|

市場調查報告書

商品編碼

1871244

數位臨床解決方案市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Digital Clinical Solution Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

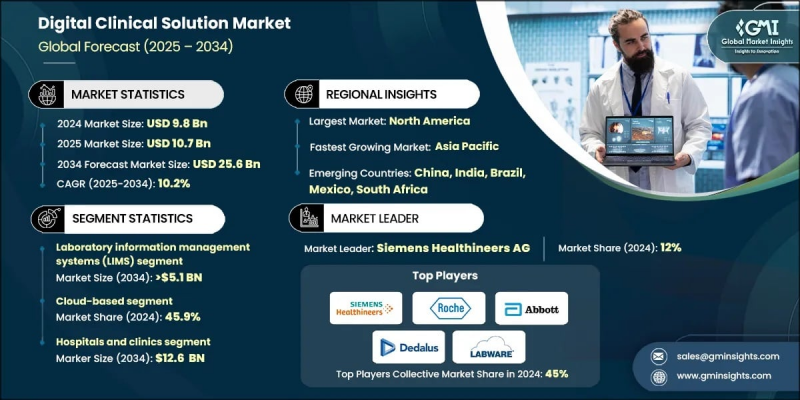

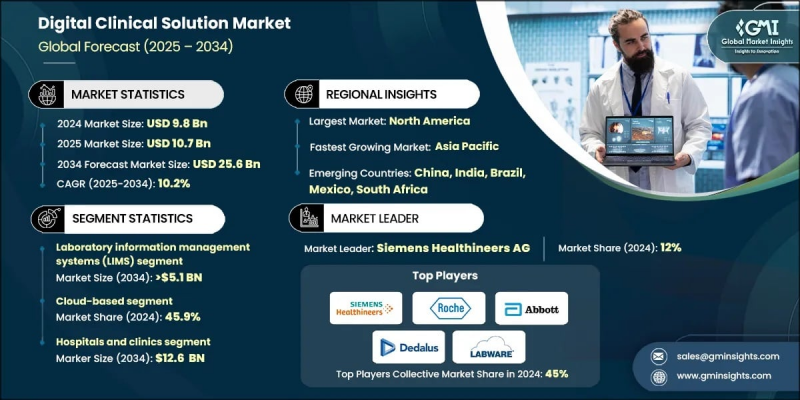

2024 年全球數位臨床解決方案市值為 98 億美元,預計到 2034 年將以 10.2% 的複合年成長率成長至 256 億美元。

市場強勁成長勢頭源自於對可擴展、以數據為中心、以患者為中心的醫療保健模式日益成長的需求。隨著慢性病增多、人口老化和醫療專業人員短缺等挑戰的不斷加劇,數位化平台正在重塑全球醫療服務的提供方式。創新的醫療技術正在改善協調性、診斷精準度和整體治療效果。隨著醫療系統向效率和價值導向模式轉型,數位化臨床解決方案的採用持續加速,幫助醫療機構更好地管理病患資料、簡化工作流程並提升營運績效。數位化臨床解決方案涵蓋先進的軟體和技術平台,旨在簡化醫療營運、改善臨床流程並提升患者療效。這些系統能夠幫助醫療機構、實驗室和研究機構管理臨床資料、確保合規性並利用資料分析進行策略決策。它們在實現即時監測和促進醫療環境中的循證臨床干預方面發揮著至關重要的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 98億美元 |

| 預測值 | 256億美元 |

| 複合年成長率 | 10.2% |

預計到2034年,資料分析和報告軟體市場將以11.2%的複合年成長率成長。這一成長主要歸功於臨床對分析洞察、預測建模和績效追蹤的日益依賴,以提升臨床效率。隨著醫療服務提供者越來越重視數據驅動和結果導向的醫療服務,先進的分析工具對於將複雜的患者資料轉化為可操作的洞察,從而最佳化診斷和治療決策,變得至關重要。

