|

市場調查報告書

商品編碼

1871183

汽車區塊鏈安全模組市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Blockchain Security Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

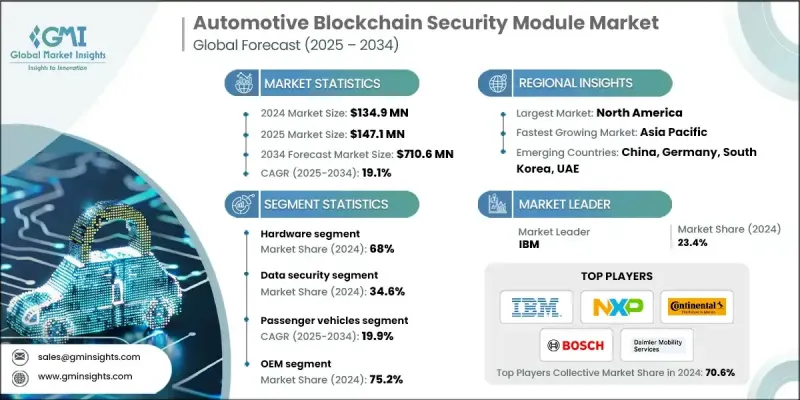

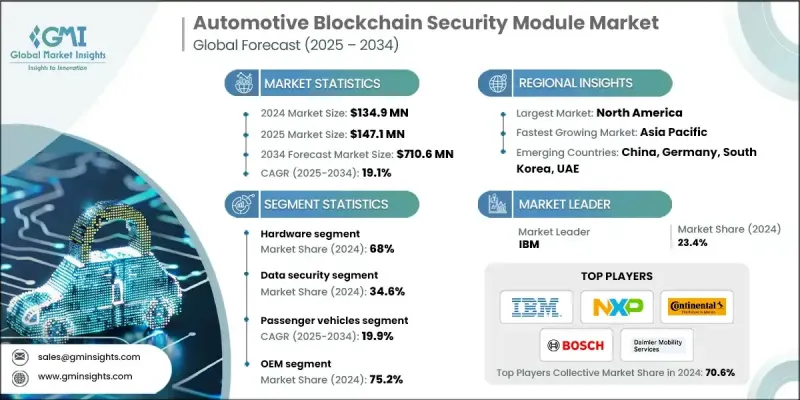

2024 年全球汽車區塊鏈安全模組市場價值為 1.349 億美元,預計到 2034 年將以 19.1% 的複合年成長率成長至 7.106 億美元。

隨著汽車產業在人工智慧整合、先進半導體發展和日益嚴格的網路安全要求的推動下進行數位轉型,市場正在不斷擴張。市場領導者正致力於打造高效、低功耗的晶片,旨在保障通訊網路安全、實現去中心化身分管理,並支援連網汽車中基於區塊鏈的交易。隨著汽車製造商向多域和區域車輛架構轉型,區塊鏈技術正被嵌入到現代微控制器、收發器和閘道器中,以建立防篡改、可驗證的通訊系統。這一趨勢在電動和混合動力汽車領域尤其顯著,因為可靠且經過認證的資料傳輸對於電池管理、動力系統控制和能量回收系統至關重要。向互聯和自動駕駛的轉變,使得區塊鏈安全模組成為保障數位通訊安全、確保車輛、基礎設施和雲端生態系統之間信任的核心技術。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.349億美元 |

| 預測值 | 7.106億美元 |

| 複合年成長率 | 19.1% |

電動車 (EV) 的日益普及進一步加速了對區塊鏈安全半導體解決方案的需求,這些解決方案需同時針對能源管理和網路安全進行最佳化。這些模組能夠實現能源採集和儲存系統之間安全透明的資料交換,並透過區塊鏈驗證確保所有電力交易的完全可追溯性。汽車製造商正在開發基於人工智慧和區塊鏈的架構,將智慧能源效率與不可篡改的數位信任框架結合。此類系統允許中央運算單元動態分配資源,同時永久記錄軟體更新、元件完整性和能耗模式。隨著現代汽車向軟體定義實體演進,整合區塊鏈的安全模組正成為在所有互聯領域建立可靠透明資料交換的基礎。

