|

市場調查報告書

商品編碼

1871279

測試、檢驗及認證 (TIC) 服務市場機會、成長促進因素、產業趨勢分析及預測(2025-2034 年)Testing, Inspection and Certification (TIC) Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

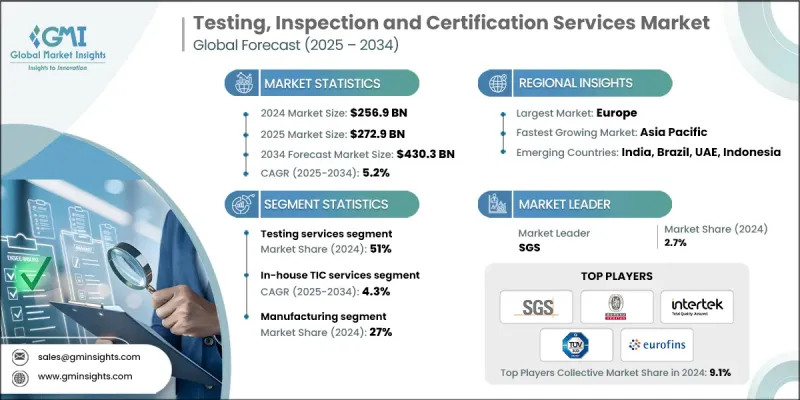

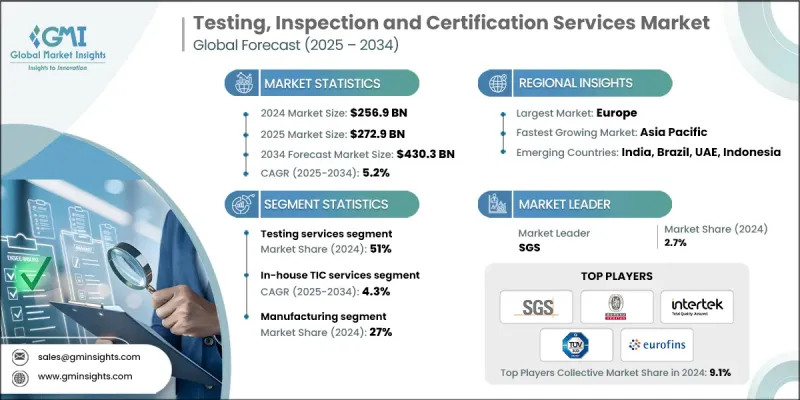

2024 年全球測試、檢驗和認證 (TIC) 服務市值為 2569 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長至 4303 億美元。

檢驗、認證和合規 (TIC) 服務市場在確保產品品質、安全性和合規性方面發揮著至關重要的作用,涵蓋製造業、能源、建築業和消費品等眾多行業。這些服務可協助製造商驗證其產品是否符合國內和國際標準,從而在產品進入全球市場前確保其一致性、安全性和可靠性。隨著全球貿易的擴張,TIC 服務在降低風險、維護消費者信任和提高營運效率方面變得至關重要。監管合規的重要性日益凸顯,尤其是在汽車、醫療保健、食品和電子等行業,這持續推動對 TIC 服務的穩定需求。世界各國政府和私人企業都依賴這些服務來確保產品符合嚴格的品質、性能和環境法規。國際貿易的日益複雜化和不斷提高的安全期望促使企業更加依賴獨立的 TIC 服務供應商,這進一步推動了全球市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2569億美元 |

| 預測值 | 4303億美元 |

| 複合年成長率 | 5.2% |

北美、歐洲和亞太等地區的政府強制規定正在加速推動對第三方技術資訊認證(TIC)服務的需求。國家和地區主管機關要求對產品進行統一的測試和認證,以保護消費者健康和確保環境安全,無論是在國內還是出口市場。製造商擴大與獲得認證的TIC服務提供者合作,由其負責合規性評估,從而有效率地滿足國際貿易標準。獨立的測試和認證能夠驗證產品是否符合進口法規和地區技術要求,幫助企業更快進入市場,並降低因召回或出口被拒而造成的高成本風險。

