|

市場調查報告書

商品編碼

1871317

戈謝氏症藥物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Gaucher Disease Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

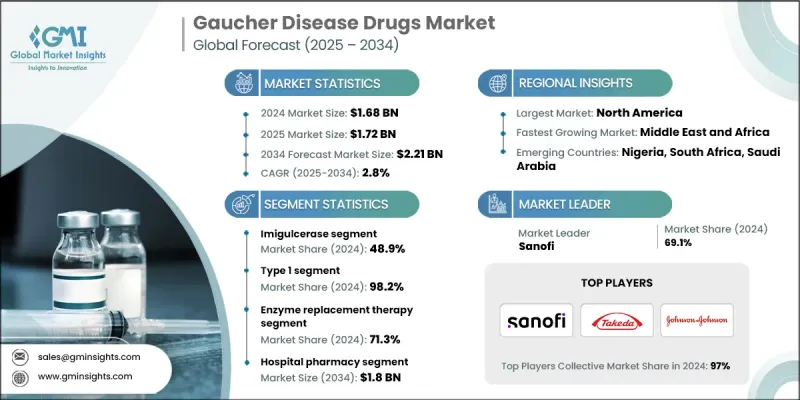

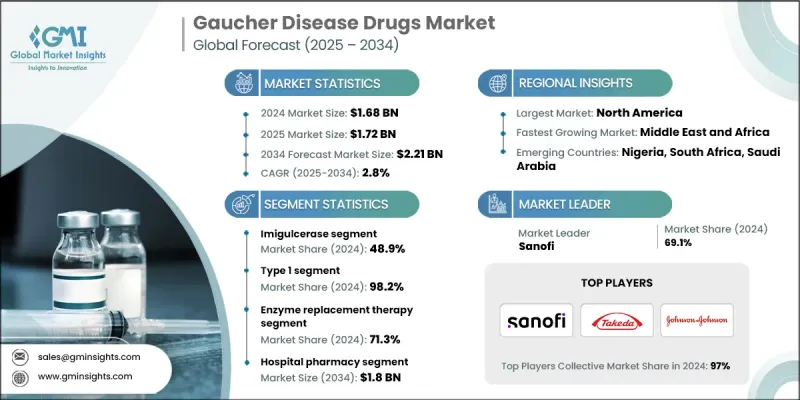

2024 年戈謝氏症藥物市場價值為 16.8 億美元,預計到 2034 年將以 2.8% 的複合年成長率成長至 22.1 億美元。

隨著人們對罕見遺傳疾病的認知不斷提高、診斷技術不斷進步以及酵素替代療法和底物減少療法的普及,市場正在穩步擴張。戈謝氏症是一種由葡萄糖腦苷脂酶缺乏引起的溶小體貯積症,在過去十年中取得了顯著的治療突破。標靶治療透過解決潛在的酵素缺乏問題、改善患者的生活品質和控制疾病症狀,正在重塑患者的治療模式。武田藥品工業株式會社、強生公司和賽諾菲等領先的製藥公司正透過持續的研發、策略合作和專注於罕見疾病的平台,推動創新。區域差異影響著治療重點,某些亞型在亞太地區更為常見,而北美和歐洲則以1型病例為主,這凸顯了針對特定區域的治療方案以及酶替代療法(ERT)和底物減少療法(SRT)的可及性的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16.8億美元 |

| 預測值 | 22.1億美元 |

| 複合年成長率 | 2.8% |

2024年,伊米苷酶(Imiglucerase)市佔率為48.9%。這種重組酵素替代療法可彌補葡糖腦苷脂酶缺乏,幫助分解體內累積的葡糖腦苷脂,進而緩解疾病症狀。其廣泛的應用得益於顯著的臨床療效、已證實的長期安全性以及廣泛的監管批准,使其成為醫療服務提供者和患者信賴的治療方案。

2024 年,1 型戈謝氏症 (GD1) 市佔率為 98.2%。 GD1 是最常見的亞型,其特徵是全身性症狀,但沒有神經系統受累,因此對現有療法的反應更敏感,也是全球藥物開發和商業化工作的重點。

