|

市場調查報告書

商品編碼

1871303

即時檢測市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Point of Care Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

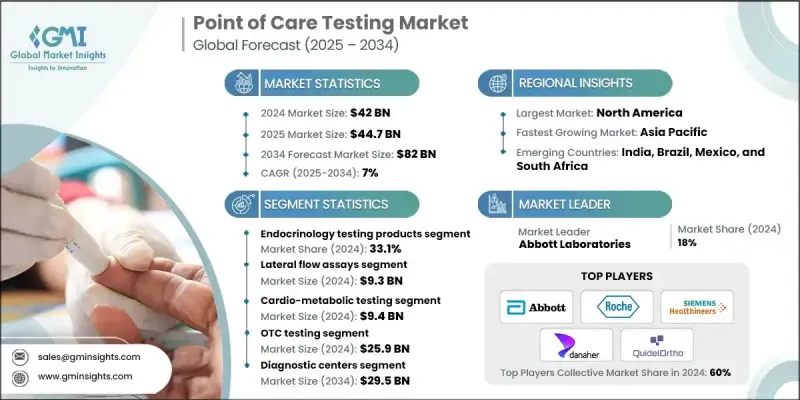

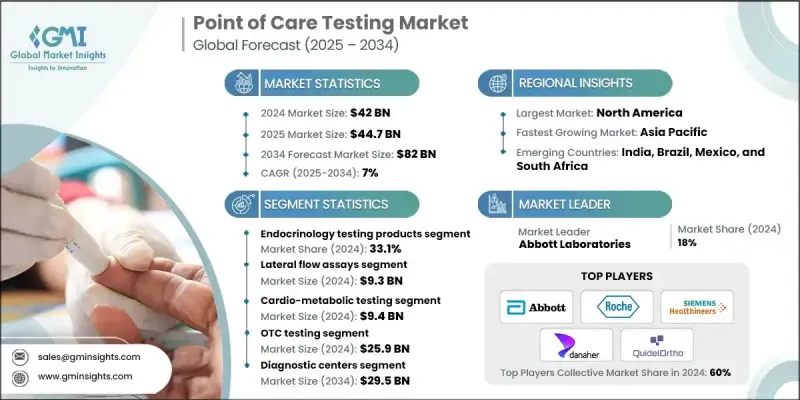

2024 年全球即時檢測市場價值為 420 億美元,預計到 2034 年將以 7% 的複合年成長率成長至 820 億美元。

市場擴張的促進因素包括發展中國家疾病盛行率的上升、配備先進檢測技術的診斷實驗室數量的增加以及研發方面的大量投資。急診和偏遠地區對快速、準確診斷的需求不斷成長,促使各國政府和醫療機構採用創新的即時檢測(POC)解決方案。即時檢測使臨床醫生能夠在患者所在之處直接獲得快速、實驗室層級的檢測結果,有助於快速做出醫療決策並減少對中心實驗室的依賴。這些設備採用微流控平台、免疫分析和側向流動檢測等先進技術來分析血液、尿液或唾液,通常可在幾分鐘內提供結果。現代設備通常與行動應用程式或電子健康記錄整合,從而提高了農村和醫療服務不足地區的可及性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 420億美元 |

| 預測值 | 820億美元 |

| 複合年成長率 | 7% |

2024年,內分泌檢測產品市佔率高達33.1%。由於糖尿病和甲狀腺疾病等內分泌疾病的盛行率不斷上升,對快速且準確診斷的需求日益成長,該細分市場正穩步發展。生物感測器、免疫分析和微流控技術的進步提高了檢測效率和準確性。血糖儀和糖化血紅蛋白分析儀等設備正逐漸發展成為智慧工具,並可透過行動應用程式進行遠端監測和遠距醫療應用。

2024年,側向流動檢測(LFA)市場規模預計將達93億美元。 LFA是一種紙基診斷設備,利用抗體檢測液體樣本中的目標物質。由於其操作簡單、快速且高效,LFA被廣泛應用。傳染病發生率的上升加速了對LFA的需求,LFA使醫療服務提供者能夠快速篩檢、診斷和應對患者,從而支持更快速的治療決策和更好的治療效果。

