|

市場調查報告書

商品編碼

1871188

軟性內視鏡手術機器人市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Flexible Endoscopic Surgery Robot Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

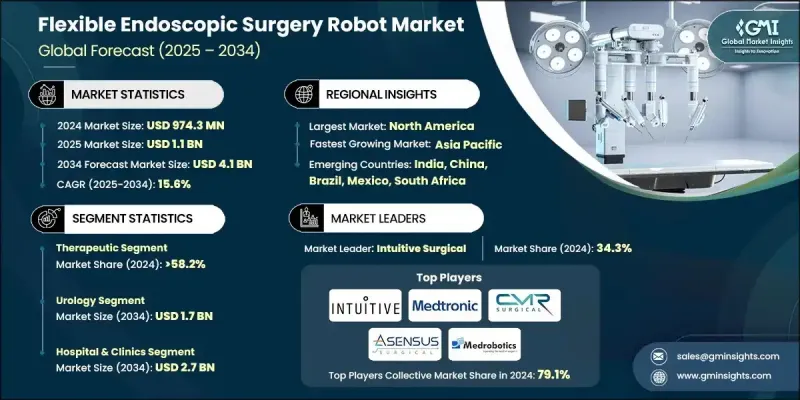

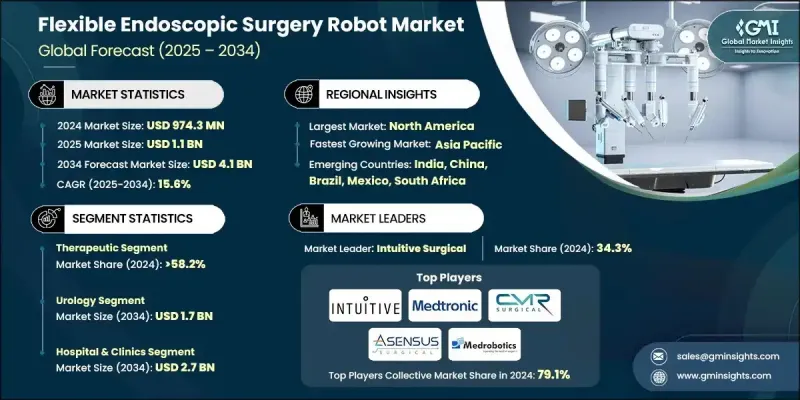

2024 年全球軟性內視鏡手術機器人市場價值為 9.743 億美元,預計到 2034 年將以 15.6% 的複合年成長率成長至 41 億美元。

市場成長的驅動力來自對微創手術工具的激增需求、機器人技術的快速發展以及全球手術數量的不斷成長。軟性內視鏡手術機器人正在改變醫療保健格局,為醫院、門診中心和其他醫療機構提供先進、精準的微創治療系統。這些機器人解決方案融合了人工智慧、成像技術和軟性機械手臂,可同時支援診斷和治療功能,從而提高手術精度並促進患者康復。人工智慧系統、高清可視化和改進的軟性機械手臂等機器人技術的進步,使外科醫生能夠以更高的精度和更低的風險完成複雜的手術。此外,人口老化和慢性病負擔加重導致全球手術量增加,進一步推動了產品需求。主要製造商持續加大研發投入,並積極拓展國際市場,提高了這些系統的可近性,並促進了其在醫療機構的更廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.743億美元 |

| 預測值 | 41億美元 |

| 複合年成長率 | 15.6% |

2024年,治療領域市佔率達到58.2%,這主要歸功於微創手術的日益普及以及機器人控制系統精準度的提升。人們對機器人輔助治療的偏好不斷成長,這正在重塑該領域格局,它能夠提供更清晰的視野、更靈巧的操作以及更精準的導航,從而在最大限度減少創傷和加快患者康復的前提下,完成諸如腫瘤切除和組織分離等複雜手術。

2024年,泌尿外科應用領域佔了41.3%的市場佔有率,預計到2034年將達到17億美元。該領域市場成長的驅動力主要來自泌尿系統疾病盛行率的上升以及機器人輔助手術的廣泛應用,這些技術能夠提高手術精度、減少創傷並縮短住院時間。包括軟性機械手臂和人工智慧導航系統在內的技術進步,顯著提高了複雜泌尿外科手術的精準度,並推動了市場的快速擴張。

