|

市場調查報告書

商品編碼

1871281

柴油動力建築發電機組市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Diesel Fired Construction Generator Sets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

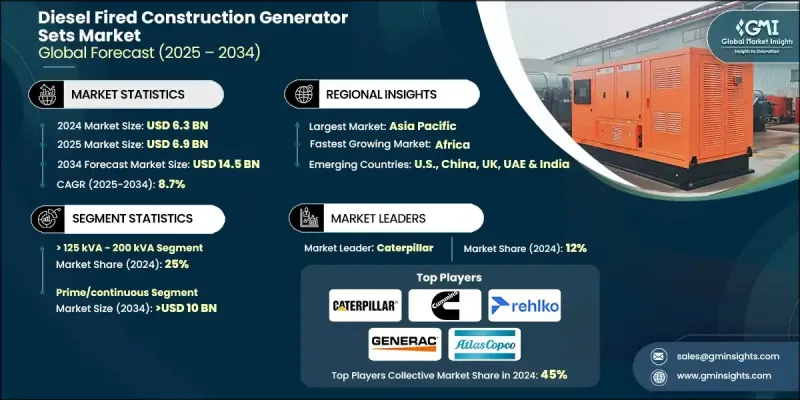

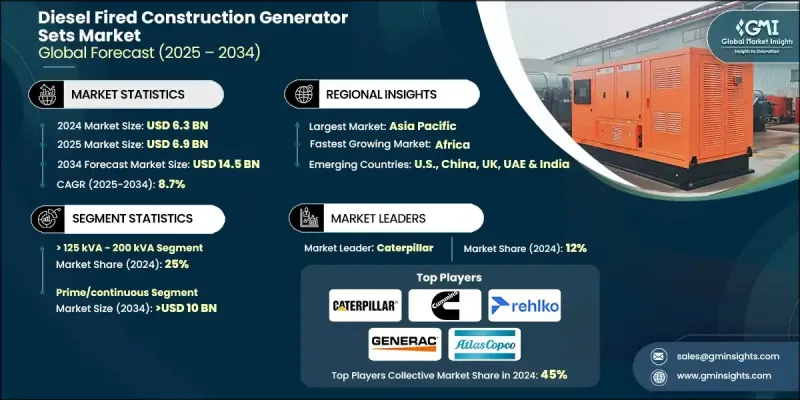

2024 年全球柴油建築發電機組市場價值為 63 億美元,預計到 2034 年將以 8.7% 的複合年成長率成長至 145 億美元。

對清潔能源技術的監管壓力日益增大,以及對燃油效率和成本最佳化的高度重視,正在推動市場成長。建築公司正轉向新一代柴油發電機組,這些發電機組兼具可靠性和更高的環保性能。無論專案規模大小,這些發電機組都不可或缺,為電網接入有限或不穩定的作業提供可靠的離網電力。柴油發電機組的設計旨在為設備、照明和臨時現場設施提供持續的能源供應,即使在偏遠或環境惡劣的地區也能確保工作流程不間斷。這些系統專為應對嚴苛的現場條件而設計,可提供穩定的性能和長久的使用壽命,滿足高要求建築活動的營運需求。隨著各行業尋求在不犧牲性能的前提下實現永續的解決方案,向先進、高效的柴油系統的過渡正日益普及。由於不間斷的能源供應對於現場安全和生產力至關重要,柴油發電機組在基礎設施、交通運輸和大型建設項目中的應用不斷成長,並持續推動市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 63億美元 |

| 預測值 | 145億美元 |

| 複合年成長率 | 8.7% |

預計到2034年,功率範圍在50 kVA至125 kVA之間的發電機組市場規模將達到15億美元。市場需求的成長源於其靈活性和支持中型建設項目(例如商業綜合體、道路和維護工程)的能力。這些發電機組能夠為包括泵浦、攪拌機和物料搬運系統在內的關鍵設備提供穩定可靠的電力,因此非常適合需要多班次作業的施工環境,在這些環境中,性能和正常運行時間至關重要。

