|

市場調查報告書

商品編碼

1871239

汽車沖壓機自動化市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Stamping Press Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

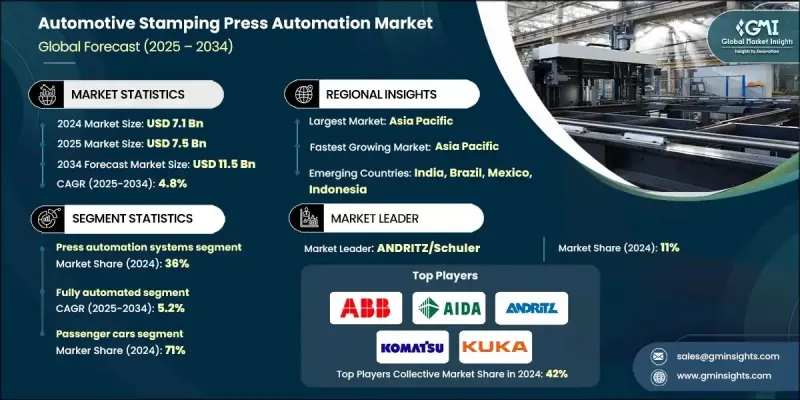

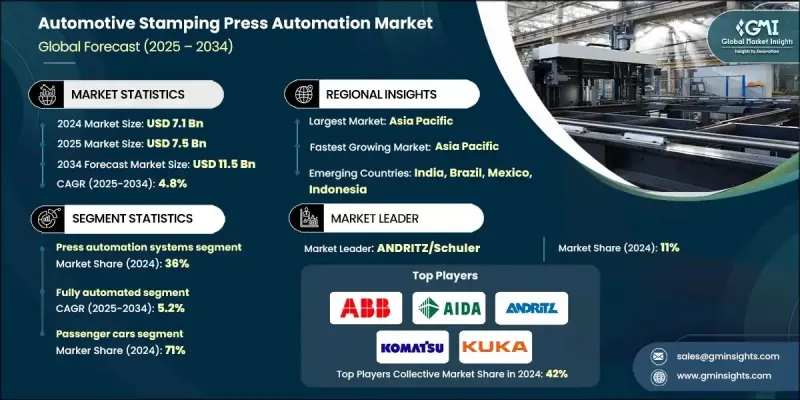

2024 年全球汽車沖壓機自動化市場價值為 71 億美元,預計到 2034 年將以 4.8% 的複合年成長率成長至 115 億美元。

沖壓市場在汽車製造業中扮演著至關重要的角色,因為它專注於金屬汽車零件的自動化成型、加工和組裝。機器人、CNC工具機和自動化控制系統的日益普及,正在提升汽車製造流程的生產精度、速度和重複性。電動車領域的快速擴張也正在重塑沖壓自動化,因為電動車的生產需要輕量化且結構複雜的零件。製造商正加大對先進自動化技術的投資,以支援高強度鋼、鋁和複合材料的加工。包括物聯網、智慧感測器和預測性維護在內的工業4.0技術的整合,進一步改變了這個產業。這些創新透過實現即時監控、自動化品質檢查和預測性設備維護,最佳化了生產效率。這種整合減少了停機時間,提高了能源效率,並確保了汽車零件生產的高產量和高精度。隨著自動化對於維持全球競爭力變得越來越重要,乘用車、商用車和電動車製造領域對先進沖壓系統的需求持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 71億美元 |

| 預測值 | 115億美元 |

| 複合年成長率 | 4.8% |

到2024年,沖壓自動化系統市佔率將達到36%。此細分市場的成長主要得益於伺服驅動沖壓技術的應用,與傳統液壓機相比,伺服沖壓機具有更高的精度、靈活性和能源效率。伺服沖壓機使操作人員能夠即時微調成型參數,減少材料浪費,並有效加工各種材料,例如鋁合金和高強度鋼。其在電動車零件生產中的日益廣泛的應用,凸顯了其在精密製造環境中的價值。

預計從2025年到2034年,全自動化沖壓領域將以5.2%的複合年成長率成長。該領域整合了高速沖壓機、機器人搬運系統和智慧過程控制解決方案,可實現連續不間斷生產。透過最大限度地減少人工干預,這些系統提高了產量、產品一致性和操作安全性,同時縮短了生產週期並降低了生產成本。如今,全自動化沖壓生產線對於實現精益生產目標以及在大型汽車生產設施中保持統一的品質標準至關重要。