2024年,美國戈謝氏症藥物市場規模預估為6.457億美元。美國先進的醫療基礎設施、廣泛的臨床應用以及對個人化醫療的重視,為戈謝氏症的早期診斷和長期管理提供了支持。酵素替代療法,如伊米苷酶和維拉苷酶α,以及口服底物減少療法(如依利格魯司他)的日益普及,是該地區戈謝病治療的主要手段。

全球戈謝氏症藥物市場的主要參與者包括ANI Pharmaceuticals, Inc.、輝瑞公司、武田藥品工業株式會社、強生公司、Protalix BioTherapeutics, Inc.、Navinta, LLC、Dipharma SA、Prevail Therapeutics、ISU ABXIS、Generium和賽諾菲。這些公司正透過大力投資研發下一代療法和罕見疾病平台來鞏固其市場地位。他們積極尋求策略合作夥伴關係和合作,以擴大全球市場准入並獲得監管部門的批准。市場領導者專注於以患者為中心的治療方案,包括針對不同亞型和地區的客製化療法。他們也透過醫療服務提供者和患者群體的教育計畫來提升品牌知名度。持續創新、精準的行銷策略以及對新興市場的拓展,幫助這些公司保持競爭優勢;而合規性和智慧財產權保護則進一步鞏固了其市場地位。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 戈謝病患病率不斷上升

- 加大對戈謝氏症治療藥物研發的投資

- 提高對及時診斷和治療的認知

- 政府對罕見疾病療法的支持力道不斷加大

- 產業陷阱與挑戰

- 治療費用高昂

- 存在嚴格的法規核准程序

- 市場機遇

- 新興市場擴張與本地製造

- 底物減少療法的採用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術格局

- 當前技術趨勢

- 改進的臨床生物標記

- 基因治療方法

- 人工智慧引導的藥物發現平台

- 新興技術

- 多組學整合用於個人化治療

- 量子計算在藥物設計最佳化的應用

- 當前技術趨勢

- 專利分析

- 未來市場趨勢

- 管道分析

- 2024年定價分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依藥物類型分類,2021-2034年

- 主要趨勢

- 伊米苷酶

- Velaglucerase alfa

- Taliglucerase alfa

- Eliglustat

- 米格魯司他

第6章:市場估計與預測:依疾病類型分類,2021-2034年

- 主要趨勢

- 1型

- 3型

第7章:市場估計與預測:依治療類型分類,2021-2034年

- 主要趨勢

- 酵素替代療法

- 底物替代療法

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 醫院藥房

- 零售藥房

- 網路藥房

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

- 哥倫比亞

- 秘魯

- 厄瓜多

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 奈及利亞

- 以色列

- 伊朗

第10章:公司簡介

- ANI Pharmaceuticals, Inc.

- Dipharma SA

- Generium

- ISU ABXIS

- Johnson & Johnson

- Navinta, LLC

- Pfizer Inc.

- Prevail Therapeutics

- Protalix BioTherapeutics, Inc.

- Sanofi

- Takeda Pharmaceutical Company Limited

The Gaucher Disease Drugs Market was valued at USD 1.68 billion in 2024 and is estimated to grow at a CAGR of 2.8% to reach USD 2.21 billion by 2034.

The market is steadily expanding as awareness of rare genetic disorders rises, diagnostic techniques improve, and access to enzyme replacement and substrate reduction therapies broadens. Gaucher disease, a lysosomal storage disorder caused by glucocerebrosidase deficiency, has seen significant therapeutic breakthroughs over the past decade. Targeted treatments are reshaping patient care by addressing the underlying enzyme deficiency, improving quality of life, and managing disease symptoms. Leading pharmaceutical companies such as Takeda Pharmaceutical Company Limited, Johnson & Johnson, and Sanofi are driving innovation through continuous research and development, strategic collaborations, and rare disease-focused platforms. Regional variations influence treatment focus, with certain subtypes more prevalent in Asia Pacific, while North America and Europe are dominated by Type 1 cases, highlighting the importance of region-specific therapy availability and access to both enzyme replacement therapies (ERTs) and substrate reduction therapies (SRTs).