2024年,硬體細分市場佔據68%的市場佔有率,預計2025年至2034年將以18.3%的複合年成長率成長。由於區塊鏈安全處理器、加密加速器和可信任模組擴大整合到汽車ECU中,該細分市場持續成長。這些硬體組件可確保車輛系統間的安全認證和資料傳輸,滿足下一代車輛嚴苛的網路安全需求。隨著向基於區域和域的架構過渡,硬體區塊鏈模組對於保護車載網路、閘道器和雲端系統之間的通訊鏈路變得不可或缺。

2024年,資料安全領域佔據34.6%的市場佔有率,預計2025年至2034年間將以19.7%的複合年成長率成長。在對不可篡改且透明的資料儲存解決方案日益成長的需求驅動下,資料安全仍然是基於區塊鏈的汽車模組的主要應用領域。區塊鏈的不可篡改帳本技術可防止未經授權修改安全關鍵資料,並支援互聯出行生態系統中設備、使用者和服務的安全數位身分管理。汽車製造商正擴大採用區塊鏈加密技術來增強信任,並確保對連網汽車免受網路威脅的強大保護。

2024年,北美汽車區塊鏈安全模組市佔率達36.5%。該地區強大的數位基礎設施、穩健的網路安全能力以及汽車應用領域對區塊鏈解決方案的早期採用,加速了市場成長。汽車製造商與科技公司之間的合作正在推動去中心化資料網路的構建,從而確保車輛通訊系統的透明性和防篡改性。在美國和加拿大,電動車和自動駕駛汽車對區塊鏈技術的應用持續成長,進一步鞏固了北美在這一快速成長市場的領先地位。

汽車區塊鏈安全模組市場的主要參與者包括大陸集團、義法半導體、泰雷茲、英飛凌、博世、IBM、微芯科技、恩智浦半導體、戴姆勒和瑞薩電子。全球汽車區塊鏈安全模組市場的各公司正在實施多種策略,以鞏固其市場地位並擴大其全球業務版圖。領先企業正大力投資研發,以開發節能高效、性能卓越的區塊鏈晶片以及專為下一代汽車架構設計的安全硬體組件。他們正積極尋求與汽車製造商和科技公司進行策略合作,以加速區塊鏈技術在互聯汽車和電動車中的應用。許多公司正致力於透過人工智慧賦能的安全平台和加密加速器實現產品多元化,進而提升系統的可靠性和可擴展性。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 監理合規要求

- 日益嚴峻的連網汽車網路安全威脅

- OTA更新安全指示

- 供應鏈透明度要求

- 產業陷阱與挑戰

- 實施成本高且技術複雜

- 可擴展性和效能限制

- 各區域監管碎片化

- 遺留系統整合挑戰

- 市場機遇

- 自動駕駛車輛安全要求

- V2X 通訊安全標準

- 保險和遠端資訊處理資料完整性

- 跨境監管協調

- 成長促進因素

- 成長潛力分析

- 監管環境

- 區域一體化法規

- 國際標準協調

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利分析

- 成本細分分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 供應商選擇與評估框架

- 供應商評估標準

- 技術成熟度評估

- 支援與服務水準分析

- 合作戰略指南

- 商業案例及投資報酬率分析

- 總擁有成本模型

- 投資報酬率計算

- 成本效益分析框架

- 財務影響評估

- 實施路線圖和最佳實踐

- 部署時間表和階段

- 整合方法

- 變革管理策略

- 培訓和勞動力需求

- 風險評估與合規框架

- 安全審計方法

- 監理合規性檢查清單

- 資料隱私和 GDPR 的影響

- 保險和責任的考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 硬體

- 可信任平台模組(TPM)

- 硬體安全模組(HSM)

- 安全元件

- 密碼加速器

- 安全控制器

- 防篡改硬體

- 軟體

- 區塊鏈客戶端軟體

- 智慧合約平台

- 密碼庫

- 密鑰管理軟體

- 共識演算法實現

- 區塊鏈中介軟體和API

- 數位錢包軟體

- 韌體和嵌入式軟體

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 資料安全

- 供應鏈

- 租賃業務

- 移動出行與車隊管理

- 電池和電動車生命週期管理

第7章:市場估算與預測:依部署方式分類,2021-2034年

- 主要趨勢

- OEM嵌入式解決方案

- 售後市場

第8章:市場估算與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 重型商用車(HCV)