2024年,美國汽車沖壓機自動化市場規模預計將達到10.9億美元。美國市場的成長主要得益於對國內製造業的重新重視以及對先進自動化技術的應用。汽車製造商正加大對新一代沖壓系統的投資,以提高乘用車和商用車生產的靈活性、生產效率和品質。製造業回流以及對供應鏈韌性的重視,持續推動該地區對自動化解決方案的需求。

全球汽車沖壓機自動化市場的主要企業包括ABB、小松工業、庫卡、發那科、愛達工程、AMADA、世義機械、美國比勒公司、安德里茨/舒勒以及優傲機器人。為了鞏固自身地位,汽車沖壓機自動化產業的領導者正採取以技術創新、合作和產能擴張為核心的策略。各公司正在開發整合人工智慧和物聯網的智慧伺服驅動系統,以實現預測性維護、改善能源控制和增強製程最佳化。與汽車製造商和機器人公司的策略聯盟正在幫助企業將自動化解決方案推廣到整個生產設施。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電動車和輕量化材料的日益普及

- 工業4.0與智慧工廠技術的融合

- 新興市場汽車產量不斷成長

- 對高品質、性能穩定的金屬部件的需求

- 產業陷阱與挑戰

- 先進自動化的高額資本投入

- 多材料沖壓製程整合的複雜性

- 市場機遇

- 擴大電動車和輕型汽車項目

- 採用人工智慧驅動的預測性維護和流程最佳化

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 碳足跡評估

- 循環經濟一體化

- 電子垃圾管理要求

- 綠色製造計劃

- 用例和應用

- 最佳情況

- 投資環境

- 沖壓自動化領域的資本支出趨勢

- 私募股權和創投活動

- 合併、收購和策略夥伴關係

- 投資報酬率與投資回收期分析

- 市場採納趨勢

- 各類車輛的自動化普及率

- 依自動化程度分類的採用情況:半自動化與全自動

- 物聯網和人工智慧技術的融合

- 採用障礙和促進因素

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 印刷自動化系統

- 機器人物料搬運

- 製程控制與監控

- 整合與服務

第6章:市場估算與預測:依自動化程度分類,2021-2034年

- 主要趨勢

- 半自動

- 全自動

- 智慧/互聯

第7章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車輛(HCV)

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 白車身(BIW)

- 動力系統

- 安全/結構

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- ABB

- AIDA Engineering

- AMADA

- ANDRITZ/Schuler

- Bihler of America

- FANUC

- Komatsu Industries

- KUKA

- SEYI Machinery

- Universal Robots

- 區域玩家

- Acro Metal Stamping

- American Axle & Manufacturing

- ArtiFlex Manufacturing

- Challenge Manufacturing

- 新興參與者/顛覆者

- AmeriStar

- Arcade Metal Stamping

- Automation Tool & Die (ATD)

- Eagle Press & Equipment

The Global Automotive Stamping Press Automation Market was valued at USD 7.1 Billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 11.5 Billion by 2034.

The market holds a crucial role in automotive manufacturing, as it focuses on the automated forming, shaping, and assembly of metal vehicle components. The growing use of robotics, CNC machinery, and automated control systems is enhancing production precision, speed, and repeatability across vehicle manufacturing processes. The rapid expansion of the electric vehicle segment is also reshaping stamping automation, as EV production requires lightweight and complex structural parts. Manufacturers are increasingly investing in advanced automation to support the processing of high-strength steel, aluminum, and composite materials. The integration of Industry 4.0 technologies including IoT, smart sensors, and predictive maintenance has further transformed the sector. These innovations optimize production efficiency by enabling real-time monitoring, automated quality checks, and predictive equipment maintenance. This integration reduces downtime, improves energy efficiency, and ensures high throughput and accuracy in automotive component production. With automation increasingly essential to maintain global competitiveness, demand for advanced stamping systems continues to rise across passenger, commercial, and electric vehicle manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 4.8% |

The press automation systems segment accounted for a 36% share in 2024. This segment is primarily driven by the adoption of servo-driven press technology, which offers superior accuracy, flexibility, and energy efficiency compared to traditional hydraulic presses. Servo presses enable operators to fine-tune forming parameters in real time, reduce material waste, and efficiently process diverse materials such as aluminum alloys and high-strength steel. Their growing use in the production of electric vehicle components underscores their value in precision manufacturing environments.