2024年,美國即時檢測市場規模預計將達125億美元。推動市場成長的主要因素包括疾病盛行率的上升(尤其是糖尿病)以及快速、技術驅動診斷解決方案的日益普及。美國醫療保健產業對創新和可近性的重視,使其成為即時檢測技術的領先市場。

全球即時檢測市場的主要參與者包括 Meridian Bioscience、Abbott Laboratories、Bio-Rad Laboratories、LifeScan IP Holdings, LLC、Acon Laboratories、Becton, Dickinson and Company、Danaher Corporation、BioMerieux SA、Dexcom, Inc.、QuidelOrtron Corporation、Dragerageral AG & Co. Kr. Biomedical、Siemens Healthineers AG 和 Sysmex Corporation。這些企業正利用多種策略來鞏固其市場地位。他們大力投資研發,以開發速度更快、更精準、更互聯的診斷設備。策略合作、夥伴關係和收購使企業能夠擴展產品組合併進入新的區域市場。許多企業專注於技術創新,將人工智慧、互聯技術和數位健康平台整合到設備中,以改善資料管理和遠距醫療能力。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 發展中國家疾病盛行率呈上升趨勢

- 配備先進診斷設備的病理實驗室和服務機構數量激增

- 即時檢測技術的進步

- 增加研發投入

- 產業陷阱與挑戰

- 嚴格的監管框架

- 產品開發成本高

- 市場機遇

- 偏遠和農村地區的需求不斷成長

- 與數位健康平台整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 亞太地區

- 歐洲

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略儀錶板

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 內分泌檢測產品

- 血糖監測

- 條狀物

- 儀表

- 柳葉刀

- 膽固醇檢測產品

- 驗孕產品

- 生育力檢測產品

- 甲狀腺功能檢查

- 血糖監測

- 心血管代謝檢測產品

- 心臟標記檢測產品

- 高敏感性肌鈣蛋白I (hsTnI)

- BNP(B型鈉尿肽)

- D-二聚體

- CK-MB(肌酸激酶-MB)

- 肌紅蛋白

- 其他心臟標記檢測

- 血氣(肺功能)

- 代謝物檢測產品

- 電解質測試

- 肝功能

- 膽紅素

- 丙胺酸轉氨酶(ALT)

- 腎功能

- 肌酸酐

- 尿素

- 尿酸

- HBA1C 檢測產品

- 心臟標記檢測產品

- 傳染病檢測產品

- 流感檢測產品

- HIV檢測產品

- 丙型肝炎檢測產品

- 性傳染病(STD)檢測產品

- 醫療相關感染 (HAI) 檢測產品

- 呼吸道感染檢測產品

- 熱帶疾病檢測產品

- 其他傳染病檢測產品

- 凝血檢測產品

- PT/INR 檢測產品

- 活化凝血時間 (ACT/APTT) 檢測產品

- 腫瘤/癌症標記檢測產品

- 尿液分析檢測產品

- 血液學檢測產品

- 濫用藥物(DoA)檢測產品

- 糞便隱血試驗產品

- 其他產品

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 側向流動檢測

- 油尺

- 微流控技術

- 分子診斷

- 免疫測定

- 凝集試驗

- 流通式

- 固相

- 生物感測器

- 電化學

- 光學的

- 熱的

- 品質敏感型

- 其他生物感測器

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 心血管代謝測試

- 傳染病檢測

- 腎臟科檢查

- 藥物濫用檢測

- 血糖檢測

- 妊娠測試

- 癌症生物標記檢測

- 其他應用

第8章:市場估算與預測:以處方量計算,2021-2034年

- 主要趨勢

- 非處方藥檢測

- 基於處方的檢測

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 診斷中心

- 研究實驗室

- 居家照護環境

- 其他最終用途

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Abbott Laboratories

- Acon Laboratories

- Becton, Dickinson, and Company

- BioMerieux SA

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Dexcom, Inc

- Dragerwerk AG & Co. KGaA

- F. Hoffmann-La Roche Ltd.

