|

市場調查報告書

商品編碼

1871222

粗粒生物燃料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Coarse Grain Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

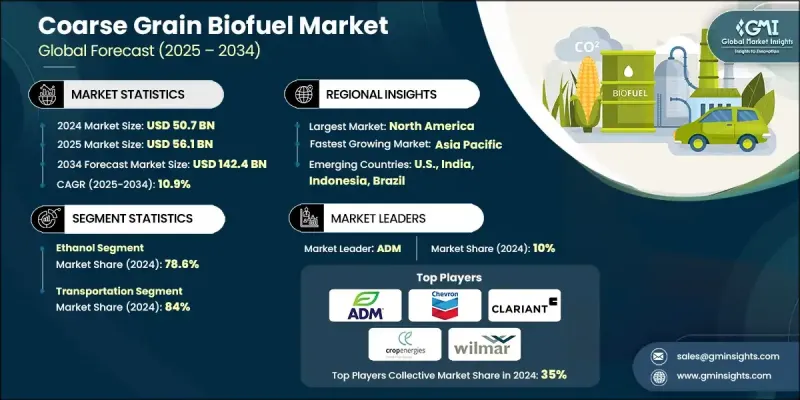

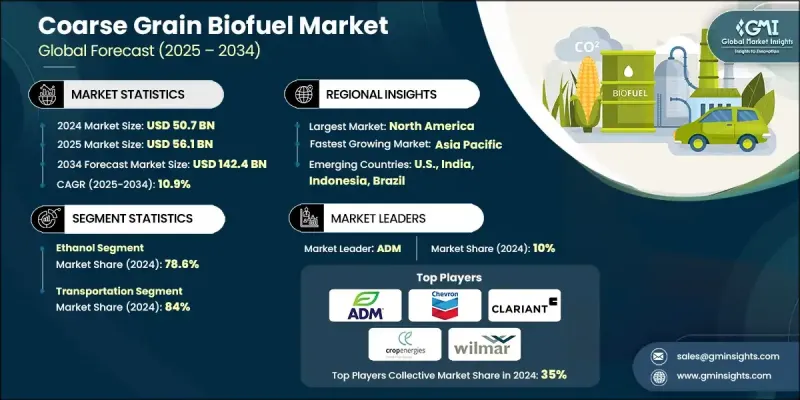

2024 年全球粗粒生質燃料市場價值為 507 億美元,預計到 2034 年將以 10.9% 的複合年成長率成長至 1,424 億美元。

該產業的強勁成長得益於政府不斷擴大的燃料摻混政策以及對永續航空燃料原料需求的增加。隨著各國加強減少對化石燃料的依賴,生物燃料目標在減排策略中扮演關鍵角色。以玉米和高粱等粗糧為原料生產的乙醇正成為交通運輸燃料政策的重要組成部分,尤其是在航空業尋求脫碳路徑之際。促進乙醇基永續航空燃料發展的監管架構正在幫助粗糧生物燃料拓展到公路運輸以外的新應用領域。對永續性、國家能源安全以及資源在地化利用的日益重視,都為創造有利的商業環境做出了貢獻。隨著國際社會對淨零排放目標的承諾不斷推進,各產業正加速採用低碳燃料。粗糧基乙醇因其顯著更低的生命週期排放量,正成為交通運輸和工業生態系統長期脫碳計畫的關鍵組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 507億美元 |

| 預測值 | 1424億美元 |

| 複合年成長率 | 10.9% |

2024年,乙醇燃料市佔率達到78.6%,預計到2034年將以11%的複合年成長率成長。這一主導地位主要得益於政策驅動的需求以及乾磨乙醇生產技術的日益普及。在美國,大部分乙醇產自乾磨廠,這些工廠採用現代技術來提高原料轉換效率、降低能耗並最佳化產品價值。這些工廠將玉米和高粱轉化為乙醇、玉米油和酒糟,為生產鏈帶來經濟和環境雙重價值。

到2034年,生質柴油市場規模將達到250億美元。雖然傳統植物油仍是主要原料,但作為乙醇精煉副產品的玉米油在生質柴油混合的應用日益廣泛。這種融合不僅提高了原料利用效率,而且透過最大限度地減少浪費和實現最終用途多樣化,也符合循環生物經濟的原則。

2024年,美國粗糧生物燃料市場佔93%的佔有率,產值達187億美元。這一領先地位得益於農業政策與氣候目標的緊密結合,糧食生產成為一項戰略優勢。美國和加拿大的生物燃料計劃與涵蓋交通、農業和工業領域的更廣泛的脫碳計劃緊密相連,強化了該地區對能源獨立和排放控制的承諾。