到2024年,測試服務板塊佔據51%的市場。這些服務廣泛應用於醫療保健、製造業、電子產品和消費品等行業,以確保產品性能的準確性和安全性。測試仍然是確認產品符合本地和國際標準的重要步驟。另一方面,檢驗服務則廣泛應用於建築和農業等行業,用於在產品上市前驗證其安全性、品質一致性以及是否符合監管規範。

預計2025年至2034年間,企業內部檢測、認證和合規(TIC)服務市場將以4.3%的複合年成長率成長。許多公司傾向於內部開展TIC業務,以保持直接監督並保護專有資訊。內部服務還能提供更快的周轉時間、更強的品質保證控制以及與內部合規框架的一致性。採用這種方式的企業通常會投入資金建立檢測實驗室、購買專用設備並聘請技術人員,確保有效率、保密地提供服務,同時遵守全球標準。

2024年,美國測試、檢驗和認證(TIC)服務市場規模達637億美元。該國市場成長的主要驅動力來自製造業,製造業高度依賴TIC服務來維持生產標準、符合法規要求並確保產品可靠性。該產業在支持汽車、電子和機械等關鍵產業方面發揮著重要作用,凸顯了其在維護產品完整性和維持國際市場競爭力方面的重要性。

全球測試、檢驗和認證 (TIC) 服務市場的主要企業包括 TÜV SÜD、SGS、DEKRA、Eurofins、Bureau Veritas、BSI、DNV、TUV Rheinland、Intertek 和 UL Solutions。這些企業正透過併購和策略聯盟來加強其全球影響力,以拓展服務組合和地理覆蓋範圍。領先企業正大力投資自動化、數位化平台和基於人工智慧的檢測工具,以提高測試精度、縮短週轉時間並提升效率。為應對日益嚴格的環境法規,許多企業正在採用以永續發展為導向的測試和合規解決方案。此外,拓展在再生能源、自動駕駛汽車和智慧製造等新興領域的業務能力也成為企業關注的重點。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 日益嚴格的產品安全和品質法規正在更強的執行。

- 新興經濟體的工業化和製造業產出不斷提高

- 消費者對經過認證的永續產品的意識和需求不斷提高

- 採用數位化和遠端檢測技術(人工智慧、物聯網、區塊鏈)