The fully automated segment is expected to grow at a CAGR of 5.2% from 2025 to 2034. This category integrates high-speed presses, robotic handling systems, and intelligent process control solutions that enable continuous, uninterrupted production. By minimizing manual intervention, these systems enhance throughput, product consistency, and operational safety while reducing cycle times and production costs. Fully automated stamping lines are now central to achieving lean manufacturing objectives and maintaining uniform quality standards across large-scale automotive production facilities.

United States Automotive Stamping Press Automation Market generated USD 1.09 Billion in 2024. Growth in the U.S. market is being driven by a renewed focus on domestic manufacturing and the adoption of advanced automation technologies. Automotive producers are increasingly investing in next-generation stamping systems to improve flexibility, productivity, and quality across both passenger and commercial vehicle production. The reshoring of manufacturing operations and the focus on supply chain resilience continue to strengthen demand for automated solutions in the region.

Key companies operating in the Global Automotive Stamping Press Automation Market include ABB, Komatsu Industries, KUKA, FANUC, AIDA Engineering, AMADA, SEYI Machinery, Bihler of America, ANDRITZ/Schuler, and Universal Robots. To reinforce their position, leading players in the automotive stamping press automation industry are adopting strategies centered on technological innovation, partnerships, and capacity expansion. Companies are developing intelligent servo-driven systems that integrate AI and IoT for predictive maintenance, improved energy control, and enhanced process optimization. Strategic alliances with automakers and robotics firms are helping expand automation solutions across production facilities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Automation Level

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of EVs and lightweight materials

- 3.2.1.2 Integration of Industry 4.0 and smart factory technologies

- 3.2.1.3 Rising vehicle production in emerging markets

- 3.2.1.4 Demand for high-quality, consistent metal components

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment for advanced automation

- 3.2.2.2 Complexity in integrating multi-material stamping processes

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of EV and lightweight vehicle programs

- 3.2.3.2 Adoption of AI-driven predictive maintenance and process optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability & environmental aspects

- 3.11.1 Carbon Footprint Assessment

- 3.11.2 Circular Economy Integration

- 3.11.3 E-Waste Management Requirements

- 3.11.4 Green Manufacturing Initiatives

- 3.12 Use cases and applications

- 3.13 Best-case scenario

- 3.14 Investment landscape

- 3.14.1 Capital expenditure trends in stamping automation

- 3.14.2 Private equity and venture funding activity

- 3.14.3 Mergers, acquisitions, and strategic partnerships

- 3.14.4 Return on investment and payback period analysis

- 3.15 Market adoption trends

- 3.15.1 Rate of automation adoption across vehicle types

- 3.15.2 Adoption by automation level: semi-automated vs fully automated

- 3.15.3 Integration of IoT and AI technologies

- 3.15.4 Adoption barriers and enablers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Press Automation systems

- 5.3 Robotic Material Handling

- 5.4 Process Control & Monitoring

- 5.5 Integration & services

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Semi-Automated

- 6.3 Fully Automated

- 6.4 Smart/Connected

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial Vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Body-in-White (BIW)

- 8.3 Powertrain

- 8.4 Safety/Structural

- 8.5 Other

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 ABB

- 10.1.2 AIDA Engineering

- 10.1.3 AMADA

- 10.1.4 ANDRITZ/Schuler

- 10.1.5 Bihler of America

- 10.1.6 FANUC

- 10.1.7 Komatsu Industries

- 10.1.8 KUKA

- 10.1.9 SEYI Machinery

- 10.1.10 Universal Robots

- 10.2 Regional Players

- 10.2.1 Acro Metal Stamping

- 10.2.2 American Axle & Manufacturing

- 10.2.3 ArtiFlex Manufacturing

- 10.2.4 Challenge Manufacturing

- 10.3 Emerging Players / Disruptors

- 10.3.1 AmeriStar

- 10.3.2 Arcade Metal Stamping

- 10.3.3 Automation Tool & Die (ATD)

- 10.3.4 Eagle Press & Equipment