2024年,北美軟性內視鏡手術機器人市佔率達到35.5%,這主要得益於美敦力、直覺外科和強生等產業領導者的存在。該地區的領先地位也得益於微創手術的廣泛應用、有利的醫保報銷機制以及美國食品藥物管理局(FDA)對機器人輔助系統的積極支持。胃腸道和大腸直腸疾病的高發生率,以及對技術教育和外科醫生培訓的持續重視,正在推動醫院和手術中心迅速採用軟性機器人平台。

全球軟性內視鏡手術機器人市場的主要參與者包括Intuitive Surgical、Medtronic、強生、CMR Surgical、Asensus Surgical、Medrobotics、Endo Tools Therapeutics、Endotics和GI View。為了鞏固市場地位,軟性內視鏡手術機器人市場的關鍵企業正採取一系列策略性舉措,旨在推動創新並擴大全球影響力。各公司正大力投資研發,以推出配備人工智慧精準工具和先進影像功能的下一代機器人平台。此外,各公司也透過建立合作關係和策略聯盟來加強技術整合並拓展臨床應用。同時,各公司也致力於獲得監管部門的批准,並制定全面的培訓計劃,以提高外科醫生對機器人的接受度。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 人們越來越傾向選擇微創手術

- 機器人技術的進步

- 慢性病盛行率上升

- 人工智慧(AI)的整合

- 產業陷阱與挑戰

- 高昂的初始投資成本

- 有限的報銷政策

- 市場機遇

- 一次性機器人系統的開發

- 人工智慧和機器學習的進步

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 2024年定價分析

- 技術格局

- 當前技術趨勢

- 整合先進的影像和3D可視化系統,以提高手術精度

- 機械手臂的小型化和靈活性增強,提高了其在狹小解剖區域內的機動性

- 增強型外科醫師操作台人體工學設計,配備即時觸覺回饋和直覺的控制介面

- 新興技術

- 人工智慧輔助導航和自主運動控制用於精準引導的外科手術

- 雲端連接的機器人系統可實現遠端手術輔助和資料分析

- 將擴增實境(AR)和虛擬實境(VR)技術相結合,用於手術規劃、培訓和術中可視化

- 當前技術趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 人工智慧、影像和機器人導航的融合

- 小型化和增強的系統靈活性

- 與數位化手術生態系的整合

- 觸覺回饋與自主輔助科技的進步

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新服務類型推出

- 擴張計劃

第5章:市場估算與預測:依類別分類,2021-2034年

- 主要趨勢

- 治療

- 診斷

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 泌尿科

- 呼吸系統應用

- 胃腸道應用

- 其他應用

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院和診所

- 門診手術中心

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Asensus Surgical

- CMR Surgical

- Endo Tools Therapeutics

- Endotics

- GI View

- Intuitive Surgical

- Johnson & Johnson

- Medrobotics

- Medtronic

The Global Flexible Endoscopic Surgery Robot Market was valued at USD 974.3 million in 2024 and is estimated to grow at a CAGR of 15.6% to reach USD 4.1 Billion by 2034.

Market growth is driven by the surging need for minimally invasive surgical tools, rapid advancements in robotic technology, and the growing number of surgical procedures worldwide. Flexible endoscopic surgery robots are transforming the healthcare landscape by offering hospitals, ambulatory centers, and other medical institutions advanced, precision-driven systems for minimally invasive treatments. These robotic solutions combine AI, imaging, and flexible robotic mechanisms to support both diagnostic and therapeutic functions, enhancing surgical precision and patient recovery. Progress in robotics, such as AI-enabled systems, high-definition visualization, and improved flexible arms, allows surgeons to perform complex interventions with higher accuracy and reduced risks. Additionally, the rise in global surgical procedures, spurred by an aging population and an increasing burden of chronic diseases, is further accelerating product demand. Continued investments in research and innovation, coupled with international expansion efforts by key manufacturers, are increasing accessibility and encouraging broader adoption of these systems in healthcare facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $974.3 Million |

| Forecast Value | $4.1 Billion |

| CAGR | 15.6% |

In 2024, the therapeutic segment held a 58.2% share attributed to the rising acceptance of minimally invasive surgeries and enhanced precision in robotic control systems. The growing preference for robotic-assisted therapeutic interventions is reshaping the segment, offering improved visualization, superior dexterity, and refined navigation for intricate operations such as tumor excisions and tissue dissections with minimal trauma and faster patient recovery.