- 產業陷阱與挑戰

- 複雜測試環境的高昂營運和服務成本

- 各地區認證標準存在差異

- 市場機遇

- TIC服務在再生能源、電動車和綠色科技領域的拓展

- 網路安全和數位系統認證的需求日益成長

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利分析

- 永續性和環境方面

- 碳足跡評估

- 循環經濟一體化

- 電子垃圾管理要求

- 綠色製造計劃

- 用例和應用

- 最佳情況

- 成本效益分析框架

- 內部TIC服務與外包TIC服務成本比較

- 總擁有成本 (TCO) 分析

- 上市時間影響評估

- 合規風險緩解價值分析

- 數位服務交付成本模型與傳統服務交付成本模型對比

- 市場成熟度及技術採納分析

- 按地區分類的TIC市場成熟度評估

- 技術採納曲線和實施時間表

- 數位轉型準備度指數

- 監理協調進展分析

- 產業基準研究

- 客戶需求與採購分析

- 供應商選擇標準和基準框架

- 合規成本最佳化策略

- 投資報酬率分析與績效指標

- 風險管理和業務連續性要求

- 數位能力評估框架

- 品質保證與認證要求

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依服務類型分類,2021-2034年

- 主要趨勢

- 測試服務

- 電磁相容性測試

- 電氣安全和性能測試

- 機械和材料測試

- 其他

- 檢查服務

- 裝運前及貨物檢驗

- 工業場地和設備檢查

- 建築和基礎設施檢查

- 其他

- 認證服務

- 產品認證

- 管理系統認證

- 人員認證

- 其他

- 校準服務

- 儀器校準

- 計量和測量標準

- 其他

- 其他

第6章:市場估算與預測:依採購方式分類,2021-2034年

- 主要趨勢

- 內部TIC服務

- 內部測試和品質控制實驗室

- 專屬檢驗和認證部門

- 企業研發和合規性測試中心

- 其他

- 外包TIC服務

- 獨立的第三方TIC提供者

- 合約檢測實驗室

- 外部檢驗和認證機構

- 其他

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 製造業

- 工業機械設備測試

- 品質控制和工廠審核

- 供應鍊和零件驗證

- 能源與公用事業

- 再生能源系統測試

- 智慧電網和電池認證

- 核電廠安全檢查

- 油氣資產完整性評估

- 食品和飲料

- 食品安全和衛生檢測

- 包裝和標籤合規性

- 供應鏈可追溯性和原產地驗證

- 有機認證和永續發展認證

- 汽車

- 電動汽車測試和認證

- 自動駕駛車輛驗證

- 連網汽車網路安全測試

- 車輛檢驗和認證

- 化學品

- 化學成分和純度測試

- 危險物質認證

- 環境和監管合規性審計

- 建築和基礎設施

- 建築材料測試

- 結構完整性檢查

- 綠建築與永續發展認證

- 醫療保健和生命科學

- 生物相容性和滅菌測試

- 藥物和臨床試驗驗證

- 醫療器材和軟體驗證

- 航太與國防

- 航空零件認證

- 國防系統和軍事標準測試

- 空間系統資格

- 消費品

- 電器安全測試

- 玩具、紡織品和化妝品認證

- 消費者保護和品質保證

- 其他

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 全球頂尖玩家

- Bureau Veritas

- DEKRA

- DNV

- Eurofins Scientific

- Intertek

- SGS

- TUV Rheinland

- TUV SUD

- Regional Champions

- APAVE

- BSI

- Centre Testing International

- CCIC

- CSA

- Lloyd's Register

- SOCOTEC

- UL Solutions

- 新興參與者和專家

- ALS

- Applus+ Services

- Element Materials Technology

- Kiwa

- NSF International

- QIMA

- RINA

The Global Testing, Inspection, and Certification (TIC) Services Market was valued at USD 256.9 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 430.3 billion by 2034.

The TIC services market plays a vital role in ensuring product quality, safety, and compliance across diverse industries, including manufacturing, energy, construction, and consumer goods. These services help manufacturers verify that their products meet both domestic and international standards, guaranteeing consistency, safety, and reliability before entering global markets. As global trade expands, TIC services are becoming essential in minimizing risk, maintaining consumer trust, and enhancing operational efficiency. The increasing importance of regulatory compliance, particularly in sectors such as automotive, healthcare, food, and electronics, continues to drive steady demand for TIC services. Governments and private entities worldwide depend on these services to ensure that products meet stringent quality, performance, and environmental regulations. The rising complexity of international trade and heightened safety expectations are pushing companies to rely more on independent TIC providers, further strengthening market growth globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $256.9 Billion |

| Forecast Value | $430.3 Billion |

| CAGR | 5.2% |

Government mandates across regions like North America, Europe, and Asia-Pacific are accelerating demand for third-party TIC services. National and regional authorities require consistent product testing and certification to protect consumer health and ensure environmental safety, both domestically and for exports. Manufacturers increasingly partner with accredited TIC service providers to handle compliance assessments, enabling them to meet international trade standards efficiently. Independent testing and certification validate that products adhere to import regulations and regional technical requirements, helping companies gain faster market access and reduce the risk of costly recalls or export rejections.