預計2025年至2034年間,備用建築發電機市場將以8%的複合年成長率成長。需求激增的主要原因是需要可靠的緊急備用系統,以便在電網中斷或惡劣天氣導致的停電期間自動啟動。這些系統永久安裝在建築工地,透過在停電期間維持必要的電力供應,確保施工連續性和工地安全。隨著極端天氣事件的日益頻繁以及對電力驅動機械的依賴性不斷增強,採用備用發電機組已成為維持各種規模專案生產力的策略性必要措施。

2024年,美國柴油建築發電機組市場佔據85%的佔有率,市場規模達9.043億美元。美國建築業高度依賴持續穩定的電力供應來運作重型機械、起重機、照明系統和其他關鍵的現場基礎設施。電網不穩定、電力中斷和極端天氣頻繁,凸顯了強大且高效的現場電力系統的重要性。因此,柴油發電機組憑藉其耐用性、可靠性和即時供電能力,仍然是各類建築項目中最受歡迎的選擇。

全球柴油建築發電機組市場的主要參與者包括瓦錫蘭、Caterpillar、康明斯、馬恆達動力、斯特林發電機、格里夫斯棉業、蘇迪爾動力、阿特拉斯科普柯、羅爾斯·羅伊斯、FG威爾遜、阿格雷科、HIMOINSA、雷爾科、三菱重工、JC Bamford、50kandpford、Colek、GeneC。這些企業正採取多種策略來擴大其競爭範圍並鞏固市場領導地位。主要參與者正在投資先進的引擎技術,以提高燃油效率、減少排放並確保符合日益嚴格的全球法規。產品多元化仍然是一項核心策略,各公司正在開發緊湊型和混合動力發電機組,以滿足建築工地的靈活應用需求。與建築承包商和租賃服務提供者的合作有助於擴大分銷網路,並改善客戶獲得客製化電力解決方案的途徑。企業也正在利用數位監控系統和預測性維護工具來提高營運可靠性並最大限度地減少停機時間。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 原物料供應及採購分析

- 製造能力評估

- 供應鏈韌性與風險因素

- 配電網路分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 柴油建築發電機組成本結構分析

- 價格趨勢分析(美元/單位)

- 按地區

- 按功率等級

- 新興機會與趨勢

- 數位化與物聯網整合

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東

- 非洲

- 拉丁美洲

- 戰略儀錶板

- 策略舉措

- 重要夥伴關係與合作

- 主要併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭性標竿分析

- 創新與永續發展格局

第5章:市場規模及預測:依功率等級分類,2021-2034年

- 主要趨勢

- ≤ 50 kVA

- 50千伏安 - 125千伏安

- 125千伏安 - 200千伏安

- 200千伏安 - 330千伏安

- 330千伏安 - 750千伏安

- 750千伏安以上

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 支援

- 削峰

- 主/連續

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 俄羅斯

- 英國

- 德國

- 法國

- 西班牙

- 奧地利

- 義大利

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 泰國

- 越南

- 菲律賓

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亞

- 阿爾及利亞

- 南非

- 安哥拉

- 肯亞

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第8章:公司簡介

- Aggreko

- Ashok Leyland

- Atlas Copco

- Caterpillar

- Cummins

- FG Wilson

- Generac Power Systems

- Greaves Cotton

- HIMOINSA

- Jakson

- JC Bamford Excavators

- Kirloskar

- Mahindra Powerol

- Mitsubishi Heavy Industries

- Rehlko

- Rolls-Royce

- Sterling Generators

- Sudhir Power

- Supernova Genset

- Wartsila

The Global Diesel Fired Construction Generator Sets Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 14.5 billion by 2034.