到2024年,基於雲端的部署模式市佔率將達到45.9%。其廣泛應用得益於市場對靈活、經濟且易於部署的醫療保健技術的需求。雲端基礎設施使醫療機構能夠安全地管理和交換患者資訊,而無需依賴成本高昂的實體系統。這種靈活性既支持發達的醫療保健市場,也支持新興地區,使醫療服務提供者能夠在確保資料安全和合規性的同時,擴展其數位化能力。

預計到2024年,美國數位臨床解決方案市場規模將達39億美元。美國憑藉先進的醫療基礎設施、對數位醫療技術的大量投資以及政府大力推動數位轉型的舉措,繼續引領全球市場。美國對互聯互通、數據驅動型醫療的重視,正在加速醫院、診斷中心和門診網路等各領域整合臨床解決方案的部署。

全球數字臨床解決方案市場的主要參與者包括雅培實驗室、貝克曼庫爾特公司、Bio-Rad Laboratories Inc.、CLTech、COYALab、DataArt、Dedalus、羅氏公司、GrupoBIOS SA、GTPLAN、IL Werfen、KERN IT、LabCoreSoft、LabWare、Matrix Sistemas、Optilink SRL、Pixeon、西門子醫療、Tesi Group 和 Tips Salud。為了鞏固自身地位,數位臨床解決方案領域的關鍵企業正專注於創新、合作和產品組合拓展。許多企業正大力投資研發,以增強軟體功能、提高互通性並提供人工智慧驅動的分析,從而改善臨床結果。與醫療服務提供者和技術公司的策略合作有助於加速跨不同醫療生態系統的整合和客製化。此外,各企業也強調併購和產品多元化,以擴大其全球影響力。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 遠距醫療和遠距保健的需求日益成長

- 數位臨床軟體解決方案的技術進步

- 臨床工作流程管理需求日益成長

- 產業陷阱與挑戰

- 高昂的實施和維護成本

- 醫療保健和熟練專業人員短缺

- 市場機遇

- 政府主導的數位健康計劃

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 專利分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依軟體分類,2021-2034年

- 主要趨勢

- 實驗室資訊管理系統(LIMS)

- 實驗室資訊系統(LIS)

- 中介軟體解決方案

- 即時資料監控系統

- 庫存管理軟體

- 企業資源規劃(ERP)

- 臨床決策支援系統(CDSS)

- 電子實驗紀錄本(ELN)

- 數據分析和報告軟體

第6章:市場估算與預測:以交付方式分類,2021-2034年

- 主要趨勢

- 基於雲端的

- 本地部署

- 混合

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院和診所

- 實驗室

- 臨床和診斷實驗室

- 研究實驗室

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc

- CLTech

- COYALab

- DataArt

- Dedalus

- F. Hoffmann-La Roche Ltd.

- GrupoBIOS SA

- GTPLAN

- IL Werfen

- KERN IT

- LabCoreSoft

- LabWare

- Matrix Sistemas

- Optilink SRL

- Pixeon

- Siemens Healthineers AG

- Tesi Group

- Tips Salud

The Global Digital Clinical Solution Market was valued at USD 9.8 Billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 25.6 Billion by 2034.

The market's strong momentum is driven by the growing need for scalable, data-centric, and patient-focused healthcare models. With increasing challenges such as the rise in chronic illnesses, aging populations, and shortages in healthcare professionals, digital platforms are reshaping the delivery of care worldwide. Innovative healthcare technologies are improving coordination, diagnostic precision, and overall treatment outcomes. As healthcare systems shift toward efficiency and value-based models, the adoption of digital clinical solutions continues to accelerate, helping institutions better manage patient data, streamline workflows, and enhance operational performance. Digital clinical solutions encompass advanced software and technology platforms designed to simplify healthcare operations, improve clinical processes, and elevate patient outcomes. These systems assist healthcare facilities, laboratories, and research organizations in managing clinical data, ensuring compliance, and utilizing data analytics for strategic decision-making. They play a critical role in enabling real-time monitoring and facilitating evidence-based clinical interventions across healthcare environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 billion |

| Forecast Value | $25.6 billion |

| CAGR | 10.2% |

The data analytics and reporting software segment is anticipated to grow at a CAGR of 11.2% through 2034. This expansion is attributed to the growing reliance on analytical insights, predictive modeling, and performance tracking to support clinical efficiency. As healthcare providers increasingly focus on data-driven and outcome-based care, advanced analytics tools are becoming essential for transforming complex patient data into actionable insights that enhance diagnostic and therapeutic decisions.