The testing services segment held a 51% share in 2024. These services are widely applied across healthcare, manufacturing, electronics, and consumer goods sectors to ensure performance accuracy and safety. Testing remains an essential step in confirming compliance with both local and international standards. Inspection services, on the other hand, are widely adopted in industries such as construction and agriculture to verify product safety, quality consistency, and compliance with regulatory norms before market release.

The in-house TIC services segment is projected to grow at a CAGR of 4.3% from 2025 to 2034. Many companies prefer to perform TIC operations internally to maintain direct oversight and safeguard proprietary information. In-house services also provide faster turnaround times, greater control over quality assurance, and alignment with internal compliance frameworks. Organizations investing in this approach often allocate capital to establish testing laboratories, specialized equipment, and technical expertise, ensuring efficient and confidential service delivery while maintaining adherence to global standards.

U.S. Testing, Inspection, and Certification (TIC) Services Market generated USD 63.7 billion in 2024. The country's market growth is primarily driven by the manufacturing sector, which depends heavily on TIC services for maintaining production standards, regulatory compliance, and product reliability. The industry's role in supporting critical sectors such as automotive, electronics, and machinery underscores its importance in maintaining product integrity and sustaining competitiveness in international markets.

Key companies operating in the Global Testing, Inspection and Certification (TIC) Services Market include TUV SUD, SGS, DEKRA, Eurofins, Bureau Veritas, BSI, DNV, TUV Rheinland, Intertek, and UL Solutions. Companies operating in the Testing, Inspection, and Certification (TIC) Services Market are strengthening their global presence through mergers, acquisitions, and strategic alliances to expand their service portfolios and geographical reach. Leading firms are heavily investing in automation, digital platforms, and AI-based inspection tools to improve testing accuracy, reduce turnaround time, and enhance efficiency. Many are adopting sustainability-driven testing and compliance solutions in response to growing environmental regulations. Expanding capabilities in emerging sectors such as renewable energy, autonomous vehicles, and smart manufacturing has also become a key focus.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Sourcing

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing enforcement of stringent product safety and quality regulations

- 3.2.1.2 Rising industrialization and manufacturing output in emerging economies

- 3.2.1.3 Increased consumer awareness and demand for certified, sustainable products

- 3.2.1.4 Adoption of digital and remote inspection technologies (AI, IoT, blockchain)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High operational and service costs for complex testing environments

- 3.2.2.2 Variability in certification standards across regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of TIC services in renewable energy, EVs, and green technologies

- 3.2.3.2 Growing demand for cybersecurity and digital system certification

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability & environmental aspects