- 中型商用車(MCV)

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 葡萄牙

- 克羅埃西亞

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第10章:公司簡介

- 全球參與者

- IBM

- NXP Semiconductors

- Accenture

- Bosch

- Daimler Mobility

- Thales

- Infineon Technologies

- VeChain

- Renesas Electronics

- Toyota

- BMW

- Mercedes-Benz

- 區域玩家

- Renesas Electronics

- STMicroelectronics

- Microchip Technology

- Rambus

- ON Semiconductor

- Samsung Electronics

- 新興參與者

- Upstream Security

- Argus Cyber Security

- GuardKnox

- RunSafe Security

- C2 A Security

- XAGE Security

The Global Automotive Blockchain Security Module Market was valued at USD 134.9 million in 2024 and is estimated to grow at a CAGR of 19.1% to reach USD 710.6 million by 2034.

The market is expanding as the automotive industry undergoes digital transformation, fueled by AI integration, advanced semiconductor development, and heightened cybersecurity requirements. Market leaders are concentrating on creating high-efficiency, low-power chips designed to secure communication networks, enable decentralized identity management, and support blockchain-driven transactions in connected vehicles. As automakers move toward multi-domain and zonal vehicle architectures, blockchain technology is being embedded within modern microcontrollers, transceivers, and gateways to establish tamper-proof, verifiable communication systems. This trend is particularly significant in electric and hybrid vehicles, where reliable and authenticated data transfer is essential for battery management, powertrain control, and energy recovery systems. The shift toward connected and autonomous mobility has positioned blockchain security modules as a core technology for safeguarding digital communication and ensuring trust between vehicles, infrastructure, and cloud ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $134.9 Million |

| Forecast Value | $710.6 Million |

| CAGR | 19.1% |

The rising adoption of electric vehicles (EVs) is further accelerating demand for blockchain-secured semiconductor solutions optimized for both energy management and cybersecurity. These modules enable secure and transparent data exchanges across energy harvesting and storage systems while maintaining full traceability of all power transactions through blockchain verification. Automotive manufacturers are developing AI-powered, blockchain-based architectures that combine intelligent energy efficiency with immutable digital trust frameworks. Such systems allow central computing units to allocate resources dynamically while maintaining permanent records of software updates, component integrity, and energy consumption patterns. As modern vehicles evolve into software-defined entities, blockchain-integrated security modules are becoming the foundation for establishing reliable and transparent data exchange across all connected domains.

The hardware segment held a 68% share in 2024 and is forecast to grow at a CAGR of 18.3% from 2025 to 2034. This segment continues to gain traction due to the increasing integration of blockchain-secured processors, cryptographic accelerators, and trusted modules into automotive ECUs. These hardware components ensure secure authentication and data transfer across vehicle systems, addressing the stringent cybersecurity needs of next-generation vehicles. With the transition toward zonal and domain-based architectures, hardware blockchain modules are becoming indispensable for protecting communication links among in-vehicle networks, gateways, and cloud-based systems.

The data security segment held a 34.6% share in 2024 and is estimated to grow at a CAGR of 19.7% between 2025 and 2034. Data security remains the leading application area for blockchain-based automotive modules, driven by the growing demand for unalterable and transparent data storage solutions. Blockchain's immutable ledger technology prevents unauthorized modification of safety-critical data and supports secure digital identity management for devices, users, and services in the connected mobility ecosystem. Automakers are increasingly adopting blockchain encryption technologies to enhance trust and ensure robust protection against cyber threats targeting connected vehicles.

North America Automotive Blockchain Security Module Market held a 36.5% share in 2024. The region's strong digital infrastructure, robust cybersecurity capabilities, and early adoption of blockchain solutions in automotive applications have accelerated market growth. Collaborations between automakers and technology companies are driving the creation of decentralized data networks that ensure transparent and tamper-resistant vehicle communication systems. The adoption of blockchain technology for electric and autonomous vehicles continues to gain momentum in both the US and Canada, reinforcing North America's leadership position in this rapidly growing market.

