multiple industries and applications strengthens market foothold. Marketing campaigns highlight operational efficiency, cost savings, and performance reliability to build customer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Power source

- 2.2.4 Capacity

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for industrial ventilation

- 3.2.1.2 Expanding industrial applications

- 3.2.1.3 Urbanization and infrastructure development

- 3.2.1.4 Security and safety concerns

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Maintenance and operational costs

- 3.2.2.2 Competitive pricing pressure

- 3.2.3 Opportunities

- 3.2.3.1 Energy-efficient and smart ventilation systems

- 3.2.3.2 Growth in HVAC and pollution control applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-8414.59.30)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Industrial fans

- 5.2.1 Centrifugal fans

- 5.2.1.1 Forward curved

- 5.2.1.2 Backward curved

- 5.2.2 Axial fans

- 5.2.3 Mixed flow fans

- 5.2.4 Cross flow fans

- 5.2.5 Others (Plenum Fans, etc.)

- 5.2.1 Centrifugal fans

- 5.3 Industrial blower

- 5.3.1 Positive displacement blowers

- 5.3.2 Centrifugal blowers

- 5.3.3 High speed turbo blowers

- 5.3.4 Multistage centrifugal blowers

- 5.3.5 Others (regenerative blowers etc.)

Chapter 6 Market Estimates & Forecast, By Power source, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Cord

- 6.3 Cordless

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 High

- 7.3 Medium

- 7.4 Low

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Wastewater treatment

- 8.4 Cement plant

- 8.5 Steel plant

- 8.6 Mining

- 8.7 Power plant

- 8.8 Chemical

- 8.9 Oil and gas

- 8.10 Aerospace and defense

- 8.11 Food processing

- 8.12 Pulp and paper

- 8.13 Water treatment plant

- 8.14 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aerzen

- 11.2 Atlantic Blower

- 11.3 Atlas Copco

- 11.4 Busch

- 11.5 Dicheng

- 11.6 Everest

- 11.7 Howden

- 11.8 Ingersoll Rand

- 11.9 Kaeser

- 11.10 Kay International

- 11.11 New York Blower

- 11.12 Piller

- 11.13 Savio

- 11.14 Sofaco

- 11.15 Xylem