The cloud-based deployment model segment held a 45.9% share in 2024. Its widespread adoption is fueled by the demand for flexible, affordable, and easily deployable healthcare technologies. Cloud infrastructure allows healthcare organizations to securely manage and exchange patient information without relying on costly physical systems. This flexibility supports both developed healthcare markets and emerging regions, enabling providers to expand their digital capabilities while maintaining data security and compliance.

United States Digital Clinical Solution Market reached USD 3.9 Billion in 2024. The U.S. continues to lead the global market, supported by advanced healthcare infrastructure, high investments in digital health technologies, and strong government initiatives promoting digital transformation. The nation's focus on connected, data-enabled healthcare is accelerating the implementation of integrated clinical solutions across hospitals, diagnostic centers, and outpatient networks.

Leading participants in the Global Digital Clinical Solution Market include Abbott Laboratories, Beckman Coulter Inc., Bio-Rad Laboratories Inc., CLTech, COYALab, DataArt, Dedalus, F. Hoffmann-La Roche Ltd., GrupoBIOS S.A., GTPLAN, IL Werfen, KERN IT, LabCoreSoft, LabWare, Matrix Sistemas, Optilink S.R.L., Pixeon, Siemens Healthineers AG, Tesi Group, and Tips Salud. To strengthen their position, key companies in the digital clinical solutions sector are focusing on innovation, partnerships, and portfolio expansion. Many are investing heavily in research and development to enhance software functionality, improve interoperability, and deliver AI-powered analytics for better clinical outcomes. Strategic collaborations with healthcare providers and technology firms help accelerate integration and customization across diverse healthcare ecosystems. Companies are also emphasizing mergers, acquisitions, and product diversification to expand their global footprint.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Software trends

- 2.2.3 Mode of delivery trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for remote healthcare and telemedicine

- 3.2.1.2 Technological advancements in digital clinical software solutions

- 3.2.1.3 Increasing need for clinical workflow management

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and maintenance costs

- 3.2.2.2 Shortage of healthcare and skilled professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Government led digital health initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Software, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Laboratory information management systems (LIMS)

- 5.3 Laboratory information systems (LIS)

- 5.4 Middleware solutions

- 5.5 Real-time data monitoring systems

- 5.6 Inventory management software

- 5.7 Enterprise resource planning (ERP)

- 5.8 Clinical decision support systems (CDSS)

- 5.9 Electronic lab notebooks (ELN)

- 5.10 Data analytics and reporting software

Chapter 6 Market Estimates and Forecast, By Mode of Delivery, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premise

- 6.4 Hybrid

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Laboratories

- 7.3.1 Clinical and diagnostic laboratories

- 7.3.2 Research laboratories

- 7.4 Other End use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Beckman Coulter, Inc.

- 9.3 Bio-Rad Laboratories, Inc

- 9.4 CLTech

- 9.5 COYALab

- 9.6 DataArt

- 9.7 Dedalus

- 9.8 F. Hoffmann-La Roche Ltd.

- 9.9 GrupoBIOS S.A.

- 9.10 GTPLAN

- 9.11 IL Werfen

- 9.12 KERN IT

- 9.13 LabCoreSoft

- 9.14 LabWare

- 9.15 Matrix Sistemas

- 9.16 Optilink S.R.L.

- 9.17 Pixeon

- 9.18 Siemens Healthineers AG

- 9.19 Tesi Group

- 9.20 Tips Salud