- LifeScan IP Holdings, LLC

- Medtronic Plc

- Meridian Bioscience, Inc.

- Nova Biomedical

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Sysmex Corporation

The Global Point of Care Testing Market was valued at USD 42 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 82 billion by 2034.

The market's expansion is driven by increasing disease prevalence in developing nations, the growing number of diagnostic laboratories equipped with advanced testing technologies, and significant investments in research and development. Rising demand for rapid, accurate diagnostics in emergency care and remote locations is pushing governments and healthcare organizations to adopt innovative POC testing solutions. Point-of-care testing enables clinicians to obtain fast, lab-grade results directly at the patient's location, facilitating quick medical decisions and reducing dependence on central labs. Devices use advanced technologies such as microfluidic platforms, immunoassays, and lateral flow assays to analyze blood, urine, or saliva, often providing results within minutes. Modern devices often integrate with mobile apps or electronic health records, improving accessibility in rural and underserved areas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42 Billion |

| Forecast Value | $82 Billion |

| CAGR | 7% |

The endocrinology testing products segment held a substantial share of 33.1% in 2024. This segment is growing steadily due to the increasing prevalence of endocrine disorders, including diabetes and thyroid-related conditions, which demand rapid and accurate diagnostics. Advances in biosensors, immunoassays, and microfluidic technology have improved test efficiency and accuracy. Devices like glucose meters and HbA1c analyzers are evolving into smart tools connected to mobile apps for remote monitoring and telehealth applications.

The lateral flow assays segment was valued at USD 9.3 billion in 2024. LFAs are paper-based diagnostic devices that detect target substances in liquid samples using antibodies. They are widely used due to their simplicity, speed, and ease of use. Rising incidences of infectious diseases have accelerated the demand for LFAs, which allow healthcare providers to quickly screen, diagnose, and respond to patients, supporting faster treatment decisions and better outcomes.

U.S. Point of Care Testing Market was valued at USD 12.5 billion in 2024. Growth is being driven by increasing disease prevalence, particularly diabetes, and the rising adoption of fast, technology-enabled diagnostic solutions. The U.S. healthcare sector's focus on innovation and accessibility has positioned it as a leading market for point-of-care testing technologies.

Key players in the Global Point of Care Testing Market include Meridian Bioscience, Abbott Laboratories, Bio-Rad Laboratories, LifeScan IP Holdings, LLC, Acon Laboratories, Becton, Dickinson, and Company, Danaher Corporation, BioMerieux SA, Dexcom, Inc., QuidelOrtho Corporation, Dragerwerk AG & Co. KGaA, F. Hoffmann-La Roche Ltd., Medtronic Plc, Nova Biomedical, Siemens Healthineers AG, and Sysmex Corporation. Companies in the Point of Care Testing Market are leveraging multiple strategies to strengthen their market presence. They are heavily investing in R&D to develop faster, more accurate, and connected diagnostic devices. Strategic collaborations, partnerships, and acquisitions allow firms to expand product portfolios and enter new regional markets. Many are focusing on technological innovation, integrating AI, connectivity, and digital health platforms into devices to improve data management and telemedicine capabilities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Products trends

- 2.2.3 Technology trends

- 2.2.4 Prescription trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Upward trend in disease prevalence among developing countries

- 3.2.1.2 Surging number of pathology labs and services equipped with advanced diagnostic equipment

- 3.2.1.3 Technological advancements in point of care tests

- 3.2.1.4 Increasing research and development investment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of product development

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand in remote and rural areas

- 3.2.3.2 Integration with digital health platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Asia Pacific

- 3.4.3 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Endocrinology testing products

- 5.2.1 Glucose monitoring

- 5.2.1.1 Strips

- 5.2.1.2 Meters

- 5.2.1.3 Lancets

- 5.2.2 Cholesterol testing products

- 5.2.3 Pregnancy testing products

- 5.2.4 Fertility testing products

- 5.2.5 Thyroid function tests

- 5.2.1 Glucose monitoring

- 5.3 Cardiometabolic testing products

- 5.3.1 Cardiac marker testing products

- 5.3.1.1 hsTnI (High-Sensitivity Troponin I)

