|

市場調查報告書

商品編碼

1871311

骨缺損填充材料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Bone Void Fillers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

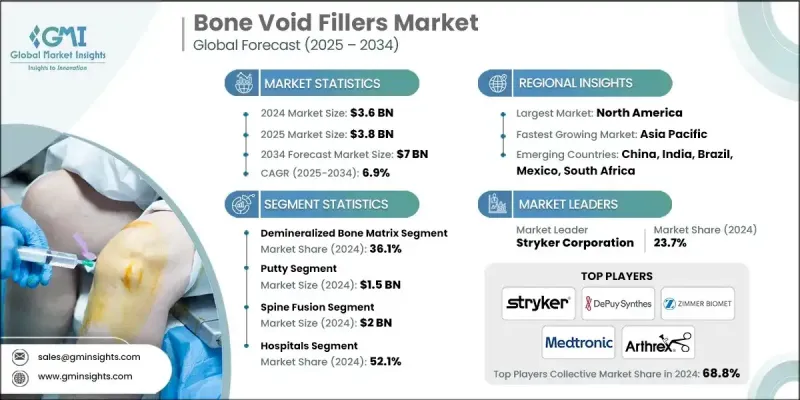

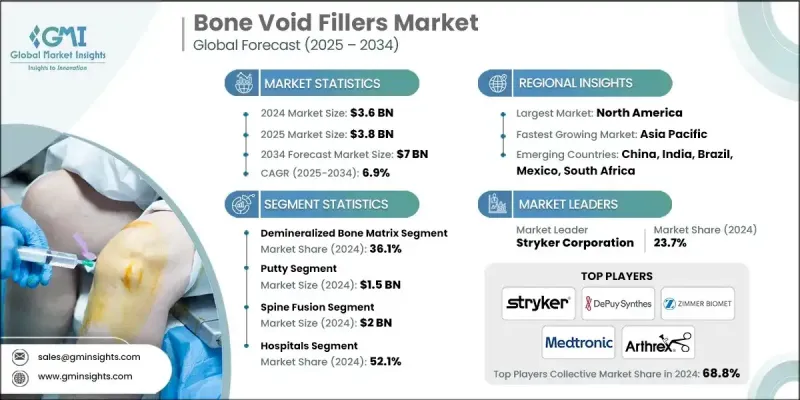

2024 年全球骨缺損填充物市場價值為 36 億美元,預計到 2034 年將以 6.9% 的複合年成長率成長至 70 億美元。

骨科和創傷手術數量的增加以及骨折、骨質疏鬆等骨骼相關疾病盛行率的上升推動了市場擴張。一個主要趨勢是從傳統的自體骨移植和異體骨移植轉向合成和生物活性骨填充材料,包括磷酸鈣、生物活性玻璃和複合支架。這些替代材料具有可預測的吸收率、更低的感染風險和更優異的生物相容性,使其成為廣泛臨床應用的理想選擇。注射式骨填充材料的需求也不斷成長,因為它們有助於微創手術、縮短手術時間並改善患者復原。全球預期壽命的延長、城市化進程的加快以及退化性骨骼疾病和創傷相關損傷發病率的上升進一步推動了市場成長,尤其是在已開發地區和新興地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 36億美元 |

| 預測值 | 70億美元 |

| 複合年成長率 | 6.9% |

2024年,脫礦骨基質(DBM)市佔率為36.1%,預計2025年至2034年間將以6.1%的複合年成長率成長。 DBM因其高骨誘導潛能、良好的生物相容性和臨床應用的多樣性而備受青睞。 DBM源自於加工後的同種異體骨,保留了膠原蛋白、骨形態發生蛋白和生長因子等關鍵有機成分,這些成分能夠促進新骨形成和有效的移植物整合。 DBM有多種給藥形式,例如糊狀物、膏狀物、凝膠和條狀物,使外科醫生在骨科、創傷和脊椎融合手術中能夠靈活選擇。

2024年,骨糊劑市場規模達到15億美元,預計2034年將以7.2%的複合年成長率成長。外科醫生偏愛骨糊劑,因為它具有良好的黏性和可塑性,能夠精準地填充不規則或複雜的骨缺損。其優異的操作性和適應性使其成為脊椎融合、顱顏重建、骨科創傷和牙科手術的理想選擇。

2024年,北美骨填充劑市佔率達到48.9%。該地區受益於先進的醫療基礎設施、龐大的手術量,以及許多提供微創解決方案和創新骨移植替代材料的領導者。生物活性注射填充劑的早期應用,以及對研發和臨床試驗的大量投入,鞏固了北美在該領域的領先地位。

全球骨填充材料市場的主要企業包括Arthrex、Bioventus、Medline、Medtronic、Abyrx、Stryker、Baxter International、DePuy Synthes(強生)、Bonesupport、Acumed和Zimmer Biomet。這些企業正透過策略措施提升自身在骨填充材料市場的佔有率。他們加大研發投入,致力於推出具有卓越骨誘導性、吸收率和生物相容性的先進生物材料。與醫院、手術中心和經銷商建立合作關係有助於擴大市場覆蓋範圍,並提高創新產品的市場接受度。併購則用於增強技術實力和擴大生產規模。此外,各企業也專注於獲得監管部門的批准、產品認證和開展臨床試驗,以提升自身信譽。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 骨骼疾病和損傷的發生率不斷上升