- 3.9.1 Carbon Footprint Assessment

- 3.9.2 Circular Economy Integration

- 3.9.3 E-Waste Management Requirements

- 3.9.4 Green Manufacturing Initiatives

- 3.10 Use cases and applications

- 3.11 Best-case scenario

- 3.12 Cost-Benefit Analysis Framework

- 3.12.1 In-House vs Outsourced TIC services cost comparison

- 3.12.2 Total Cost of Ownership (TCO) analysis

- 3.12.3 Time-to-market impact assessment

- 3.12.4 Compliance risk mitigation value analysis

- 3.12.5 Digital vs traditional service delivery cost models

- 3.13 Market maturity & technology adoption analysis

- 3.13.1 TIC market maturity assessment by region

- 3.13.2 technology adoption curves & implementation timelines

- 3.13.3 digital transformation readiness index

- 3.13.4 regulatory harmonization progress analysis

- 3.13.5 industry benchmarking studies

- 3.14 Client Requirements & Procurement Analysis

- 3.14.1 Vendor selection criteria & benchmarking framework

- 3.14.2 Compliance cost optimization strategies

- 3.14.3 ROI analysis & performance metrics

- 3.14.4 Risk management & business continuity requirements

- 3.14.5 Digital capability assessment framework

- 3.14.6 Quality assurance & accreditation requirement

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Testing Services

- 5.2.1 Electromagnetic compatibility testing

- 5.2.2 Electrical safety and performance testing

- 5.2.3 Mechanical and materials testing

- 5.2.4 Others

- 5.3 Inspection Services

- 5.3.1 Pre-shipment and consignment inspection

- 5.3.2 Industrial site and equipment inspection

- 5.3.3 Construction and infrastructure inspection

- 5.3.4 Others

- 5.4 Certification Services

- 5.4.1 Product certification

- 5.4.2 Management system certification

- 5.4.3 Personnel certification

- 5.4.4 Others

- 5.5 Calibration Services

- 5.5.1 Instrument calibration

- 5.5.2 Metrology and measurement standards

- 5.5.3 Others

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Sourcing, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 In-House TIC Services

- 6.2.1 Internal testing and quality control laboratories

- 6.2.2 Captive inspection and certification departments

- 6.2.3 Corporate R&D and compliance testing centers

- 6.2.4 Others

- 6.3 Outsourced TIC Services

- 6.3.1 Independent third-party TIC providers

- 6.3.2 Contract-based testing laboratories

- 6.3.3 External inspection and certification bodies

- 6.3.4 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.2.1 Industrial machinery and equipment testing

- 7.2.2 Quality control and factory audits

- 7.2.3 Supply chain and component verification

- 7.3 Energy and Utilities

- 7.3.1 Renewable energy system testing

- 7.3.2 Smart grid and battery certification

- 7.3.3 Nuclear plant safety inspection

- 7.3.4 Oil and gas asset integrity assessments

- 7.4 Food and Beverages

- 7.4.1 Food safety and hygiene testing

- 7.4.2 Packaging and labeling compliance

- 7.4.3 Supply chain traceability and origin verification

- 7.4.4 Organic and sustainability certifications

- 7.5 Automotive

- 7.5.1 Electric vehicle testing and certification

- 7.5.2 Autonomous vehicle validation

- 7.5.3 Connected car cybersecurity testing

- 7.5.4 Vehicle inspection and homologation

- 7.6 Chemicals

- 7.6.1 Chemical composition and purity testing

- 7.6.2 Hazardous material certification

- 7.6.3 Environmental and regulatory compliance audits

- 7.7 Construction and Infrastructure

- 7.7.1 Building materials testing

- 7.7.2 Structural integrity inspections

- 7.7.3 Green building and sustainability certification

- 7.8 Healthcare and Life Sciences

- 7.8.1 Biocompatibility and sterilization testing

- 7.8.2 Pharmaceutical and clinical trial validation

- 7.8.3 Medical device and software validation

- 7.9 Aerospace and Defense

- 7.9.1 Aviation component certification

- 7.9.2 Defense system and military standards testing

- 7.9.3 Space system qualification

- 7.10 Consumer Products

- 7.10.1 Electrical appliance safety testing

- 7.10.2 Toy, textile, and cosmetic certification

- 7.10.3 Consumer protection and quality assurance

- 7.11 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Top Global Players

- 9.1.1 Bureau Veritas

- 9.1.2 DEKRA

- 9.1.3 DNV

- 9.1.4 Eurofins Scientific

- 9.1.5 Intertek

- 9.1.6 SGS

- 9.1.7 TUV Rheinland

- 9.1.8 TUV SUD

- 9.2 Regional Champions

- 9.2.1 APAVE

- 9.2.2 BSI

- 9.2.3 Centre Testing International

- 9.2.4 CCIC

- 9.2.5 CSA

- 9.2.6 Lloyd's Register

- 9.2.7 SOCOTEC

- 9.2.8 UL Solutions

- 9.3 Emerging Players & Specialists

- 9.3.1 ALS

- 9.3.2 Applus+ Services

- 9.3.3 Element Materials Technology

- 9.3.4 Kiwa

- 9.3.5 NSF International

- 9.3.6 QIMA

- 9.3.7 RINA