The urology application segment held a 41.3% share in 2024 and is projected to reach USD 1.7 Billion by 2034. Market growth in this domain is propelled by the increasing prevalence of urological disorders and the widespread integration of robotic-assisted surgeries that enhance surgical accuracy, reduce trauma, and shorten hospital stays. Technological advancements, including flexible robotic arms and AI-guided navigation systems, are significantly boosting precision in complex urological procedures and contributing to the market's rapid expansion.

North America Flexible Endoscopic Surgery Robot Market held 35.5% share in 2024, supported by the presence of leading industry participants such as Medtronic, Intuitive Surgical, and Johnson & Johnson. The region's dominance is further supported by a strong base of minimally invasive surgical procedures, favorable reimbursement frameworks, and active FDA support for robotic-assisted systems. The high prevalence of gastrointestinal and colorectal diseases, alongside the continuous focus on technological education and surgeon training, is fostering the swift adoption of flexible robotic platforms across hospitals and surgical centers.

Prominent companies active in the Global Flexible Endoscopic Surgery Robot Market include Intuitive Surgical, Medtronic, Johnson & Johnson, CMR Surgical, Asensus Surgical, Medrobotics, Endo Tools Therapeutics, Endotics, and GI View. To strengthen their position, key players in the Flexible Endoscopic Surgery Robot Market are adopting a mix of strategic initiatives aimed at driving innovation and expanding global reach. Companies are heavily investing in R&D to introduce next-generation robotic platforms equipped with AI-based precision tools and advanced imaging capabilities. Collaborative partnerships and strategic alliances are being formed to enhance technology integration and expand clinical applications. Firms are also focusing on obtaining regulatory approvals and developing comprehensive training programs to increase adoption rates among surgeons.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Category trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing preference for minimally invasive procedures

- 3.2.1.2 Advancements in robotic technology

- 3.2.1.3 Rising prevalence of chronic diseases

- 3.2.1.4 Integration of artificial intelligence (AI)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Limited reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 Development of single-use robotic systems

- 3.2.3.2 Advancements in AI and machine learning

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Pricing analysis, 2024

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Integration of advanced imaging and 3D visualization systems for enhanced surgical precision

- 3.6.1.2 Miniaturization and increased flexibility of robotic arms for improved maneuverability in confined anatomical regions

- 3.6.1.3 Enhanced surgeon-console ergonomics with real-time haptic feedback and intuitive control interfaces

- 3.6.2 Emerging technologies

- 3.6.2.1 AI-assisted navigation and autonomous motion control for precision-guided surgical interventions

- 3.6.2.2 Cloud-connected robotic systems enabling remote surgery assistance and data analytics

- 3.6.2.3 Integration of augmented reality (AR) and virtual reality (VR) for surgical planning, training, and intraoperative visualization

- 3.6.1 Current technological trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.10.1 Integration of AI, imaging, and robotic navigation

- 3.10.2 Miniaturization and enhanced system flexibility

- 3.10.3 Integration with digital surgical ecosystems

- 3.10.4 Advancements in haptic feedback and autonomous assistance

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Category, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Therapeutic

- 5.3 Diagnostic

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Urology

- 6.3 Respiratory applications

- 6.4 Gastrointestinal applications

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital & clinics

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Asensus Surgical

- 9.2 CMR Surgical

- 9.3 Endo Tools Therapeutics

- 9.4 Endotics

- 9.5 GI View

- 9.6 Intuitive Surgical

- 9.7 Johnson & Johnson

- 9.8 Medrobotics

- 9.9 Medtronic