- 老年人口成長

- 外科技術的進步

- 骨科手術日益增多

- 產業陷阱與挑戰

- 骨骼疾病治療費用高昂

- 嚴格的監管環境

- 市場機遇

- 轉向微創和注射解決方案

- 生物活性和抗生素洗脫填充劑的進展

- 成長促進因素

- 成長潛力分析

- 技術格局

- 當前技術趨勢

- 新興技術

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 去礦骨基質

- 硫酸鈣

- 膠原蛋白基質

- 磷酸三鈣/磷酸鈣基

- 其他材料類型

第6章:市場估算與預測:依形式分類,2021-2034年

- 主要趨勢

- 凝膠

- 顆粒

- 膏劑/注射劑

- 油灰

- 其他形式

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 脊椎融合術

- 骨折

- 關節重建

- 牙科/顱顏面外科(CMF)

- 其他應用

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 專科診所

- 門診手術中心

- 其他最終用途

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abyrx

- Acumed

- Arthrex

- Baxter International

- Bioventus

- Bonesupport

- DePuy Synthes (Johnson & Johnson)

- Medline

- Medtronic

- Stryker

- Zimmer Biomet

The Global Bone Void Fillers Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 7 billion by 2034.

The market expansion is fueled by the rising number of orthopedic and trauma surgeries and the increasing prevalence of bone-related conditions, such as fractures and osteoporosis. A major trend is the shift from conventional autografts and allografts to synthetic and bioactive bone void fillers, including calcium phosphate, bioactive glass, and composite scaffolds. These alternatives provide predictable resorption rates, lower infection risks, and superior biocompatibility, making them ideal for widespread clinical use. The demand for injectable bone void fillers is also increasing, as they facilitate minimally invasive procedures, reduce surgical time, and improve patient recovery. Rising global life expectancy, urbanization, and the growing incidence of degenerative skeletal diseases and trauma-related injuries are further driving market growth, especially across both developed and emerging regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $7 Billion |

| CAGR | 6.9% |

The demineralized bone matrix (DBM) segment held a 36.1% share in 2024 and is projected to grow at a CAGR of 6.1% during 2025-2034. DBM is favored for its high osteoinductive potential, biocompatibility, and versatility in clinical applications. Derived from processed allograft bone, DBM retains key organic components, including collagen, bone morphogenetic proteins, and growth factors, which promote new bone formation and effective graft integration. Available in multiple delivery formats, such as putty, paste, gel, and strips, it allows surgeons flexibility in orthopedic, trauma, and spinal fusion procedures.

The putty segment generated USD 1.5 billion in 2024 and is expected to grow at a CAGR of 7.2% through 2034. Surgeons prefer putty due to its cohesive, moldable texture, which allows precise placement in irregular or complex bone defects. Its superior handling and adaptability make it ideal for applications in spinal fusion, craniofacial reconstruction, orthopedic trauma, and dental surgeries.

North America Bone Void Fillers Market held a 48.9% share in 2024. The region benefits from advanced healthcare infrastructure, high surgical volumes, and the presence of leading players offering minimally invasive solutions and innovative bone graft substitutes. Early adoption of bioactive and injectable fillers, along with significant investment in R&D and clinical trials, has reinforced North America's leadership in this sector.

Key companies operating in the Global Bone Void Fillers Market include Arthrex, Bioventus, Medline, Medtronic, Abyrx, Stryker, Baxter International, DePuy Synthes (Johnson & Johnson), Bonesupport, Acumed, and Zimmer Biomet. Companies in the Bone Void Fillers Market are enhancing their presence through strategic initiatives. They are investing in research and development to introduce advanced biomaterials with superior osteoinductivity, resorption rates, and biocompatibility. Partnerships and collaborations with hospitals, surgical centers, and distributors help expand market reach and improve adoption of innovative products. Mergers and acquisitions are used to strengthen technological capabilities and scale production. Firms are also focusing on regulatory approvals, product certifications, and clinical trials to enhance credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Material type trends

- 2.2.3 Form trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of bone disorders and injuries

- 3.2.1.2 Rise in geriatric population

- 3.2.1.3 Advancements in surgical techniques

- 3.2.1.4 Growing orthopedic surgeries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with bone disorders

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward minimally invasive and injectable solutions

- 3.2.3.2 Advancement in bioactive and antibiotic-eluting fillers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Demineralized bone matrix

- 5.3 Calcium sulfate

- 5.4 Collagen matrix

- 5.5 Tricalcium phosphate/calcium phosphate based

- 5.6 Other material types

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gel

- 6.3 Granules

- 6.4 Paste / injectable

- 6.5 Putty

- 6.6 Other forms

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Spine fusion

- 7.3 Bone fracture

- 7.4 Joint reconstruction

- 7.5 Dental / cranio-maxillofacial surgery (CMF)

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abyrx

- 10.2 Acumed

- 10.3 Arthrex

- 10.4 Baxter International

- 10.5 Bioventus

- 10.6 Bonesupport

- 10.7 DePuy Synthes (Johnson & Johnson)

- 10.8 Medline

- 10.9 Medtronic

- 10.10 Stryker

- 10.11 Zimmer Biomet