Key players operating across the Automotive Blockchain Security Module Market include Continental, STMicroelectronics, Thales, Infineon, Bosch, IBM, Microchip Technology, NXP Semiconductors, Daimler, and Renesas Electronics. Companies in the Global Automotive Blockchain Security Module Market are implementing multiple strategies to strengthen their market position and expand their global footprint. Leading players are heavily investing in R&D to develop energy-efficient, high-performance blockchain chips and secure hardware components designed for next-generation vehicle architectures. Strategic collaborations with automakers and technology firms are being pursued to accelerate blockchain integration in connected and electric vehicles. Many companies are focusing on product diversification through AI-enabled security platforms and cryptographic accelerators to enhance system reliability and scalability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Application

- 2.2.4 Vehicle

- 2.2.5 Deployment

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Regulatory compliance requirements

- 3.2.1.2 Rising connected vehicle cybersecurity threats

- 3.2.1.3 OTA update security mandates

- 3.2.1.4 Supply chain transparency demands

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs & technical complexity

- 3.2.2.2 Scalability & performance limitations

- 3.2.2.3 Regulatory fragmentation across regions

- 3.2.2.4 Legacy system integration challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Autonomous vehicle security requirements

- 3.2.3.2 V2X communication security standards

- 3.2.3.3 Insurance & telematics data integrity

- 3.2.3.4 Cross-border regulatory harmonization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Regional integration regulations

- 3.4.2 International standards harmonization

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Carbon footprint considerations

- 3.12 Vendor Selection & Evaluation Framework

- 3.12.1 Vendor assessment criteria

- 3.12.2 Technology maturity evaluation

- 3.12.3 Support & service level analysis

- 3.12.4 Partnership strategy guidelines

- 3.13 Business Case & ROI Analysis

- 3.13.1 Total cost of ownership models

- 3.13.2 Return on investment calculations

- 3.13.3 Cost-benefit analysis framework

- 3.13.4 Financial impact assessment

- 3.14 Implementation Roadmap & Best Practices

- 3.14.1 Deployment timelines & phases

- 3.14.2 Integration methodologies

- 3.14.3 Change management strategies

- 3.14.4 Training & workforce requirements

- 3.15 Risk Assessment & Compliance Framework

- 3.15.1 Security audit methodologies

- 3.15.2 Regulatory compliance checklists

- 3.15.3 Data privacy & GDPR implications

- 3.15.4 Insurance & liability considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Trusted Platform Modules (TPMs)

- 5.2.2 Hardware Security Modules (HSMs)

- 5.2.3 Secure Elements

- 5.2.4 Cryptographic Accelerators

- 5.2.5 Security Controllers

- 5.2.6 Tamper-Resistant Hardware

- 5.3 Software

- 5.3.1 Blockchain Client Software

- 5.3.2 Smart Contract Platforms

- 5.3.3 Cryptographic Libraries

- 5.3.4 Key Management Software

- 5.3.5 Consensus Algorithm Implementations

- 5.3.6 Blockchain Middleware & APIs

- 5.3.7 Digital Wallet Software

- 5.3.8 Firmware & Embedded Software

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Data Security

- 6.3 Supply Chain

- 6.4 Leasing Operations

- 6.5 Mobility & Fleet Management

- 6.6 Battery & EV Lifecycle Management

Chapter 7 Market Estimates & Forecast, By Deployment, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 OEM Embedded Solutions

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Passenger Cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial Vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Heavy commercial vehicles (HCV)

- 8.3.3 Medium commercial vehicles (MCV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 IBM

- 10.1.2 NXP Semiconductors

- 10.1.3 Accenture

- 10.1.4 Bosch

- 10.1.5 Daimler Mobility

- 10.1.6 Thales

- 10.1.7 Infineon Technologies

- 10.1.8 VeChain

- 10.1.9 Renesas Electronics

- 10.1.10 Toyota

- 10.1.11 BMW

- 10.1.12 Mercedes-Benz

- 10.2 Regional Players

- 10.2.1 Renesas Electronics

- 10.2.2 STMicroelectronics

- 10.2.3 Microchip Technology

- 10.2.4 Rambus

- 10.2.5 ON Semiconductor

- 10.2.6 Samsung Electronics

- 10.3 Emerging Players

- 10.3.1 Upstream Security

- 10.3.2 Argus Cyber Security

- 10.3.3 GuardKnox

- 10.3.4 RunSafe Security

- 10.3.5. C2 A Security

- 10.3.6 XAGE Security