Increasing regulatory pressure for cleaner energy technologies and the strong focus on fuel efficiency and cost optimization are shaping market growth. Construction companies are moving toward next-generation diesel gensets that combine reliability with improved environmental compliance. These generators remain indispensable across large and small construction projects, offering dependable off-grid power for operations where electrical grid access is limited or inconsistent. Diesel fired generator sets are engineered to supply continuous energy to run equipment, lighting, and temporary on-site installations, ensuring uninterrupted workflow even in remote or challenging environments. Designed to withstand rugged field conditions, these systems deliver consistent performance and longevity, meeting the operational needs of demanding construction activities. The transition toward advanced, high-efficiency diesel systems is gaining traction as industries seek sustainable solutions without compromising performance. Their growing application in infrastructure, transportation, and large-scale construction projects continues to strengthen market expansion, as uninterrupted energy remains critical to safety and productivity on-site.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $14.5 Billion |

| CAGR | 8.7% |

The >50 kVA - 125 kVA power range segment will reach USD 1.5 billion by 2034. Rising demand stems from their flexibility and capability to support mid-scale construction projects such as commercial complexes, roads, and maintenance works. These generator sets offer steady and dependable power to operate critical equipment including pumps, mixers, and material handling systems, making them highly suitable for multi-shift construction operations where performance and uptime are key considerations.

The standby construction generator segment is projected to grow at a CAGR of 8% from 2025 to 2034. The demand surge is primarily driven by the need for reliable emergency backup systems that automatically activate during power failures caused by grid disruptions or adverse weather events. Permanently installed on construction sites, these systems ensure operational continuity and site safety by maintaining essential power supply during outages. With the increasing frequency of extreme weather conditions and rising dependency on electrically powered machinery, the adoption of standby gensets has become a strategic necessity for maintaining productivity across projects of varying sizes.

U.S. Diesel Fired Construction Generator Sets Market held 85% share in 2024, generating USD 904.3 million. The country's construction industry relies heavily on continuous power availability to run heavy machinery, cranes, lighting systems, and other critical on-site infrastructure. Recurring grid instabilities, power interruptions, and severe weather patterns have heightened the importance of robust and efficient on-site power systems. As a result, diesel gensets remain the most preferred option across diverse construction projects due to their durability, reliability, and readiness to deliver instant power.

Key players in the Global Diesel Fired Construction Generator Sets Market include Wartsila, Caterpillar, Cummins, Mahindra Powerol, Sterling Generators, Greaves Cotton, Sudhir Power, Atlas Copco, Rolls-Royce, FG Wilson, Aggreko, HIMOINSA, Rehlko, Mitsubishi Heavy Industries, J C Bamford Excavators, Kirloskar, Ashok Leyland, Generac Power Systems, Jakson, and Supernova Genset. Companies in the Diesel Fired Construction Generator Sets Market are pursuing multiple strategies to expand their competitive reach and reinforce market leadership. Major players are investing in advanced engine technologies to enhance fuel efficiency, reduce emissions, and ensure compliance with tightening global regulations. Product diversification remains a core strategy, with companies developing compact and hybrid-ready gensets for flexible applications across construction sites. Collaborations with construction contractors and rental service providers help expand distribution networks and improve customer access to customized power solutions. Firms are also leveraging digital monitoring systems and predictive maintenance tools to enhance operational reliability and minimize downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Power rating trends

- 2.1.3 Application trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of diesel fired construction generator sets

- 3.8 Price trend analysis (USD/Unit)

- 3.8.1 By region

- 3.8.2 By power rating

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East

- 4.2.5 Africa

- 4.2.6 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Peak shaving

- 6.4 Prime/continuous

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkiye

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 Ashok Leyland

- 8.3 Atlas Copco

- 8.4 Caterpillar

- 8.5 Cummins

- 8.6 FG Wilson

- 8.7 Generac Power Systems

- 8.8 Greaves Cotton

- 8.9 HIMOINSA

- 8.10 Jakson

- 8.11 J C Bamford Excavators

- 8.12 Kirloskar

- 8.13 Mahindra Powerol

- 8.14 Mitsubishi Heavy Industries

- 8.15 Rehlko

- 8.16 Rolls-Royce

- 8.17 Sterling Generators

- 8.18 Sudhir Power

- 8.19 Supernova Genset

- 8.20 Wartsila