粗粒生物燃料市場的主要企業包括Verbio、雪佛龍、Praj Industries、科萊恩、POET、道達爾能源、FutureFuel、豐益國際、安德森公司、ADM、耐斯特、My Eco Energy、博雷加德、Zilor、BTG Bioliquids、Munzer Bioindustrie、UPM、CropEnergies、中集團和加糧。為了鞏固其在全球粗粒生物燃料市場的地位,主要企業正在實施多項重點策略。各公司正大力投資技術升級,尤其是在乾磨和發酵系統方面,以提高製程效率和產品產量。擴大原料來源並將玉米油等副產品納入生質柴油產業鏈,有助於提升營運價值。許多公司也與政府機構合作,使產品開發與監管目標保持一致,尤其是在永續農業燃料(SAF)領域。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭性標竿分析

- 戰略儀錶板

- 創新與技術格局

第5章:市場規模及預測:依燃料類型分類,2021-2034年

- 主要趨勢

- 乙醇

- 生質柴油

- 其他

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 運輸

- 航空

- 其他

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 印尼

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ADM

- Borregaard

- BTG Bioliquids

- Cargill

- Chevron

- Clariant

- COFCO

- CropEnergies

- FutureFuel

- Munzer Bioindustrie

- My Eco Energy

- Neste

- POET

- Praj Industries

- The Andersons

- TotalEnergies

- UPM

- Verbio

- Wilmar International

- Zilor

The Global Coarse Grain Biofuel Market was valued at USD 50.7 Billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 142.4 Billion by 2034.

Strong growth in the sector is supported by expanding government mandates on fuel blending and increasing feedstock demand for sustainable aviation fuel. As countries ramp up efforts to reduce dependence on fossil fuels, biofuel targets are playing a key role in emissions reduction strategies. Ethanol produced from coarse grains such as corn and sorghum is becoming integral to transport fuel policies, particularly as the aviation sector looks for decarbonization pathways. Regulatory frameworks that promote ethanol-based SAF are helping to expand the role of coarse grain biofuels into new applications beyond road transportation. Growing emphasis on sustainability, national energy security, and the shift toward localized resource utilization are all contributing to a favorable business environment. With international commitments to net-zero targets gaining momentum, industries are accelerating the adoption of low-carbon fuels. Coarse grain-based ethanol, with its significantly lower lifecycle emissions, is emerging as a key component in long-term decarbonization plans across both transportation and industrial ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $50.7 Billion |

| Forecast Value | $142.4 Billion |

| CAGR | 10.9% |

The ethanol-based fuels segment accounted for a 78.6% share in 2024 and is forecast to grow at a CAGR of 11% through 2034. This dominant position is being driven by policy-driven demand and the increasing application of dry mill ethanol production technologies. In the U.S., most ethanol output comes from dry mill plants, which have adopted modern technologies to enhance feedstock conversion efficiency, reduce energy use, and optimize product value. These facilities convert corn and sorghum into ethanol, corn oil, and distillers' grains, delivering both economic and environmental value to the production chain.

The biodiesel segment will reach USD 25 Billion by 2034. While traditional vegetable oils remain a primary input, corn oil, a byproduct of ethanol refining, is seeing expanded use in biodiesel blending. This integration not only boosts the efficiency of feedstock utilization but also aligns with the principles of a circular bioeconomy by minimizing waste and diversifying end uses.

U.S. Coarse Grain Biofuel Market held 93% share in 2024, generating USD 18.7 Billion. This leadership is underpinned by a strong alignment of agricultural policy and climate goals, with grain production serving as a strategic advantage. Biofuel initiatives across the U.S. and Canada are closely tied to broader decarbonization plans involving transport, agriculture, and industrial sectors, reinforcing the region's commitment to energy independence and emissions control.

Key companies in the Coarse Grain Biofuel Market include Verbio, Chevron, Praj Industries, Clariant, POET, TotalEnergies, FutureFuel, Wilmar International, The Andersons, ADM, Neste, My Eco Energy, Borregaard, Zilor, BTG Bioliquids, Munzer Bioindustrie, UPM, CropEnergies, COFCO, and Cargill. To solidify their position in the Global Coarse Grain Biofuel Market, major players are deploying several focused strategies. Companies are heavily investing in technology upgrades, particularly in dry mill and fermentation systems, to improve process efficiencies and product yields. Expanding their feedstock base and incorporating co-products like corn oil into biodiesel chains is helping increase operational value. Many firms are also collaborating with government bodies to align product development with regulatory goals, especially in the SAF segment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, Mtoe)

- 5.1 Key trends

- 5.2 Ethanol

- 5.3 Biodiesel

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, Mtoe)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Aviation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Mtoe)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Indonesia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ADM

- 8.2 Borregaard

- 8.3 BTG Bioliquids

- 8.4 Cargill

- 8.5 Chevron

- 8.6 Clariant

- 8.7 COFCO

- 8.8 CropEnergies

- 8.9 FutureFuel

- 8.10 Munzer Bioindustrie

- 8.11 My Eco Energy

- 8.12 Neste

- 8.13 POET

- 8.14 Praj Industries

- 8.15 The Andersons

- 8.16 TotalEnergies

- 8.17 UPM

- 8.18 Verbio

- 8.19 Wilmar International

- 8.20 Zilor