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.68 Billion |

| Forecast Value | $2.21 Billion |

| CAGR | 2.8% |

The Imiglucerase segment held a share of 48.9% in 2024. This recombinant enzyme replacement therapy compensates for glucocerebrosidase deficiency, aiding the breakdown of accumulated glucocerebroside and alleviating disease manifestations. Its widespread adoption is supported by strong clinical efficacy, proven long-term safety, and broad regulatory approval, establishing it as a trusted treatment among healthcare providers and patients.

Type 1 Gaucher disease (GD1) segment held a 98.2% share in 2024. GD1, the most common subtype, is characterized by systemic symptoms without neurological involvement, making it more responsive to existing therapies and a central focus for drug development and commercialization efforts globally.

U.S. Gaucher Disease Drugs Market was valued at USD 645.7 million in 2024. The country's advanced healthcare infrastructure, widespread clinical adoption, and emphasis on personalized medicine support early diagnosis and long-term management of Gaucher disease. Enzyme replacement therapies like imiglucerase and velaglucerase alfa, along with increasing use of oral substrate reduction therapies such as eliglustat, dominate treatment practices in the region.

Key players in the Global Gaucher Disease Drugs Market include ANI Pharmaceuticals, Inc., Pfizer Inc., Takeda Pharmaceutical Company Limited, Johnson & Johnson, Protalix BioTherapeutics, Inc., Navinta, LLC, Dipharma SA, Prevail Therapeutics, ISU ABXIS, Generium, and Sanofi. Companies in the Gaucher Disease Drugs Market are strengthening their presence by investing heavily in R&D for next-generation therapies and rare disease platforms. They pursue strategic partnerships and collaborations to expand global access and regulatory approvals. Market leaders focus on patient-centric approaches, including tailored therapies for different subtypes and regions. They also enhance visibility through education programs for healthcare providers and patient communities. Continuous innovation, targeted marketing strategies, and expansion into emerging markets help companies maintain a competitive edge, while regulatory compliance and intellectual property protections further consolidate their market foothold.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Disease type trends

- 2.2.4 Therapy type trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of Gaucher disease

- 3.2.1.2 Growing investments for developing Gaucher disease therapies

- 3.2.1.3 Increasing awareness towards timely diagnosis and treatment

- 3.2.1.4 Rising government support for rare disease therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of therapies

- 3.2.2.2 Presence of stringent regulatory approval procedures

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market expansion and local manufacturing

- 3.2.3.2 Substrate reduction therapy adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Improved clinical biomarkers

- 3.5.1.2 Gene therapy approaches

- 3.5.1.3 AI- guided drug discovery platforms

- 3.5.2 Emerging technologies

- 3.5.2.1 Multi-omics integration for personalized therapy

- 3.5.2.2 Quantum computing for drug design optimization

- 3.5.1 Current technological trends

- 3.6 Patent analysis

- 3.7 Future market trends

- 3.8 Pipeline analysis

- 3.9 Pricing analysis, 2024

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Imiglucerase

- 5.3 Velaglucerase alfa

- 5.4 Taliglucerase alfa

- 5.5 Eliglustat

- 5.6 Miglustat

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1

- 6.3 Type 3

Chapter 7 Market Estimates and Forecast, By Therapy Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Enzyme replacement therapy

- 7.3 Substrate replacement therapy

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacy

- 8.3 Retail pharmacy

- 8.4 Online pharmacy

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Chile

- 9.5.5 Colombia

- 9.5.6 Peru

- 9.5.7 Ecuador

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Egypt

- 9.6.5 Nigeria

- 9.6.6 Israel

- 9.6.7 Iran

Chapter 10 Company Profiles

- 10.1 ANI Pharmaceuticals, Inc.

- 10.2 Dipharma SA

- 10.3 Generium

- 10.4 ISU ABXIS

- 10.5 Johnson & Johnson

- 10.6 Navinta, LLC

- 10.7 Pfizer Inc.

- 10.8 Prevail Therapeutics

- 10.9 Protalix BioTherapeutics, Inc.

- 10.10 Sanofi

- 10.11 Takeda Pharmaceutical Company Limited