- 5.3.1.2 BNP (B-Type Natriuretic Peptide)

- 5.3.1.3 D-dimer

- 5.3.1.4 CK-MB (Creatine Kinase-MB)

- 5.3.1.5 Myoglobin

- 5.3.1.6 Other Cardiac Marker Testing

- 5.3.2 Blood gas (Lung function)

- 5.3.3 Metabolite testing products

- 5.3.3.1 Electrolytes testing

- 5.3.3.2 Liver function

- 5.3.3.2.1 Bilirubin

- 5.3.3.2.2 Alanine transaminase (ALT)

- 5.3.3.3 Kidney function

- 5.3.3.3.1 Creatinine

- 5.3.3.3.2 Urea

- 5.3.3.3.3 Uric Acid

- 5.3.4 HBA1C testing products

- 5.3.1 Cardiac marker testing products

- 5.4 Infectious disease testing products

- 5.4.1 Influenza testing products

- 5.4.2 HIV testing products

- 5.4.3 Hepatitis C testing products

- 5.4.4 Sexually transmitted disease (STD) testing products

- 5.4.5 Healthcare-associated infection (HAI) testing products

- 5.4.6 Respiratory infection testing products

- 5.4.7 Tropical disease testing products

- 5.4.8 Other infectious disease testing products

- 5.5 Coagulation testing products

- 5.5.1 PT/INR testing products

- 5.5.2 Activated clotting time (ACT/APTT) testing products

- 5.6 Tumor/cancer marker testing products

- 5.7 Urinalysis testing products

- 5.8 Hematology testing products

- 5.9 Drug-of-abuse (DoA) testing products

- 5.10 Fecal occult testing products

- 5.11 Other products

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Lateral flow assays

- 6.3 Dipsticks

- 6.4 Microfluidics

- 6.5 Molecular diagnostics

- 6.6 Immunoassays

- 6.7 Agglutination assays

- 6.8 Flow-through

- 6.9 Solid phase

- 6.10 Biosensors

- 6.10.1 Electrochemical

- 6.10.2 Optical

- 6.10.3 Thermal

- 6.10.4 Mass-sensitive

- 6.10.5 Other biosensors

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Cardio metabolic testing

- 7.3 Infectious disease testing

- 7.4 Nephrology testing

- 7.5 Drug-of-abuse (DoA) testing

- 7.6 Blood glucose testing

- 7.7 Pregnancy testing

- 7.8 Cancer biomarker testing

- 7.9 Other applications

Chapter 8 Market Estimates and Forecast, By Prescription, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 OTC testing

- 8.3 Prescription-based testing

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Research laboratories

- 9.5 Home-care settings

- 9.6 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 1.1.1 U.S.

- 1.1.2 Canada

- 10.3 Europe

- 1.1.3 Germany

- 1.1.4 UK

- 1.1.5 France

- 1.1.6 Spain

- 1.1.7 Italy

- 1.1.8 Netherlands

- 10.4 Asia Pacific

- 1.1.9 China

- 1.1.10 Japan

- 1.1.11 India

- 1.1.12 Australia

- 1.1.13 South Korea

- 10.5 Latin America

- 1.1.14 Brazil

- 1.1.15 Mexico

- 1.1.16 Argentina

- 10.6 Middle East and Africa

- 1.1.17 South Africa

- 1.1.18 Saudi Arabia

- 1.1.19 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Laboratories

- 11.2 Acon Laboratories

- 11.3 Becton, Dickinson, and Company

- 11.4 BioMerieux SA

- 11.5 Bio-Rad Laboratories, Inc.

- 11.6 Danaher Corporation

- 11.7 Dexcom, Inc

- 11.8 Dragerwerk AG & Co. KGaA

- 11.9 F. Hoffmann-La Roche Ltd.

- 11.10 LifeScan IP Holdings, LLC

- 11.11 Medtronic Plc

- 11.12 Meridian Bioscience, Inc.

- 11.13 Nova Biomedical

- 11.14 QuidelOrtho Corporation

- 11.15 Siemens Healthineers AG

- 11.16 Sysmex Corporation